6 Proven Strategies for Fresh Graduates to Conquer Financial Struggles and Launch Their Careers

Are you feeling overwhelmed by financial struggles after graduation? Overcoming financial struggles after graduation can be a daunting challenge for many recent graduates.

As a life coach, I’ve helped many professionals navigate these entry-level job financial challenges. In my experience, I’ve seen how daunting it can be to start a career with financial uncertainty, especially when dealing with student loan management strategies.

In this article, you’ll discover practical strategies to overcome financial struggles after graduation and start your career on stable footing. From creating a budget to exploring side hustles for recent graduates, we’ll cover actionable advice to set you up for success. We’ll discuss budget tips for new graduates, first job salary negotiation, and cost-effective living for young professionals.

Let’s dive in to explore financial planning for career beginners and strategies for overcoming financial struggles after graduation.

Understanding the Financial Challenges of Fresh Graduates

Stepping into the workforce with high student loan debt can feel overwhelming. Many clients initially struggle with balancing loan repayments and everyday expenses when overcoming financial struggles after graduation.

Low starting salaries add to the stress, making it difficult to save or invest. Additionally, the high cost of living in many cities only exacerbates these financial pressures for those facing entry-level job financial challenges.

Imagine trying to build a future when your paycheck barely covers rent and groceries. It’s a harsh reality that many recent graduates face as they navigate cost-effective living for young professionals.

But you’re not alone. With a strategic approach to managing debt as a fresh graduate, you can navigate these challenges and achieve financial stability.

The Benefits of Working with a Life Coach

Have you ever felt stuck in your personal or professional life, unsure of how to move forward? That’s where a life coach can make a significant difference, especially when overcoming financial struggles after graduation.

A life coach is a professional who helps individuals identify their goals, overcome obstacles, and achieve their full potential. But what exactly can a life coach do for you, particularly when facing entry-level job financial challenges?

Key Advantages of Hiring a Life Coach

- Clarity and Focus: A life coach helps you clarify your goals and create a focused plan to achieve them, including budget tips for new graduates.

- Accountability: Regular check-ins keep you on track and motivated to follow through on your commitments, such as student loan management strategies.

- Personalized Strategies: Coaches tailor their approach to your unique needs and circumstances, like first job salary negotiation.

- Objective Perspective: An unbiased viewpoint can help you see situations from new angles and find innovative solutions for cost-effective living for young professionals.

- Skill Development: Learn new techniques for problem-solving, communication, and personal growth, including financial planning for career beginners.

How Life Coaching Can Transform Your Life

Working with a life coach can lead to profound personal and professional transformations. Many clients report increased confidence, improved relationships, and greater career satisfaction, even when overcoming financial struggles after graduation.

A coach can help you break through limiting beliefs and develop a growth mindset. This shift in perspective often leads to breakthroughs in areas where you’ve previously felt stuck, such as finding affordable housing options for new workers.

Is Life Coaching Right for You?

If you’re considering hiring a life coach, ask yourself these questions:

- Do you feel unfulfilled in your current personal or professional situation?

- Are you struggling to achieve your goals despite your best efforts?

- Do you want to improve your relationships or communication skills?

- Are you facing a major life transition and need guidance on saving money on a starter salary?

If you answered yes to any of these questions, life coaching could be a valuable investment in your future, especially when managing debt as a fresh graduate.

Finding the Right Coach for You

When selecting a life coach, it’s essential to find someone who aligns with your values and goals. Look for a coach with experience in the areas you want to improve, such as overcoming financial struggles after graduation.

Many coaches offer free consultations. Take advantage of these to get a feel for their coaching style and approach to side hustles for recent graduates.

Conclusion

Investing in a life coach can be a transformative experience. With the right coach, you can unlock your potential, overcome obstacles, and create the life you’ve always dreamed of, even when facing financial challenges after graduation.

Are you ready to take the first step towards a more fulfilling life? Consider reaching out to a life coach today and start your journey towards personal and professional success, including overcoming financial struggles after graduation.

Key Steps to Tackle Financial Challenges for Fresh Graduates

Overcoming financial struggles after graduation requires a few key steps. Here are the main areas to focus on to make progress:

- Create a realistic budget and track expenses: Use a budgeting app to monitor daily expenses and plan for upcoming bills, which is crucial for managing debt as a fresh graduate.

- Seek entry-level jobs with growth potential: Research companies with strong career growth prospects and tailor your resume for each application, addressing entry-level job financial challenges.

- Build an emergency fund for financial security: Set a savings goal and automate transfers to your savings account, essential for saving money on a starter salary.

- Explore side hustles for additional income: Identify side hustles for recent graduates that fit your skills and balance them with your main job.

- Negotiate salary and benefits confidently: Research market salary rates and prepare for first job salary negotiation by practicing scenarios.

- Improve financial literacy through free resources: Take advantage of online financial literacy courses and read personal finance books and blogs to enhance financial planning for career beginners.

Let’s dive in to these strategies for overcoming financial struggles after graduation!

1: Create a realistic budget and track expenses

Creating a realistic budget and tracking expenses is crucial for managing your finances effectively as a recent graduate, especially when overcoming financial struggles after graduation.

Actionable Steps:

- Use a budgeting app to monitor daily expenses. Set up spending categories and automate savings, which is essential for budget tips for new graduates.

- Reduce discretionary spending. Identify non-essential expenses and cut back, a key strategy for cost-effective living for young professionals.

- Plan for upcoming expenses. Create a monthly financial plan to anticipate bills and payments, crucial for financial planning for career beginners.

Explanation: These steps help you gain control over your finances and ensure that you are living within your means while managing debt as a fresh graduate.

By using tools like budgeting apps, you can stay organized and make informed decisions. For more insights, explore financial literacy resources that can guide you further in overcoming financial struggles after graduation.

Taking these steps will set a solid foundation for your financial journey, including saving money on a starter salary.

Let’s move on to finding entry-level jobs with growth potential.

![]()

2: Seek entry-level jobs with growth potential

Finding a job with growth potential is crucial for building a stable and prosperous career, especially when overcoming financial struggles after graduation.

Actionable Steps:

- Research companies with strong career growth prospects.

- Use platforms like LinkedIn and Glassdoor to read reviews and identify growth opportunities, focusing on entry-level job financial challenges.

- Tailor your resume and cover letter for each application.

- Highlight internships, volunteer work, and relevant coursework to stand out and improve your first job salary negotiation position.

- Network with professionals in your desired field.

- Attend industry events and join professional organizations for valuable connections, which can lead to side hustles for recent graduates.

Key factors to consider when evaluating job opportunities:

- Company culture and values alignment

- Professional development programs

- Potential for advancement within the organization

Explanation: These steps help you secure a job that offers advancement opportunities and career development, essential for financial planning for career beginners.

By researching companies and tailoring your applications, you increase your chances of landing a role that aligns with your career goals. Networking can open doors to hidden opportunities and help in managing debt as a fresh graduate.

To learn more about how networking can impact your career, check out this resource from the American Marketing Journal.

By following these steps, you can position yourself for long-term success in your chosen field and overcome financial struggles after graduation.

Now, let’s explore how to build an emergency fund for financial security.

3: Build an emergency fund for financial security

Building an emergency fund is essential for financial security and peace of mind, especially when overcoming financial struggles after graduation.

Actionable Steps:

- Set a savings goal. Aim to save 3-6 months’ worth of living expenses, which is crucial for managing entry-level job financial challenges.

- Automate transfers. Set up automatic transfers from your checking to your savings account, a key budget tip for new graduates.

- Use windfalls wisely. Allocate bonuses, tax refunds, or gifts to your emergency savings, helping with financial planning for career beginners.

Explanation: These steps help ensure you have a financial cushion in case of unexpected expenses.

An emergency fund can prevent debt accumulation and provide stability. For more insights on managing personal finances, explore this financial literacy resource.

Having an emergency fund is a cornerstone of financial stability, particularly when saving money on a starter salary.

Now, let’s explore how to identify side hustles for additional income.

4: Explore side hustles for additional income

Exploring side hustles can greatly supplement your income and provide financial relief when overcoming financial struggles after graduation.

Actionable Steps:

- Identify side hustle opportunities that fit your skills. Consider freelancing, tutoring, or gig economy jobs like Doordash or Uber Eats to boost your starter salary.

- Balance side hustles with your main job. Manage your time effectively to avoid burnout while managing debt as a fresh graduate.

- Utilize online platforms to find side gigs. Sign up on websites like Upwork or Fiverr to offer your services and enhance your financial planning as a career beginner.

Popular side hustles for recent graduates to overcome entry-level job financial challenges:

- Freelance writing or graphic design

- Virtual tutoring or teaching English online

- Social media management for small businesses

Explanation: These steps provide diverse options to boost your income without significantly impacting your primary job. Side hustles can be a great way to leverage your skills and interests for additional earnings while managing student loans and living cost-effectively as a young professional.

For more insights on managing finances, explore this financial literacy resource.

Finding the right side hustle can pave the way for financial stability and open new opportunities when overcoming financial struggles after graduation.

5: Negotiate salary and benefits confidently

Negotiating your salary and benefits is vital for overcoming financial struggles after graduation and ensuring you’re compensated fairly for your work and expertise.

Actionable Steps:

- Research market salary rates for your position. Use resources like Glassdoor and Payscale to understand industry standards and address entry-level job financial challenges.

- Prepare for salary negotiations. Practice negotiation scenarios with a friend or mentor to build confidence for your first job salary negotiation.

- Highlight your unique value during the negotiation. Emphasize your skills, experiences, and contributions to the company, which is crucial for financial planning for career beginners.

Explanation: These steps ensure you are well-prepared and informed during salary negotiations, increasing the likelihood of a favorable outcome and helping you manage debt as a fresh graduate.

By understanding industry standards and showcasing your value, you can confidently advocate for fair compensation, which is essential for saving money on a starter salary. For further insights, explore this financial literacy resource to enhance your negotiation skills and overcome financial struggles after graduation.

Taking these steps can significantly impact your financial stability and career satisfaction, helping you navigate cost-effective living for young professionals.

Now, let’s move on to improving financial literacy through free resources.

Partner with Alleo for Financial Stability

We’ve explored the challenges of overcoming financial struggles after graduation, how solving them can benefit your future, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster, especially when facing entry-level job financial challenges?

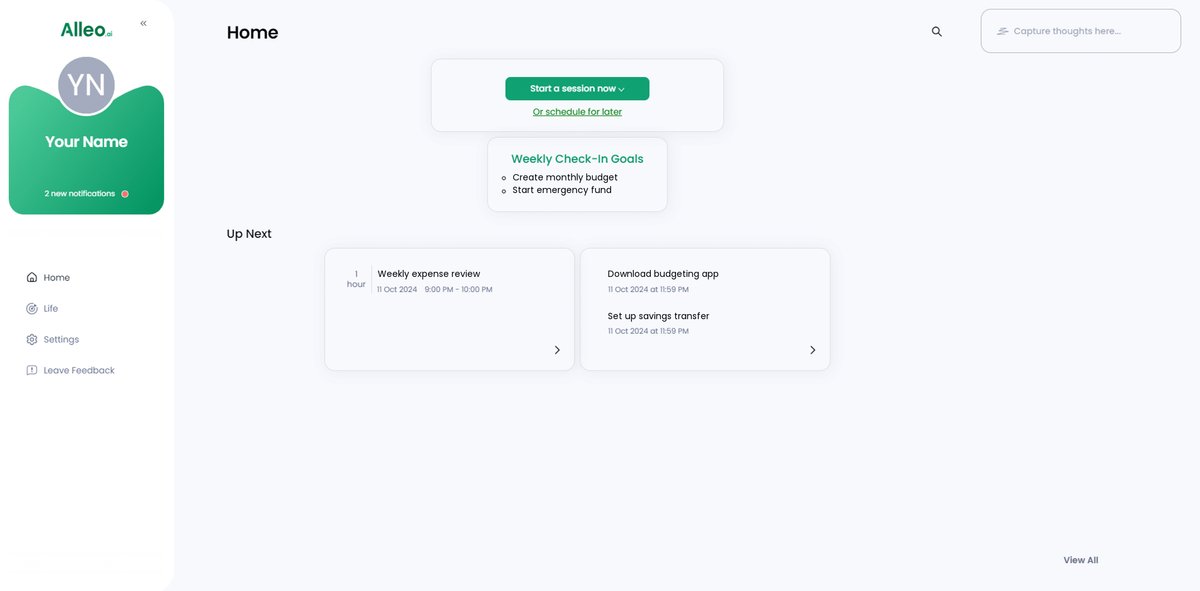

Step 1: Set up your account on Alleo’s platform. You’ll start with a free 14-day trial to help you with financial planning for career beginners.

Don’t worry, no credit card is needed.

Step 2: Create a personalized financial plan with Alleo’s AI coach. The coach will guide you through budgeting, saving, and investing, including budget tips for new graduates and student loan management strategies.

You’ll get tailored advice and actionable tips, such as side hustles for recent graduates and saving money on a starter salary.

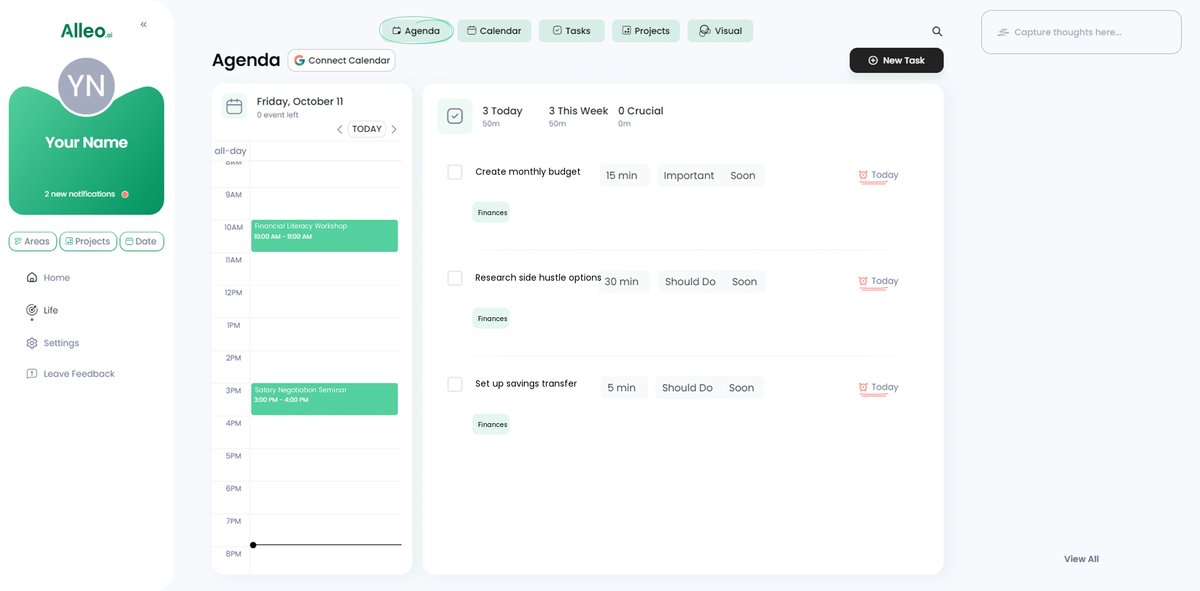

Step 3: Stay on track with regular check-ins. Alleo’s coach follows up on your progress and handles any changes, helping you manage debt as a fresh graduate.

You’ll receive reminders and motivational messages via text and push notifications to support you in overcoming financial struggles after graduation.

Ready to get started for free? Let me show you how!

Step 1: Log In or Create Your Account

Log in to your existing Alleo account or create a new one to begin your journey towards financial stability with our AI coach.

Step 2: Choose Your Financial Focus

Click on “Building better habits and routines” to start developing consistent financial practices that will help you overcome your current struggles and set a strong foundation for your future financial stability.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in the Alleo AI coach to receive personalized guidance on budgeting, saving, and overcoming financial challenges as a fresh graduate, aligning perfectly with the strategies discussed in this article.

Step 4: Starting a coaching session

Begin your journey to financial stability by scheduling an intake session with your AI coach to set up a personalized plan that addresses your unique financial challenges and goals.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your plan for overcoming financial struggles.

Step 6: Adding events to your calendar or app

To track your progress in solving financial challenges, use the calendar and task features in the Alleo app to schedule important financial events, deadlines, and reminders for budgeting, savings goals, and bill payments.

Wrapping Up: Your Path to Financial Stability

As we wrap up, remember that overcoming financial struggles after graduation is a journey.

You now have practical strategies to create a budget, find growth-oriented entry-level jobs, and build an emergency fund to tackle financial challenges.

Exploring side hustles for recent graduates and improving your financial literacy are also crucial steps in managing debt as a fresh graduate.

Empower yourself to tackle these challenges confidently, including student loan management strategies and first job salary negotiation.

And remember, Alleo is here to help you every step of the way with financial planning for career beginners.

Set up your free trial today and take control of your financial future, including cost-effective living for young professionals.

You’ve got this!