3 Essential Tips for First-Generation Professionals: Mastering Student Debt and Career Growth

Are you struggling to balance student loan debt while trying to kickstart your career? Managing student debt and career growth can be a challenging journey.

As a life coach, I’ve seen many first-generation professionals face these challenges. Navigating financial responsibilities without family savings or support can feel overwhelming, especially when it comes to student loan repayment strategies and career advancement for first-gen professionals.

In this post, you’ll discover practical tips to manage your debt and grow your career. We’ll explore budgeting strategies for career growth and loan payments, mentorship opportunities through professional mentorship programs, and employer assistance programs that can aid in balancing debt and professional development.

Stay with us, and let’s dive into effective ways of managing student debt and career growth!

The Financial Hurdles and Career Challenges for First-Generation Professionals

Many first-generation professionals face overwhelming financial challenges when managing student debt and career growth. High student loan debt and a lack of family financial support can make it difficult to get ahead.

In my experience, people often struggle with managing their debt while making informed career decisions without prior family guidance. It’s common to feel like you’re walking a tightrope, juggling financial responsibilities and career growth, especially when navigating corporate culture as a first-generation employee.

Without a safety net, even small financial setbacks can feel devastating. Several clients report feeling stuck in low-paying jobs because their loan repayments consume a large portion of their income, making student loan repayment strategies crucial.

This can make salary increases seem less impactful, highlighting the importance of salary negotiation for recent graduates.

Navigating these challenges alone can be daunting. However, there are strategies to manage debt and achieve career growth, such as professional mentorship programs and networking tips for first-generation professionals.

Let’s explore them together, focusing on balancing debt and professional development.

A Roadmap to Managing Student Debt and Growing Your Career

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in managing student debt and career growth.

- Create a Budget Prioritizing Debt Repayment: Develop a budget that prioritizes paying off high-interest loans, incorporating effective student loan repayment strategies.

- Seek Mentorship for Career Growth and Guidance: Connect with mentors to navigate your career path, especially beneficial for first-generation professionals balancing debt and professional development.

- Explore Employer Student Loan Assistance Programs: Look for employers offering student loan repayment benefits as part of your financial planning for career growth and loan payments.

Let’s dive in!

1: Create a budget prioritizing debt repayment

Creating a budget that prioritizes debt repayment is crucial for managing student debt and career growth effectively.

Actionable Steps:

- Assess Your Financial Situation: List all income sources and monthly expenses. Identify discretionary spending that can be reduced or eliminated. This is essential for budgeting for career growth and loan payments.

- Develop a Debt Repayment Plan: Prioritize high-interest loans for repayment. Allocate a fixed percentage of your monthly income towards loan payments. Consider student loan repayment strategies to optimize your approach.

- Build an Emergency Fund: Set aside a portion of your income for unexpected expenses. Aim for at least three months’ worth of living expenses in savings. This is crucial for financial planning for new graduates.

Explanation: Prioritizing debt repayment helps you reduce financial stress and interest costs over time. By assessing your financial situation, you can make informed decisions about where to cut costs while managing student debt and career growth.

Developing a repayment plan ensures you are systematically tackling your debt. Building an emergency fund provides a safety net for unexpected expenses, preventing you from falling back into debt while balancing debt and professional development.

For more insights on financial planning, you can visit this resource.

Key benefits of prioritizing debt repayment:

- Reduces overall interest paid

- Improves credit score

- Provides financial peace of mind

Taking these steps can set a solid foundation for your financial stability and career advancement for first-gen professionals. Let’s move on to the next part of the solution.

2: Seek mentorship for career growth and guidance

Finding a mentor is crucial for navigating your career path and overcoming challenges while managing student debt and career growth.

Actionable Steps:

- Connect with Alumni Networks: Reach out to your college’s alumni association or professional organizations to find potential mentors who can provide insights on balancing debt and professional development.

- Attend Industry Events: Participate in workshops and conferences to network and meet experienced professionals in your field, gaining valuable networking tips for first-generation professionals.

- Use Online Platforms: Leverage LinkedIn or other professional forums to find and engage with mentors virtually, exploring professional mentorship programs.

Explanation: Seeking mentorship provides guidance, support, and valuable connections that can significantly enhance your career trajectory and assist with managing student debt and career growth.

Mentors can offer insights and advice based on their own experiences, helping you avoid common pitfalls and navigate corporate culture as a first-generation employee.

By utilizing platforms like LinkedIn, you can connect with professionals who can share their expertise and help you navigate your career journey, including salary negotiation for recent graduates. For more on the power of mentoring, visit this resource.

What to look for in a mentor:

- Relevant industry experience

- Willingness to provide honest feedback

- Compatibility in communication styles

With the right mentor, you’ll gain the confidence and knowledge needed to succeed in managing student debt and career growth.

Let’s continue to explore other strategies.

3: Explore employer student loan assistance programs

Exploring employer student loan assistance programs can significantly ease your financial burden when managing student debt for career growth.

Actionable Steps:

- Research Potential Employers: Look for companies that offer student loan repayment strategies as part of their benefits package. Use job search engines and company websites to find relevant information on balancing debt and professional development.

- Inquire During Job Interviews: Ask potential employers about student loan assistance programs during the interview process. Prioritize job offers that include this benefit as part of the compensation package, which can aid in financial planning for new graduates.

- Utilize Employer Resources: Take advantage of any financial planning or debt management resources offered by your employer. Attend workshops or seminars provided by your employer on financial wellness, which can help in budgeting for career growth and loan payments.

Explanation: These steps matter because they help reduce your loan burden and improve your financial health. By targeting employers with these benefits, you can make a strategic career move that aligns with your financial goals while managing student debt for career growth.

According to the Yale Law School, many companies and institutions are increasingly offering these benefits to attract talented professionals, including first-generation employees navigating corporate culture.

Advantages of employer loan assistance programs:

- Accelerates debt repayment

- Reduces financial stress

- Allows focus on career growth

Taking advantage of these programs can provide you with financial relief, allowing you to focus on your career growth while managing student debt effectively.

Partner with Alleo on Your Debt Management and Career Growth Journey

We’ve explored the challenges of managing student debt and career growth as a first-generation professional. Solving these can greatly benefit your financial stability and career success.

But did you know you can work directly with Alleo to make this journey of managing student debt and career growth easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your needs, including student loan repayment strategies and career advancement for first-gen professionals.

Alleo’s AI coach will help you set financial goals and track your debt repayment progress. You’ll receive personalized advice and reminders to stay on track with your budget, essential for balancing debt and professional development.

Alleo also connects you with mentors in your field. Use its network and AI recommendations to find the right mentor, enhancing your networking skills as a first-generation professional.

Schedule and manage your mentorship meetings using Alleo’s calendar and reminder features. This ensures you stay accountable and make consistent progress in your career growth while managing student debt.

Moreover, Alleo helps you research and compare potential employers based on their student loan assistance programs. Get AI-driven insights on which job offers align best with your financial planning goals and career aspirations as a new graduate.

Ready to get started for free? Let me show you how!

Step 1: Log In or Create Your Alleo Account

To begin managing your student debt and career growth with Alleo’s AI coach, log in to your account or create a new one if you’re a first-time user.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to start tackling your student debt and career growth challenges head-on, aligning your efforts with the strategies discussed in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on managing your student loan debt, creating an effective budget, and exploring employer assistance programs that can significantly improve your financial situation as a first-generation professional.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for managing your student debt and advancing your career.

Step 5: Viewing and Managing Goals After the Session

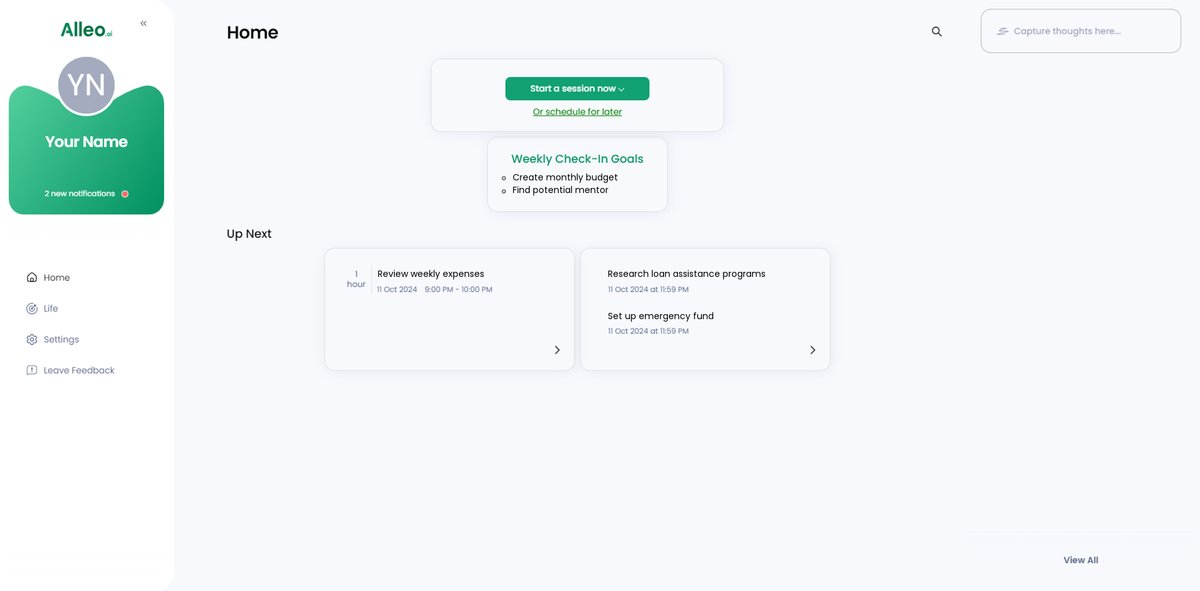

After your coaching session, check the Alleo app’s home page to review and manage the financial and career goals you discussed, helping you stay on track with your debt repayment and professional growth plans.

Step 6: Adding Events to Your Calendar or App

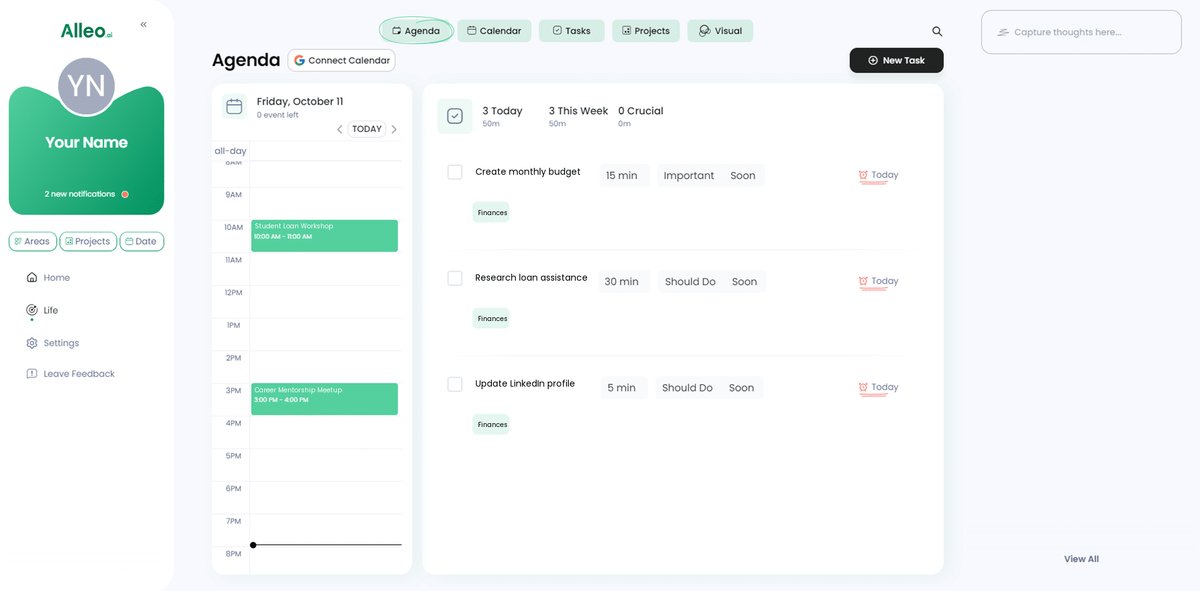

Use Alleo’s calendar feature to add important events like debt repayment due dates, mentorship meetings, and job application deadlines, helping you track your progress in managing student loans and advancing your career.

Wrapping Up Your Journey to Financial and Career Success

Taking control of your student debt and career growth is challenging but achievable. Prioritizing student loan repayment strategies, seeking professional mentorship programs, and exploring employer assistance programs are crucial steps in managing student debt and career growth.

Remember, you’re not alone in this journey. Many have faced similar struggles and succeeded, including first-generation professionals navigating corporate culture.

Alleo, your AI life coach, can support you every step of the way. With Alleo, set financial planning goals for new graduates, connect with mentors for career advancement, and find the best employers for balancing debt and professional development.

Start your journey towards financial stability and career success today. Let Alleo guide you in managing student debt and career growth, and take the first step to a brighter future.

Ready to get started? Try Alleo for free now and begin your path to effective student loan repayment and career advancement!