3 Proven Strategies for Retirees Evaluating Inheritance Impact on Financial Planning

Imagine you’re on the verge of retirement and you find out you’ll be inheriting a substantial amount of money. What should you do next? This scenario calls for careful inheritance planning for retirees.

As a life coach, I’ve helped many retirees navigate these complex financial decisions. I understand the overwhelming feeling of incorporating an unexpected inheritance into your retirement financial planning.

In this article, we’ll explore strategies for managing your inheritance effectively. You’ll learn how to assess your total wealth, create a comprehensive budget, and consult a financial advisor on tax implications of inheritance and investment strategies for inherited assets.

Let’s dive into inheritance planning for retirees.

Understanding the Challenges of Inheritance in Retirement Plans

In my experience, retirees often struggle with incorporating unexpected inheritances into their retirement financial planning. The challenge lies in balancing the newfound wealth with existing retirement savings and ensuring long-term financial stability through effective inheritance planning for retirees.

Many clients initially worry about the tax implications of inheritance. They fear that mismanaging these funds could lead to unnecessary tax burdens, eroding the financial benefits meant for their golden years. Estate planning for retirees becomes crucial in addressing these concerns.

Another common concern is deciding on the best investment strategies for inherited assets. Retirees need to align their inheritance with their current financial goals, a process that requires careful planning and professional advice on wealth management for retirees.

This step is crucial to avoid financial pitfalls and maximize the benefits of the inheritance, ensuring effective retirement income strategies and legacy planning for beneficiaries.

Key Steps for Managing Inheritance in Retirement Plans

Overcoming this challenge in inheritance planning for retirees requires a few key steps. Here are the main areas to focus on to make progress in retirement financial planning:

- Assess total wealth including potential inheritance: Evaluate all current assets, liabilities, and the estimated value of the inheritance, considering its impact on retirement income strategies.

- Create a comprehensive post-inheritance budget: Identify financial goals, develop a spending plan, and incorporate risk management strategies for wealth management for retirees.

- Consult a financial advisor on tax implications: Seek professional advice on estate planning for retirees, explore tax-efficient options for inherited assets, and update estate planning documents for legacy planning for beneficiaries.

Let’s dive into inheritance planning for retirees!

1: Assess total wealth including potential inheritance

Understanding your total wealth is vital for integrating an inheritance into your retirement plan. Inheritance planning for retirees starts with a comprehensive assessment of your financial situation.

Actionable Steps:

- Compile a comprehensive list of all current assets, debts, and liabilities for effective retirement financial planning.

- Obtain a professional appraisal of inherited assets to estimate their total value, considering potential tax implications of inheritance.

- Use financial tools to combine the inheritance with existing assets, creating a complete net worth statement for wealth management for retirees.

Explanation: Taking these steps ensures you have a clear understanding of your financial situation, making it easier to plan effectively. For further guidance on managing an inheritance, you can refer to this resource from Farm Bureau Financial Services.

Key benefits of assessing your total wealth for inheritance planning for retirees:

- Gain clarity on your overall financial picture, including investment strategies for inherited assets

- Identify potential gaps in your retirement plan, such as long-term care planning with inheritance

- Set realistic financial goals based on your new assets, considering retirement income strategies

This clarity will help you make informed decisions about your future financial stability and goals, including estate planning for retirees and legacy planning for beneficiaries.

2: Create a comprehensive post-inheritance budget

Carefully crafting a post-inheritance budget is crucial for inheritance planning for retirees to ensure financial stability and achieve long-term goals.

Actionable Steps:

- Identify and list both short-term and long-term financial goals, such as travel, healthcare, or legacy planning for beneficiaries.

- Develop a detailed spending plan that allocates funds from the inheritance for current and future expenses, ensuring the principal remains intact for retirement income strategies.

- Evaluate insurance needs to protect against unforeseen events, ensuring adequate coverage for health, life, and long-term care planning with inheritance.

Explanation: Creating a post-inheritance budget helps you prioritize financial goals and manage your new wealth effectively as part of retirement financial planning.

By planning for both immediate and future needs, you can avoid financial missteps in estate planning for retirees. For more guidance, consider reviewing this comprehensive financial planning resource from Investopedia.

This structured approach ensures your inheritance supports a secure and fulfilling retirement, considering investment strategies for inherited assets.

This methodical planning will pave the way for informed financial decisions and peace of mind in wealth management for retirees.

Next, let’s explore consulting a financial advisor on tax implications of inheritance.

3: Consult a financial advisor on tax implications

Understanding the tax implications of your inheritance is crucial for effective inheritance planning for retirees.

Actionable Steps:

- Schedule a meeting with a certified financial planner. Research and choose a reputable advisor with experience in retirement financial planning and inheritance planning for retirees.

- Explore tax-efficient investment strategies for inherited assets. Discuss options like Roth IRAs or charitable remainder trusts to reduce tax liability.

- Review and update estate planning documents for retirees. Ensure wills, trusts, and power of attorney documents reflect your new financial situation.

Key questions to ask your financial advisor:

- How can I minimize taxes on my inherited assets in retirement?

- What are the best investment strategies for my situation, considering inheritance and retirement income strategies?

- How should I adjust my estate plan to accommodate my new wealth and legacy planning for beneficiaries?

Explanation: Consulting a financial advisor helps you navigate the complexities of tax planning and wealth management for retirees.

A professional can guide you on the best strategies to minimize tax burdens and protect your wealth, including considerations for Social Security and inheritance.

For more insights, consider this resource from ProVise Management Group. Their expertise can help you achieve long-term financial stability.

Taking these steps ensures your inheritance supports a secure and fulfilling retirement, including long-term care planning with inheritance.

Partner with Alleo for Inheritance Planning Success

We’ve explored the challenges of managing inheritance in retirement. But did you know Alleo can simplify this process of inheritance planning for retirees?

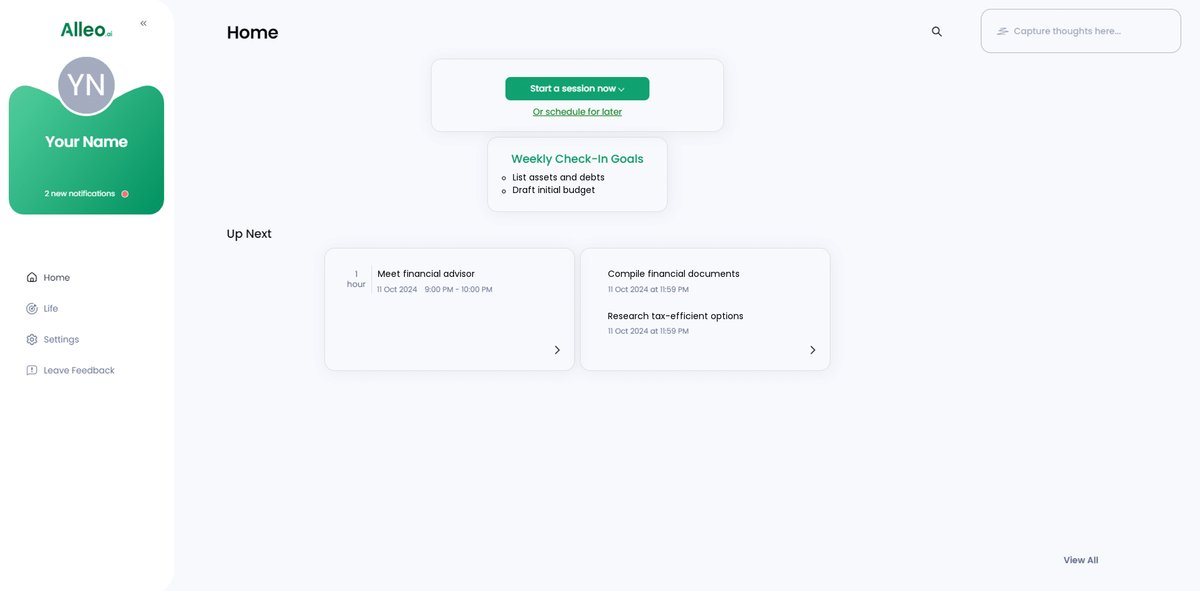

Set up an account, create a personalized retirement financial planning strategy, and work with Alleo’s AI coach to overcome financial challenges, including estate planning for retirees and tax implications of inheritance.

Alleo follows up on your progress, handles changes in investment strategies for inherited assets, and keeps you accountable via text and push notifications, aiding in long-term care planning with inheritance.

Ready to get started for free? Let me show you how Alleo can assist with your retirement income strategies and wealth management for retirees!

Step 1: Log In or Create Your Alleo Account

To begin managing your inheritance with Alleo’s AI coach, log in to your existing account or create a new one to start your personalized financial planning journey.

Step 2: Choose to Improve Overall Well-being and Life Satisfaction

Click on “Improve Overall Well-being and Life Satisfaction” to create a holistic plan that integrates your inheritance into a fulfilling retirement, addressing financial security and personal goals for your golden years.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to effectively manage your inheritance and integrate it into your retirement plan, allowing Alleo’s AI coach to provide tailored guidance on wealth assessment, budgeting, and tax planning strategies.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your inheritance and retirement goals to create a personalized financial plan tailored to your new circumstances.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on inheritance planning, check the Alleo app’s home page to view and manage the financial goals you discussed, ensuring you stay on track with your retirement and inheritance plans.

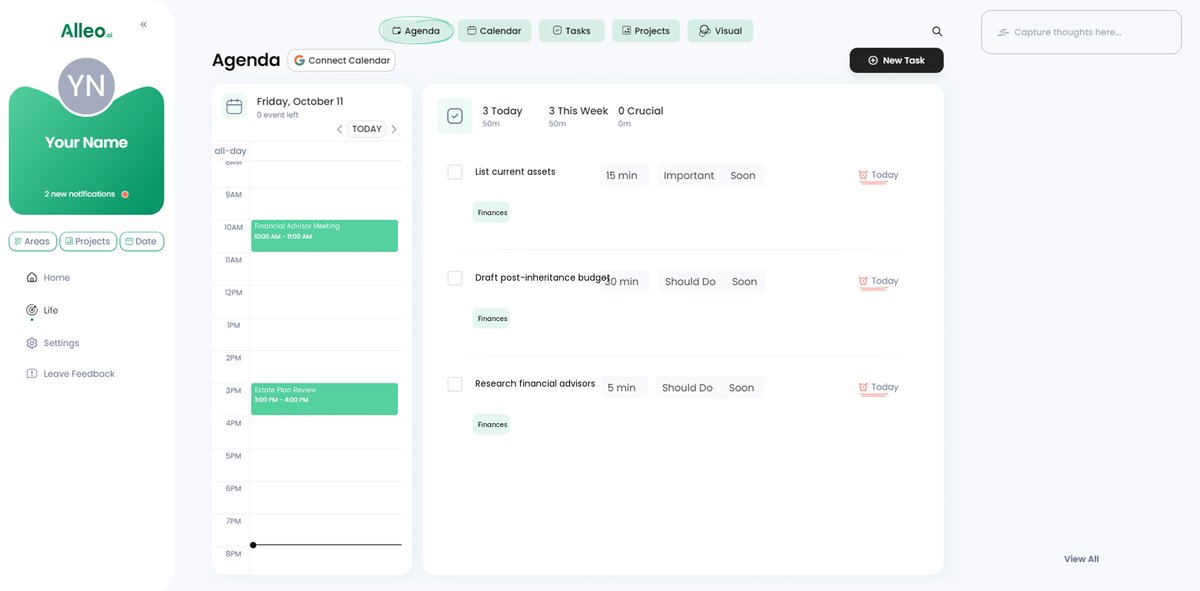

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to add important financial planning events, like meetings with your advisor or budget review dates, helping you track your progress in managing your inheritance and stay on top of your retirement goals.

Navigating Your Inheritance with Confidence

Integrating an inheritance into your retirement plan can feel daunting, especially when it comes to inheritance planning for retirees.

We’ve discussed assessing your total wealth, creating a comprehensive retirement financial planning budget, and consulting a financial advisor on tax implications of inheritance.

Remember, careful planning is essential to maximize your inheritance benefits and develop effective retirement income strategies.

You’re not alone in this journey of estate planning for retirees.

Alleo is here to guide you through each step of inheritance planning for retirees, offering personalized advice and support for wealth management.

Take control of your financial future today through strategic investment strategies for inherited assets.

Start your journey with Alleo for free and ensure a secure and fulfilling retirement with expert inheritance planning for retirees.