4 Powerful Strategies for Financial Advisors to Address Social Media’s Influence on Client Investments

Imagine a client coming to you with social media investment advice they picked up from a TikTok video. How do you respond?

As a life coach, I’ve helped many professionals navigate similar challenges. I’ve seen firsthand how social media influences investment decisions and the impact of influencer financial advice on client portfolios.

In this article, you’ll learn how to educate clients about the difference between social media investment advice and expert guidance. You’ll also discover strategies to create engaging, educational social media content that promotes financial literacy in the age of social media while addressing the risks of trend-driven investments.

Let’s dive in and explore how to balance long-term planning vs. short-term hype in the context of social media investment trends.

Understanding the Social Media Influence Challenge

The rise of social media influencers has significantly shaped how people perceive social media investment advice. Many clients initially struggle with distinguishing between expert advice and the often sensationalized content they find online, particularly in the realm of influencer financial advice.

This is a problem because it can lead to misguided investment decisions. Social media platforms are flooded with financial tips and social media investment trends, but not all of them are reliable.

In my experience, people often find it hard to navigate these mixed messages. You might find clients coming to you with high expectations set by influencers, making your job tougher in providing client education on viral investing.

Navigating this landscape requires a strategic approach. It’s essential to address these challenges head-on to maintain client trust and provide valuable advice, especially when it comes to risk management for trend-driven investments and long-term planning vs. short-term hype.

Strategic Steps to Address Social Media Influences on Investments

Overcoming the challenge of social media investment advice requires a few key steps. Here are the main areas to focus on to make progress:

- Educate clients on social media vs expert advice: Help clients distinguish between reliable expert advice and social media investment trends.

- Create engaging, educational social media content: Share informative posts that clarify common investment misconceptions and promote financial literacy in the age of social media.

- Develop a strong personal brand online: Establish a consistent and credible online presence to counter influencer financial advice.

- Monitor and address trending financial advice: Stay updated on social media investment advice and offer timely, professional insights on risk management for trend-driven investments.

Let’s dive into these strategies for navigating social media investment advice!

1: Educate clients on social media vs expert advice

Educating clients on the difference between social media investment advice and expert advice is crucial for informed investment decisions and financial literacy in the age of social media.

Actionable Steps:

- Host educational webinars: Organize webinars focusing on the differences between social media investment advice and professional financial guidance, addressing social media investment trends.

- Provide comparison guides: Create easy-to-understand guides comparing influencer financial advice with expert advice and distribute them through newsletters, highlighting long-term planning vs. short-term hype.

- Offer personalized consultations: Schedule regular one-on-one sessions to address individual client concerns about social media investment advice and discuss risk management for trend-driven investments.

Key benefits of educating clients include:

- Improved financial literacy

- Better decision-making skills

- Increased trust in professional advice

Explanation:

These steps are essential because they help clients differentiate between reliable investment advice and potentially misleading social media content, addressing behavioral finance and social media influence.

By hosting webinars and providing comparison guides, you educate clients on client education on viral investing, enabling them to make better-informed decisions. Offering personalized consultations builds trust and allows for tailored advice, including diversification strategies for influencer-impacted portfolios.

According to Select Advisors Institute, such educational efforts are critical for maintaining client trust and engagement, aligning with regulatory compliance in social media investing.

This approach helps clients discern valuable information, ensuring they rely on expert guidance for their investments, reinforcing fiduciary duty and influencer-driven investment decisions.

2: Create engaging, educational social media content

Creating engaging, educational social media content is crucial to influence and guide clients effectively, especially when it comes to social media investment advice.

Actionable Steps:

- Develop a content calendar: Plan and schedule regular posts on platforms like LinkedIn, Instagram, and YouTube. Focus on educational topics that clarify common misconceptions from social media investment trends.

- Use multimedia: Create infographics and short videos explaining complex financial concepts and risk management for trend-driven investments. Feature client testimonials that highlight successful investment strategies and long-term planning vs. short-term hype.

- Collaborate with trusted influencers: Partner with credible, industry-recognized influencers to co-create content on influencer financial advice. Ensure the content aligns with your professional advice, standards, and regulatory compliance in social media investing.

Explanation:

These steps matter because they help establish your credibility and keep clients informed with accurate information on social media investment advice. By planning content and using multimedia, you engage clients visually and intellectually, promoting financial literacy in the age of social media.

Collaborating with trusted influencers can further extend your reach and credibility while addressing behavioral finance and social media influence. According to Oktopost, maintaining a consistent and informative social media presence is vital for financial advisors.

Effective social media engagement can significantly enhance your client relationships and trust, especially when providing social media investment advice and discussing diversification strategies for influencer-impacted portfolios.

3: Develop a strong personal brand online

Developing a strong personal brand online is crucial for building credibility and attracting clients in today’s digital age, especially when providing social media investment advice.

Actionable Steps:

- Establish a consistent online presence: Regularly update your LinkedIn profile with thought leadership articles and insights on social media investment trends.

- Share your expertise: Write blog posts on current market trends and investment strategies, including client education on viral investing. Participate in webinars and podcasts to showcase your knowledge of behavioral finance and social media influence.

- Use professional visuals: Invest in high-quality photography and branding materials for your social media profiles. Ensure all content maintains a consistent visual identity when discussing risk management for trend-driven investments.

Key elements of a strong personal brand:

- Authentic voice and messaging on long-term planning vs. short-term hype

- Consistent visual identity

- Regular, valuable content on financial literacy in the age of social media

Explanation:

These steps matter because they help you build trust and authority in your field. By consistently sharing your expertise and maintaining a professional online image, you attract and retain clients seeking social media investment advice.

According to AssetMark, a strong brand helps create emotional connections and foster client loyalty.

A well-crafted personal brand sets you apart from competitors and positions you as a trusted advisor for diversification strategies for influencer-impacted portfolios.

4: Monitor and address trending financial advice

Monitoring and addressing trending financial advice, including social media investment advice, is crucial for staying informed and maintaining client trust.

Actionable Steps:

- Set up social media alerts: Use tools to track social media investment trends and influencers. This keeps you updated on the latest advice circulating on social media platforms.

- Provide timely updates: Share your expert opinions on trending topics through your social media channels. Address any misinformation or harmful influencer financial advice promptly.

- Engage with online communities: Join relevant groups and forums where financial discussions are taking place. Offer your professional insights on client education for viral investing and correct inaccuracies when necessary.

Effective ways to address trending advice:

- Fact-check and provide accurate information

- Offer context and deeper analysis on risk management for trend-driven investments

- Present alternative perspectives on long-term planning vs. short-term hype

Explanation:

These steps matter because they help you stay proactive and relevant in a rapidly changing digital landscape. By setting up alerts and providing timely updates, you ensure your clients receive accurate information on social media investment advice.

Engaging with online communities allows you to build trust and establish your expertise in financial literacy in the age of social media. According to Javelin Strategy, staying informed about social media trends is key for financial advisors.

Maintaining an active presence helps you mitigate the impact of misleading advice and reinforces your role as a trusted advisor, addressing behavioral finance and social media influence while upholding your fiduciary duty in influencer-driven investment decisions.

Partner with Alleo to Navigate Social Media Influences

We’ve explored the challenges of handling social media influences on client investments and the steps to address them, including social media investment advice and managing risk for trend-driven investments.

Did you know you can work directly with Alleo to make this easier and faster, especially when dealing with social media investment trends?

Start by setting up an account with Alleo. Create a personalized plan tailored to your needs, focusing on long-term planning vs. short-term hype.

Alleo’s AI coach will provide affordable, tailored coaching support, just like a human coach. The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you navigate influencer financial advice and maintain regulatory compliance in social media investing.

Ready to get started for free? Let me show you how to enhance your financial literacy in the age of social media!

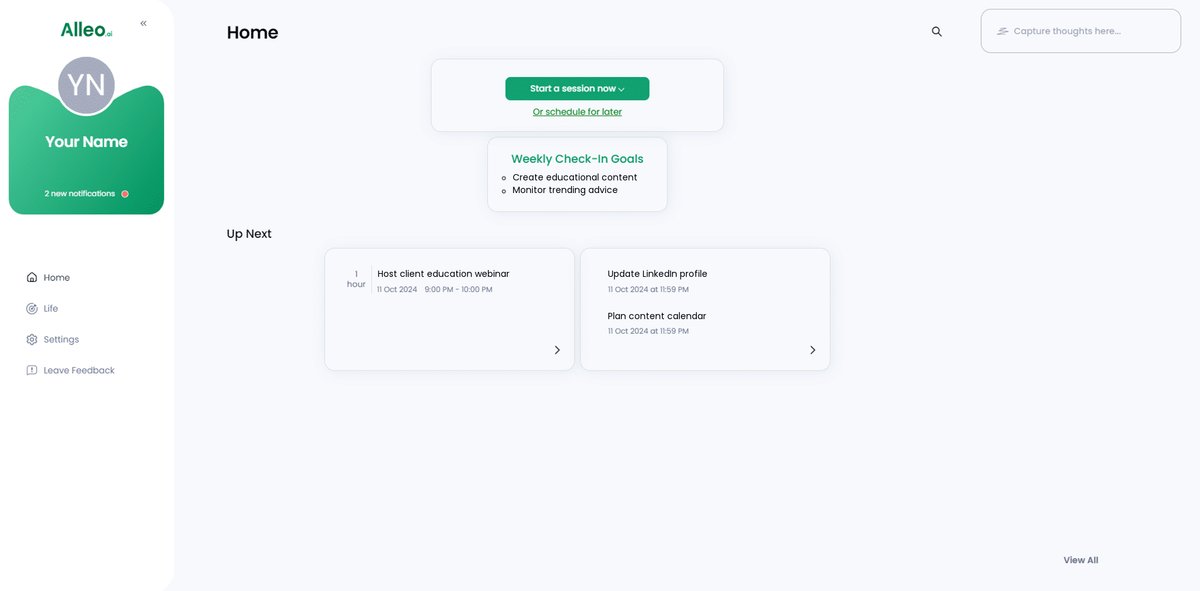

Step 1: Log In or Create Your Alleo Account

To begin your journey with Alleo’s AI coach and tackle social media investment challenges, simply Log in to your account or create a new one to access personalized guidance and support.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” from the goals list to develop a consistent approach for creating educational content and maintaining a strong online presence, helping you effectively counter social media influences on client investments.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to receive tailored guidance on navigating social media influences on investments, helping you make informed decisions and educate your clients effectively.

Step 4: Starting a coaching session

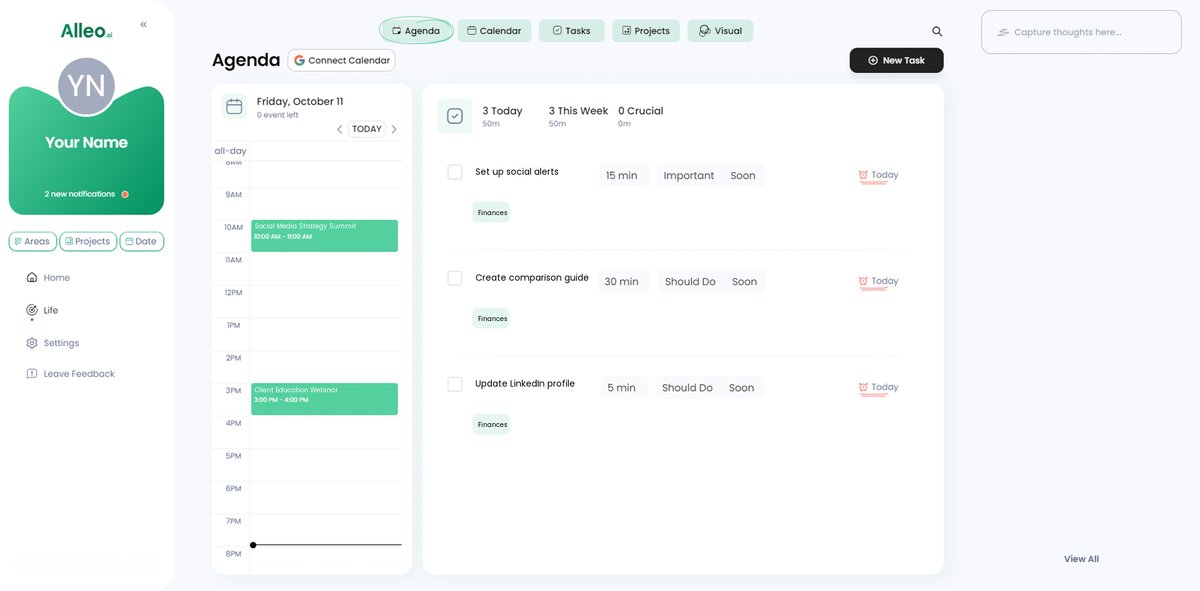

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your social media strategy and investment advising goals to create a personalized plan for navigating client concerns about online financial advice.

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app to find your discussed goals conveniently displayed on the home page, allowing you to easily track and manage your progress in addressing social media influences on client investments.

Step 6: Adding Events to Your Calendar or App

To track your progress in addressing social media influences on client investments, use the Alleo app’s calendar and task features to schedule key activities like client education sessions, content creation, and trend monitoring, helping you stay organized and accountable in your advisory practice.

Tying It All Together: Empowering Your Financial Guidance

Navigating the influence of social media on client investments can be daunting. However, by educating clients about social media investment advice, creating engaging content, developing your personal brand, and staying on top of social media investment trends, you can effectively guide your clients.

Remember, it’s about fostering trust and providing value. Your proactive approach will make a significant difference in your clients’ financial decisions, especially when balancing long-term planning vs. short-term hype.

To make this journey smoother, consider partnering with Alleo. Our platform can help streamline your efforts, ensuring you stay ahead of the curve in providing social media investment advice and maintaining regulatory compliance in social media investing.

Take the first step today. Empower your advisory practice with Alleo and see the difference it makes in enhancing financial literacy in the age of social media.