5 Essential Ways Financial Advisors Can Master Web3 Concepts for Client Guidance

Imagine confidently guiding your clients through the complexities of Web3 and cryptocurrency investments, becoming their go-to expert in this rapidly evolving field of blockchain technology in finance.

Financial advisors learning Web3 concepts are facing the challenge of understanding and explaining these technologies to clients, including topics like DeFi, NFTs, and digital asset management.

As a life coach, I’ve helped many professionals navigate these challenges, including financial advisors learning Web3 concepts. In my experience supporting clients in tech adoption, I often encounter the same struggles with grasping smart contracts in financial planning and tokenization of assets.

In this article, you’ll discover specific strategies to help you master Web3 concepts for effective client guidance. These strategies will ensure you stay current and competitive in areas such as metaverse opportunities for investors and crypto regulations and compliance.

Let’s dive into Web3 basics for financial advisors and cryptocurrency investment strategies.

Understanding the Challenge Financial Advisors Face with Web3

Financial advisors learning Web3 concepts often struggle to keep up with rapidly evolving technologies like blockchain and cryptocurrencies. This constant change can make it challenging to provide accurate and up-to-date guidance to clients on topics such as DeFi explained for financial professionals or NFTs and digital asset management.

Without a clear grasp of Web3 basics for financial advisors, professionals risk giving misinformation, leading to loss of client trust and missed opportunities. Many clients initially find these technologies overwhelming and look to their advisors for clarity on cryptocurrency investment strategies and blockchain technology in finance.

In my experience, staying current on Web3 concepts is essential for financial advisors learning to maintain a competitive edge. Clients rely on advisors to demystify complex topics like smart contracts in financial planning and help them navigate the investment landscape confidently, including metaverse opportunities for investors.

A Roadmap to Mastering Web3 for Financial Advisors

Overcoming this challenge requires a few key steps for financial advisors learning Web3 concepts. Here are the main areas to focus on to make progress in understanding blockchain technology in finance.

- Enroll in Online Blockchain Certificate Programs: Start with structured learning to build a solid foundation in Web3 basics for financial advisors.

- Attend Web3/DeFi Workshops and Seminars: Engage with experts and stay updated on industry trends, including DeFi explained for financial professionals.

- Practice Crypto Transactions on Test Networks: Gain hands-on experience with cryptocurrency investment strategies without financial risk.

- Join Fintech Professional Networking Groups: Connect with peers and mentors for continuous learning about smart contracts in financial planning and tokenization of assets.

- Create a Web3 Learning Curriculum for Clients: Develop resources to educate and guide your clients on NFTs and digital asset management.

Let’s dive in to explore Web3 opportunities for investors!

1: Enroll in online blockchain certificate programs

Enrolling in online blockchain certificate programs is crucial for financial advisors learning Web3 concepts to build a solid foundation in blockchain technology in finance.

Actionable Steps:

- Research and select reputable online programs, such as the University of the Cumberlands’ Blockchain Certificate, focusing on Web3 basics for financial advisors.

- Dedicate specific hours each week to complete coursework and assignments on topics like DeFi explained for financial professionals.

- Engage with online communities and forums related to the program to exchange insights and ask questions about cryptocurrency investment strategies.

Explanation:

These steps are essential for gaining comprehensive knowledge in blockchain and cryptocurrencies. By dedicating time and engaging with online communities, financial advisors learning Web3 concepts stay updated and gain diverse perspectives on topics like NFTs and digital asset management.

Programs like the University of the Cumberlands’ Blockchain Certificate offer a structured curriculum that ensures you cover all necessary topics, including smart contracts in financial planning.

Key benefits of enrolling in blockchain certificate programs for financial advisors learning Web3 concepts:

- Structured learning path covering tokenization of assets

- Access to expert instructors knowledgeable about metaverse opportunities for investors

- Networking opportunities with peers interested in crypto regulations and compliance

This foundational knowledge is vital for providing accurate guidance to your clients and conducting Web3 risk assessment for client portfolios.

2: Attend Web3/DeFi workshops and seminars

Attending Web3/DeFi workshops and seminars is crucial for financial advisors learning Web3 concepts and staying updated on industry trends while networking with experts.

Actionable Steps:

- Identify upcoming workshops and seminars: Use platforms like Eventbrite or professional associations to find relevant events focused on blockchain technology in finance and DeFi explained for financial professionals.

- Participate actively: Engage by asking questions about cryptocurrency investment strategies and network with speakers and attendees to learn about Web3 basics for financial advisors.

- Follow up with contacts: Build a network of experts by scheduling regular catch-ups or information-sharing sessions on topics like smart contracts in financial planning and tokenization of assets.

Explanation:

These steps help you stay informed about the latest developments in Web3 and DeFi. Engaging with experts and peers during workshops ensures you gain practical insights on NFTs and digital asset management, and build valuable connections in the field of Web3 risk assessment for client portfolios.

For example, platforms like VanEck offer valuable content on digital assets and their role in portfolios, including metaverse opportunities for investors.

Attending these events regularly can significantly enhance your knowledge of crypto regulations and compliance, and boost your confidence in guiding clients through Web3 investments.

3: Practice crypto transactions on test networks

Practicing crypto transactions on test networks is essential for financial advisors learning Web3 concepts, allowing them to gain hands-on experience without financial risk.

Actionable Steps:

- Set up accounts on test networks: Create accounts on platforms like Ropsten or Kovan to start practicing Web3 basics for financial advisors.

- Conduct mock transactions: Perform transactions to get familiar with sending, receiving, and managing crypto assets, enhancing understanding of blockchain technology in finance.

- Experiment with different transaction types: Try smart contracts or staking to broaden your understanding of cryptocurrency investment strategies.

Explanation:

These steps are crucial for building practical skills and confidence in handling crypto assets. By using test networks, financial advisors learning Web3 concepts can safely explore various transactions.

For example, platforms like OSCE offer training exercises with Bitcoin and Ethereum, providing a valuable learning experience.

Key areas to focus on when practicing:

- Wallet management

- Gas fees and transaction speeds

- Smart contract interactions in financial planning

Practicing on test networks ensures financial advisors are prepared to guide clients effectively in real-world scenarios, including DeFi explained for financial professionals and NFTs and digital asset management.

Next, we’ll look at joining fintech professional networking groups to enhance your learning journey in Web3 concepts for financial advisors.

4: Join fintech professional networking groups

Joining fintech professional networking groups is crucial for financial advisors learning Web3 concepts and staying connected with industry experts.

Actionable Steps:

- Become a member of professional organizations: Join groups like the CFA Institute or local fintech associations to explore Web3 basics for financial advisors.

- Participate in online forums and discussion boards: Engage in platforms dedicated to fintech, blockchain technology in finance, and cryptocurrency investment strategies discussions.

- Seek out mentorship opportunities: Approach experienced professionals with specific questions about DeFi explained for financial professionals or areas where you need guidance on NFTs and digital asset management.

Explanation:

These steps are vital for staying updated on industry trends and gaining insights from peers and mentors on smart contracts in financial planning.

By joining professional organizations and engaging in online forums, you can continuously learn about tokenization of assets and share experiences.

For example, platforms like Advisors Excel offer resources and programs to help advisors grow their businesses and understand metaverse opportunities for investors.

Networking ensures you remain at the forefront of fintech developments and can provide accurate guidance to your clients on crypto regulations and compliance.

Connecting with peers can significantly enhance your knowledge and confidence in navigating Web3 concepts and conducting Web3 risk assessment for client portfolios.

5: Create a Web3 learning curriculum for clients

Creating a Web3 learning curriculum for clients is essential for helping financial advisors learning Web3 concepts to guide their clients in understanding and navigating these complex technologies confidently.

Actionable Steps:

- Develop educational materials: Create articles, webinars, and FAQs tailored to your clients’ needs using clear, jargon-free language, covering Web3 basics for financial advisors.

- Schedule regular client education sessions: Discuss Web3 concepts and answer questions, ensuring you cover all key topics with a structured agenda, including blockchain technology in finance.

- Provide curated resources: Offer clients a list of recommended readings and resources, regularly updating it to include the latest trends in cryptocurrency investment strategies and DeFi explained for financial professionals.

Explanation:

These steps help clients grasp Web3 concepts, enhancing their investment decisions and trust in your guidance. By developing tailored educational materials and scheduling regular sessions, you make complex topics like smart contracts in financial planning accessible.

Additionally, providing curated resources keeps clients informed and engaged on topics such as tokenization of assets and metaverse opportunities for investors. For more inspiration, check out how Advisors Excel offers resources to help advisors grow their businesses.

Essential components of a Web3 learning curriculum for financial advisors learning Web3 concepts:

- Blockchain fundamentals

- Cryptocurrency basics

- DeFi applications and risks

- Regulatory landscape, including crypto regulations and compliance

Creating a Web3 curriculum ensures your clients are well-informed and confident in their investment choices, including understanding NFTs and digital asset management, as well as Web3 risk assessment for client portfolios.

Partner with Alleo on Your Web3 Journey

We’ve explored the challenges of financial advisors learning Web3 concepts and how solving them can benefit your career. But did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to understanding blockchain technology in finance?

With Alleo, set up an account and create a personalized learning plan tailored to your needs as a financial advisor exploring Web3 basics. Our AI coach provides full coaching sessions on topics like DeFi explained for financial professionals and cryptocurrency investment strategies, just like a human coach.

Plus, you get a free 14-day trial with no credit card required to start learning about smart contracts in financial planning and tokenization of assets.

Alleo’s coach will follow up on your progress in understanding Web3 concepts, handle changes, and keep you accountable via text and push notifications. This ensures you stay on track with your Web3 learning goals, including mastering NFTs and digital asset management.

Ready to get started for free and dive into the world of Web3 for financial advisors?

Let me show you how!

Step 1: Log In or Create Your Account

To begin your Web3 learning journey with Alleo’s AI coach, simply Log in to your account or create a new one to access personalized guidance tailored to financial advisors.

Step 2: Choose Your Web3 Learning Goal

Select “Setting and achieving personal or professional goals” to define your Web3 mastery objective, aligning your learning journey with the strategies outlined in the article to become a confident advisor in cryptocurrency and blockchain technologies.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area in Alleo to tailor your Web3 learning journey specifically to your role as a financial advisor, helping you master the skills needed to guide clients through cryptocurrency investments and blockchain technologies.

Step 4: Starting a coaching session

Begin your Web3 learning journey by scheduling an intake session with Alleo’s AI coach to create a personalized plan tailored to your financial advising needs and goals.

Step 5: Viewing and Managing Goals After the Session

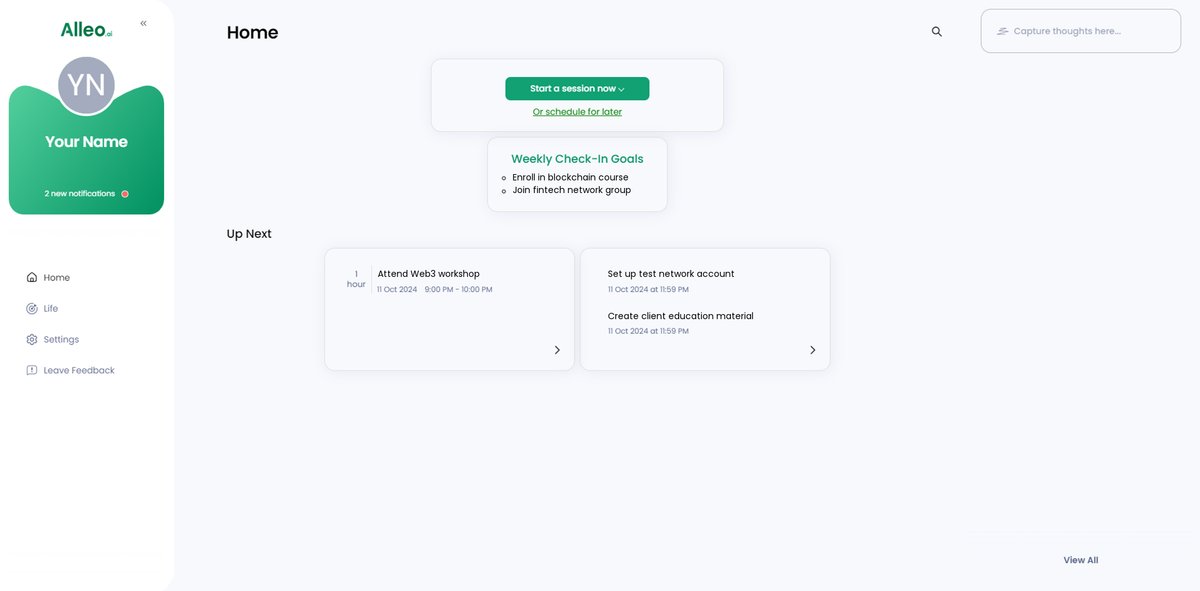

After your coaching session on Web3 mastery, check the Alleo app’s home page to view and manage the goals you discussed, allowing you to track your progress in becoming a confident advisor in blockchain and cryptocurrency investments.

Step 6: Adding events to your calendar or app

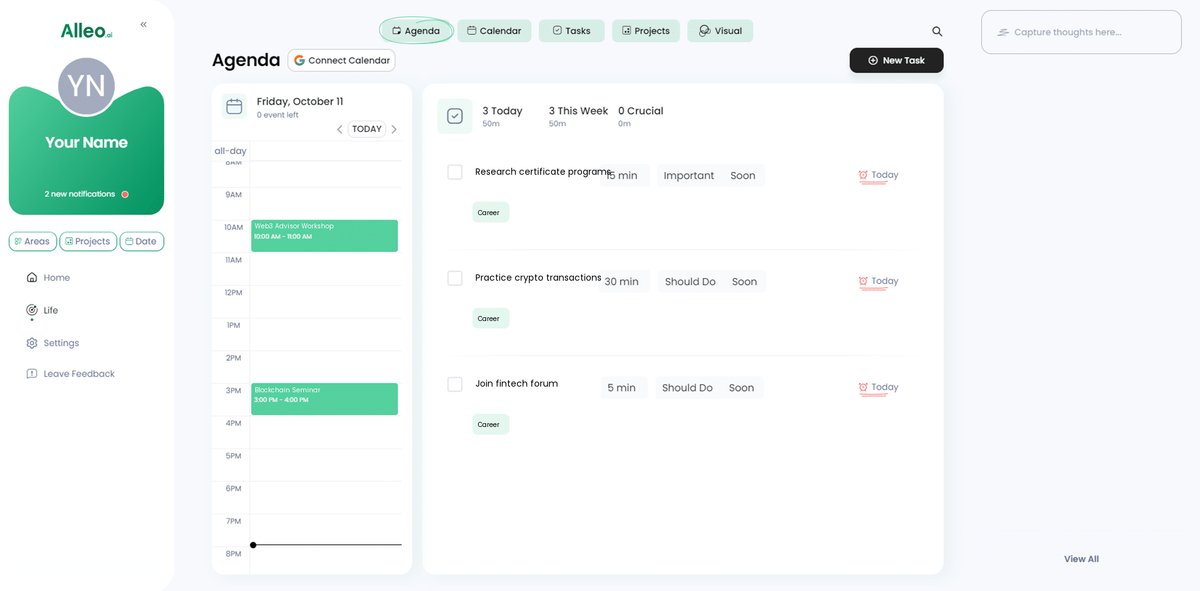

Use the calendar and task features in the Alleo app to schedule and track your Web3 learning activities, such as online courses, workshops, and practice sessions, ensuring you stay on top of your personal development journey in becoming a Web3-savvy financial advisor.

Bringing It All Together: Mastering Web3 for Your Clients

You’ve learned actionable steps to master Web3 concepts and guide your clients confidently. This journey for financial advisors learning Web3 concepts may seem daunting, but remember each step brings you closer to becoming a go-to expert in blockchain technology in finance.

By committing to continuous learning and utilizing available resources, you’ll maintain a competitive edge. Enroll in programs covering Web3 basics for financial advisors, attend seminars on cryptocurrency investment strategies, practice transactions in DeFi explained for financial professionals, join networks discussing NFTs and digital asset management, and create client curricula on smart contracts in financial planning.

Don’t forget, Alleo is here to support you. Our AI coach can help you stay on track with personalized learning plans and reminders on topics like tokenization of assets and metaverse opportunities for investors.

Start your free trial today and see how Alleo can streamline your Web3 mastery, including crypto regulations and compliance and Web3 risk assessment for client portfolios.