How to Manage Event Planning Expenses Across Multiple Accounts: 4 Essential Strategies for Budgeting Professionals

Are you struggling to keep track of event planning expense management across multiple credit cards, bank accounts, and currencies?

As a life coach, I’ve helped many professionals navigate these challenges. I often see the frustration and confusion that come with managing complex financial streams for event budgeting.

In this article, you’ll learn how to implement centralized event budget management software, create detailed event budget categories, set up a multi-account expense tracking for events process, and establish regular financial review meetings for effective event planning expense management.

Let’s dive into these corporate event budgeting strategies.

Understanding the Core Challenges

Event planning expense management often presents a daunting task for planners who must track expenses across multiple credit cards, bank accounts, and currencies. This complexity in event budget management leads to budget overruns and financial discrepancies, making accurate budgeting nearly impossible.

For example, many clients initially struggle with reconciling transactions from different sources, resulting in missed payments and unrecorded expenses. Multi-account expense tracking for events becomes crucial in these situations.

Poor expense management can also harm your reputation and client relationships. When financial oversight is lacking in corporate event budgeting strategies, it affects the entire event’s success.

Streamlining these processes is not just ideal but essential. Without a robust system for event planning expense management, you risk losing control over your finances, leading to chaos and stress.

Roadmap to Effective Expense Management

Overcoming this challenge in event planning expense management requires a few key steps. Here are the main areas to focus on to make progress:

- Implement centralized expense tracking software: Choose and integrate event budget management software to manage all financial accounts.

- Create detailed event budget categories: Allocate budgets to specific expense categories for clarity, utilizing cost allocation techniques for event planners.

- Set up multi-account reconciliation process: Develop a schedule for regular account reconciliation, focusing on cross-account reconciliation for event budgets.

- Establish regular financial review meetings: Schedule meetings to review and adjust the budget, incorporating corporate event budgeting strategies.

Let’s dive into these event planning expense management strategies!

1: Implement centralized expense tracking software

Implementing centralized expense tracking software is crucial for effective event planning expense management.

Actionable Steps:

- Research and Select Software: Identify and evaluate different event budget management software options tailored for event planners. Compare features, costs, and user reviews to choose the best fit.

- Integrate All Financial Accounts: Link all credit cards, bank accounts, and other financial sources to the chosen software. Ensure the software supports multi-account expense tracking for events and multiple currencies if needed.

- Train Your Team: Conduct training sessions to familiarize your team with the new budgeting tools for professional event managers. Provide ongoing support and resources for troubleshooting.

Explanation: Centralized expense tracking software simplifies the management of multiple financial accounts, reducing the risk of errors and discrepancies. By integrating all financial sources, you gain a comprehensive view of your event planning expense management.

This approach aligns with industry trends, where organizations use technology to improve financial oversight. According to Finance Alliance, only 31.3% of companies believe they have good visibility over spending, highlighting the need for better tools.

Key benefits of centralized expense tracking software for event planning expense management:

- Real-time visibility of all financial transactions

- Reduced manual data entry and human error

- Improved accuracy in financial reporting and ROI calculation for event expenses

Starting with centralized software sets a strong foundation for effective expense management and corporate event budgeting strategies.

2: Create detailed event budget categories

Creating detailed event budget categories is crucial for maintaining clear and organized financial oversight in event planning expense management.

Actionable Steps:

- Identify Key Expense Categories: List all potential expense categories such as venue, food/beverage, speakers, marketing, and contingency. Ensure every possible expense is covered for effective event planning expense management.

- Allocate Budget to Each Category: Set realistic budget limits for each category based on past events and current needs. Use historical data and market research to inform your allocations, utilizing corporate event budgeting strategies.

- Monitor and Adjust Allocations: Regularly review budget allocations and make adjustments as needed. Use event budget management software to track spending in real-time and facilitate multi-account expense tracking for events.

Explanation: Clear budget categories help you manage and track expenses effectively. This structure allows for better financial planning for large-scale events and reduces the risk of budget overruns.

According to HubSpot, having a detailed event marketing budget can prevent unexpected costs. This approach aligns with industry best practices and streamlines financial management, including cost allocation techniques for event planners.

With detailed budget categories, you can better control expenses and ensure successful event planning expense management.

3: Set up multi-account reconciliation process

Setting up a multi-account reconciliation process is vital for maintaining accurate financial records and avoiding discrepancies in event planning expense management.

Actionable Steps:

- Develop a Reconciliation Schedule: Establish a regular schedule for reconciling accounts, such as weekly or monthly. Assign specific team members to handle these tasks, ensuring proper cross-account reconciliation for event budgets.

- Implement Reconciliation Procedures: Create detailed procedures for reconciling accounts, including steps for handling discrepancies. Ensure all transactions are accurately recorded and categorized, focusing on expense categorization in event planning.

- Utilize Technology for Automation: Use the centralized software’s automation features to streamline reconciliation. Set up alerts for any inconsistencies or errors, leveraging event budget management software for efficiency.

Explanation: These steps ensure that financial transactions are accurately tracked and categorized, reducing the risk of errors in event planning expense management.

Consistent reconciliation helps maintain financial integrity and allows for better budget management. According to Harvard’s Sponsored Expenditures Guidelines, accurate documentation and regular reviews are crucial for compliance and financial oversight.

Benefits of regular multi-account reconciliation:

- Early detection of discrepancies or fraud

- Improved financial accuracy and reporting for event planning expense management

- Enhanced compliance with financial regulations

Regular multi-account reconciliation can save time and prevent financial mismanagement in event planning expense management.

4: Establish regular financial review meetings

Establishing regular financial review meetings is essential for maintaining accurate and up-to-date budget oversight in event planning expense management.

Actionable Steps:

- Schedule Recurring Meetings: Set up regular meetings (e.g., monthly) to review financial status and budget performance. Include key stakeholders such as event planners and finance team members to discuss corporate event budgeting strategies.

- Prepare Comprehensive Reports: Use event budget management software to generate detailed financial reports. Highlight spending patterns, budget variances, and future projections for better decision-making in financial planning for large-scale events.

- Foster Open Communication: Encourage open discussions about financial challenges and potential solutions. Use feedback from these meetings to improve financial management practices and cost allocation techniques for event planners.

Explanation: These steps ensure that all financial activities are closely monitored and any issues are promptly addressed. Regular meetings help maintain transparency and foster collaboration in event planning expense management.

According to Jitasa, regular financial reviews are crucial for effective financial management and ensuring compliance with policies.

Key topics to cover in financial review meetings:

- Budget performance and variances using multi-account expense tracking for events

- Cash flow projections and concerns for event accounts

- Upcoming financial decisions or challenges in event planning expense management

Consistent financial review meetings can significantly improve your event planning expense management process, utilizing budgeting tools for professional event managers and enhancing ROI calculation for event expenses.

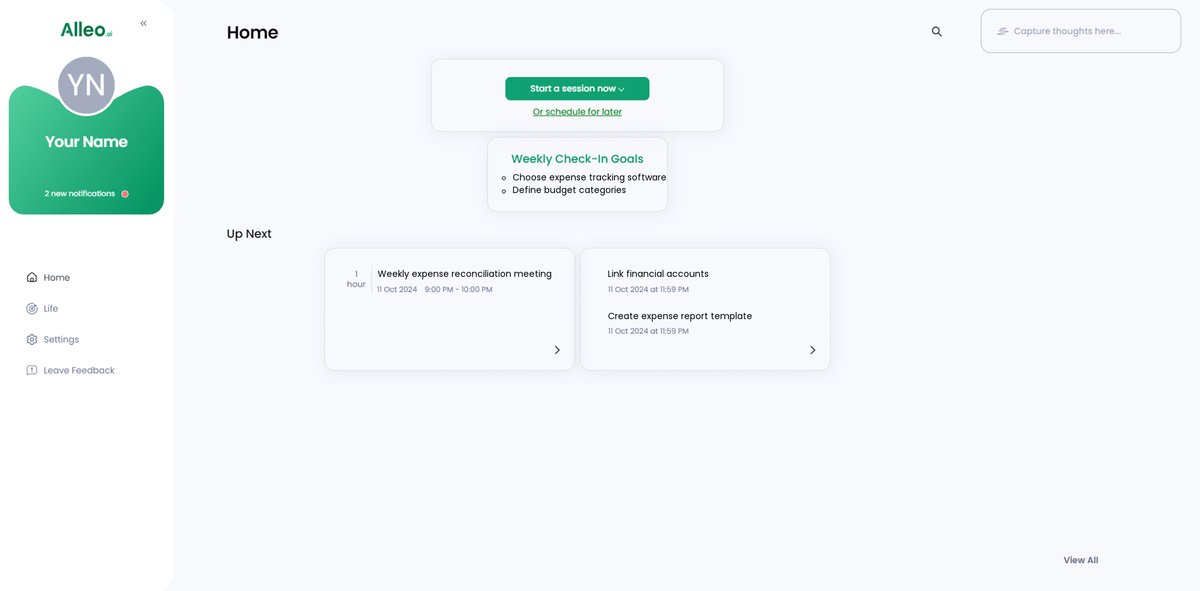

Partner with Alleo to Master Expense Management

We’ve explored the challenges of event planning expense management and the steps to overcome them. Did you know you can work directly with Alleo to simplify this journey? Our event budget management software offers comprehensive solutions for your financial planning needs.

Set up an account in minutes. Create a personalized plan tailored to your needs, incorporating effective corporate event budgeting strategies.

Alleo’s AI coach provides ongoing support, tracks your progress, and adjusts plans as needed. You get reminders and insights via text and push notifications, enhancing your cost allocation techniques for event planning.

Ready to get started for free? Let me show you how our budgeting tools for professional event managers can revolutionize your approach to event planning expense management!

Step 1: Log In or Create Your Account

To start managing your event planning expenses with Alleo’s AI coach, Log in to your account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to create a structured approach for managing your event planning finances more effectively, helping you establish consistent practices for expense tracking and budget reviews.

Step 3: Select “Finances” as Your Focus Area

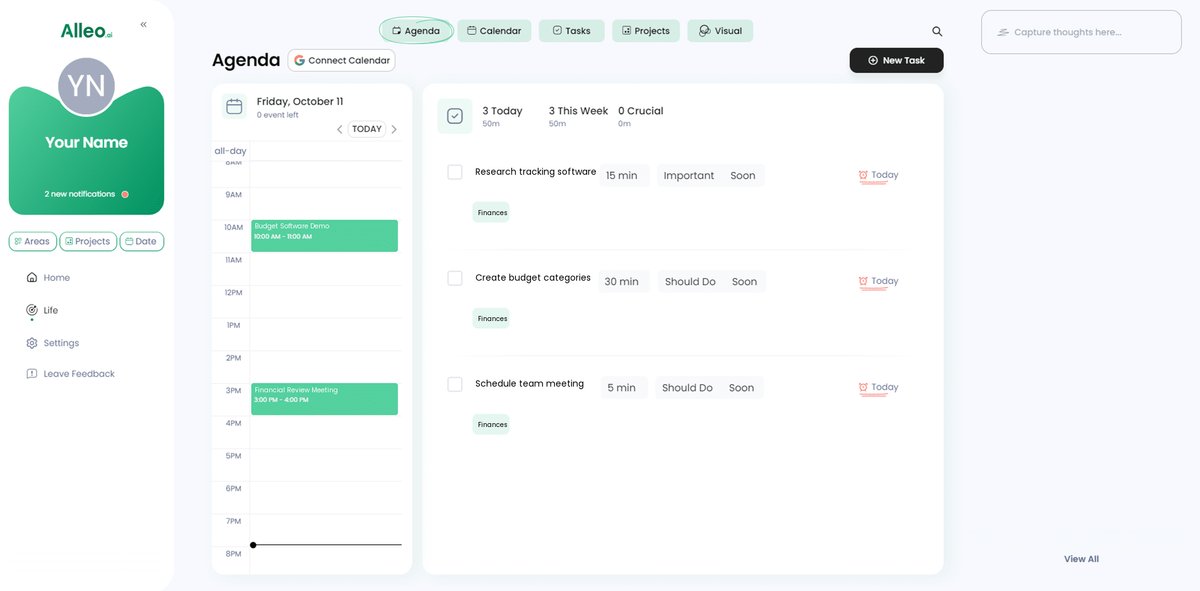

Choose “Finances” as your primary focus area to tackle your event planning expense management challenges head-on. By selecting this life area, you’ll gain access to tailored strategies and AI-powered guidance specifically designed to help you streamline your financial processes, implement effective budget tracking, and master multi-account reconciliation for successful event planning.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your event planning expense management challenges and set up a personalized plan to streamline your financial processes moving forward.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the event planning expense goals you discussed, allowing you to track progress and make adjustments as needed.

Step 6: Adding events to your calendar or app

Use the AI coach’s calendar integration feature to add financial review meetings and reconciliation tasks, allowing you to easily track your progress in solving expense management challenges within the app.

Wrapping Up: Your Path to Financial Clarity

Managing event planning expenses across multiple accounts can seem overwhelming. Yet, with the right tools and strategies for event planning expense management, it becomes manageable.

By implementing centralized expense tracking software for events, you streamline your financial oversight. Setting up detailed budget categories ensures you cover all bases in corporate event budgeting strategies.

Establishing a multi-account expense tracking process for events maintains accuracy. Regular financial review meetings keep everyone informed and aligned on cost allocation techniques for event planners.

Remember, you’re not alone in this journey of event planning expense management. Alleo is here to support you with budgeting tools for professional event managers.

Take control of your event planning expenses today. Try Alleo for free and experience seamless financial planning for large-scale events.

You’ve got this!