4 Proven Steps for Young Professionals to Decode Payroll Deductions and Taxes

Have you ever felt the thrill of receiving your first paycheck, only to be baffled by the myriad of deductions? Understanding payroll deductions for beginners can be overwhelming at first.

As a life coach, I’ve guided many young professionals through the maze of payroll and taxes. In my experience, understanding these deductions is crucial for financial well-being. From income tax basics for new workers to FICA deductions for beginners, there’s a lot to learn.

In this article, you’ll learn strategies to decode your paycheck, use online tools like tax withholding calculators, and leverage company resources. These insights will empower you to take control of your finances, from understanding W-2 forms to managing employee benefits and deductions.

Let’s dive in to explore entry-level salary breakdowns and the importance of budgeting for paycheck deductions.

Understanding the Pain of Payroll Deductions

Many young professionals are shocked by the amount deducted from their first paycheck when understanding payroll deductions for beginners. Unfamiliar terms like FICA deductions for beginners, Medicare, and state taxes can add to the confusion.

Often, recent graduates struggle to balance entry-level salaries with living expenses, making budgeting for paycheck deductions essential.

I’ve seen several clients worry about unexpected deductions. These deductions, including income tax basics for new workers, can make it difficult to manage their finances effectively.

They often feel overwhelmed by the complexity of payroll taxes explained and tax terms.

Understanding these deductions is crucial. It empowers you to take control of your financial health, including retirement contributions for young employees.

Ignoring this can lead to financial stress and poor planning, especially when it comes to state and local tax implications.

Four Steps to Mastering Payroll Deductions and Taxes

Understanding payroll deductions for beginners can be challenging. Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with payroll taxes explained.

- Review your first paycheck stub in detail: Understand each deduction listed, including FICA deductions for beginners.

- Use the IRS Tax Withholding Estimator online: Determine correct withholding amounts and explore tax withholding calculators.

- Learn about pre-tax vs. after-tax deductions: Identify and compare benefits, including retirement contributions for young employees.

- Consult HR about company-specific benefits: Get personalized guidance and maximize your employment package, including employee benefits and deductions.

Let’s dive into understanding payroll deductions for beginners!

1: Review your first paycheck stub in detail

Understanding payroll deductions for beginners starts with examining your first paycheck stub in detail. This is essential to grasping where your money is going and comprehending income tax basics for new workers.

Actionable Steps:

- Compare your gross and net income: Identify each type of deduction listed on your paycheck stub, including FICA deductions for beginners.

- Research each deduction: Look up unfamiliar terms like FICA, Medicare, and state taxes to better understand payroll taxes explained.

- Track your deductions over time: Use a spreadsheet to log deductions each pay period, helping with budgeting for paycheck deductions.

Explanation: Knowing the details of your paycheck can help identify where your money goes and reveal any discrepancies in your entry-level salary breakdown.

For instance, you can learn more about mandatory deductions like FICA on the IRS website. This understanding ensures you aren’t surprised by unexpected deductions and can plan accordingly, including state and local tax implications.

Key benefits of understanding your paycheck:

- Improved financial awareness

- Better budgeting capabilities

- Early detection of payroll errors

Next, we will discuss how to use the IRS Tax Withholding Estimator to perfect your payroll management and understand employee benefits and deductions.

2: Use IRS Tax Withholding Estimator online

Utilizing the IRS Tax Withholding Estimator can help ensure you’re withholding the correct amount of taxes from your paycheck, which is crucial for understanding payroll deductions for beginners.

Actionable Steps:

- Gather recent pay stubs and tax returns: Collect your latest pay stubs and most recent tax return to ensure accuracy when calculating income tax basics for new workers.

- Complete the estimator on the IRS website: Follow the step-by-step process on the IRS website to determine the correct withholding amounts using tax withholding calculators.

- Submit a new Form W-4 if needed: If adjustments are necessary, submit an updated W-4 form to your employer to ensure proper payroll taxes explained on your future paychecks.

Explanation: Using the IRS Tax Withholding Estimator helps you avoid underpaying or overpaying taxes, which is essential for budgeting for paycheck deductions.

This tool ensures that you withhold the correct amount, preventing unexpected tax bills or large refunds, and aids in understanding FICA deductions for beginners.

For detailed guidance, refer to the IRS Tax Withholding Estimator.

Next, we will explore the differences between pre-tax and after-tax deductions, which are important aspects of employee benefits and deductions.

3: Learn about pre-tax vs. after-tax deductions

Understanding the differences between pre-tax and after-tax deductions is essential for managing your finances effectively, especially when it comes to understanding payroll deductions for beginners.

Actionable Steps:

- Identify pre-tax benefits: Review benefits such as health insurance, retirement contributions, and flexible spending accounts as part of understanding employee benefits and deductions.

- Calculate after-tax savings: Compare your take-home pay with and without these deductions, which is crucial for entry-level salary breakdown.

- Utilize employer resources: Attend HR workshops or webinars on payroll deductions and income tax basics for new workers.

Explanation: Knowing how pre-tax benefits reduce your taxable income can help you make informed financial decisions. For instance, pre-tax retirement contributions can lower your taxable income, which might reduce your overall tax liability. This is particularly important when understanding payroll deductions for beginners.

You can find more information about pre-tax benefits on the CMS website. Understanding these differences ensures you maximize your income and benefits, which is crucial for budgeting for paycheck deductions.

Common pre-tax deductions include:

- 401(k) contributions, which are important retirement contributions for young employees

- Health insurance premiums

- Flexible Spending Account (FSA) contributions

Next, we will discuss how to consult HR about company-specific benefits and FICA deductions for beginners.

4: Consult HR about company-specific benefits

Consulting HR about company-specific benefits is vital for understanding payroll deductions for beginners and maximizing your employment package.

Actionable Steps:

- Schedule a meeting with HR: Prepare a list of questions regarding your payroll taxes explained and available benefits.

- Explore optional benefits: Discuss additional perks your company offers, such as commuter benefits or retirement contributions for young employees.

- Request written materials: Ask for brochures or guides on employee benefits and deductions, including FICA deductions for beginners.

Explanation: These steps help you clarify your benefits and make informed decisions about income tax basics for new workers. For example, understanding optional benefits like tuition reimbursement can significantly impact your financial planning and entry-level salary breakdown.

This personalized approach ensures you fully utilize your employment package and assists in budgeting for paycheck deductions. For further insight, refer to the IRS guidelines on fringe benefits.

Questions to ask HR:

- What voluntary deductions are available?

- How do company benefits impact my taxes and understanding W-2 forms?

- Are there any upcoming changes to benefit plans or state and local tax implications?

Next, we’ll discuss how to use Alleo to manage your finances effectively.

Leverage Alleo to Master Payroll Deductions

We’ve explored the challenges of understanding payroll deductions for beginners and taxes, and the steps to master them. Did you know you can work directly with Alleo to simplify this journey of learning about income tax basics for new workers?

Sign up for Alleo and create a personalized plan. Our AI coach provides tailored guidance to navigate payroll deductions, including FICA deductions for beginners and understanding W-2 forms.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications. Get help with employee benefits and deductions, entry-level salary breakdowns, and budgeting for paycheck deductions.

Ready to get started for free? Let me show you how to use tax withholding calculators and understand state and local tax implications!

Step 1: Log In or Create Your Account

To start mastering your payroll deductions with Alleo’s AI coach, log in to your existing account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start mastering your paycheck deductions through consistent financial practices, helping you take control of your finances and reduce stress around taxes and withholdings.

Step 3: Select ‘Finances’ as Your Focus Area

Choose ‘Finances’ as your focus area in Alleo to receive tailored guidance on managing payroll deductions, understanding taxes, and improving your overall financial health, helping you take control of your paycheck and reduce financial stress.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your payroll and tax concerns to create a personalized financial plan tailored to your needs.

Step 5: Viewing and managing goals after the session

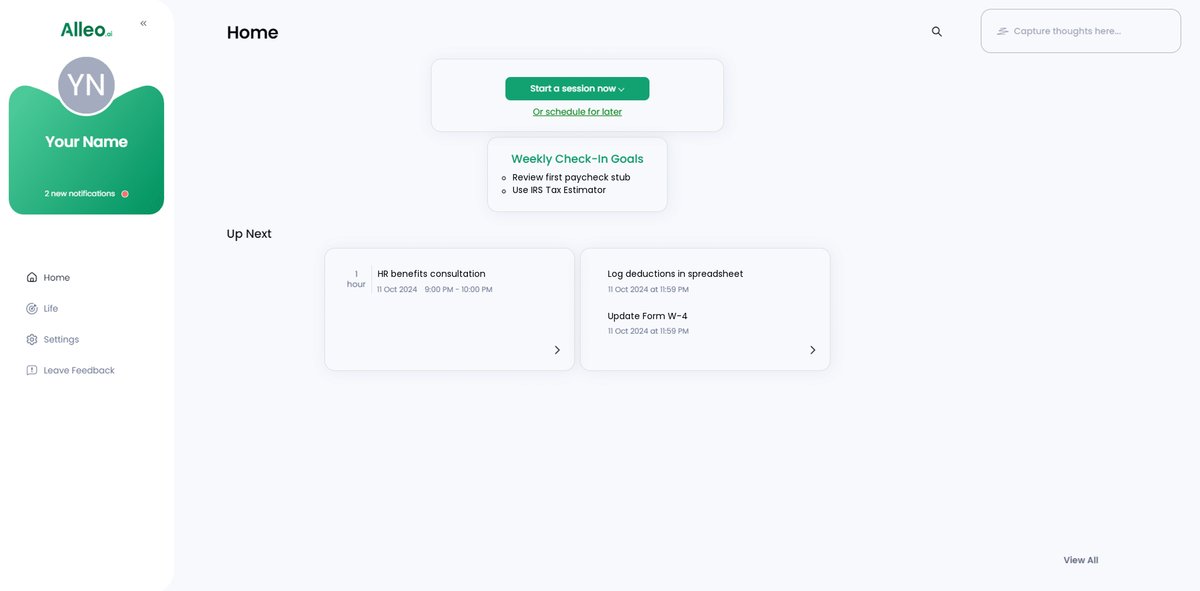

After your coaching session on payroll deductions and taxes, check the Alleo app’s home page to view and manage the personalized goals you discussed, helping you stay on track with your financial planning.

Step 6: Adding events to your calendar or app

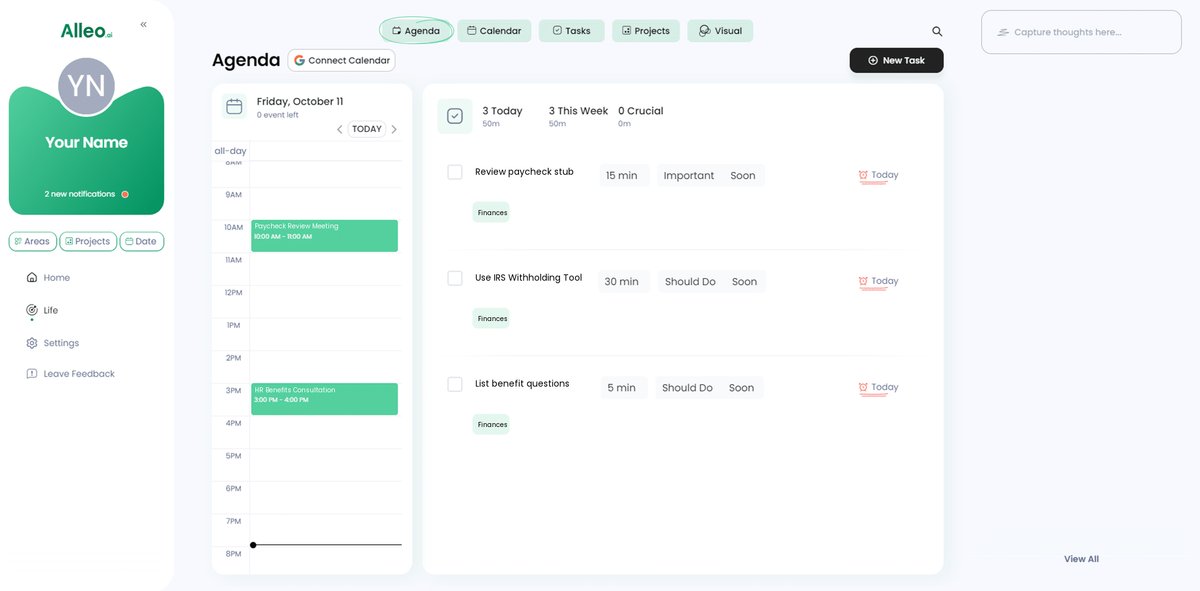

Use Alleo’s calendar and task features to track your progress in understanding payroll deductions and taxes, scheduling reminders for reviewing your pay stubs, using the IRS Tax Withholding Estimator, and meeting with HR about company benefits.

Wrapping Up: Take Control of Your Paycheck

Understanding payroll deductions for beginners can feel overwhelming, but breaking it down step by step makes it manageable. By reviewing your paycheck stub, using tax withholding calculators, and consulting HR about employee benefits and deductions, you gain clarity and control over your entry-level salary breakdown.

Remember, financial literacy is a journey, not a destination. Each step you take brings you closer to mastering your finances, including income tax basics for new workers and FICA deductions for beginners.

Your financial health is within your reach. Embrace these strategies and take charge of your paycheck, from understanding W-2 forms to planning retirement contributions for young employees.

For extra support in navigating payroll taxes explained and state and local tax implications, try Alleo. With personalized guidance, you’ll navigate payroll and taxes with ease, making budgeting for paycheck deductions simpler.

Ready to simplify your finances? Sign up for Alleo today!