5 Proven Retirement Planning Strategies for Young Professionals

Imagine retiring early and enjoying financial freedom. Is it just a dream, or can you make it a reality? For young professionals, retirement planning is a crucial step towards long-term financial goals.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, starting early and making informed decisions is crucial for retirement planning for young professionals. This includes understanding tax-advantaged retirement accounts and balancing student loan repayment with retirement saving.

In this article, you’ll discover proven strategies for retirement planning. We’ll cover maximizing employer benefits like 401(k) optimization for early career professionals, diversifying investments, automating savings, and more. These retirement savings tips for millennials can help you start building wealth in your 20s and 30s.

Let’s dive in to explore investment strategies for early retirement planning and how to leverage the power of compound interest for your future financial security.

Understanding the Challenges of Retirement Planning

Navigating retirement plans and insurance options can be overwhelming for young professionals. Many face difficulty understanding investment choices and managing student debt while trying to balance retirement planning for young professionals. In this complex landscape, strategies for building wealth in your 20s and 30s become crucial.

In my experience, poor retirement planning often leads to inadequate coverage and financial insecurity. Failing to plan early can result in missed opportunities for growth and stability. This underscores the importance of retirement savings tips for millennials and setting long-term financial goals for young adults.

Additionally, the complexity of financial products and changing regulations adds to the confusion. This makes it crucial to start early and stay informed about 401(k) optimization for early career professionals and Roth IRA benefits for young investors. Understanding tax-advantaged retirement accounts for young workers can significantly impact future financial security.

Key Steps to Secure Your Retirement Early

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for effective retirement planning for young professionals:

- Start early: Maximize employer 401(k) match – Enroll and contribute enough to get the full employer match, a crucial step in 401(k) optimization for early career professionals.

- Diversify: Open and fund a Roth IRA annually – Set up automatic contributions to a diverse mix of assets, leveraging Roth IRA benefits for young investors.

- Automate savings: Set up recurring transfers – Direct deposit into various savings accounts for ease, supporting long-term financial goals for young adults.

- Build emergency fund: 3-6 months of expenses – Save in a high-yield savings account, balancing student loan repayment and retirement saving.

- Educate yourself: Learn basic investing concepts – Attend workshops and read up on financial literacy, focusing on investment strategies for early retirement planning.

Let’s dive in to explore these retirement savings tips for millennials!

1: Start early: Maximize employer 401(k) match

Starting early with your employer’s 401(k) plan is essential for securing your financial future and is a key aspect of retirement planning for young professionals.

Actionable Steps:

- Enroll in your employer’s 401(k) plan as soon as you are eligible.

- Contact your HR department to learn about the enrollment process and deadlines.

- Contribute at least enough to receive the full employer match.

- Calculate the percentage of your salary needed to get the maximum match and set up automatic contributions.

- Review and adjust your contributions annually.

- Increase your contributions by 1% each year or after each salary increase.

Explanation: These steps matter because contributing early and maximizing your employer match significantly boosts your retirement savings and supports long-term financial goals for young adults.

According to Johnson Financial Group, employer-sponsored retirement plans are crucial for young professionals. By starting early, you leverage compound interest and employer contributions for long-term growth, essential for building wealth in your 20s and 30s.

Key benefits of maximizing your 401(k) match:

- Free money from employer contributions

- Tax advantages on contributions, similar to other tax-advantaged retirement accounts for young workers

- Potential for significant long-term growth through compound interest and early retirement contributions

This foundational step sets the stage for a secure retirement plan and is a crucial part of retirement planning for young professionals.

2: Diversify: Open and fund a Roth IRA annually

Opening and funding a Roth IRA annually is a critical step for diversifying your retirement savings and ensuring long-term financial stability. This is a key aspect of retirement planning for young professionals looking to secure their financial future.

Actionable Steps:

- Research and choose a credible financial institution to open a Roth IRA.

- Compare fees, investment options, and customer service of different providers for optimal retirement savings tips for millennials.

- Set up automatic contributions to your Roth IRA.

- Determine a fixed amount you can contribute monthly and set up automatic transfers from your checking account, a crucial step in budgeting for retirement as a young professional.

- Invest in a diverse mix of assets within your Roth IRA.

- Allocate your contributions across different asset classes such as stocks, bonds, and mutual funds to optimize investment strategies for early retirement planning.

Explanation: These steps are vital because diversifying your investments helps manage risk and maximize returns over time, which is essential for building wealth in your 20s and 30s.

According to Investopedia, starting early with diversified investments can significantly boost your retirement savings through the power of compound interest, a key principle in retirement planning for young professionals.

Setting up a Roth IRA and regularly contributing to it ensures you take advantage of tax-free growth and withdrawals in retirement, making it one of the most beneficial tax-advantaged retirement accounts for young workers.

Taking these actions will help you build a robust and resilient retirement portfolio, supporting your long-term financial goals as a young adult.

3: Automate savings: Set up recurring transfers

Automating your savings through recurring transfers is a key strategy for ensuring consistent progress toward your financial goals, especially when it comes to retirement planning for young professionals.

Actionable Steps:

- Set up direct deposit from your paycheck to multiple savings accounts. Allocate portions of your paycheck to go directly into retirement savings tips for millennials, emergency fund, and regular savings accounts.

- Use budgeting apps to track and manage your savings. Choose a reliable app that helps monitor your spending and savings progress effectively, aiding in budgeting for retirement as a young professional.

- Establish financial goals and automate transfers to meet them. Define both short-term and long-term financial goals for young adults, and set up automatic transfers to fund these goals regularly, including 401(k) optimization for early career professionals.

Explanation: Automating your savings ensures that you consistently set aside money for your future without relying on manual transfers. This approach helps you avoid the temptation to spend and ensures steady progress toward your financial goals, including building wealth in your 20s and 30s.

According to The Whole U, automating savings can significantly improve financial discipline and long-term stability.

Benefits of automating your savings:

- Consistent progress towards financial goals, including retirement planning for young professionals

- Reduced temptation to overspend

- Improved financial discipline, supporting investment strategies for early retirement planning

Taking these steps will help you build a solid financial foundation effortlessly, leveraging compound interest and early retirement contributions.

4: Build emergency fund: 3-6 months of expenses

Building an emergency fund of 3-6 months of expenses is crucial for financial security, especially during unexpected events. This is an essential step in retirement planning for young professionals.

Actionable Steps:

- Calculate your essential monthly expenses. Make a list of necessary expenses such as rent, utilities, groceries, and insurance. This helps in balancing student loan repayment and retirement saving.

- Open a high-yield savings account (HYSA) for your emergency fund. Research and select a HYSA that offers competitive interest rates, which can contribute to building wealth in your 20s and 30s.

- Set up automatic monthly transfers to your emergency fund. Determine a fixed amount to transfer each month until you reach your target amount. This practice aligns with budgeting for retirement as a young professional.

Explanation: An emergency fund ensures you have a financial safety net during unexpected situations, reducing the need to dip into retirement savings. It’s a key component of long-term financial goals for young adults.

According to The Whole U, maintaining an emergency fund can significantly improve financial discipline and long-term stability.

Taking these steps will help you build a solid financial foundation effortlessly, setting the stage for effective retirement planning for young professionals.

5: Educate yourself: Learn basic investing concepts

Educating yourself on basic investing concepts is crucial for making informed financial decisions and achieving long-term financial stability, especially when it comes to retirement planning for young professionals.

Actionable Steps:

- Attend financial literacy workshops or webinars. Sign up for free or low-cost workshops offered by local organizations or online platforms to learn about retirement savings tips for millennials.

- Read books and articles on personal finance and investing. Create a reading list of recommended personal finance books and set aside time each week to read about long-term financial goals for young adults.

- Seek mentorship from a financial advisor. Schedule a consultation with a certified financial planner to discuss your financial goals and strategies, including 401(k) optimization for early career professionals.

Explanation: Understanding investing basics helps you make better financial decisions and avoid costly mistakes in retirement planning for young professionals.

According to NBER, improving financial literacy can significantly enhance retirement outcomes. Taking these steps ensures you stay informed and confident in managing your investments and building wealth in your 20s and 30s.

Essential investing concepts to learn for retirement planning for young professionals:

- Asset allocation

- Risk tolerance

- Compound interest and early retirement contributions

- Market volatility

By continuously learning about tax-advantaged retirement accounts for young workers and investment strategies for early retirement planning, you build a strong foundation for your financial future.

Partner with Alleo on Your Retirement Journey

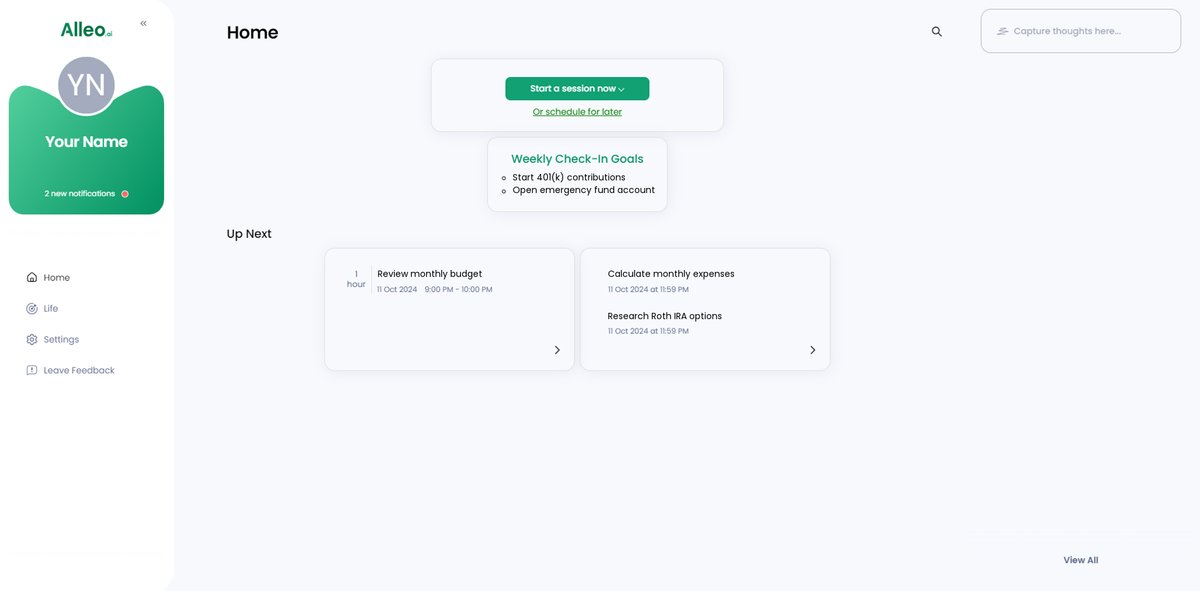

We’ve explored the challenges of retirement planning for young professionals and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to building wealth in your 20s and 30s?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your financial situation and long-term financial goals for young adults, including strategies for balancing student loan repayment and retirement saving.

Alleo’s AI coach provides affordable, tailored coaching support for retirement planning, including 401(k) optimization for early career professionals and advice on Roth IRA benefits for young investors, with full coaching sessions like any human coach.

The coach follows up on your progress, handles changes, and keeps you accountable with text and push notifications. You can track your financial goals and receive personalized advice based on your unique needs, including investment strategies for early retirement planning and guidance on tax-advantaged retirement accounts for young workers.

Ready to get started for free? Let me show you how to kickstart your retirement planning as a young professional!

Step 1: Log in or Create Your Alleo Account

To begin your journey towards financial freedom, log in to your existing Alleo account or create a new one to access personalized retirement planning guidance.

Step 2: Choose Your Focus Area

Click on “Building better habits and routines” to establish a strong foundation for your retirement planning journey, helping you consistently work towards your financial goals and create lasting positive changes in your money management habits.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to receive tailored guidance on retirement planning, investment strategies, and building long-term financial security, aligning perfectly with the retirement goals discussed in this article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to create a personalized retirement plan that aligns with your financial goals and the strategies outlined in this article.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the retirement planning goals you discussed, allowing you to track your progress and stay accountable to your financial objectives.

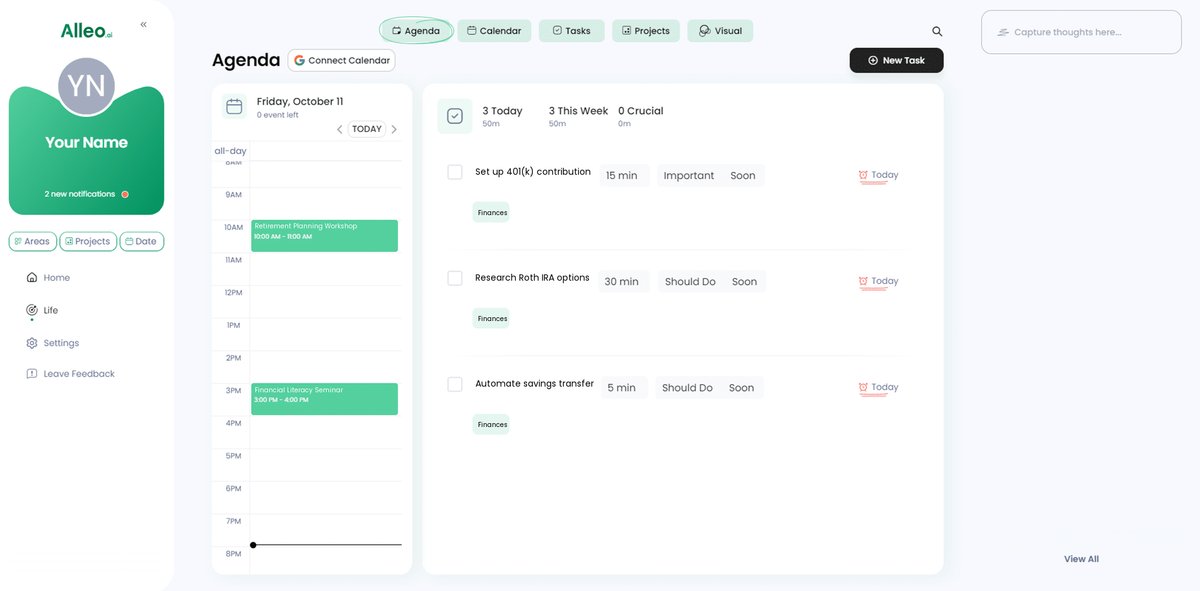

6: Add Events to Your Calendar or App

Use the calendar and task features in the Alleo app to schedule and track your progress on retirement planning activities, such as setting up automatic savings transfers or attending financial literacy workshops, helping you stay accountable and on track with your financial goals.

Take Action for a Secure Retirement

You’ve learned the steps to secure your financial future through retirement planning for young professionals. Now, it’s time to put these strategies into action.

Starting early and making informed decisions can transform your retirement dreams into reality, especially when focusing on long-term financial goals for young adults.

Remember, each small step today leads to a more secure tomorrow, whether it’s 401(k) optimization for early career professionals or exploring Roth IRA benefits for young investors.

Don’t wait. Begin maximizing your employer benefits, diversifying investments, and automating savings to start building wealth in your 20s and 30s.

Building an emergency fund and educating yourself about investment strategies for early retirement planning are crucial steps.

And if you need a helping hand with retirement planning for young professionals, Alleo is here for you.

Create a personalized plan with Alleo, and take control of your financial journey. Ready to start? Try Alleo for free today and learn about tax-advantaged retirement accounts for young workers.