3 Smart Techniques to Evaluate Financial Advisor Recommendations for Young Professionals

Are you second-guessing the advice from your financial advisor? Evaluating financial advisor recommendations is crucial for your financial future.

Imagine being on the verge of a major financial decision, like Alex, a young professional unsure if his advisor’s recommendations truly serve his best interest. This scenario is common in financial planning for millennials.

As a life coach, I’ve guided many through similar dilemmas. In my experience, understanding how to evaluate financial advisor recommendations is essential for long-term wealth building for youth.

In this post, you’ll learn how to verify advisor credentials, compare advice to established financial principles, and seek second opinions to ensure your financial stability. We’ll explore investment strategies for young adults and dive into retirement planning for beginners.

Let’s dive in and discover the best approaches for evaluating financial advisor recommendations.

Understanding the Trust Gap in Financial Advice

It’s common for many clients to feel distrust or confusion when evaluating financial advisor recommendations. This uncertainty can stem from a lack of financial knowledge or previous negative experiences, especially when considering long-term wealth building for youth.

In my experience, people often find themselves second-guessing recommendations that seem complex or unfamiliar. This is particularly painful for small business owners who must manage both personal and business finances, often requiring guidance on portfolio diversification for young investors.

Ignoring these doubts and following unverified advice can lead to significant financial loss or missed opportunities. Ensuring your advisor’s guidance aligns with your financial goals is crucial for long-term stability, especially when it comes to retirement planning for beginners.

You deserve to feel confident in your financial decisions, whether it’s about investment strategies for young adults or balancing savings and lifestyle for young professionals.

Steps to Evaluate Financial Advisor Recommendations

Overcoming this challenge of evaluating financial advisor recommendations requires a few key steps. Here are the main areas to focus on to make progress in financial planning for millennials.

- Verify Advisor Credentials and Fiduciary Status: Ensure your advisor holds proper certifications and is legally obligated to act in your best interest, especially when considering long-term wealth building for youth.

- Compare Advice to Established Financial Principles: Align recommendations with proven financial strategies and goals, including investment strategies for young adults and retirement planning for beginners.

- Seek a Second Opinion from Trusted Financial Sources: Consult another advisor or engage with financial communities for additional perspectives on evaluating financial advisor recommendations, particularly for portfolio diversification for young investors.

Let’s dive in to explore these steps for evaluating financial advisor recommendations!

1: Verify advisor credentials and fiduciary status

When evaluating financial advisor recommendations, ensuring your advisor holds the right qualifications and operates with your best interests in mind is essential.

Actionable Steps:

- Check Certifications: Confirm your advisor holds recognized credentials such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst), which are crucial for financial planning for millennials.

- Research Fiduciary Status: Verify if the advisor is legally obligated to act in your best interest by checking their registration with regulatory bodies like FINRA or SEC, especially important when considering investment strategies for young adults.

- Request a Disclosure Statement: Ask for the advisor’s Form ADV to review their qualifications, services, and any potential conflicts of interest, which is vital for retirement planning for beginners.

Explanation: Verifying your advisor’s credentials and fiduciary status ensures they are qualified and trustworthy. This step helps align their advice with your financial goals and industry standards, including risk assessment in financial advising.

For more details on this process, visit FINRA’s advertising regulation.

Taking these steps will give you confidence in your advisor’s ability and integrity, setting the stage for informed financial decisions and long-term wealth building for youth.

Key benefits of working with a credentialed fiduciary advisor when evaluating financial advisor recommendations:

- Increased trust and transparency in financial relationships

- Alignment of advisor’s interests with your financial goals, including budgeting tips for young professionals

- Access to expertise backed by recognized industry standards, which is crucial when comparing robo-advisors and traditional financial advisors

2: Compare advice to established financial principles

When evaluating financial advisor recommendations, aligning advice with established principles ensures it is sound and supports your goals.

Actionable Steps:

- Benchmark Against Financial Goals: Align the advice with your short-term and long-term financial objectives to ensure it supports your overall strategy, especially when considering retirement planning for beginners.

- Cross-Check with Reputable Sources: Compare the recommendations with advice from credible financial resources like T. Rowe Price, Vanguard, or trusted financial education platforms, which is crucial for financial planning for millennials.

- Utilize Financial Planning Tools: Use online calculators and financial planning tools to simulate the potential outcomes of the advisor’s recommendations, particularly useful for investment strategies for young adults.

Explanation: Comparing advice to established financial principles helps validate its reliability when evaluating financial advisor recommendations. This step ensures that your decisions are based on sound, proven strategies and align with your financial ambitions.

For more insights on evaluating financial advice, visit T. Rowe Price.

Doing this helps you feel confident that the advice you receive is credible and in your best interest, which is essential for long-term wealth building for youth.

Core financial principles to consider:

- Diversification of investment portfolios, crucial for portfolio diversification for young investors

- Long-term perspective in financial planning

- Regular review and rebalancing of assets, important for risk assessment in financial advising

3: Seek second opinion from trusted financial source

Getting a second opinion ensures that the financial advice you receive is sound and trustworthy when evaluating financial advisor recommendations.

Actionable Steps:

- Consult Another Financial Advisor: Schedule a meeting with another advisor to review the initial recommendations and provide a second opinion, especially for retirement planning for beginners.

- Join Financial Forums or Networks: Engage with communities like Reddit’s r/CFP or r/Bogleheads to discuss and gather diverse viewpoints on the advice received, particularly for financial planning for millennials.

- Attend Financial Workshops or Seminars: Participate in educational events to enhance your understanding and gain insights from experienced professionals on investment strategies for young adults.

Explanation: Seeking a second opinion helps confirm the validity of the initial advice and provides additional perspectives when evaluating financial advisor recommendations. This can be especially beneficial if you have doubts about your advisor’s recommendations for long-term wealth building for youth.

According to a T. Rowe Price study, diverse viewpoints can significantly improve financial decisions. Engaging with trusted sources ensures your financial strategy is comprehensive and well-founded, particularly for portfolio diversification for young investors.

Taking these steps will help you make more informed financial decisions and boost your confidence in the advice you receive, especially when comparing robo-advisors and traditional financial advisors.

Advantages of seeking multiple financial perspectives:

- Broader understanding of financial strategies and risk assessment in financial advising

- Identification of potential blind spots in your plan, such as debt management advice for recent graduates

- Increased confidence in your financial decisions, including budgeting tips for young professionals

Partner with Alleo for Confident Financial Decisions

We’ve explored the challenges of evaluating financial advisor recommendations and the steps to make informed decisions. But did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to financial planning for millennials?

Setting up an account with Alleo is simple. Start with a free 14-day trial, no credit card required. This is perfect for those interested in comparing robo-advisors and traditional financial advisors.

Create a personalized plan tailored to your financial goals, including investment strategies for young adults and retirement planning for beginners. Alleo’s AI coach provides full coaching sessions just like a human coach, helping with evaluating financial advisor recommendations.

The AI coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications. Alleo helps you set clear financial goals, analyze recommendations, and build financial literacy, which is crucial for long-term wealth building for youth.

Ready to get started for free? Let me show you how to begin evaluating financial advisor recommendations with confidence!

Step 1: Logging In or Creating Your Account

To start your journey towards confident financial decision-making, log in to your existing Alleo account or create a new one in just a few clicks.

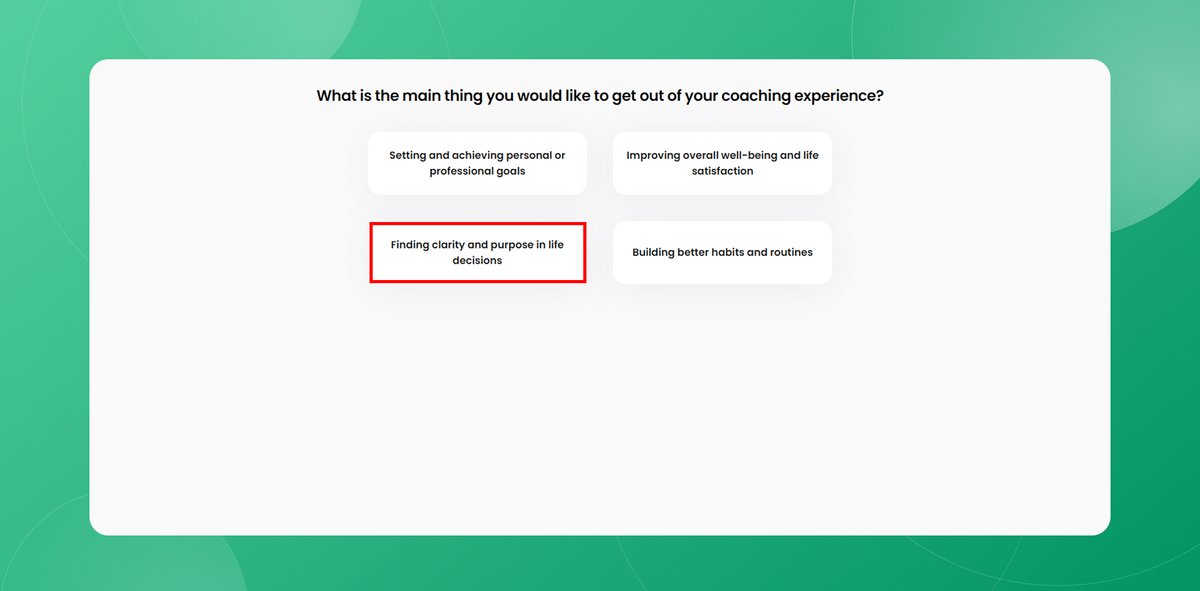

Step 2: Choose Your Financial Focus

Select “Finding clarity and purpose in life decisions” to align your financial goals with your overall life vision, helping you evaluate advisor recommendations more effectively and make confident choices about your financial future.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive tailored guidance on evaluating financial advisor recommendations, comparing advice to established principles, and making confident financial decisions aligned with your goals.

Step 4: Starting a coaching session

Begin your journey with Alleo by initiating an intake session, where the AI coach will guide you through setting up a personalized financial plan tailored to your goals and concerns discussed in this article.

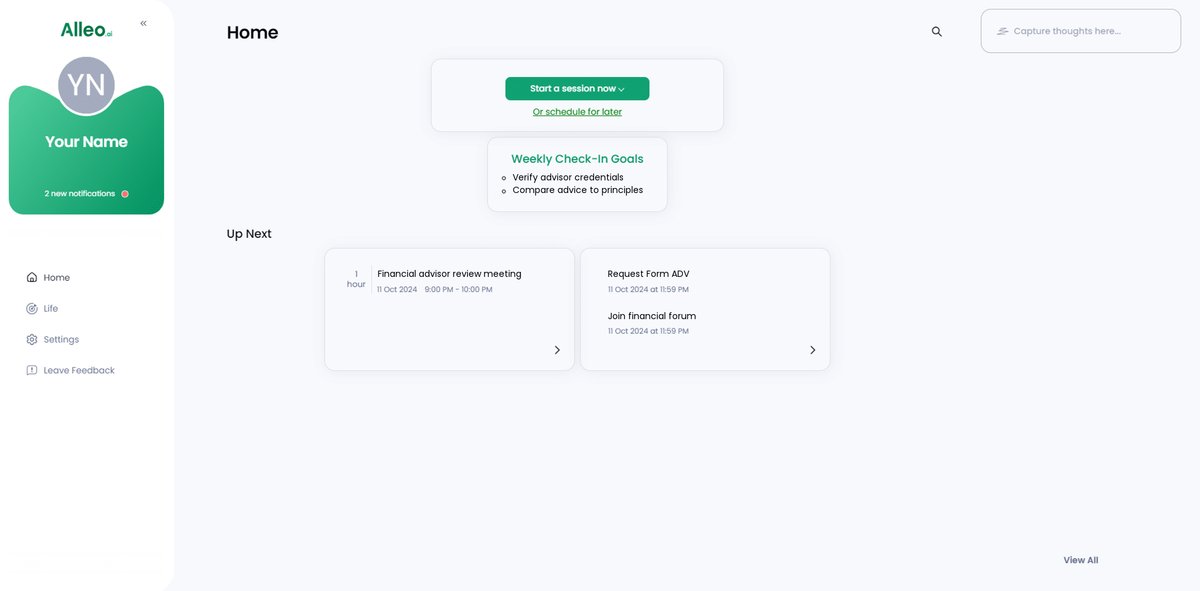

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to see your discussed financial goals displayed on the home page, where you can easily track and manage your progress.

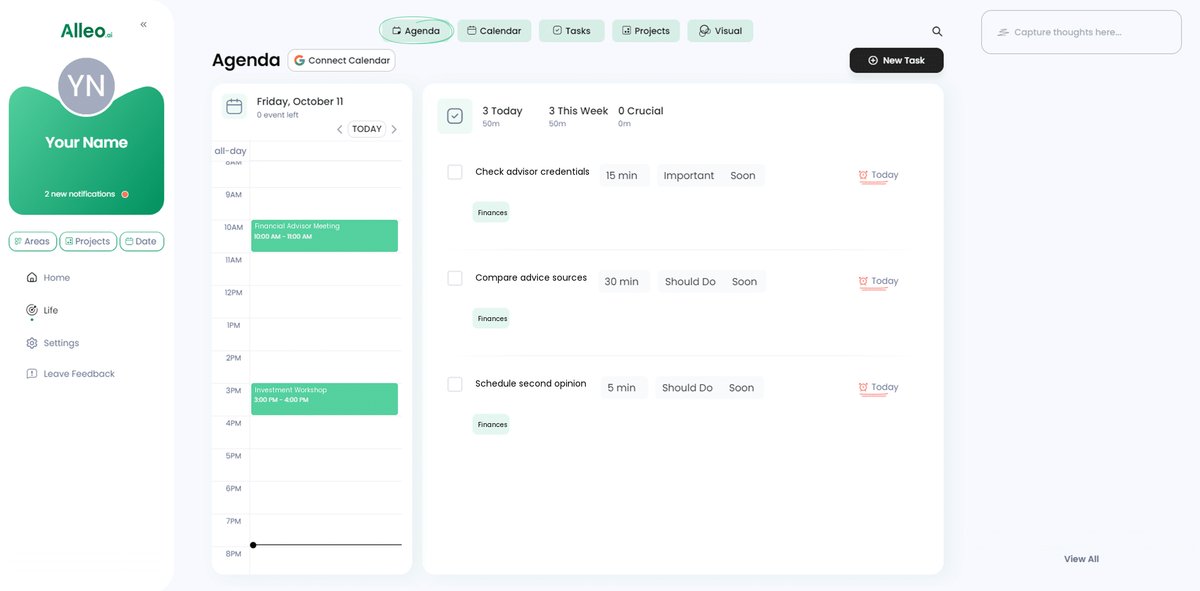

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to easily schedule and track important financial events, such as advisor meetings or review sessions, helping you stay organized and accountable as you work towards your financial goals.

Empowering Your Financial Future

As you take the time to verify your financial advisor’s credentials, you’ll gain confidence in evaluating financial advisor recommendations. Comparing advice to established financial principles ensures your decisions are sound and aligned with your goals, which is crucial for financial planning for millennials.

Seeking a second opinion can further solidify your financial strategy. You deserve to feel secure and confident in your financial decisions, especially when it comes to investment strategies for young adults and retirement planning for beginners.

Remember, Alleo is here to support you every step of the way. With its AI life coach and organizer, achieving your financial objectives becomes simpler and more efficient, whether you’re focusing on budgeting tips for young professionals or long-term wealth building for youth.

Take control of your financial future today. Sign up for Alleo’s free trial and see the difference it can make in evaluating financial advisor recommendations and managing your finances effectively.