5 Powerful Strategies to Manage Student Loan Debt for Recent Graduates

Are you feeling overwhelmed by the burden of student loan debt? Managing student loan debt effectively can be challenging, but it’s not impossible.

Graduation is a time of celebration, but for many, it also marks the beginning of a daunting journey—managing student loan debt. Understanding student loan repayment options is crucial during this transition.

As a life coach, I’ve helped many recent graduates navigate these challenges. I understand the specific struggles you face with high interest rates on federal college loans and the importance of exploring income-driven repayment plans.

In this article, you’ll discover five key strategies for managing student loan debt effectively, helping you reduce financial stress and achieve your future goals. We’ll explore topics such as loan forgiveness programs, refinancing student loans, and budgeting for loan payments.

Let’s dive in and explore how to tackle your federal vs. private student loans head-on.

The Weight of Student Loan Debt

It’s not just the loan itself; it’s the high interest rates that compound the problem. Many graduates find that the interest on their federal student loans is financially crippling, making it difficult to get ahead when managing student loan debt effectively.

This debt impacts your financial stability and future goals. You might delay buying a home, starting a family, or even pursuing further education. Exploring student loan repayment options and income-driven repayment plans can help alleviate some of this burden.

Additionally, the emotional and psychological toll can be overwhelming. Debt stress can affect your mental health and overall well-being. Understanding the differences between federal vs. private student loans and utilizing the student loan interest deduction can provide some relief.

In my experience, many clients initially struggle with anxiety and frustration due to their mounting debt. However, there are actionable steps you can take to alleviate this burden and regain control of your finances, such as exploring loan forgiveness programs or considering refinancing student loans.

Key Strategies to Manage Student Loan Debt

Overcoming the challenge of managing student loan debt effectively requires a few key steps. Here are the main areas to focus on to make progress:

- Enroll in income-driven repayment plans: These student loan repayment options adjust your payments based on your income.

- Create a detailed budget and stick to it: Budgeting for loan payments helps manage loan payments and daily expenses.

- Explore loan forgiveness program eligibility: Some programs may forgive part or all of your debt, especially for federal vs. private student loans.

- Make extra payments to reduce principal: Extra payments can significantly reduce your overall debt and are a key strategy in managing student loan debt effectively.

- Refinance high-interest private student loans: Refinancing student loans can lower your interest rate and monthly payments.

Let’s dive in!

1: Enroll in income-driven repayment plans

Enrolling in income-driven repayment (IDR) plans is a crucial step in managing student loan debt effectively. These plans can significantly alleviate the financial strain of student loans by adjusting your payments based on your income.

Actionable Steps:

- Calculate your discretionary income: Use the Federal Student Aid website to understand your potential monthly payments and explore student loan repayment options.

- Apply for IDR plans: Complete your application through the Federal Student Aid website and ensure to recertify annually. This is one of the most effective strategies for managing student loan debt.

- Consult with a student loan advisor: Get professional advice to choose the best IDR plan for your specific financial situation and learn about loan forgiveness programs.

Explanation: Enrolling in an IDR plan is essential for managing student loan debt effectively. These plans can make your monthly payments more affordable, reducing financial stress and potentially offering loan forgiveness.

According to Student Loan Borrower Assistance, IDR plans can offer loan forgiveness after a set period, making them a valuable option for many borrowers dealing with federal vs. private student loans.

Taking these steps ensures you can manage your debt while working towards your financial goals, including budgeting for loan payments.

This approach will start you on the right path to managing your student loan debt effectively. Next, we will explore how creating a detailed budget can further support your financial journey.

2: Create a detailed budget and stick to it

Creating a detailed budget is crucial for managing student loan debt effectively and ensuring financial stability.

Actionable Steps:

- List all income sources and categorize expenses: Identify where your money is coming from and where it’s going. This helps in pinpointing unnecessary expenses and allocating funds for loan payments.

- Set up a monthly budget: Allocate specific amounts for student loan repayment options, necessities, and savings. Stick to this budget to avoid financial pitfalls.

- Use budgeting apps and tools: These can help you track spending and stay on course with your financial goals, including managing student loan debt effectively.

Explanation:

Creating and adhering to a budget is key to managing student loan debt effectively. By understanding your income and expenses, you can make informed decisions that prioritize loan repayments and financial health.

According to Greater Nevada Credit Union, budgeting is essential for financial success and stability. Utilizing tools and apps ensures you remain consistent and accountable when budgeting for loan payments.

Key benefits of budgeting include:

- Improved financial awareness

- Reduced stress about money

- Better ability to meet financial goals, including managing student loan debt effectively

Next, we’ll explore how to maximize loan forgiveness programs to further reduce your debt burden.

3: Explore loan forgiveness program eligibility

Exploring loan forgiveness programs is crucial for managing student loan debt effectively and reducing your debt burden.

Actionable Steps:

- Research available programs: Investigate loan forgiveness programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness.

- Verify eligibility: Check the specific requirements and gather necessary documentation to qualify for these student loan repayment options.

- Maintain accurate records: Regularly update your employment and payment records to ensure you meet program criteria for loan forgiveness programs.

Explanation:

Understanding and utilizing loan forgiveness programs can significantly lower your debt when managing student loan debt effectively. For example, programs like PSLF offer forgiveness after 10 years of qualifying payments while working in public service.

According to the Student Loan Borrower Assistance, these programs are designed to help those with high debt from pursuing careers in fields that serve the public good.

By taking these steps, you can potentially save thousands and achieve financial stability sooner while effectively managing student loan debt.

Next, let’s look into making extra payments to reduce your loan principal.

4: Make extra payments to reduce principal

Making extra payments on your student loans can significantly reduce your overall debt and save you money in interest, which is crucial for managing student loan debt effectively.

Actionable Steps:

- Allocate windfalls: Use tax refunds or work bonuses to make additional loan payments, enhancing your student loan repayment options.

- Set up automatic payments: Ensure consistency and avoid late fees by automating extra payments, a key strategy in budgeting for loan payments.

- Use the debt avalanche method: Prioritize paying off high-interest loans first to save on interest, especially when dealing with federal vs. private student loans.

Explanation:

Making extra payments helps you reduce the principal balance faster, which in turn lowers the amount of interest you pay over time, an essential aspect of managing student loan debt effectively.

According to College Money Tips, this strategy can significantly shorten your repayment period and save you money. Taking these steps ensures you’re actively working towards financial freedom, which is particularly important during the grace period for student loans.

The impact of extra payments can be substantial:

- Reduced total interest paid

- Shorter loan term

- Faster path to debt freedom

Next, let’s discuss the benefits and process of refinancing student loans with high interest rates.

5: Refinance high-interest private student loans

Refinancing high-interest private student loans can be an effective strategy for managing student loan debt effectively, helping you lower your monthly payments and interest rates.

Actionable Steps:

- Compare refinancing offers: Research multiple lenders to find the best interest rates and terms for refinancing student loans.

- Check your credit score: Make sure your credit score is in good shape to qualify for better refinancing rates, which is crucial when exploring student loan repayment options.

- Consider the long-term impact: Assess the financial consequences of extending loan terms versus reducing monthly payments, keeping in mind your overall debt consolidation strategies.

Explanation:

Refinancing your private student loans can lead to significant savings when managing student loan debt effectively. By securing a lower interest rate, you can reduce your overall debt and free up money for other financial goals, similar to how income-driven repayment plans can help with federal loans.

According to Navy Federal Credit Union, refinancing can also help you manage your monthly budget more effectively. Ensuring you take these steps can set you on the path to financial stability and improve your approach to budgeting for loan payments.

Factors to consider when refinancing:

- Current market interest rates

- Your financial goals

- Potential savings over time

With these strategies, you’ll be well-equipped to tackle your student loan debt and explore various student loan repayment options.

Partner with Alleo to Tackle Your Student Loan Debt

We’ve explored strategies for managing student loan debt effectively. But did you know you can work directly with Alleo to make this journey easier and faster?

How Alleo Helps:

- Set Up Your Account: Sign up for Alleo with no credit card required and enjoy a free 14-day trial to explore student loan repayment options.

- Personalized Plan: Create a tailored repayment plan based on your financial situation and goals, including income-driven repayment plans.

- Coaching Support: Alleo’s AI coach offers full coaching sessions, just like a human coach, to guide you through every step of managing student loan debt effectively.

- Progress Tracking: Get automated reminders for recertifying IDR plans and making extra payments to stay on top of your loan forgiveness programs.

- Stay Accountable: Receive text and push notifications to stay on track with your budget and repayment goals, helping you with budgeting for loan payments.

Ready to get started for free?

Let me show you how!

Step 1: Log In or Create Your Alleo Account

To begin tackling your student loan debt with Alleo’s AI coach, log in to your existing account or create a new one to access personalized guidance and support.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to develop consistent financial practices that will help you manage your student loan debt more effectively, such as regular budgeting and making extra loan payments.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on managing your student loan debt, creating a budget, and exploring loan forgiveness options, helping you achieve financial stability and reduce stress related to your educational debt.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session with your AI coach to create a personalized student loan repayment plan tailored to your financial situation and goals.

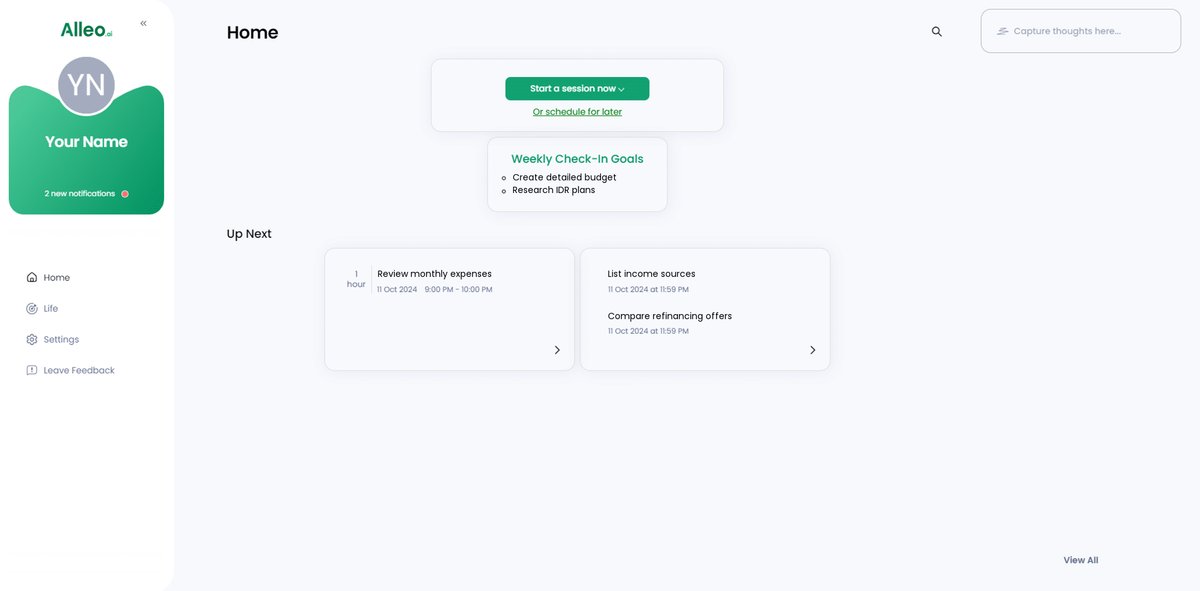

Step 5: Viewing and managing goals after the session

After your coaching session on managing student loan debt, check the Alleo app’s home page to review and track the personalized goals you discussed, helping you stay on top of your repayment strategies and financial progress.

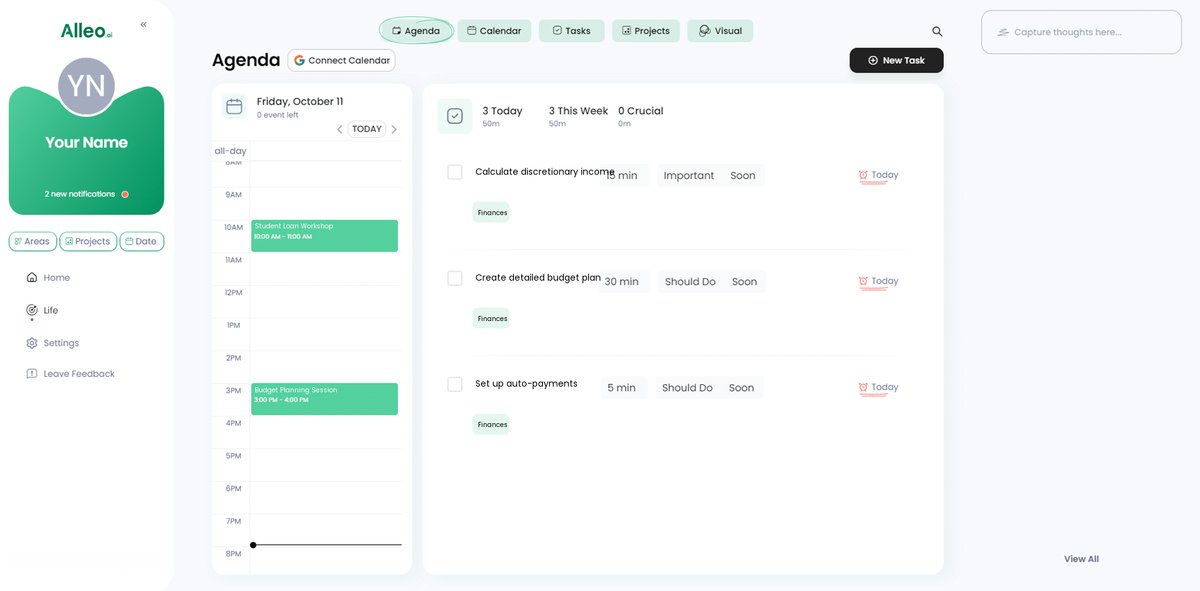

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important dates like loan payment deadlines, budget check-ins, and refinancing application timelines, helping you stay on top of your student loan management goals.

Taking Control of Your Student Loan Debt

Having explored actionable strategies, it’s time to take charge of your financial future by managing student loan debt effectively.

Managing student loan debt requires planning and dedication. By enrolling in income-driven repayment plans, creating a detailed budget for loan payments, and exploring loan forgiveness programs, you can significantly reduce your debt.

Making extra payments and refinancing student loans with high interest rates are also key steps in student loan repayment options. These debt consolidation strategies will help you regain control and reduce financial stress.

Remember, you’re not alone in this journey. Alleo is here to support you every step of the way as you navigate federal vs. private student loans.

Sign up for Alleo today and start your path to financial freedom. Together, we can make managing student loan debt effectively a reality.