6 Powerful Strategies for Financial Advisors to Attract High-Net-Worth Clients

Are you struggling to attract high-net-worth wealth clients in the competitive wealth management industry? You’re not alone in seeking premium wealth solutions for affluent investors.

As a life coach, I’ve helped many professionals navigate these challenges in high-net-worth client acquisition. In my experience, financial advisors often face difficulties in generating leads and acquiring new clients, especially when targeting affluent demographics.

This article will cover key strategies to help you attract high-net-worth clients and enhance your luxury financial services. You’ll discover actionable steps and proven wealth management marketing tactics to improve your client acquisition efforts for ultra-high-net-worth individuals.

Let’s dive into exclusive financial advisory techniques for attracting high-net-worth wealth clients.

Understanding the Challenge of Attracting High-Net-Worth Clients

Navigating the competitive landscape of wealth management, many financial advisors find generating leads and attracting high-net-worth wealth clients daunting. The fierce competition means you must stand out to attract high-net-worth clients and develop effective wealth management marketing tactics.

In my experience, the shift towards a more digital and personalized client experience has intensified this challenge. Ultra-high-net-worth individuals now expect tailored services that align with their unique financial goals and values, often seeking exclusive financial advisory services.

Moreover, traditional methods often fall short in high-net-worth client acquisition. For instance, cold calling no longer yields the same results due to changing client expectations and preferences in the realm of luxury financial services.

Adapting to these modern demands is crucial for private banking clientele. Without evolving your approach to affluent investor outreach, you risk losing potential clients to more tech-savvy competitors offering premium wealth solutions.

It’s tough, but not insurmountable. With the right strategies for targeting affluent demographics, you can overcome these hurdles and thrive in the wealth management industry, providing upscale financial planning services to high-net-worth clients.

A Roadmap to Attracting High-Net-Worth Clients

Overcoming this challenge of attracting high-net-worth wealth clients requires a few key steps. Here are the main areas to focus on to make progress in high-net-worth client acquisition:

- Develop a personalized, value-focused approach: Understand and cater to the unique needs of high-net-worth clients and ultra-high-net-worth individuals.

- Leverage digital marketing and social media: Utilize online platforms to engage potential affluent investors effectively.

- Offer comprehensive financial planning services: Provide a wide range of premium wealth solutions to meet complex client needs.

- Build strategic partnerships and referral networks: Leverage relationships to generate leads and credibility in luxury financial services.

- Create educational content for wealth management: Share knowledge to establish thought leadership in upscale financial planning services.

- Enhance client experience with white-glove service: Offer exceptional service to build trust and loyalty among private banking clientele.

Let’s dive into these wealth management marketing tactics!

1: Develop a personalized, value-focused approach

Creating a personalized, value-focused approach is essential for attracting high-net-worth wealth clients in the luxury financial services sector.

Actionable Steps:

- Conduct in-depth client interviews to uncover the specific goals and values of ultra-high-net-worth individuals.

- Create tailored financial plans that align with affluent clients’ long-term objectives and premium wealth solutions.

- Regularly review and adjust plans to ensure they remain relevant and effective for your private banking clientele.

Explanation: High-net-worth clients expect personalized services that reflect their unique financial goals and values. By conducting thorough interviews, you gain deeper insights into the needs of affluent investors.

Tailored financial plans demonstrate your commitment to their success, fostering trust and loyalty among your exclusive financial advisory clients. Regular reviews ensure your strategies stay aligned with their evolving goals in upscale financial planning services.

For more on understanding client needs, see this article.

Implementing this approach will help you stand out in the competitive wealth management industry and improve your high-net-worth client acquisition efforts.

2: Leverage digital marketing and social media

In today’s digital age, leveraging digital marketing and social media is crucial for attracting high-net-worth wealth clients and enhancing wealth management marketing tactics.

Actionable Steps:

- Develop a strong online presence through a professional website and active social media profiles for targeting affluent demographics.

- Use targeted ads and SEO strategies to attract high-net-worth individuals and ultra-high-net-worth individuals.

- Share valuable content, such as blogs and videos, to build credibility and trust with potential private banking clientele.

Key elements of a strong digital presence for luxury financial services include:

- A user-friendly, mobile-responsive website showcasing premium wealth solutions

- Consistent branding across all platforms for exclusive financial advisory services

- Regular, high-quality content updates focused on upscale financial planning services

Explanation: A robust digital presence helps you engage potential high-net-worth wealth clients where they spend their time.

Targeted ads and SEO enhance visibility, bringing your luxury financial services to the right audience.

Sharing high-quality content builds your reputation as a knowledgeable advisor for affluent investor outreach. This approach aligns with current trends, as noted in this resource.

Leveraging digital marketing and social media can significantly boost your high-net-worth client acquisition efforts.

3: Offer comprehensive financial planning services

Providing comprehensive financial planning services is crucial to meet the complex needs of high-net-worth clients and is key to attracting high-net-worth wealth clients.

Actionable Steps:

- Expand your service offerings to include tax optimization, estate planning, and retirement planning for ultra-high-net-worth individuals.

- Partner with specialists in legal and tax advisory to offer holistic solutions for premium wealth management.

- Implement a family office approach to manage all aspects of affluent investors’ financial lives.

Explanation: High-net-worth clients seek advisors who can handle their diverse financial needs. By expanding your exclusive financial advisory services, you cater to their complex requirements and build trust.

Partnering with specialists ensures you provide well-rounded advice for luxury financial services. Adopting a family office approach demonstrates your commitment to their long-term success in private banking.

For more insights on high-net-worth client acquisition, check out this article.

Offering comprehensive financial services positions you as a trusted advisor for attracting high-net-worth wealth clients.

![]()

4: Build strategic partnerships and referral networks

Building strategic partnerships and referral networks is vital for attracting high-net-worth wealth clients and expanding your reach and credibility in the wealth management industry.

Actionable Steps:

- Network with other professionals: Connect with accountants, attorneys, and other professionals serving ultra-high-net-worth individuals.

- Join industry associations: Participate in associations and attend events to expand your network and visibility in luxury financial services.

- Create a referral program: Incentivize existing clients and partners to refer new high-net-worth clients through a structured program for affluent investor outreach.

Explanation: These steps matter because strategic partnerships and referral networks can significantly enhance your high-net-worth client acquisition efforts.

Collaborating with trusted professionals helps build credibility and trust among affluent clients seeking exclusive financial advisory services. For instance, networking with accountants and attorneys can open doors to new client referrals for premium wealth solutions.

Additionally, a well-structured referral program incentivizes your existing private banking clientele to help grow your client base. For more insights on attracting high-net-worth wealth clients, see this resource.

This approach will help you build a strong network and attract high-net-worth clients effectively, targeting affluent demographics for upscale financial planning services.

5: Create educational content for wealth management

Creating educational content for wealth management is vital for establishing yourself as a trusted advisor in the industry and attracting high-net-worth wealth clients.

Actionable Steps:

- Write and publish articles: Share insights on wealth management topics through blogs, whitepapers, and e-books, focusing on ultra-high-net-worth individuals.

- Host webinars and workshops: Educate potential clients about financial planning with engaging and informative sessions tailored to affluent investor outreach.

- Develop a wealth management blog: Address common concerns and questions of high-net-worth individuals to build credibility and showcase premium wealth solutions.

Key topics to cover in your educational content for attracting high-net-worth wealth clients:

- Investment strategies for high-net-worth individuals

- Tax optimization techniques for affluent demographics

- Estate planning considerations for private banking clientele

Explanation: These steps matter because they position you as a knowledgeable expert in luxury financial services, enhancing your credibility.

Sharing valuable content helps build trust and attract high-net-worth clients. For additional insights on creating impactful educational content and high-net-worth client acquisition, check out this resource.

Creating educational content will establish you as a thought leader in exclusive financial advisory and attract high-net-worth clients effectively, boosting your wealth management marketing tactics.

6: Enhance client experience with white-glove service

Providing an exceptional client experience with white-glove service is pivotal in attracting and retaining high-net-worth clients for wealth management and luxury financial services.

Actionable Steps:

- Offer personalized and proactive communication: Schedule regular check-ins and updates tailored to each high-net-worth client’s preferences.

- Organize exclusive events and experiences: Host VIP events to strengthen relationships and show appreciation for your affluent investor clients.

- Implement a concierge service: Assist ultra-high-net-worth individuals with unique needs and preferences, ensuring they feel valued and cared for.

Essential elements of white-glove service for attracting high-net-worth wealth clients include:

- 24/7 availability for urgent matters in private banking

- Personalized gift-giving on special occasions for premium wealth solutions

- Anticipating client needs before they arise in exclusive financial advisory

Explanation: These steps matter because high-net-worth clients expect superior service that demonstrates your commitment to their satisfaction. Personalized communication builds trust and loyalty in upscale financial planning services.

Exclusive events create memorable experiences that enhance client bonds in wealth management marketing. A concierge service addresses the unique needs of affluent demographics, setting you apart from competitors in high-net-worth client acquisition.

For more on enhancing client experiences, see this article.

These strategies will help you establish a strong, long-lasting relationship with high-net-worth clients in targeting affluent demographics for your financial services.

![]()

Partner with Alleo to Attract High-Net-Worth Clients

We’ve explored the challenges of attracting high-net-worth clients and the steps to overcome them in wealth management marketing. But did you know you can work directly with Alleo to make this journey easier and faster for high-net-worth client acquisition?

Set up an account and create a personalized plan with Alleo for targeting affluent demographics. Our AI coach offers tailored coaching sessions for attracting high-net-worth wealth clients, just like a human coach specializing in luxury financial services.

Alleo supports your progress in ultra-high-net-worth individual outreach with follow-ups, changes, and accountability via text and push notifications, enhancing your private banking clientele strategies.

Ready to get started for free on your journey to offering premium wealth solutions? Let me show you how to excel in exclusive financial advisory!

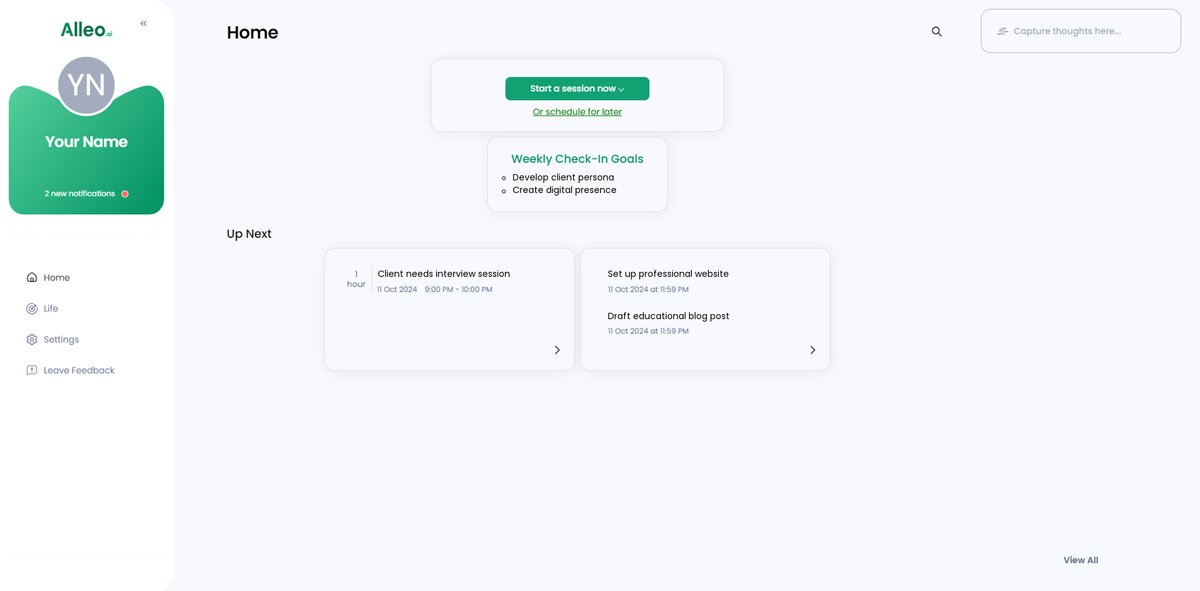

Step 1: Log In or Create Your Alleo Account

To begin attracting high-net-worth clients with Alleo’s AI coaching, Log in to your account or create a new one to access personalized strategies and support.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align Alleo’s coaching with your wealth management objectives, helping you develop strategies to attract and retain high-net-worth clients more effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to directly address your goal of attracting high-net-worth clients, allowing you to receive tailored strategies and guidance specific to wealth management and financial advisory services.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you create a personalized plan to attract high-net-worth clients and grow your wealth management practice.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, the goals you discussed will appear on the home page of the Alleo app, allowing you to easily track and manage your progress in attracting high-net-worth clients.

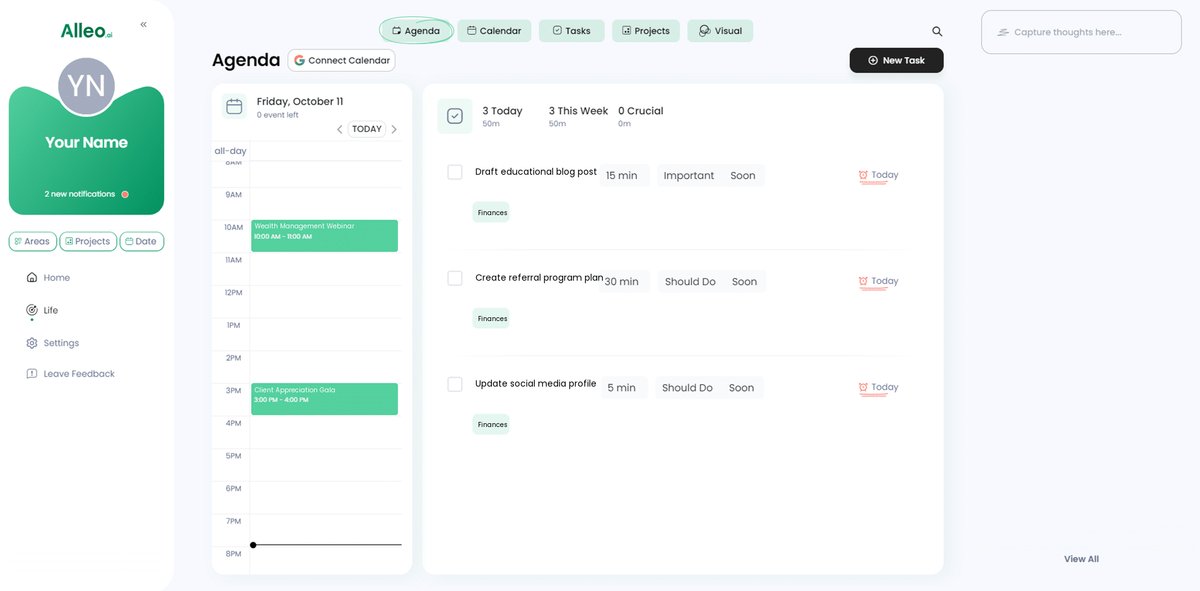

Step 6: Adding Events to Your Calendar or App

To help you stay on track with your high-net-worth client acquisition strategies, use Alleo’s calendar and task features to schedule important events and deadlines, allowing you to easily monitor your progress and maintain accountability as you implement the techniques discussed in this article.

Take Action to Attract High-Net-Worth Clients

You now have a roadmap to attract high-net-worth clients. Implementing these strategies will set you apart in the competitive wealth management industry and boost your high-net-worth client acquisition efforts.

Remember, it’s all about understanding your ultra-high-net-worth individuals and offering tailored, exceptional service. By leveraging digital marketing, building strategic partnerships, and creating educational content, you can make a significant impact in attracting high-net-worth wealth clients.

Don’t forget the importance of a personalized touch in luxury financial services. Your affluent investor clients will appreciate the effort you put into understanding and meeting their unique private banking needs.

To make this journey easier in targeting affluent demographics, consider partnering with Alleo. Our AI coach can help you stay on track and reach your goals in premium wealth solutions.

Try Alleo for free today! Let’s work together to achieve success in providing exclusive financial advisory services.