5 Essential Ways Event Planners Can Reconcile Credit Card Statements Effectively

Imagine wrapping up a successful event only to find discrepancies in your credit card statements. Frustrating, right? This is why it’s essential to reconcile event planner credit cards effectively.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, proper expense tracking for event planners is crucial for maintaining accurate financial records and managing event planning finances.

In this article, we will explore strategies to reconcile credit card statements effectively for event planners. You’ll learn systematic approaches to improve your financial reporting accuracy, including credit card statement analysis and balancing event income and expenses.

Let’s dive into the credit card reconciliation process for event planning financial management.

Understanding the Challenges of Expense Tracking

Reconciling event planner credit cards can be a nightmare for professionals in the industry. Many struggle to track every purchase, leading to missed expenses and financial discrepancies in their event planning financial management.

In my experience, mismanaged expenses can severely impact event profitability and financial reporting accuracy. Imagine planning an event with a tight budget, only to discover unaccounted charges when reconciling vendor payments.

Stressful, right?

Several clients report issues with organizing receipts and categorizing expenses. These tasks often become overwhelming, especially when juggling multiple events and trying to balance event income and expenses.

Inconsistencies can lead to financial chaos.

To avoid these pitfalls, it’s essential to adopt a systematic approach to expense tracking for event planners. Let’s explore practical solutions that can make your credit card reconciliation process more manageable.

Strategic Steps to Reconcile Credit Card Statements

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in reconciling event planner credit cards.

- Set up a dedicated event credit card account: Create a specific account for event expenses to streamline the credit card reconciliation process.

- Use expense tracking software for categorization: Implement software like QuickBooks or YNAB for effective event planning financial management.

- Reconcile statements within 60 days of charges: Ensure timely reconciliation for accuracy when balancing event income and expenses.

- Implement a receipt scanning and storage system: Digitize receipts for better organization and easier tax deductions for event expenses.

- Create event-specific SpeedTypes for transactions: Use unique identifiers for each event to simplify reconciling vendor payments and business credit card statements.

Let’s dive in!

1: Set up a dedicated event credit card account

Having a dedicated credit card account for event expenses is crucial to maintain financial clarity and streamline the process to reconcile event planner credit cards.

Actionable Steps:

- Contact your bank to set up a dedicated credit card account specifically for event-related expenses. Ensure all event-related charges are made on this card to simplify the credit card reconciliation process.

- Train your team to use only this dedicated card for all event purchases. Create guidelines to ensure proper usage and effective expense tracking for event planners.

- Monitor the account regularly to identify any unauthorized transactions. Schedule bi-weekly reviews of the business credit card statements.

Explanation: Setting up a dedicated event credit card account helps segregate expenses, making it easier to track and reconcile event planner credit cards. By training your team and monitoring transactions, you can prevent unauthorized charges and ensure accurate financial reporting, which is essential for event planning financial management.

This approach aligns with best practices in financial management, as highlighted in resources like UC Davis’s Travel Card Program, which emphasizes the importance of dedicated accounts for streamlined expense management.

Key benefits of a dedicated event credit card account:

- Simplified expense tracking for event planners

- Enhanced financial transparency

- Easier reconciliation process for vendor payments

This step sets the foundation for effective expense tracking, leading us to the next crucial strategy in budgeting for event planning.

2: Use expense tracking software for categorization

Using expense tracking software for categorization is essential for organizing and managing your event-related expenses efficiently, especially when you need to reconcile event planner credit cards.

Actionable Steps:

- Choose an expense tracking software that suits your needs, such as QuickBooks or YNAB. Ensure it has user-friendly interfaces and strong support for credit card reconciliation processes.

- Integrate the software with your dedicated event credit card account for real-time tracking. Make sure the software automatically categorizes expenses, facilitating event planning financial management.

- Train your team on how to categorize expenses correctly within the software. Conduct a training session and provide a user manual on expense tracking for event planners.

Explanation: Implementing expense tracking software helps you maintain an organized record of all event-related transactions. It ensures real-time tracking and accurate categorization, reducing the risk of errors when reconciling vendor payments and analyzing business credit card statements.

As highlighted by Citrin Cooperman, accurate reconciliation is crucial for improved financial control and reporting.

This step streamlines your financial management, preparing you for timely expense reconciliation and efficient budgeting for event planning.

3: Reconcile statements within 60 days of charges

Timely reconciliation of credit card statements is crucial for maintaining accurate financial records and avoiding discrepancies in event planning financial management.

Actionable Steps:

- Set a deadline to reconcile event planner credit cards within 60 days of charges. Use calendar reminders to ensure deadlines are met.

- Cross-check statements with receipts and expense reports. Verify each charge against your records for accuracy in your credit card reconciliation process.

- Address discrepancies immediately with vendors or the bank. Create a protocol for handling any inconsistencies when reconciling vendor payments.

Explanation: Ensuring that you reconcile event planner credit cards within 60 days helps maintain financial accuracy and prevents errors. Timely reconciliation aligns with best practices for expense tracking for event planners and overall financial management.

For more insights on why this is important, check out Cvent’s guidelines on managing financial records efficiently. Staying on top of your reconciliations ensures smooth financial operations and accurate reporting for balancing event income and expenses.

Next, let’s explore how implementing a receipt scanning and storage system can further streamline your expense tracking for event planners.

4: Implement a receipt scanning and storage system

Implementing a receipt scanning and storage system is essential for maintaining an organized and accessible record of all event-related expenses, which is crucial when you need to reconcile event planner credit cards.

Actionable Steps:

- Invest in a receipt scanning tool or app to digitize all receipts. Select a tool that integrates with your expense tracking for event planners software.

- Create a digital storage system for easy access and retrieval of receipts. Organize receipts by event and category to facilitate the credit card reconciliation process.

- Train your team to scan and upload receipts immediately after purchases. Ensure all receipts are uploaded within 24 hours of purchase to streamline event planning financial management.

Explanation: Having a receipt scanning and storage system reduces the risk of lost or misplaced receipts and ensures you have a digital backup for all expenses, making it easier to reconcile event planner credit cards.

This approach aligns with best practices in financial management, as highlighted in resources like Solvexia, which emphasizes the importance of accurate record-keeping for efficient credit card reconciliation.

By organizing and digitizing receipts, you streamline the reconciliation process, making it easier to track and verify expenses, including reconciling vendor payments.

Advantages of a digital receipt system:

- Rapid retrieval of expense information for business credit card statements

- Reduced risk of lost receipts

- Improved accuracy in expense reporting and balancing event income and expenses

This step enhances your financial control, paving the way for the next strategy in financial software for event planners.

5: Create event-specific SpeedTypes for transactions

Creating event-specific SpeedTypes for transactions is vital for precise expense tracking and reporting when you reconcile event planner credit cards.

Actionable Steps:

- Assign unique SpeedTypes to each event. Use distinct identifiers for accurate expense categorization in your credit card reconciliation process.

- Use SpeedTypes during transactions to streamline expense tracking for event planners. Ensure all team members are aware of and use the correct SpeedTypes.

- Review and update SpeedTypes regularly. Conduct quarterly reviews to reflect current events and budget allocations, improving your event planning financial management.

Explanation: Implementing event-specific SpeedTypes helps maintain clear and organized financial records. This method ensures accurate tracking and reporting, reducing the risk of errors when reconciling vendor payments.

According to Cvent’s guidelines, it’s crucial for event planners to have precise financial details for proper money allocation. By regularly reviewing and updating SpeedTypes, you can ensure they align with your current events and budget needs, enhancing your budgeting for event planning.

Benefits of using SpeedTypes:

- Streamlined expense categorization

- Improved budget allocation accuracy

- Enhanced financial reporting capabilities

This step enhances financial control, leading to improved event management and efficient credit card statement analysis.

Partner with Alleo on Your Event Planning Journey

We’ve explored the challenges of reconciling credit card statements for event planners and the steps to achieve it. But did you know you can work directly with Alleo to make this credit card reconciliation process easier?

Alleo is an AI coach that provides affordable, tailored support for event planners looking to improve their financial management. You get full coaching sessions like any human coach to help you reconcile event planner credit cards and manage expenses. There’s a free 14-day trial with no credit card required to start balancing your event income and expenses.

Setting up an account is simple. Create a personalized plan with Alleo, and work with our coach to overcome specific challenges in reconciling vendor payments and tracking expenses for event planners.

Alleo will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you master the art of reconciling event planner credit cards and improving your overall budgeting for event planning.

Ready to get started for free and streamline your event planning financial management? Let me show you how!

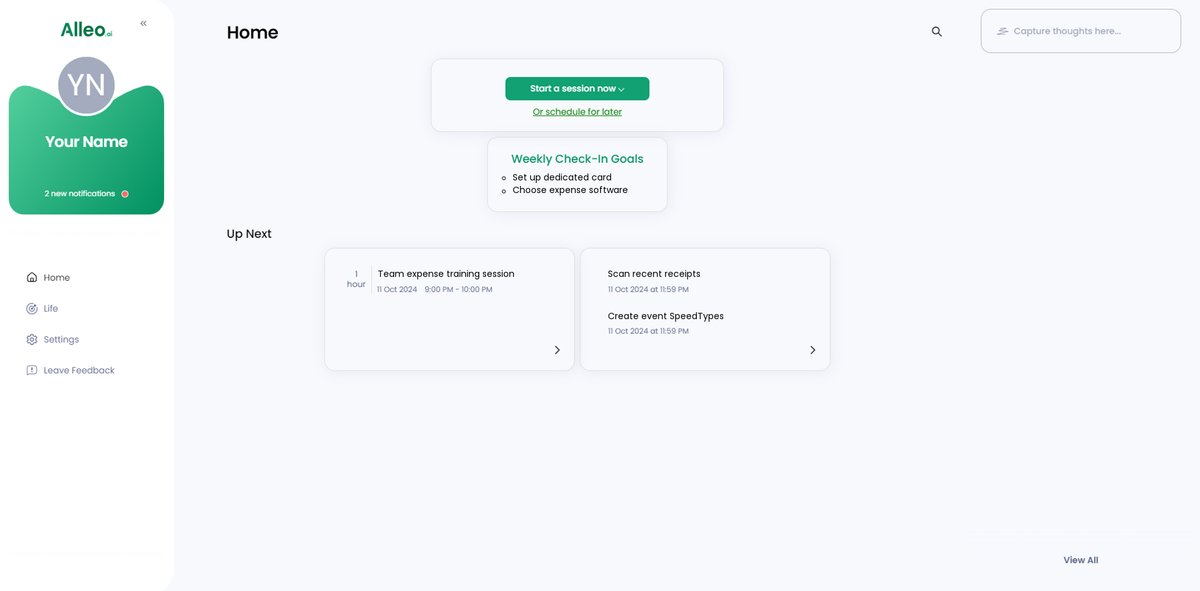

Step 1: Log In or Create Your Alleo Account

To begin your journey with Alleo’s AI coaching for event expense management, Log in to your account or create a new one to access personalized support for reconciling credit card statements and tracking event expenses.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing a systematic approach to expense tracking, which will help you establish consistent practices for reconciling credit card statements and managing event finances more effectively.

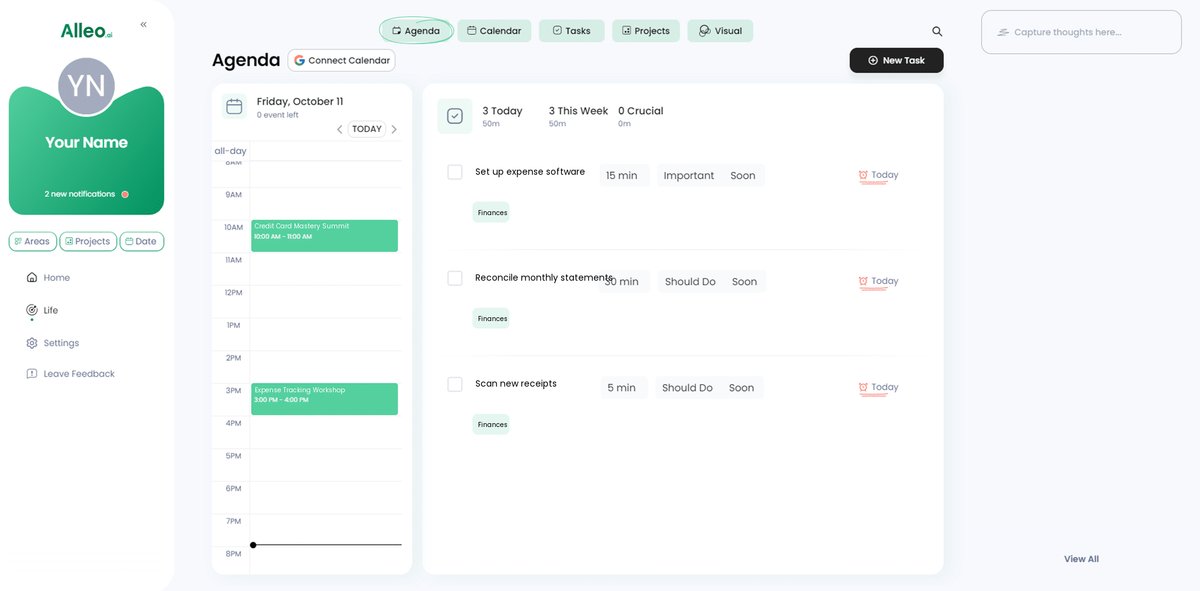

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to tackle your event planning expense tracking challenges head-on. By selecting this life area, you’ll receive tailored guidance on implementing effective strategies for credit card reconciliation, expense categorization, and financial reporting accuracy, helping you streamline your event planning finances with confidence.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to discuss your event planning challenges and create a personalized plan for managing your expenses more effectively.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to review and manage the expense tracking goals you discussed with Alleo, ensuring you stay on track with implementing the strategies for credit card reconciliation.

6: Adding events to your calendar or app

Integrate your event planning tasks with Alleo by adding key dates and milestones to the app’s calendar, allowing you to easily track your progress in solving expense reconciliation challenges and stay on top of important deadlines.

Wrapping Up Your Event Financials

Let’s bring it all together.

To reconcile event planner credit cards doesn’t have to be daunting. By setting up dedicated accounts, using financial software for event planners, timely reconciliation, scanning receipts, and using SpeedTypes, you can streamline the credit card reconciliation process.

Remember, the right tools and strategies for event planning financial management make a world of difference.

I understand the pressure you face. But with these steps, you can achieve financial accuracy and peace of mind when balancing event income and expenses.

Consider giving Alleo a try. It can provide the support you need to manage your expenses effectively and assist with budgeting for event planning.

Let’s make your next event a financial success. Start with Alleo today, and experience the ease of organized expense tracking for event planners.