4 Proven Methods to Create Effective Business Development Strategies for Financial Planners

Are you struggling to grow your client base despite providing excellent financial planning services? Effective financial planner business development strategies can help you overcome this challenge.

As a life coach, I’ve helped many financial planners navigate these exact challenges in financial planning business growth. In my experience, the key lies in implementing client acquisition strategies for financial advisors.

In this article, you’ll learn actionable steps to overcome common business development obstacles for financial planners. We’ll cover:

- Niche specialization in financial planning

- Targeted content marketing for financial advisors

- Referral generation in financial services

- Client relationship management for financial planning businesses

Ready to transform your practice with effective financial planner business development strategies? Let’s dive in.

Understanding the Challenges Financial Planners Face

Navigating the competitive landscape of financial planning can be daunting. Many planners struggle with lead generation, client acquisition strategies for financial advisors, and maintaining consistent financial planning business growth.

In my experience, financial planners often find themselves stuck in service-oriented roles, neglecting the essential financial planner business development strategies. Evolving client expectations only add to the challenge, making it harder to stand out in niche markets in financial planning.

Lead generation is another significant hurdle. Despite quality service, many planners fail to attract new clients through effective marketing techniques for financial planners.

This issue can be incredibly frustrating.

You might also face difficulties in keeping up with the latest industry trends and digital marketing for financial advisors. Adapting to these changes is crucial for staying relevant.

Ultimately, these challenges can hinder your growth and success. But don’t worry, solutions are available.

Let’s explore them together.

Strategic Steps to Overcome Business Development Challenges

Overcoming these business development challenges requires a few key financial planner business development strategies. Here are the main areas to focus on to make progress in financial planning business growth:

- Develop a niche specialization strategy: Focus on a specific client segment to build expertise and credibility in niche markets in financial planning.

- Implement a targeted content marketing plan: Create and share content that addresses the needs of your chosen niche, utilizing digital marketing for financial advisors.

- Create a referral generation system: Encourage existing clients and professional contacts to refer new clients, implementing effective referral programs in financial services.

- Enhance client relationship management skills: Use CRM systems for financial planning businesses and techniques to improve client interactions and satisfaction.

Let’s dive into these client acquisition strategies for financial advisors!

1: Develop a niche specialization strategy

Developing a niche specialization strategy is crucial for financial planners to stand out in a crowded market and is a key financial planner business development strategy.

Actionable Steps:

- Identify a profitable niche: Use data analytics to find client segments that align with your strengths and interests, focusing on niche markets in financial planning.

- Create a unique value proposition: Tailor your services to meet the specific needs of your niche clients, enhancing your value proposition for financial planners.

- Network within your niche: Attend industry-specific events and join relevant professional associations to build credibility, employing effective networking for financial planners.

Key benefits of niche specialization include:

- Increased perceived expertise

- More targeted marketing efforts

- Higher client acquisition rates for financial advisors

Explanation: These steps help you focus your efforts, making it easier to market your services effectively as part of your financial planning business growth strategy.

Specializing in a niche allows you to become an expert in a particular area, which can attract more clients and boost your financial planner business development strategies.

For more insights, visit this Kitces article on niche marketing.

By implementing these strategies, you can build a strong reputation and grow your client base efficiently, enhancing your overall financial planner business development approach.

2: Implement a targeted content marketing plan

Implementing a targeted content marketing plan is essential for financial planners to engage potential clients and demonstrate expertise as part of their business development strategies.

Actionable Steps:

- Create a content calendar: Develop a schedule focusing on topics relevant to your niche, such as blog posts, whitepapers, and case studies to support financial planning business growth.

- Leverage social media platforms: Share your content and engage with your audience on platforms like LinkedIn, connecting with potential clients and industry influencers as part of your digital marketing for financial advisors strategy.

- Measure performance: Use analytics tools to track metrics like engagement rates, lead conversion rates, and website traffic to optimize your client acquisition strategies for financial advisors.

Explanation: These steps help you consistently produce valuable content, engage with your target audience, and measure the effectiveness of your efforts in financial planner business development strategies.

A well-executed content marketing plan can significantly enhance your visibility and credibility, supporting your overall marketing techniques for financial planners.

For more insights, visit this Select Advisors Institute article on business development coaching.

By implementing these strategies, you can build a strong online presence and attract more clients to your financial planning business.

3: Create a referral generation system

Creating a referral generation system is a crucial financial planner business development strategy to expand their client base through trusted recommendations.

Actionable Steps:

- Develop a referral program: Incentivize current clients with discounts or additional services for successful referrals, enhancing client acquisition strategies for financial advisors.

- Build relationships with professionals: Partner with accountants, attorneys, and other complementary service providers who can refer clients to you, leveraging networking for financial planners.

- Request testimonials and referrals: Implement a follow-up system to ask satisfied clients for feedback and referrals after successful engagements, supporting marketing techniques for financial planners.

Effective referral strategies often include:

- Personalized follow-up communications

- Client appreciation events

- Referral-specific marketing materials

Explanation: These steps matter because referrals from trusted sources can significantly enhance your credibility and client base, contributing to financial planning business growth.

For instance, building relationships with professionals like accountants can lead to high-quality referrals. By regularly asking for testimonials, you can also gather social proof to attract new clients, strengthening your value proposition for financial planners.

For more insights on business development, visit this Investopedia article on business development.

Next, let’s explore how enhancing client relationship management skills can further boost your financial planner business development strategies.

4: Enhance client relationship management skills

Enhancing client relationship management skills is crucial for building long-term trust and loyalty, making it a key financial planner business development strategy.

Actionable Steps:

- Invest in a CRM system: Track client interactions and personalize your communication with tailored messages, essential for financial planning business growth.

- Provide exceptional client service: Be responsive and proactive by scheduling regular check-ins and offering valuable financial insights, a vital client acquisition strategy for financial advisors.

- Continuously improve your skills: Attend workshops and webinars on advanced financial planning and relationship management as part of your professional development as a financial advisor.

Key components of effective client relationship management:

- Active listening and empathy

- Clear and timely communication

- Proactive problem-solving

Explanation: These steps matter because they help you build strong, lasting relationships with clients, leading to increased satisfaction and loyalty. For example, using a CRM system for financial planning businesses can enhance your ability to provide personalized service, which is essential for maintaining client trust.

For more insights, check out this MD Anderson article on research planning and development.

By enhancing your client relationship management skills, you can foster deeper connections and drive business growth, a cornerstone of successful financial planner business development strategies.

Partner with Alleo on Your Business Development Journey

We’ve explored the challenges financial planners face in business development. But did you know you can work with Alleo to overcome these challenges and implement effective financial planner business development strategies more efficiently?

Alleo offers affordable, tailored coaching support for financial planning business growth. Set up an account, create a personalized plan, and start receiving expert guidance on client acquisition strategies for financial advisors.

Alleo’s AI coach provides full coaching sessions, just like a human coach, and follows up on your progress in implementing marketing techniques for financial planners. The coach handles changes and keeps you accountable via text and push notifications, helping you explore niche markets in financial planning.

Ready to get started for free? Let me show you how to enhance your financial planner business development strategies!

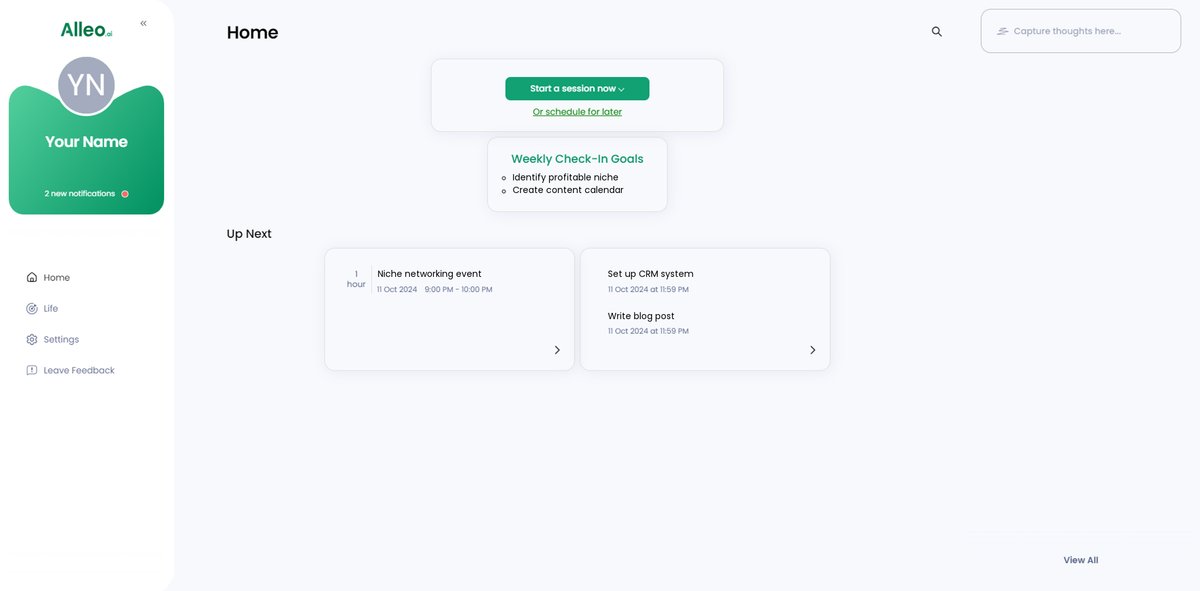

Step 1: Log In or Create Your Alleo Account

To begin your business development journey with Alleo, log in to your existing account or create a new one to access personalized coaching support tailored for financial planners.

Step 2: Choose Your Business Development Focus

Select “Setting and achieving personal or professional goals” to address the business development challenges outlined in the article. By focusing on this area, you’ll be able to work on specific strategies like niche specialization or improving your content marketing, which are crucial for growing your financial planning practice.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to align with your goals as a financial planner and receive tailored guidance on business development strategies that will help you grow your client base and improve your practice.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with your AI coach to create a personalized plan for overcoming business development challenges and growing your financial planning practice.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app and check your home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable to your business development objectives.

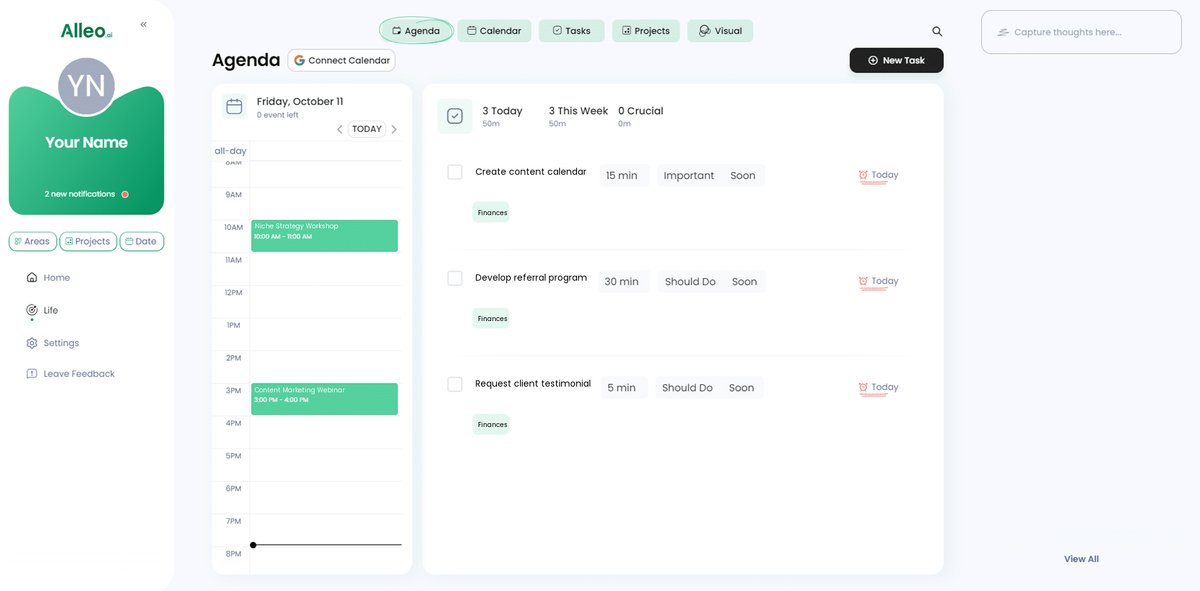

Step 6: Adding events to your calendar or app

To stay on track with your business development goals, use the Alleo app’s calendar and task features to add important events, deadlines, and milestones, allowing you to easily monitor your progress in overcoming challenges and implementing the strategies discussed in this article.

Take Charge of Your Business Development Journey

As we’ve explored, developing effective financial planner business development strategies can transform your financial planning practice.

By focusing on niche markets in financial planning, targeted content marketing, referral programs in financial services, and enhanced client relationship management, you can overcome common challenges in financial planning business growth.

I understand these client acquisition strategies for financial advisors may seem daunting, but remember, you’re not alone.

You have the skills to make it happen and implement these marketing techniques for financial planners.

Alleo is here to support you every step of the way in your financial planner business development strategies.

Embrace these strategies, take action, and watch your client base grow through networking for financial planners and digital marketing for financial advisors.

Start your journey with Alleo today and see the difference it can make in your value proposition for financial planners.

You can do this!