6 Essential Strategies for Choosing the Best Budgeting App for Long-Term Financial Planning

Imagine planning an event where every detail is meticulously budgeted for the entire year without stress. This is the essence of long-term event budget planning.

As a life coach, I’ve helped many professionals navigate these challenges. From seasonal fluctuations to unexpected expenses, managing a budget can be overwhelming. Effective long-term event budget planning often involves utilizing tools like financial goal setting apps and expense management apps.

In this article, you’ll discover strategies to streamline your budget planning. We’ll cover multi-month planning, personalized insights, and scenario modeling. These techniques can be applied not only to event budgeting but also to personal finance forecasting and long-term savings calculations.

Let’s dive in.

The Complexities of Budgeting for Event Planners

Long-term event budget planning presents unique challenges across multiple months. Many clients initially struggle with balancing seasonal fluctuations and unexpected expenses, similar to challenges faced in retirement planning software.

This often leads to stress and financial mismanagement, highlighting the need for effective expense management apps.

Event planners need reliable tools for long-term event budget planning. Without these, visualizing and tracking expenses becomes a nightmare, much like trying to manage without a comprehensive financial dashboard.

In my experience, detailed financial insights are crucial. They help you adapt to changing circumstances and manage budgets effectively, similar to how personal finance forecasting aids in financial goal setting.

Key Steps to Effective Long-Term Budget Planning for Event Planners

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in long-term event budget planning.

- Implement multi-month budget planning feature: Create detailed monthly budgets and set reminders, similar to a financial goal setting app.

- Visualize planned expenses across yearly timeline: Use timeline tools to map and highlight key expenses, akin to comprehensive financial dashboards.

- Integrate AI for personalized financial insights: Analyze spending patterns and suggest optimizations, much like personal finance forecasting tools.

- Enable scenario modeling for future projections: Compare outcomes of various scenarios to make informed decisions, similar to retirement planning software.

- Incorporate goal tracking with milestone alerts: Set clear financial goals and use alerts to stay on track, functioning as a long-term savings calculator.

- Add customizable reports for long-term analysis: Generate and share detailed financial reports, similar to investment tracking tools.

Let’s dive into these long-term event budget planning strategies!

1: Implement multi-month budget planning feature

Effective long-term event budget planning is crucial for event planners managing long-term projects.

Actionable Steps:

- Create detailed monthly budgets: Develop a specific budget template for each event type, detailing expected expenses, similar to a financial goal setting app.

- Set automatic reminders: Schedule monthly reminders to review and adjust budgets as needed, akin to features in investment tracking tools.

- Use historical data: Analyze past event data to predict and plan for future monthly expenses, much like personal finance forecasting.

Explanation: These steps are vital for maintaining financial stability and ensuring you’re prepared for any unforeseen costs in long-term event budget planning.

Leveraging historical data can enhance accuracy in budgeting, similar to how a comprehensive financial dashboard operates.

For more insights, check out this article on forecasting and budgeting software that highlights the importance of data-driven financial planning.

Now, let’s explore how to visualize planned expenses across a yearly timeline, akin to a cash flow projection tool.

2: Visualize planned expenses across yearly timeline

Visualizing planned expenses across a yearly timeline is crucial for effective long-term event budget planning and overall financial management.

Actionable Steps:

- Utilize timeline visualization tools: Map out expenses month-by-month using tools that offer clear visual representations, similar to a comprehensive financial dashboard.

- Highlight key expense periods: Identify and emphasize periods with significant expenses to anticipate potential budget gaps, aiding in personal finance forecasting.

- Integrate calendar syncing: Sync your budget with a calendar to keep track of financial milestones and deadlines, similar to features in financial goal setting apps.

Explanation: These steps help you stay on top of your financial planning by providing a clear overview of expenses throughout the year, much like using a cash flow projection tool.

This approach allows you to anticipate and manage budget fluctuations effectively, similar to using investment tracking tools. For more insights, check out this study on UPI-based budgeting apps that emphasizes the importance of visualizing expenses.

Implementing these strategies will make it easier to manage your finances and avoid unexpected setbacks in your long-term event budget planning.

3: Integrate AI for personalized financial insights

Integrating AI for personalized financial insights can revolutionize the way you manage your event budgets, especially when it comes to long-term event budget planning.

Actionable Steps:

- Leverage AI to analyze spending patterns: Use AI tools to examine past expenses and identify trends, similar to how a financial goal setting app works.

- Receive personalized alerts: Set up AI-driven notifications for overspending or underspending, much like expense management apps.

- Apply predictive analytics: Use AI to forecast future financial needs based on historical data, akin to personal finance forecasting tools.

Explanation: These steps are crucial for maintaining financial stability and avoiding unexpected costs. Leveraging AI helps you make data-driven decisions and optimize your budgeting process, similar to how retirement planning software functions.

For more insights, check out this review on Copilot, which highlights the benefits of AI-driven financial management.

Key benefits of AI in financial planning include:

- Enhanced accuracy in budget forecasting, similar to long-term savings calculators

- Real-time insights for quick decision-making, like a comprehensive financial dashboard

- Automated pattern recognition for cost-saving opportunities, akin to investment tracking tools

Implementing AI can help you stay ahead of potential financial issues and streamline your long-term event budget planning.

4: Enable scenario modeling for future projections

Scenario modeling is essential for anticipating future financial outcomes and making informed decisions in long-term event budget planning.

Actionable Steps:

- Create different financial scenarios: Develop multiple scenarios based on potential changes in event plans, utilizing personal finance forecasting tools.

- Compare the outcomes: Evaluate the results of various scenarios to make data-driven decisions, similar to using a comprehensive financial dashboard.

- Adjust planning strategies: Refine your strategies based on scenario outcomes to enhance financial stability and long-term event budget planning.

Explanation: These steps help you prepare for different financial possibilities, ensuring you can adapt to changes in event plans.

Using scenario modeling tools helps you make informed decisions and optimize your budget, much like using investment tracking tools or a cash flow projection tool.

For more insights, check out this article on corporate budget planning that emphasizes the importance of scenario planning.

Implementing these strategies will provide a clearer financial outlook and improve budget management for long-term event planning.

5: Incorporate goal tracking with milestone alerts

Incorporating goal tracking with milestone alerts is essential for keeping your long-term event budget planning on track.

Actionable Steps:

- Set clear financial goals: Define specific financial objectives for each event and overall yearly targets using a financial goal setting app.

- Use milestone alerts: Schedule alerts to monitor progress toward your financial goals and adjust strategies as needed, similar to retirement planning software.

- Review progress regularly: Periodically evaluate your progress and celebrate achievements to stay motivated, utilizing investment tracking tools.

Explanation: These steps ensure you’re consistently working towards your financial targets, helping you stay organized and focused in your long-term event budget planning.

By setting clear goals and using milestone alerts, you can manage your budget more effectively and anticipate potential issues, much like using expense management apps.

For more insights, check out this article on creating a personal budget that emphasizes the importance of goal tracking in financial planning.

Effective goal tracking strategies for long-term event budget planning include:

- Breaking larger goals into smaller, manageable milestones using a personal finance forecasting tool

- Using visual progress trackers for motivation, similar to a comprehensive financial dashboard

- Regularly reassessing and adjusting goals as needed with a long-term savings calculator

Taking these actions will help you maintain financial stability and achieve your event planning goals through effective long-term event budget planning.

6: Add customizable reports for long-term analysis

Adding customizable reports for long-term analysis is key to effective budget management and long-term event budget planning.

Actionable Steps:

- Generate detailed financial reports: Create monthly and yearly reports that highlight key financial metrics, similar to a comprehensive financial dashboard.

- Customize report focus: Tailor reports to emphasize specific areas, like expense categories or revenue streams, using expense management apps.

- Share reports with stakeholders: Provide transparent access to reports for team members and stakeholders, akin to investment tracking tools.

Explanation: These steps allow you to monitor financial performance and make informed decisions. Customizable reports help identify trends and areas for improvement in long-term event budget planning.

For more insights, check out this article on forecasting and budgeting software, which underscores the importance of detailed financial analysis.

Essential components of effective financial reports:

- Clear data visualization for easy interpretation, similar to personal finance forecasting tools

- Comparative analysis of actual vs. budgeted figures, like a cash flow projection tool

- Actionable insights and recommendations for long-term event budget planning

Implementing these strategies will enhance your budget planning and ensure financial transparency, much like using a financial goal setting app.

Partner with Alleo for Effortless Event Budgeting

We’ve explored the complexities of long-term event budget planning for event planners and effective strategies. But did you know you can work directly with Alleo, a comprehensive financial dashboard, to simplify this process?

Setting up an account with Alleo, your personal finance forecasting partner, is straightforward. Create a personalized long-term event budget planning strategy and start working with Alleo’s AI coach, which functions like an advanced financial goal setting app.

The coach offers tailored support for your budgeting needs, similar to retirement planning software. You’ll receive follow-ups on progress, handle changes easily with our expense management features, and stay accountable with text and push notifications, much like a debt reduction planner.

Ready to get started for free? Let me show you how to begin your long-term event budget planning journey!

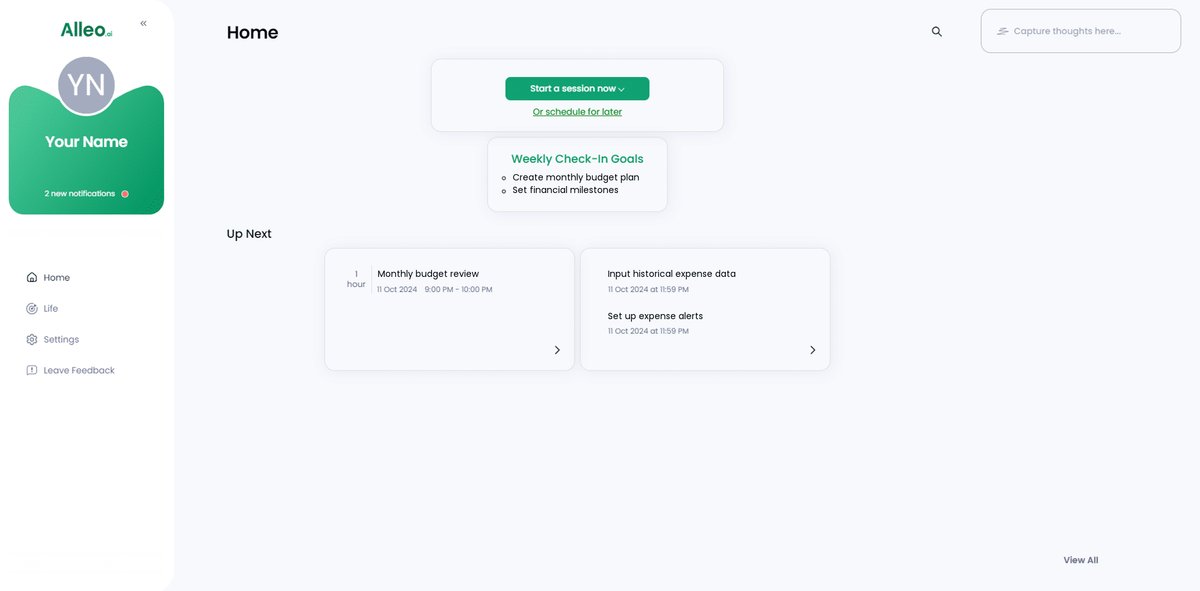

Step 1: Log In or Create Your Alleo Account

To begin your journey with Alleo’s AI coach for event budgeting, simply Log in to your account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to create a structured approach to your event planning and budgeting, helping you establish consistent practices that will streamline your financial management and reduce stress in the long run.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to access tailored budgeting tools and AI-driven insights, helping you master long-term event planning and financial management with ease.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with our AI coach to set up a personalized budget plan tailored to your event planning needs.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the goals you discussed, allowing you to track progress and stay accountable to your event budgeting objectives.

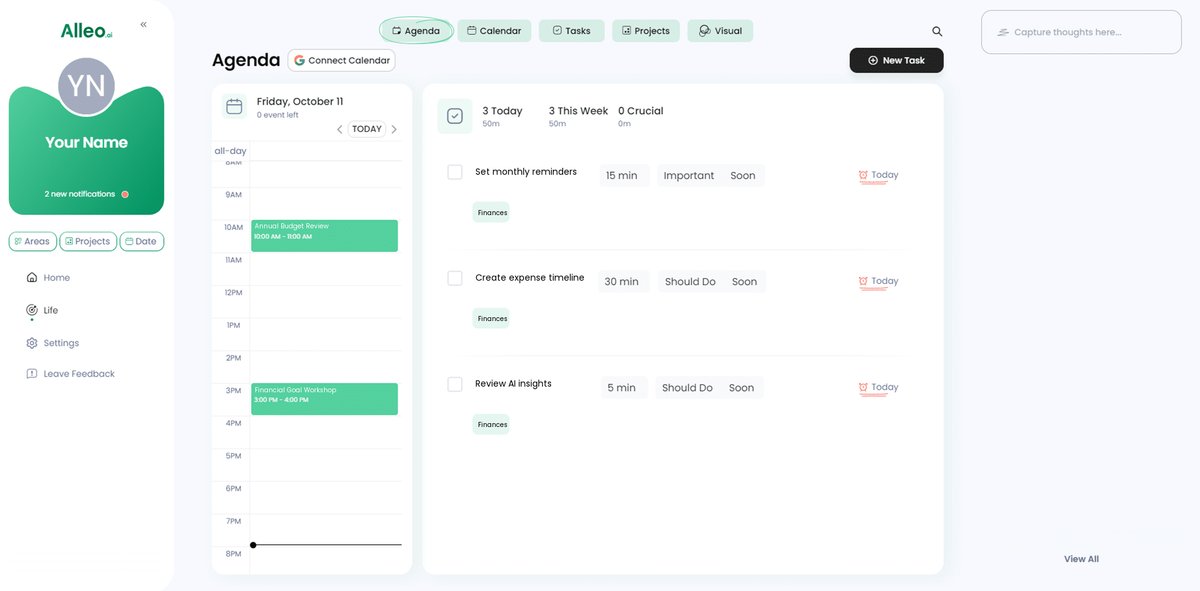

Step 6: Adding Events to Your Calendar or App

Easily add your event budgets and milestones to the Alleo app’s calendar feature, allowing you to track your progress, set reminders for important financial deadlines, and visualize your budget timeline alongside your event schedule.

Wrapping Up Your Event Budgeting Journey

Managing long-term event budget planning can be challenging, but it’s crucial for success. We’ve covered actionable steps to help you streamline this process, much like a financial goal setting app would.

By implementing these strategies, you’ll gain control over your finances. Visualizing expenses, leveraging AI, and scenario modeling are key, similar to features found in comprehensive financial dashboards.

Remember, personalizing insights and tracking goals can make a huge difference. Customizable reports will keep you informed and prepared, akin to investment tracking tools.

I understand the stress of event planning and long-term event budget planning. You’re not alone in this.

Alleo is here to support you. Start your journey with Alleo today and simplify your budget planning, much like expense management apps do for personal finances.

Transform your financial management with our AI coach, offering features similar to personal finance forecasting tools.