6 Powerful Techniques for Financial Analysts to Enhance Planning Tools with Data Analytics

Are you struggling with outdated financial planning tools and seeking ways to improve financial planning with analytics? Data-driven financial planning can revolutionize your approach.

As a life coach, I’ve seen many professionals face this challenge. In my experience, leveraging advanced data analytics and programming skills can transform your financial planning process, incorporating predictive analytics in finance and business intelligence for analysts.

In this post, you’ll discover strategies to integrate AI-driven forecasting, real-time financial dashboard tools, custom algorithms, automation, and more. You’ll also learn how to enhance data quality and leverage cloud-based solutions for financial forecasting techniques and big data in financial analysis.

Let’s dive in to explore how you can improve financial planning with analytics and advanced Excel for financial modeling.

The Challenges Financial Analysts Face with Traditional Tools

Traditional financial planning tools can be a significant roadblock for many analysts looking to improve financial planning with analytics. They often struggle with outdated software that can’t keep up with the demands of modern financial data and data-driven financial planning.

Many clients initially struggle with the lack of real-time insights and cumbersome data entry in their financial forecasting techniques. This can lead to errors and inefficiencies, making it hard to stay competitive in a rapidly evolving market that demands advanced Excel for financial modeling.

In my experience, people often find that existing tools require extensive manual effort, hindering efforts to improve financial planning with analytics. This takes time away from more strategic activities like implementing predictive analytics in finance.

The gap between current capabilities and the potential of advanced analytics is significant. Advanced technical skills and data analytics, including big data in financial analysis, are no longer optional—they are essential.

Embracing these technologies, such as machine learning in financial planning and data visualization for financial reports, can transform your financial planning process, making it more accurate and efficient.

Strategic Roadmap to Better Financial Planning Tools

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to improve financial planning with analytics and make progress.

- Integrate AI-driven forecasting tools: Use AI to improve forecasting accuracy and efficiency, leveraging predictive analytics in finance.

- Implement real-time data visualization: Utilize real-time financial dashboard tools like Power BI or Tableau for instant insights.

- Develop custom financial modeling algorithms: Tailor algorithms to your specific business needs for better results, incorporating advanced Excel for financial modeling.

- Automate reporting with Python scripts: Reduce manual effort through automated financial reporting systems.

- Enhance data quality management processes: Ensure data integrity and accuracy with governance policies, crucial for data-driven financial planning.

- Leverage cloud-based FP&A solutions: Improve collaboration and scalability with cloud technology, enabling big data in financial analysis.

Let’s dive in!

1: Integrate AI-driven forecasting tools

Integrating AI-driven forecasting tools is crucial for enhancing your financial planning accuracy and efficiency, helping you improve financial planning with analytics.

Actionable Steps:

- Enroll in online courses focused on AI and machine learning. This will help you understand how these technologies can be applied to data-driven financial planning and forecasting.

- Partner with data scientists to create custom AI models. Ensure these models are tailored to your financial data for precise forecasts and advanced financial modeling.

- Regularly review and adjust AI forecasting tools. Monitor their performance to maintain accuracy and relevance in your financial forecasting techniques.

Key benefits of AI-driven forecasting:

- Enhanced prediction accuracy through predictive analytics in finance

- Faster data processing with big data in financial analysis

- Adaptive learning capabilities for improved financial planning with analytics

Explanation:

These steps matter because AI-driven forecasting tools can significantly improve the precision of your financial predictions and help you improve financial planning with analytics.

By understanding AI applications, collaborating with experts, and continuously refining your tools, you can stay competitive in the evolving financial landscape and leverage business intelligence for analysts.

For more insights, check out this informative article on AI in financial analysis.

Following these steps will position you to leverage AI’s full potential, making your financial planning more effective through data-driven financial planning and machine learning in financial planning.

2: Implement real-time data visualization

Implementing real-time data visualization is essential for gaining instant insights and making informed decisions to improve financial planning with analytics.

Actionable Steps:

- Invest in advanced data visualization for financial reports tools like Power BI or Tableau. These real-time financial dashboard tools offer interactive dashboards that update in real time.

- Train your team on how to interpret and use these visualizations. This helps ensure everyone can leverage the insights for better data-driven financial planning.

Explanation:

These steps matter because real-time data visualization enables you to react swiftly to market changes. It also helps in identifying trends and anomalies immediately, enhancing your financial forecasting techniques.

By using tools like Power BI, you can enhance your decision-making capabilities and improve financial planning with analytics. For more insights, check out this article on financial analysis software.

Following these steps will position you to leverage real-time data effectively, making your financial planning more dynamic and responsive through business intelligence for analysts.

3: Develop custom financial modeling algorithms

Developing custom financial modeling algorithms is crucial for tailoring solutions to improve financial planning with analytics and address your specific business needs.

Actionable Steps:

- Learn programming languages such as Python or R. Enroll in online courses to build your coding skills and understand how to create custom algorithms for data-driven financial planning.

- Develop and test financial models. Start small with simple models, then gradually increase complexity as you gain confidence and expertise in predictive analytics in finance.

- Continuously refine these algorithms. Use feedback and changing financial conditions to adapt and improve your models, incorporating big data in financial analysis.

Essential components of effective financial models:

- Clear assumptions and inputs

- Flexible scenario analysis

- Robust error checking

Explanation:

These steps matter because custom financial modeling algorithms allow you to address unique business challenges more effectively. By learning programming languages, you can create models that provide more precise insights and improve financial planning with analytics.

For more information, check out this article on financial analytics. This approach ensures your financial planning is more accurate and aligned with your business goals.

By following these steps, you’ll be well-equipped to develop sophisticated financial models that enhance your financial planning tools and leverage business intelligence for analysts.

4: Automate reporting with Python scripts

Automate reporting with Python scripts to reduce manual effort and improve data accuracy, a key step to improve financial planning with analytics.

Actionable Steps:

- Identify repetitive reporting tasks. Determine which reporting tasks take up the most time and can be automated for efficiency in data-driven financial planning.

- Write and deploy Python scripts. Create scripts to handle these tasks, ensuring they run smoothly and accurately, enhancing business intelligence for analysts.

- Set up automated alerts. Use Python to create alerts and automated financial reporting systems, keeping stakeholders informed without manual intervention.

Explanation:

These steps matter because automating reporting reduces errors and frees up time for strategic activities in financial forecasting techniques.

Using Python scripts can streamline workflows and improve accuracy. For more insights, visit this article on financial analytics.

This approach ensures your financial planning with analytics is efficient and reliable.

By following these steps, you’ll enhance your reporting processes and focus on more value-added tasks in data-driven financial planning.

5: Enhance data quality management processes

Improving data quality management processes is essential for ensuring accurate and reliable financial planning with analytics.

Actionable Steps:

- Implement data governance policies. Establish rules to maintain data integrity and accuracy across your organization, supporting data-driven financial planning.

- Use data quality tools. Invest in tools to clean and standardize data inputs, ensuring consistent and reliable data for business intelligence for analysts.

- Regularly audit data quality. Conduct periodic checks to identify and rectify data issues, maintaining high standards for financial forecasting techniques.

Key aspects of data quality management:

- Data validation procedures

- Consistent data definitions

- Regular data cleansing routines

Explanation:

These steps matter because high data quality is crucial for precise financial analysis. Reliable data leads to better decision-making and efficiency in big data financial analysis.

For more insights, read this article on financial data analytics. By following these steps, you ensure your financial planning is built on a solid data foundation, ready for predictive analytics in finance.

By enhancing data quality management, you’ll improve the accuracy and reliability of your financial planning tools and improve financial planning with analytics.

6: Leverage cloud-based FP&A solutions

Leveraging cloud-based FP&A solutions is vital for enhancing collaboration, scalability, and efficiency in financial planning. These tools can help improve financial planning with analytics and provide data-driven insights.

Actionable Steps:

- Research and select a cloud-based FP&A solution. Look for one that fits your organizational needs, offers scalability, and supports predictive analytics in finance.

- Migrate existing data and processes to the new cloud platform. Ensure a smooth transition by planning and testing data migration thoroughly, considering big data in financial analysis.

- Train your team on using the cloud-based solution. Provide comprehensive training to maximize the benefits of the new platform, including data visualization for financial reports.

Explanation:

These steps matter because cloud-based FP&A solutions offer real-time data access and improved collaboration. They enhance flexibility and scalability, making financial planning more efficient and enabling advanced financial forecasting techniques.

For more insights, check out this article on cloud-based FP&A solutions. By following these steps, you’ll position your financial planning process for greater success and improve financial planning with analytics.

Utilizing cloud-based FP&A tools can transform your financial planning, making it more dynamic and responsive. These solutions often incorporate business intelligence for analysts and real-time financial dashboard tools to enhance decision-making.

Partner with Alleo on Your Financial Planning Journey

We’ve explored the challenges of improving financial planning with analytics and the steps to achieve it. But did you know you can work directly with Alleo to make this data-driven financial planning journey easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your specific needs and goals, leveraging advanced Excel for financial modeling and predictive analytics in finance.

Alleo’s AI coach will help bridge your AI skills gaps and keep you accountable. It provides continuous support through text and push notifications, assisting you with business intelligence for analysts and financial forecasting techniques.

Ready to get started for free and improve financial planning with analytics? Let me show you how!

Step 1: Log In or Create Your Account

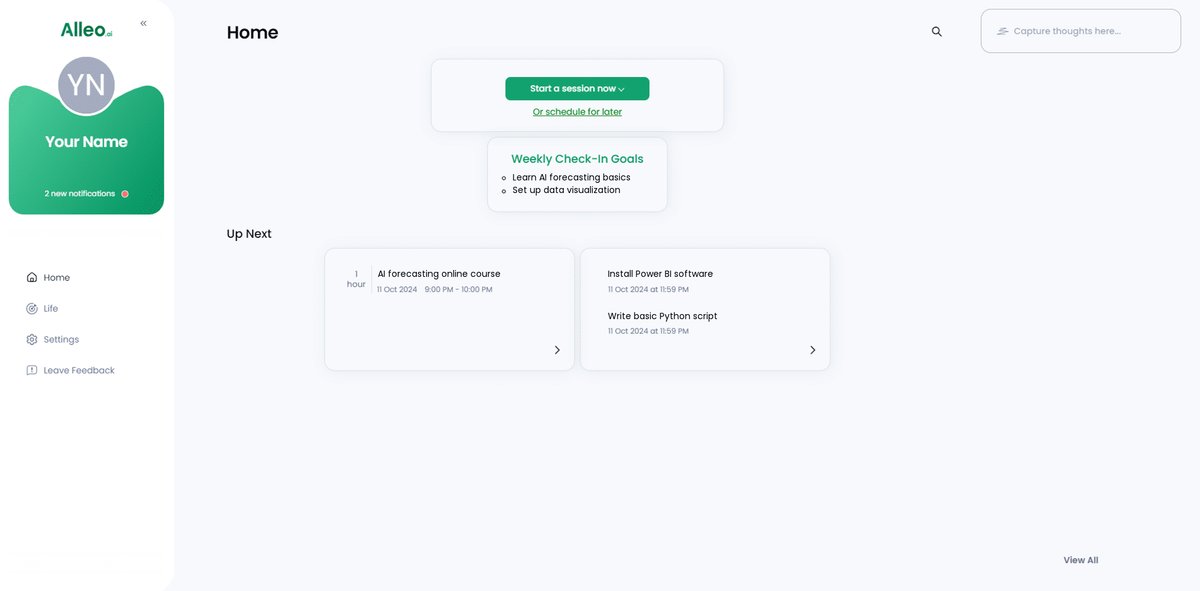

To start improving your financial planning tools with AI-driven analytics, log in to your Alleo account or create a new one if you haven’t already.

Step 2: Choose Your Financial Planning Focus

Select “Setting and achieving personal or professional goals” to align your financial planning efforts with your career aspirations and overcome challenges with outdated tools, enabling you to leverage data analytics for more accurate and efficient financial planning.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area to align Alleo’s AI coach with your goal of improving financial planning tools through data analytics, ensuring personalized guidance to enhance your financial strategies and decision-making processes.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to set up your personalized financial planning improvement strategy, aligning AI-driven tools and data analytics with your specific goals.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the financial planning goals you discussed, allowing you to track your progress and stay accountable in improving your data analytics skills and tools.

Step 6: Adding events to your calendar or app

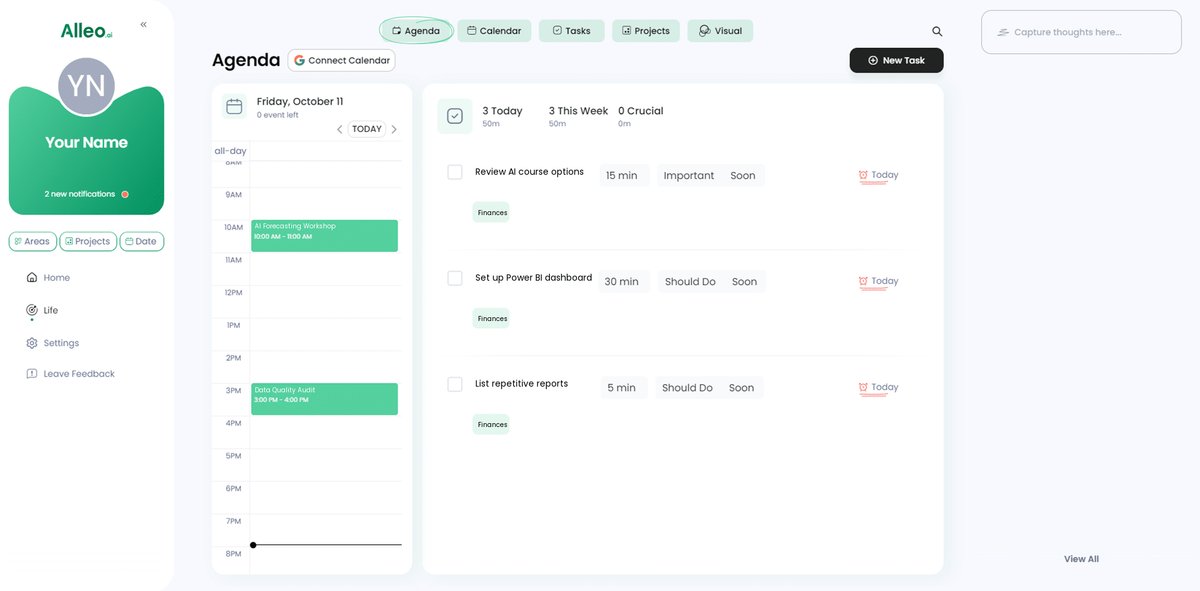

Use the calendar and task features in Alleo to schedule and track your progress on implementing data analytics improvements to your financial planning tools, ensuring you stay on top of key milestones and deadlines.

Take the Next Step: Transform Your Financial Planning

You’ve now explored various strategies to improve financial planning with analytics. It’s time to put these insights into action.

I understand the frustration of dealing with outdated tools for data-driven financial planning.

But remember, the transition to advanced Excel for financial modeling is within reach.

By integrating AI, real-time financial dashboard tools, and automated financial reporting systems, you will streamline your processes and gain a competitive edge.

Don’t forget to enhance data quality and leverage cloud-based solutions for better collaboration in big data financial analysis.

You can do this!

Alleo is here to support you every step of the way. Start your transformation journey to improve financial planning with analytics using Alleo today for free!