5 Essential Best Practices for Financial Data Retention Strategies: A Guide for IT Managers

Are you struggling with balancing regulatory compliance and data accessibility for your financial data? You’re not alone. Financial data retention best practices can be challenging to implement.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, it’s a common issue for both accountants and IT managers dealing with data retention policies and IT security in financial data management.

In this post, you’ll discover actionable strategies to develop an effective log retention and backup strategy. We’ll explore best practices for tiered data retention policies, encrypted cloud storage for financial records, and more cost-effective data archiving methods.

Let’s dive into financial data retention best practices.

Understanding the Pain Points in Financial Data Retention

Tackling financial data retention best practices is a hefty challenge for many accountants and IT managers. The complexity of balancing regulatory compliance for financial data, storage limitations, and data accessibility can be overwhelming.

In my experience, many clients initially struggle with the sheer volume of financial data they need to manage. This often leads to storage issues and increased costs, highlighting the need for cost-effective data archiving methods.

Data breaches and regulatory fines add another layer of stress to an already daunting task, emphasizing the importance of IT security in financial data management.

Additionally, the lack of a comprehensive data retention policy can result in inefficiencies and non-compliance. It’s crucial to develop a balanced approach that addresses these challenges effectively, incorporating data lifecycle management in finance.

By understanding these pain points, you can take proactive steps to mitigate risks and enhance your financial data retention best practices.

A Roadmap to Effective Financial Data Retention

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to implement financial data retention best practices and make progress.

- Implement a tiered data retention policy: Categorize data by importance, setting specific retention periods for effective data lifecycle management in finance.

- Utilize encrypted cloud storage for backups: Encrypt and securely store sensitive data in the cloud, leveraging cost-effective data archiving methods and cloud storage for financial records.

- Automate email archiving and retention: Use automated solutions to manage email retention effectively, enhancing IT security in financial data management.

- Establish clear data destruction protocols: Develop policies for secure data deletion, aligning with regulatory compliance for financial data.

- Conduct regular compliance audits: Schedule periodic audits to ensure ongoing compliance and maintain robust data backup and recovery strategies.

Let’s dive in!

1: Implement a tiered data retention policy

Implementing a tiered data retention policy is essential for balancing regulatory compliance with efficient data management, especially when it comes to financial data retention best practices.

Actionable Steps:

- Assess and categorize data: Identify and classify financial data based on importance and regulatory requirements. Determine specific retention periods for each category, aligning with data retention policies.

- Develop a tiered storage system: Prioritize high-speed, expensive storage for critical financial data and use cost-effective data archiving methods for less important information.

- Regularly review and update: Continuously evaluate and update the retention policy to ensure compliance with regulatory requirements for financial data and maintain efficiency.

Explanation:

These steps ensure that your financial data retention best practices are both compliant and efficient. By categorizing data and using a tiered storage system, you can optimize costs and accessibility while adhering to IT security in financial data management.

Regular reviews help maintain compliance with evolving regulations. For more insights on data retention strategies, visit this resource.

Key benefits of a tiered data retention policy include:

- Improved data organization and accessibility

- Cost-effective storage utilization, including cloud storage for financial records

- Enhanced compliance with regulatory requirements for financial data

This structured approach sets the foundation for a robust data retention strategy, incorporating data lifecycle management in finance.

2: Utilize encrypted cloud storage for backups

Using encrypted cloud storage for backups is crucial for safeguarding sensitive financial data while ensuring accessibility and compliance with financial data retention best practices.

Actionable Steps:

- Choose a reliable cloud storage provider: Select a provider that offers robust end-to-end encryption to secure your data and supports regulatory compliance for financial data.

- Encrypt data before uploading: Use encryption tools to secure sensitive financial data before uploading it to the cloud, adhering to data storage solutions for finance.

- Implement multi-factor authentication: Add an extra security layer by enabling multi-factor authentication for access to your cloud storage, enhancing IT security in financial data management.

Explanation:

These steps ensure that your financial data is protected from unauthorized access while providing the flexibility of cloud storage for financial records.

Encrypting data and using multi-factor authentication significantly enhance security. Regularly reviewing these practices helps maintain compliance with industry standards and supports data lifecycle management in finance.

For more insights, check out this resource on financial data management.

Ensuring secure cloud storage is a key component of an effective financial data retention strategy, incorporating data backup and recovery strategies.

3: Automate email archiving and retention

Automating email archiving and retention is vital for maintaining compliance and ensuring quick access to important communications, which is a key aspect of financial data retention best practices.

Actionable Steps:

- Select an email archiving solution: Choose a tool that supports automated retention policies to streamline the process and enhance data lifecycle management in finance.

- Configure retention criteria: Set up the system to archive emails based on age, keywords, or other relevant factors, aligning with data retention policies.

- Integrate with your email platform: Ensure the archiving solution works seamlessly with your current email provider for ease of use and supports regulatory compliance for financial data.

Explanation:

These steps help you efficiently manage email retention, reducing the risk of non-compliance and data loss. By automating the process, you save time and resources while ensuring important emails are archived according to predefined criteria, supporting cost-effective data archiving methods.

For more insights on best practices for email retention, visit this resource.

Key advantages of automated email archiving:

- Streamlined compliance management

- Faster retrieval of important communications

- Reduced storage costs for email servers

Automating your email archiving and retention is a crucial part of an effective data retention strategy, contributing to overall IT security in financial data management.

4: Establish clear data destruction protocols

Establishing clear data destruction protocols is crucial for ensuring that sensitive financial information is securely deleted when no longer needed, aligning with financial data retention best practices.

Actionable Steps:

- Develop a comprehensive data retention policy: Outline specific guidelines detailing when and how different types of data should be securely deleted, adhering to regulatory compliance for financial data.

- Use certified data destruction tools: Employ certified software or services to ensure the complete and irreversible eradication of sensitive information, enhancing IT security in financial data management.

- Train staff on data destruction procedures: Educate your team about the importance of data destruction and the proper steps to follow as part of data lifecycle management in finance.

Explanation:

These steps are vital for preventing unauthorized access to outdated or sensitive financial data, thus mitigating risks of data breaches and ensuring compliance with financial data retention best practices.

Implementing certified tools and regular staff training helps maintain robust data security. For more insights on data retention and destruction best practices, visit this resource.

Proper data destruction protocols are an essential part of a comprehensive financial data retention strategy, supporting long-term data preservation techniques.

5: Conduct regular compliance audits

Conducting regular compliance audits is essential for ensuring your financial data retention best practices meet industry standards and regulations.

Actionable Steps:

- Schedule periodic audits: Set a regular schedule for audits to review the adherence to data retention policies and regulatory compliance for financial data.

- Utilize audit findings: Use the results from audits to identify and address any gaps or weaknesses in your data lifecycle management in finance.

- Document audit outcomes: Keep detailed records of audit results and subsequent actions for accountability and future reference, supporting long-term data preservation techniques.

Explanation:

These steps are crucial for maintaining compliance and identifying areas for improvement in your financial data retention best practices. Regular audits help ensure that your strategies align with current regulations and industry standards for IT security in financial data management.

For further insights on maintaining regulatory compliance, visit this resource on financial data management.

Benefits of regular compliance audits:

- Early detection of potential compliance issues in financial data retention best practices

- Continuous improvement of data storage solutions for finance

- Enhanced confidence in regulatory adherence and data backup and recovery strategies

Consistent compliance audits can significantly enhance your financial data retention best practices, ensuring they remain effective and up-to-date with evolving regulations and cost-effective data archiving methods.

Transform Your Financial Data Retention with Alleo

We’ve explored the challenges of financial data retention and the steps to overcome them. But did you know you can work directly with Alleo to make implementing financial data retention best practices easier?

Setting up an account with Alleo is simple. Create a personalized plan to address your specific financial data retention needs, including data retention policies and regulatory compliance for financial data.

Alleo’s AI coach will guide you through each step of implementing financial data retention best practices. The coach will follow up on your progress, handle changes in data lifecycle management in finance, and keep you accountable via text and push notifications.

Ready to get started for free with cost-effective data archiving methods? Let me show you how!

Step 1: Log In or Create Your Alleo Account

To start mastering your financial data retention strategy, log in to your existing Alleo account or create a new one to access our AI coach and personalized guidance.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a structured approach for managing your financial data retention, helping you create consistent practices that ensure compliance and efficiency in your data management strategy.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to get tailored guidance on improving your financial data retention strategies, helping you effectively manage compliance and optimize your data management practices.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll collaborate with the AI coach to create a personalized plan for improving your financial data retention strategies.

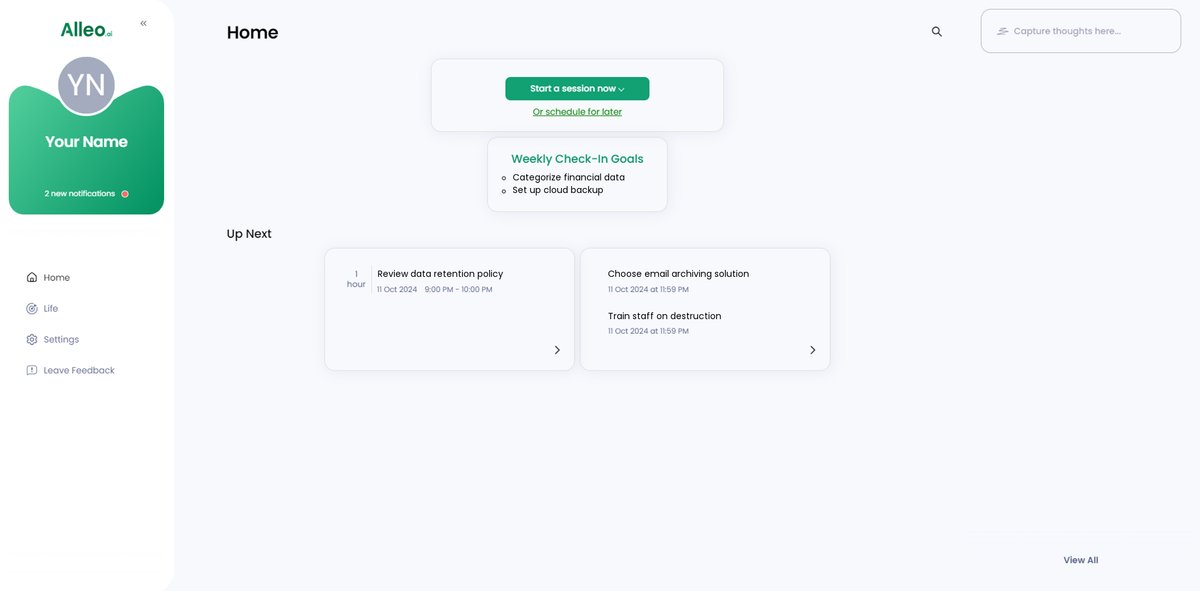

Step 5: Viewing and Managing Goals After the Session

After your coaching session on financial data retention strategies, check the Alleo app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable to your data management objectives.

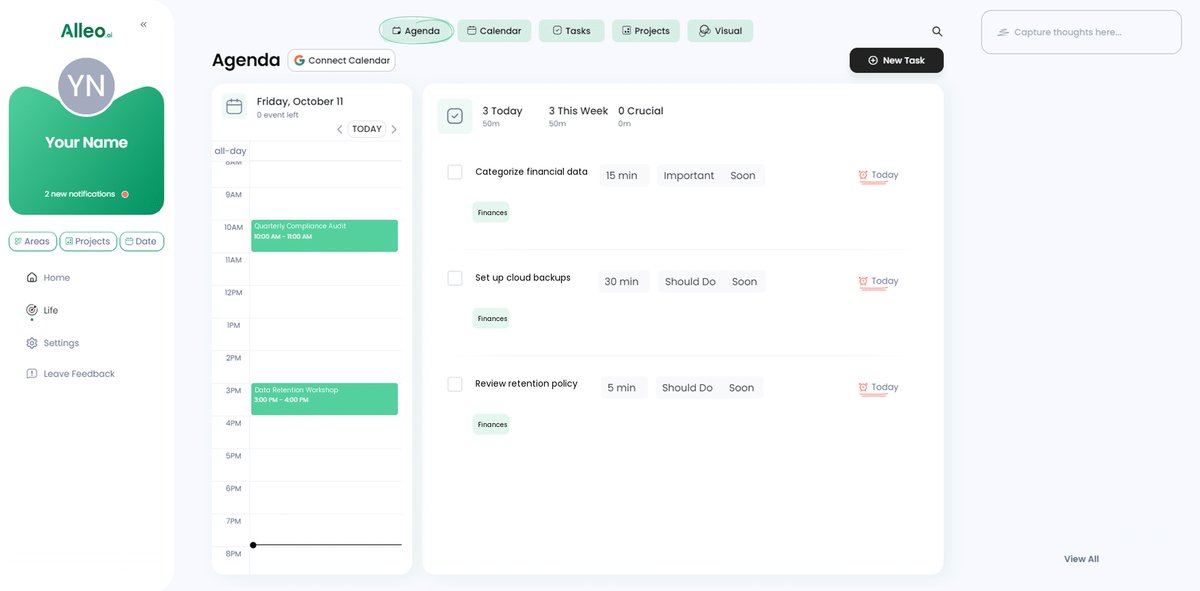

Step 6: Adding events to your calendar or app

Track your progress in implementing your financial data retention strategy by adding key milestones and compliance audit dates to the Alleo app’s calendar and task features, allowing you to stay organized and accountable throughout the process.

Final Thoughts on Mastering Financial Data Retention

You’ve now explored practical steps to enhance your financial data retention best practices. Addressing these challenges in data lifecycle management in finance can seem daunting, but with the right approach, it’s manageable.

Remember, implementing a tiered data retention policy ensures efficiency and regulatory compliance for financial data. Utilizing encrypted cloud storage for financial records protects your sensitive data.

Automating email archiving saves time and resources, contributing to cost-effective data archiving methods. Clear data destruction protocols prevent unauthorized access to outdated information, enhancing IT security in financial data management.

Regular compliance audits keep your practices up-to-date with industry standards. Alleo can help streamline these processes, including data backup and recovery strategies.

Don’t let financial data retention challenges overwhelm you. Take the first step today in implementing long-term data preservation techniques.

Try Alleo for free and transform your data storage solutions for finance.