5 Essential Strategies for Accountants: Mastering Financial Report Updates in a Changing Regulatory Landscape

Imagine a world where accountants seamlessly adapt to every regulatory change without missing a beat, effortlessly updating financial reports for regulations.

As an experienced coach in the accounting industry, I’ve helped many professionals navigate these challenges. I often encounter the struggle of keeping up with financial compliance updates and GAAP modifications while ensuring accurate financial statement revisions.

In this article, you’ll discover specific strategies and tools to maintain compliance effortlessly. We’ll cover monitoring systems, compliance task forces, internal checklists, training, and digital tools for handling regulatory changes for accountants. From IFRS reporting adjustments to ESG reporting requirements, we’ll explore how to stay ahead.

Let’s dive in to explore audit preparation strategies and the impact of tax regulation on reporting.

The Real Cost of Falling Behind on Regulatory Changes

Missing a regulatory update when updating financial reports for regulations can have severe repercussions. I’ve seen several clients face hefty fines and legal troubles due to non-compliance with financial compliance updates.

These penalties are not just financial; they can also damage your reputation in the context of regulatory changes for accountants.

Moreover, the complexity and frequency of changes, including GAAP modifications and IFRS reporting adjustments, make it hard to keep up. Many clients initially struggle with interpreting the nuances of new regulations.

This often leads to errors in financial statement revisions, which can be costly.

In my experience, the stress of constantly updating financial reports for regulations is overwhelming. You might feel like you’re always playing catch-up with accounting software updates.

But, with a structured approach to audit preparation strategies, you can navigate these changes more effectively.

Let’s explore how you can achieve this while considering tax regulation impacts on reporting.

A Roadmap to Seamlessly Update Financial Reports

Overcoming this challenge of updating financial reports for regulations requires a few key steps. Here are the main areas to focus on to make progress:

- Establish a regulatory change monitoring system: Keep track of updates from reliable sources and set alerts for financial compliance updates.

- Create cross-functional compliance task forces: Form diverse teams to oversee compliance strategies and ensure accountability for GAAP modifications and IFRS reporting adjustments.

- Develop internal checklists for new requirements: Use detailed checklists integrated into workflows to track compliance tasks and financial statement revisions.

- Implement regular staff training on updates: Organize workshops and mentorship programs to keep staff informed about regulatory changes for accountants.

- Utilize digital tools for streamlined reporting: Implement accounting software updates and AI tools to ensure compliance, secure financial data, and address tax regulation impacts on reporting.

Let’s dive in!

1: Establish a regulatory change monitoring system

Staying on top of regulatory changes is crucial for updating financial reports for regulations and maintaining compliance in financial reporting.

Actionable Steps:

- Subscribe to regulatory updates from reliable sources like government websites and industry newsletters on financial compliance updates. Review these updates weekly to stay informed.

- Set up automated alerts through platforms like Google Alerts or regulatory monitoring software to notify team members of GAAP modifications and IFRS reporting adjustments promptly.

- Regularly review and document changes in a centralized database. Assign a team member to update this database bi-weekly, including regulatory changes for accountants.

Explanation:

These steps ensure that you are always aware of the latest regulatory changes, thus minimizing the risk of non-compliance. By subscribing to updates and setting up alerts, you can react quickly to new information on updating financial reports for regulations.

Documenting changes in a centralized database helps maintain an organized and accessible record. For more insights, check out this resource on maintaining compliance in financial reporting.

Key benefits of a robust monitoring system:

- Proactive approach to compliance and financial statement revisions

- Reduced risk of penalties

- Improved decision-making for audit preparation strategies

Implementing these steps will help you proactively manage regulatory changes and keep your financial reports accurate and compliant, considering tax regulation impacts on reporting.

2: Create cross-functional compliance task forces

Establishing cross-functional compliance task forces is crucial for updating financial reports for regulations and ensuring every department is aligned with regulatory changes.

Actionable Steps:

- Form a diverse team including members from finance, legal, and operations. Schedule monthly meetings to discuss financial compliance updates and strategies.

- Designate specific roles within the task force to ensure accountability. Assign a leader, a recorder, and subject matter experts on GAAP modifications and IFRS reporting adjustments.

- Develop a communication plan for task force updates and recommendations. Use collaboration tools like Slack or Microsoft Teams for ongoing communication about regulatory changes for accountants.

Explanation:

These steps matter because they promote collaboration and accountability across departments, ensuring comprehensive compliance when updating financial reports for regulations.

Diverse teams bring varied perspectives, improving problem-solving for financial statement revisions and audit preparation strategies. For more on the importance of structured compliance, visit this resource.

Creating such task forces can significantly enhance your ability to stay compliant and effectively manage regulatory changes impacting financial reporting.

3: Develop internal checklists for new requirements

Creating detailed internal checklists is essential for ensuring compliance with new regulations and updating financial reports for regulations.

Actionable Steps:

- Create comprehensive checklists for each regulatory update, outlining all necessary steps for compliance, including financial compliance updates and GAAP modifications. Review and update these checklists monthly.

- Integrate checklists into existing workflows and project management tools like Asana or Trello to track progress on compliance tasks and address regulatory changes for accountants.

- Conduct regular audits of completed checklists to ensure adherence to IFRS reporting adjustments. Schedule quarterly audits for consistency.

Explanation:

These steps are crucial because they provide a structured approach to compliance, reducing the risk of oversight when updating financial reports for regulations. By integrating checklists into workflows, you can track progress and ensure all steps are followed, including accounting software updates and financial statement revisions.

Regular audits help maintain accountability and accuracy in addressing tax regulation impacts on reporting. For more on maintaining compliance, visit this resource.

Developing and maintaining internal checklists will streamline your compliance process and ensure you stay ahead of regulatory changes, including emerging areas like blockchain in financial reporting and ESG reporting requirements.

4: Implement regular staff training on updates

Keeping your team well-informed about regulatory changes is essential for maintaining compliance and updating financial reports for regulations.

Actionable Steps:

- Organize quarterly workshops on new regulations and compliance strategies, including GAAP modifications and IFRS reporting adjustments. Track attendance and gather feedback to ensure effectiveness.

- Develop a mentorship program where experienced accountants guide newer staff through regulatory changes and financial compliance updates. Pair mentors and mentees with monthly check-ins.

- Provide access to online courses and certifications related to regulatory compliance and accounting software updates. Partner with educational platforms like Coursera or LinkedIn Learning for comprehensive training.

Key components of effective staff training for updating financial reports for regulations:

- Interactive learning sessions on financial statement revisions

- Real-world case studies on tax regulation impacts on reporting

- Continuous assessment and feedback on audit preparation strategies

Explanation:

These steps matter because regular training ensures your team stays updated and compliant with new regulations. Workshops provide timely knowledge on financial compliance updates, while mentorship fosters continuous learning for accountants facing regulatory changes.

Online courses offer flexibility and depth in understanding topics like blockchain in financial reporting and ESG reporting requirements. For more on maintaining compliance, visit this resource.

Investing in staff training will help you navigate regulatory changes seamlessly and maintain compliance when updating financial reports for regulations.

5: Utilize digital tools for streamlined reporting

Utilizing digital tools for streamlined reporting is essential to stay compliant and efficient when updating financial reports for regulations in today’s fast-paced regulatory environment.

Actionable Steps:

- Implement accounting software that updates automatically to comply with new regulations and GAAP modifications. Choose software with high user ratings and regular update schedules for financial compliance updates.

- Use AI-driven tools to analyze and validate compliance in financial reports. Integrate tools like Alleo to identify discrepancies and suggest corrections, aiding in audit preparation strategies.

- Regularly back up and secure financial data to prevent information loss. Schedule daily backups and monthly security checks to maintain data integrity, considering blockchain in financial reporting for enhanced security.

Explanation:

These steps matter because digital tools can greatly enhance accuracy and efficiency in compliance efforts. Automated updates ensure you never miss a regulatory change or IFRS reporting adjustments.

AI tools offer advanced analysis, reducing human error in financial statement revisions. Regular backups secure your data, safeguarding against potential losses and supporting tax regulation impacts on reporting.

For further insights on maintaining compliance, visit this resource.

Benefits of digital tools in financial reporting:

- Enhanced accuracy and consistency in updating financial reports for regulations

- Time-saving automation for regulatory changes for accountants

- Improved data security and ESG reporting requirements compliance

Implementing these digital solutions will help you stay ahead of regulatory requirements and maintain accurate financial reports.

Partner with Alleo for Seamless Regulatory Compliance

We’ve explored the challenges of updating financial reports for regulations and the solutions to achieve compliance. But did you know you can work directly with Alleo to make this journey easier and faster, especially when dealing with financial compliance updates?

Imagine having a dedicated coach guiding you through each step of managing regulatory changes for accountants. With Alleo, setting up an account is simple, whether you’re focusing on GAAP modifications or IFRS reporting adjustments.

Create a personalized plan tailored to your needs, including strategies for audit preparation and addressing tax regulation impacts on reporting. Our AI coach will follow up on your progress, manage changes, and keep you accountable via text and push notifications, ensuring you stay on top of financial statement revisions.

Ready to get started for free and explore how Alleo can assist with updating financial reports for regulations? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards seamless regulatory compliance, log in to your existing Alleo account or create a new one in just a few clicks, setting the foundation for personalized guidance through each step of the compliance process.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a solid foundation for managing regulatory changes effectively, helping you create a systematic approach to staying compliant and updating your financial reports with ease.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to tackle regulatory compliance challenges head-on, aligning perfectly with your goal of keeping financial reports up-to-date and compliant with ever-changing regulations.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will guide you through setting up a personalized plan to tackle regulatory compliance challenges and keep your financial reports up-to-date.

Step 5: Viewing and managing goals after the session

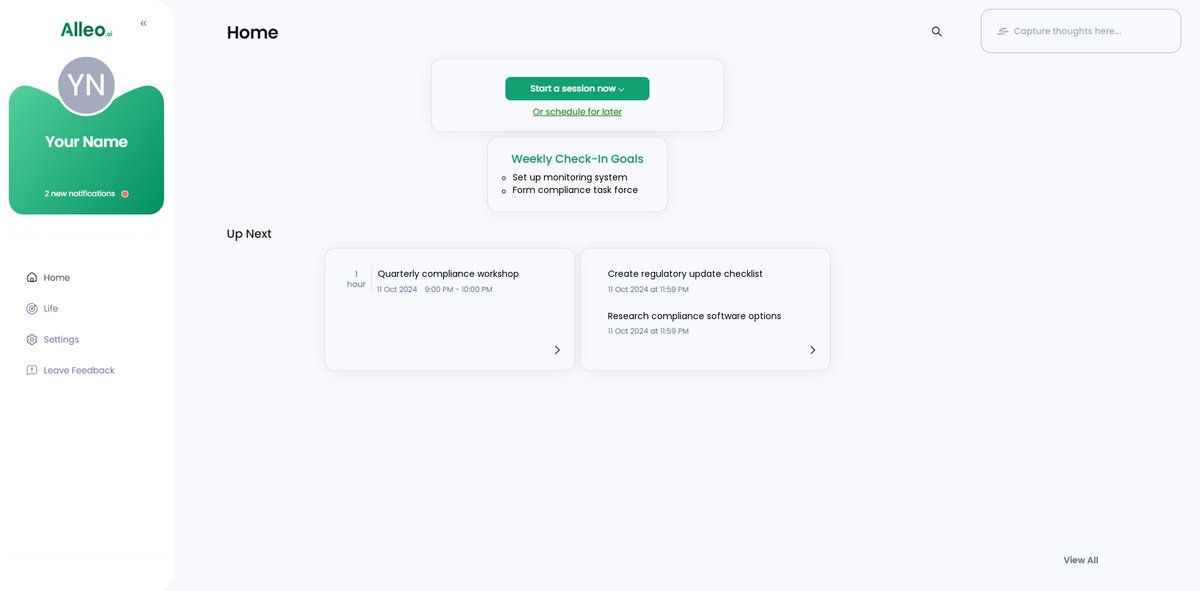

After your coaching session on regulatory compliance, check the Alleo app’s home page to view and manage the goals you discussed, ensuring you stay on track with implementing strategies for seamless financial reporting updates.

Step 6: Adding events to your calendar or app

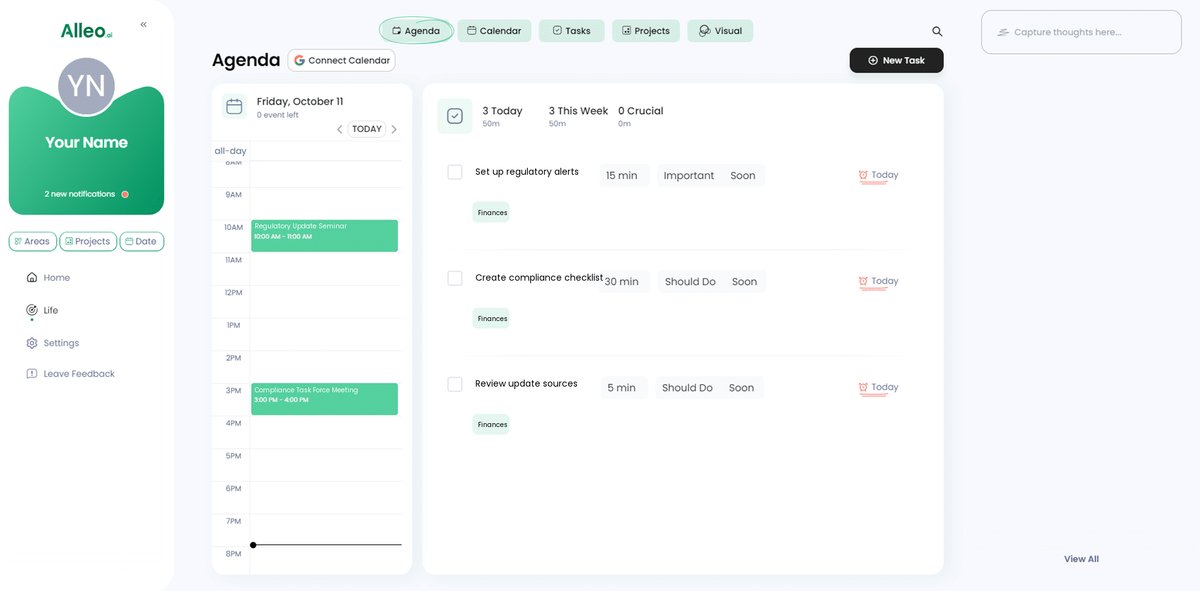

Use Alleo’s calendar and task features to easily add compliance-related events and deadlines, allowing you to track your progress in solving regulatory challenges and staying up-to-date with financial reporting requirements.

Take Charge of Regulatory Compliance Now

Navigating regulatory changes and updating financial reports for regulations can be daunting, but it’s essential for maintaining accurate financial statements. By establishing monitoring systems, creating task forces, developing checklists, training staff on financial compliance updates, and leveraging digital tools, you can stay on top of these changes and ensure GAAP modifications are properly implemented.

I understand the challenges you face with regulatory changes for accountants. Managing IFRS reporting adjustments and tax regulation impacts on reporting is a lot to handle, but you’re not alone.

At Alleo, we’ve got your back. Our tools and strategies are designed to make this process of updating financial reports for regulations smoother for you, including assistance with audit preparation strategies.

Are you ready to make compliance effortless and stay current with ESG reporting requirements?

Try Alleo for free and experience the difference in managing financial statement revisions and accounting software updates.

Remember, staying compliant and efficiently updating financial reports for regulations is just a click away. Let’s make it happen together!