6 Essential Investment Strategies for Young Professionals Balancing Long-Term Growth and Active Trading

Are you struggling to balance long-term stability with the excitement of active trading? Many young professionals face this challenge when considering investment strategies.

As a life coach, I’ve helped many young professionals navigate these financial challenges. I understand the balancing act between securing your future and seizing immediate opportunities, especially when it comes to retirement planning for millennials.

In this blog, I’ll guide you through the best investment strategies for young professionals. We’ll explore how to allocate your extra post-tax money efficiently, discussing short-term vs long-term investment options.

You’ll learn how to set up a Roth IRA, allocate funds between index funds and active trading, and much more. We’ll cover stock market basics for young investors and discuss diversification techniques for young portfolios.

Let’s dive in and explore investment strategies young professionals can use to build their financial future.

Understanding the Investment Dilemma for Young Professionals

Balancing long-term investments with active trading is a significant challenge for young professionals seeking effective investment strategies. Many find themselves overwhelmed by the choices between short-term vs long-term investment options.

They often struggle with deciding how to allocate their extra income effectively, torn between retirement planning for millennials and exploring high-yield savings accounts for professionals.

This dilemma is more common than you might think. I frequently see clients feeling torn between securing their financial future through 401(k) optimization strategies and exploring immediate growth opportunities in the stock market.

The fear of missing out on potential high returns from active trading adds to the confusion, especially when considering risk management in active trading.

For instance, several clients report being uncertain about where to begin with investment strategies for young professionals. They want the security that long-term investments offer but are also tempted by the thrill of active trading, unsure whether to focus on index funds vs individual stocks for young adults.

This balance is essential to achieve, yet without a clear strategy for diversification techniques for young portfolios, it can feel unattainable.

Key Steps to Balance Long-Term and Active Trading

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in investment strategies for young professionals:

- Set up a Roth IRA for long-term investing: Choose a reliable provider, fund your account, and understand the tax advantages for retirement planning for millennials.

- Allocate 80% to index funds, 20% to active trading: Diversify with broad-market index funds and explore active trading opportunities, balancing short-term vs long-term investment options.

- Use dollar-cost averaging for consistent investing: Automate regular investments to maintain consistency and reduce risk, a key strategy for young investors learning stock market basics.

- Learn options basics before active trading: Educate yourself through courses and communities to understand fundamentals, including risk management in active trading.

- Start with paper trading to practice strategies: Use simulation platforms to test your trading strategies without real money, ideal for beginners exploring index funds vs individual stocks for young adults.

- Rebalance portfolio quarterly to manage risk: Regularly adjust allocations to maintain your desired risk level, incorporating diversification techniques for young portfolios.

Let’s dive into these investment strategies for young professionals!

1: Set up a Roth IRA for long-term investing

Setting up a Roth IRA is essential for long-term financial stability and growth, making it one of the key investment strategies for young professionals.

Actionable Steps:

- Research and choose a provider: Look for low fees, diverse investment options, and solid customer support. Consider robo-advisors for beginner investors if you’re new to the stock market.

- Open and fund your Roth IRA: Start with an initial deposit and set up automatic contributions for consistent funding. This is crucial for retirement planning for millennials.

- Understand tax advantages and rules: Familiarize yourself with contribution limits and withdrawal rules to maximize benefits. This knowledge is key for tax-efficient investing for early career stages.

Explanation:

These steps help you create a solid foundation for your future. A Roth IRA offers tax-free growth and withdrawals in retirement, making it an attractive option among investment strategies for young professionals.

According to CNBC, consistent contributions and understanding tax benefits can significantly enhance your retirement savings.

Key benefits of a Roth IRA include:

- Tax-free withdrawals in retirement

- No required minimum distributions

- Flexibility for early withdrawals of contributions

Starting with a Roth IRA sets the stage for your long-term investment journey, providing a foundation for diversification techniques for young portfolios.

2: Allocate 80% to index funds, 20% to active trading

Allocating most of your investment to index funds while keeping a portion for active trading can balance stability and growth. This approach is one of the key investment strategies young professionals should consider.

Actionable Steps:

- Choose broad-market index funds: Select options like the S&P 500 or total market index funds for diversified exposure, which is crucial for retirement planning for millennials.

- Set aside 20% for active trading: Identify stocks or sectors you believe have growth potential, and allocate funds accordingly. This allows young investors to explore short-term vs long-term investment options.

- Monitor and adjust allocations: Review your portfolio quarterly to ensure it aligns with your investment goals and practice risk management in active trading.

Explanation:

These steps help you balance long-term growth with the excitement of active trading. Index funds provide diversification and stability, while active trading allows you to capitalize on market opportunities. This strategy combines the benefits of index funds vs individual stocks for young adults.

According to Fidelity, combining these strategies can enhance your financial resilience and potential returns, making it an effective investment strategy for young professionals.

Let’s move on to the next strategy.

3: Use dollar-cost averaging for consistent investing

Using dollar-cost averaging helps you invest consistently, reducing the impact of market volatility. This is a key investment strategy for young professionals looking to build wealth over time.

Actionable Steps:

- Set up automatic transfers: Schedule monthly or bi-weekly transfers from your bank to your investment account to ensure regular contributions, an essential part of retirement planning for millennials.

- Invest a fixed amount regularly: Decide on a specific amount to invest at regular intervals, regardless of market conditions. This approach works well for both short-term and long-term investment options.

- Monitor and adjust contributions: Periodically review your financial situation and adjust the investment amount if necessary, considering factors like 401(k) optimization strategies.

Explanation:

These steps ensure you maintain a disciplined approach to investing while reducing the risk of market timing, which is crucial for young professionals developing their investment strategies.

Regular investments smooth out the purchase price, potentially lowering the average cost per share over time. This principle applies to various options, from index funds to individual stocks for young adults.

According to Navy Federal, this strategy can help mitigate emotional decision-making and foster long-term growth.

By implementing dollar-cost averaging, you’ll build a consistent investment habit, which is fundamental to investment strategies for young professionals.

4: Learn options basics before active trading

Understanding options trading basics is crucial before diving into active trading, as it can help you manage risk and maximize returns. This is especially important for investment strategies young professionals should consider.

Actionable Steps:

- Enroll in an online course: Take a reputable course to grasp the fundamentals of options trading, including key concepts and strategies for young investors interested in stock market basics.

- Join a trading community: Engage with experienced traders in forums to gain insights, tips, and real-world perspectives on trading options and risk management in active trading.

- Read advanced trading literature: Expand your knowledge by reading books or articles from experts in the field to understand complex strategies and diversification techniques for young portfolios.

Explanation:

These steps are essential for building a solid foundation in options trading. Gaining knowledge through courses, communities, and literature helps you make informed decisions and navigate the complexities of the market, which is crucial for investment strategies young professionals should adopt.

According to Investopedia, understanding the basics of options trading can significantly enhance your ability to manage risk and achieve your investment goals.

Key concepts to master in options trading:

- Call and put options

- Strike price and expiration date

- Option Greeks (delta, gamma, theta, vega)

By mastering these basics, you’ll be better prepared for active trading and implementing effective investment strategies young professionals can benefit from.

5: Start with paper trading to practice strategies

Starting with paper trading is crucial for young professionals exploring investment strategies as it allows you to practice without risking real money.

Actionable Steps:

- Sign up for a paper trading account: Choose a platform that offers realistic market simulations to practice your investment strategies for young professionals.

- Test different trading scenarios: Experiment with various strategies under different market conditions to see what works best for you, including short-term vs long-term investment options.

- Analyze and refine your performance: Regularly review your trades, identify mistakes, and adjust your strategies accordingly, focusing on risk management in active trading.

Explanation:

These steps help you gain practical experience and confidence. By using a paper trading account, you can refine your skills without financial risk, which is crucial for young professionals developing investment strategies.

According to Investopedia, practicing with simulated trades can significantly enhance your understanding of market dynamics. This preparation will set you up for success when you start trading with real money, whether you’re considering index funds vs individual stocks for young adults.

Starting with paper trading is an essential step in your investment journey, especially for young professionals exploring various investment strategies.

6: Rebalance portfolio quarterly to manage risk

Regularly rebalancing your portfolio is essential to maintain your desired risk level and investment goals, especially for young professionals exploring investment strategies.

Actionable Steps:

- Review your portfolio’s performance: Every three months, evaluate how your investments are performing compared to your goals, considering both short-term vs long-term investment options.

- Adjust your allocations: Reallocate funds to ensure you maintain your target distribution of 80% index funds and 20% active trading, a crucial aspect of investment strategies for young professionals.

- Stay informed about market trends: Follow financial news to make educated decisions on rebalancing your portfolio, including stock market basics for young investors.

Explanation:

These steps are crucial for keeping your investments aligned with your goals and risk tolerance. Regular rebalancing helps you stay on track and adapt to market changes, which is vital for retirement planning for millennials.

According to Investopedia, maintaining a balanced portfolio can enhance your financial stability and growth over time, a key principle in investment strategies for young professionals.

Benefits of regular portfolio rebalancing:

- Maintains desired risk level

- Forces disciplined selling high and buying low

- Keeps your investment strategy on track, including diversification techniques for young portfolios

Staying consistent with rebalancing helps manage risk and optimize your investment strategy, essential for young professionals navigating the world of investments.

Partner with Alleo on Your Investment Journey

We’ve explored the challenges of balancing long-term investments with active trading. But did you know you can work directly with Alleo to make this investment journey easier for young professionals?

Set up your account, create a personalized plan, and let Alleo’s AI coach guide you through various investment strategies for young professionals. Alleo provides tailored coaching on topics like retirement planning for millennials, tracks your progress in short-term vs long-term investment options, and keeps you accountable with reminders via text and push notifications for stock market basics and 401(k) optimization strategies.

Ready to get started for free and learn about diversification techniques for young portfolios? Let me show you how!

Step 1: Log In or Create Your Account

To start your investment journey with Alleo’s AI coach, log in to your existing account or create a new one to access personalized guidance and track your progress towards balancing long-term investments and active trading.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a consistent investment strategy that balances long-term stability with active trading, helping you overcome the challenge of allocating your extra income effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive personalized guidance on balancing long-term investments with active trading, helping you achieve your financial goals and secure your future.

Step 4: Starting a Coaching Session

Begin your investment journey with Alleo by scheduling an intake session to create a personalized plan that balances long-term stability and active trading strategies.

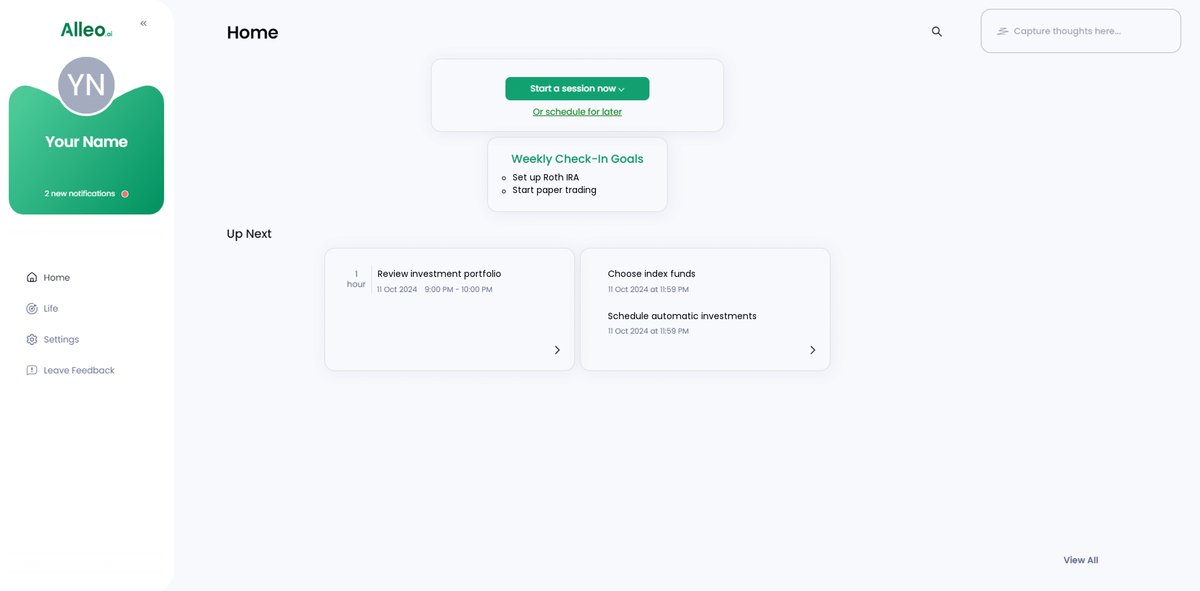

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the investment goals you discussed, allowing you to track your progress and stay aligned with your financial strategy.

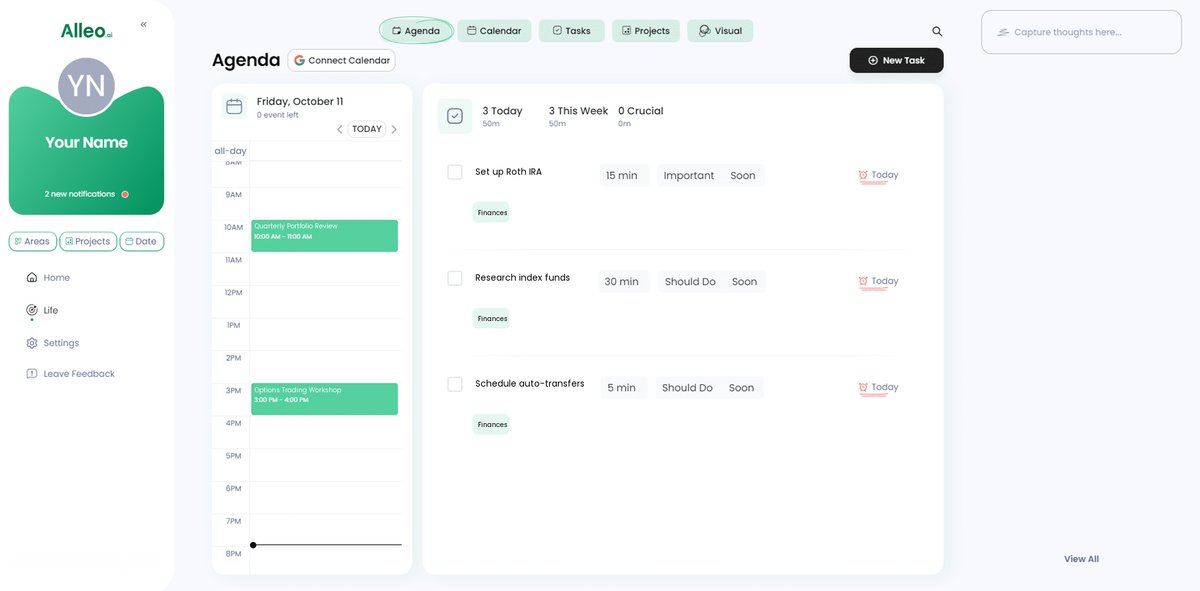

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your investment activities, such as quarterly portfolio rebalancing and regular contributions, helping you stay on top of your financial goals and monitor your progress in balancing long-term investments with active trading.

Wrapping Up Your Investment Journey

We’ve covered a lot of ground together. Balancing long-term stability with active trading is achievable for young professionals exploring investment strategies.

Remember, setting up a Roth IRA builds a solid foundation for retirement planning for millennials. Allocating funds wisely and using dollar-cost averaging helps maintain consistency, whether you’re considering short-term vs long-term investment options.

Learning stock market basics for young investors, including options fundamentals and starting with paper trading, boosts your confidence. Regularly rebalancing your portfolio keeps you on track with diversification techniques for young portfolios.

You can do this. With Alleo’s AI coach, your investment journey becomes easier, whether you’re exploring high-yield savings accounts for professionals or 401(k) optimization strategies.

Empower yourself today. Start your free trial with Alleo and take control of your financial future, mastering investment strategies young professionals need for success.