7 Best Strategies for Real Estate Investors: Mastering Market Fluctuations

Are you struggling to determine the best time to buy or sell property amidst fluctuating market conditions? Timing real estate market fluctuations can be challenging, but it’s crucial for successful investing.

As a life coach, I’ve guided many real estate agents through such challenges. I understand the complexities of real estate market cycles and the impact they have on your investment decisions. Property price trends analysis and economic indicators for real estate play a vital role in timing real estate purchases effectively.

In this post, you’ll discover actionable strategies to navigate market fluctuations effectively. We’ll cover monitoring market indicators, diversification, and focusing on long-term value, among other essential tips. You’ll learn about real estate market forecasting techniques and property market volatility strategies to enhance your investment timing in real estate.

Let’s dive in and explore how to master the art of timing real estate market fluctuations.

The Real Challenge of Timing Real Estate Market Fluctuations

Navigating the volatile real estate market is no small feat. Many clients find it overwhelming to predict the best moments to buy or sell properties, struggling with timing real estate market fluctuations effectively.

Fluctuating market conditions, interest rates, and economic indicators for real estate further complicate decisions. Even seasoned investors can struggle with these uncertainties and property market volatility strategies.

In my experience, people often second-guess their choices when it comes to timing real estate purchases. The pressure to make the right move in property price trends analysis can be stressful.

Ultimately, this unpredictability makes it tough to plan effectively in real estate market cycles. However, understanding these challenges is the first step toward mastering real estate market forecasting techniques.

A Proven Roadmap for Navigating Market Fluctuations

Overcoming this challenge of timing real estate market fluctuations requires a few key steps. Here are the main areas to focus on to make progress:

- Monitor local market indicators regularly: Stay up-to-date with property price trends analysis and economic indicators for real estate.

- Diversify across property types and locations: Reduce risk by spreading investments to manage property market volatility.

- Focus on long-term value over short-term gains: Prioritize sustainable growth in long-term vs short-term real estate investing.

- Analyze seasonal trends in your target areas: Plan activities around real estate market cycles and seasonal trends in property markets.

- Build relationships with local market experts: Leverage expert insights for real estate market forecasting techniques.

- Stay informed on economic and policy changes: Keep track of relevant updates affecting timing real estate purchases.

- Maintain financial flexibility for opportunities: Be ready to act quickly on investment timing in real estate.

Let’s dive in!

1: Monitor local market indicators regularly

Keeping an eye on local market indicators is crucial for making informed investment decisions and timing real estate market fluctuations.

Actionable Steps:

- Set up alerts for local market reports and property price trends analysis to stay updated on changes.

- Attend local real estate forums and seminars to gain insights directly from experts on real estate market cycles.

- Use online tools and platforms to track property listings and sales data in real-time, aiding in real estate market forecasting techniques.

Explanation: Regularly monitoring market indicators helps you stay ahead of trends and make timely decisions for timing real estate purchases. By setting up alerts and attending forums, you ensure you have the latest information on economic indicators for real estate.

Additionally, using tools to track data can give you a real-time view of market conditions, essential for investment timing in real estate. This approach aligns with advice from Real Wealth Network, which emphasizes the importance of understanding market cycles and indicators.

Key benefits of regular market monitoring include:

- Early detection of emerging trends and property market volatility strategies

- Better informed decision-making for long-term vs short-term real estate investing

- Increased ability to capitalize on opportunities and recognize seasonal trends in property markets

These steps will keep you informed and ready to act on opportunities as they arise, helping you in timing real estate market fluctuations effectively.

2: Diversify across property types and locations

Diversifying your investments across property types and locations is essential for mitigating risk and maximizing returns when timing real estate market fluctuations.

Actionable Steps:

- Invest in various property types: Explore residential, commercial, and industrial properties to create a balanced portfolio and navigate real estate market cycles.

- Spread investments geographically: Allocate funds in different regions to reduce vulnerability to local market downturns and property price trends.

- Regularly evaluate portfolio performance: Assess the returns of each property type and location, making adjustments as needed based on economic indicators for real estate.

Explanation: Diversifying your investments helps protect against market volatility and unforeseen economic shifts when timing real estate purchases.

By spreading your investments, you can leverage growth opportunities in various sectors and regions. Additionally, regular evaluation ensures that your portfolio remains optimized for current market trends and aids in real estate market forecasting techniques.

According to Raintree Wealth Management, real estate investments offer potential for appreciation over time, making diversification a key strategy for long-term success in timing real estate market fluctuations.

This approach allows you to navigate market fluctuations with greater confidence and resilience, utilizing property market volatility strategies.

3: Focus on long-term value over short-term gains

Prioritizing long-term value over short-term gains is crucial for sustainable success in real estate investing, especially when timing real estate market fluctuations.

Actionable Steps:

- Evaluate potential for appreciation: Assess properties based on their likelihood to appreciate over time rather than immediate profit, considering real estate market cycles and property price trends analysis.

- Invest in growth areas: Target regions with strong economic indicators for real estate and infrastructure development, focusing on long-term vs short-term real estate investing.

- Avoid quick flips: Focus on sustainable growth by holding properties longer instead of flipping them for a quick profit, aligning with property market volatility strategies.

Explanation: Focusing on long-term value helps you build a more resilient and profitable portfolio while timing real estate market fluctuations.

Evaluating properties for appreciation and investing in growth areas ensures that you benefit from sustained market trends. Avoiding the temptation to flip properties quickly aligns with the sustainable growth strategy and helps in timing real estate purchases.

According to Raintree Wealth Management, real estate investments offer potential for appreciation over time, making this approach essential for long-term success and effective real estate market forecasting techniques.

This strategy positions you to achieve lasting financial growth and stability, considering seasonal trends in property markets and real estate bubble prediction.

4: Analyze seasonal trends in your target areas

Analyzing seasonal trends in your target areas is crucial for maximizing returns on your real estate investments and timing real estate market fluctuations effectively.

Actionable Steps:

- Review historical data: Examine past property prices to identify seasonal peaks and troughs in real estate market cycles.

- Plan buying and selling activities: Align your transactions with seasonal trends to optimize returns and time real estate purchases strategically.

- Adjust marketing strategies: Tailor your marketing efforts to match seasonal buyer behavior and property market volatility strategies.

Explanation: Understanding seasonal trends helps you make strategic decisions that align with market cycles and improve your real estate market forecasting techniques.

By reviewing historical data and planning accordingly, you can maximize your investment returns. Adjusting your marketing strategies ensures you attract buyers at the right time, which is crucial for timing real estate market fluctuations.

This approach is supported by the Real Wealth Network, which emphasizes the importance of recognizing market cycles.

Key seasonal factors to consider in real estate include:

- Weather patterns affecting property demand

- School year cycles influencing family moves

- Holiday seasons impacting buying behavior

This strategy helps you stay ahead of market fluctuations and optimize your investment outcomes, whether you’re focused on long-term vs short-term real estate investing.

5: Build relationships with local market experts

Building relationships with local market experts is crucial for gaining valuable insights and timing real estate market fluctuations effectively.

Actionable Steps:

- Network with local real estate agents and appraisers: Attend industry events and join local real estate groups to connect with professionals who understand property market volatility strategies.

- Join local investment groups: Regularly participate in meetings and discussions to learn from experienced investors about real estate market cycles and forecasting techniques.

- Hire a mentor: Seek guidance from a seasoned real estate professional with extensive local market knowledge and expertise in timing real estate purchases.

Explanation: Establishing strong relationships with local market experts provides you with first-hand insights and expertise in property price trends analysis.

This network can help you make more informed decisions and navigate market fluctuations effectively, aiding in real estate bubble prediction and understanding seasonal trends in property markets.

According to IESE Real Estate, resilience and innovation are crucial in the current challenging economic environment.

These connections can be invaluable for staying ahead in the real estate market and mastering the art of timing real estate market fluctuations.

6: Stay informed on economic and policy changes

Staying informed on economic and policy changes is crucial for timing real estate market fluctuations and making well-timed investment decisions.

Actionable Steps:

- Subscribe to financial news outlets and real estate journals: Get daily updates on economic indicators for real estate and property price trends analysis.

- Participate in webinars and online courses on economic trends: Enhance your understanding of real estate market cycles and how these trends impact real estate.

- Engage with policymakers and attend city council meetings: Stay updated on local policy shifts that may affect the market and influence real estate market forecasting techniques.

Explanation: Keeping abreast of economic and policy changes helps you anticipate market shifts and make informed decisions when timing real estate purchases.

By subscribing to reliable news sources and participating in educational webinars, you ensure a comprehensive understanding of market dynamics and property market volatility strategies.

Engaging with policymakers offers insights into upcoming changes that could impact your investments. According to Chicago Agent Magazine, adapting to market shifts is essential for strategic planning in long-term vs short-term real estate investing.

This proactive approach ensures you remain prepared for any economic or policy changes that come your way, helping you better time real estate market fluctuations.

7: Maintain financial flexibility for opportunities

Maintaining financial flexibility is crucial for seizing sudden investment opportunities when timing real estate market fluctuations. This approach is essential for navigating property market volatility strategies.

Actionable Steps:

- Keep a portion of funds liquid: Ensure you have accessible cash reserves to quickly act on new opportunities in real estate market cycles.

- Regularly review financial plans: Adjust your financial strategies to stay aligned with current property price trends analysis.

- Set up a line of credit: Establish credit lines to finance new investments swiftly when market opportunities arise, aiding in timing real estate purchases.

Explanation: Maintaining financial flexibility allows you to act decisively when market opportunities present themselves, which is key to investment timing in real estate.

Keeping liquid funds and having a line of credit ensures you can capitalize on favorable conditions quickly. Additionally, regularly reviewing financial plans helps you stay prepared for market changes, essential for real estate market forecasting techniques.

According to Urban Land Institute, adapting to market shifts is essential for strategic planning.

Benefits of maintaining financial flexibility:

- Quick response to market opportunities, crucial for timing real estate market fluctuations

- Reduced risk of missing out on profitable deals in seasonal trends in property markets

- Increased negotiating power in transactions, beneficial for long-term vs short-term real estate investing

This approach ensures you’re always ready to make the most of market opportunities, including potential real estate bubble prediction scenarios.

Partner with Alleo to Master Real Estate Market Fluctuations

We’ve discussed the challenges of timing real estate market fluctuations. Did you know you can work with Alleo to make this journey easier and faster, especially when it comes to analyzing property price trends and understanding real estate market cycles?

Alleo offers affordable, tailored coaching support for timing real estate market fluctuations. With full coaching sessions like any human coach, Alleo helps you monitor market conditions, utilize economic indicators for real estate, and make informed decisions about timing real estate purchases.

Setting up an account is simple. Create a personalized plan and start working with Alleo’s coach to overcome specific challenges in real estate market forecasting techniques and investment timing in real estate.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you navigate property market volatility strategies and seasonal trends in property markets.

Ready to get started for free and learn about long-term vs short-term real estate investing? Let me show you how!

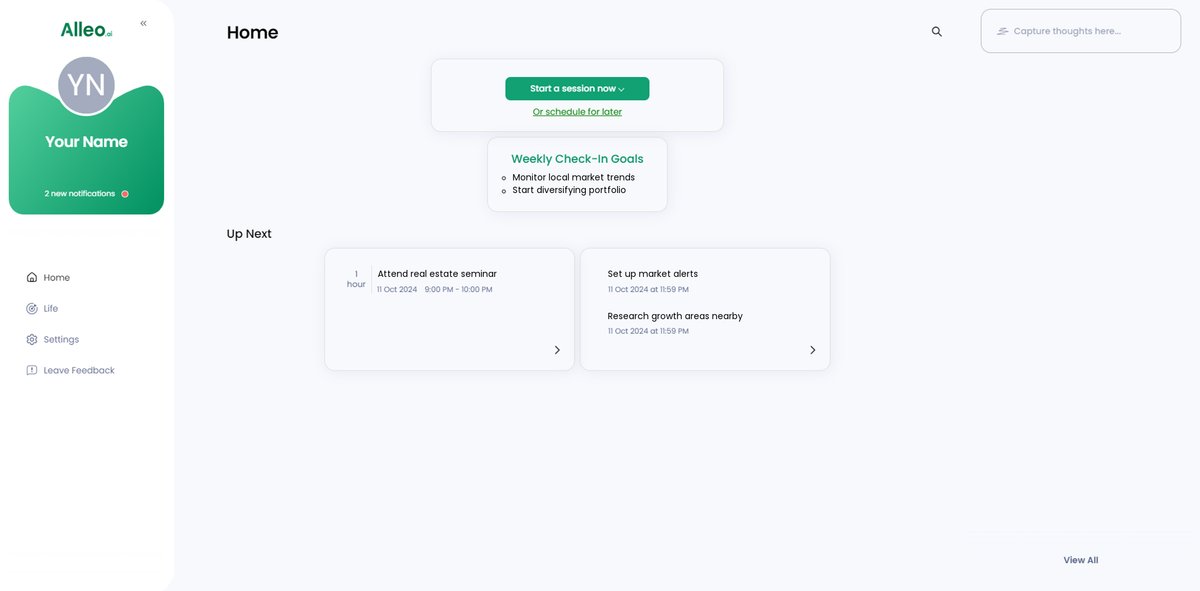

Step 1: Access Your Alleo Account

To begin mastering real estate market fluctuations with Alleo’s AI coach, simply log in to your existing account or create a new one in just a few clicks.

Step 2: Choose Your Real Estate Investment Focus

Select “Setting and achieving personal or professional goals” to define your specific real estate investment objectives, such as monitoring market indicators or diversifying your portfolio, which will help you navigate market fluctuations more effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on with Alleo, as this will help you develop strategies for navigating real estate market fluctuations, managing investments, and making informed financial decisions in the property market.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for navigating real estate market fluctuations, setting the foundation for your future coaching sessions.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on navigating real estate market fluctuations, check the Alleo app’s home page to view and manage the goals you discussed, ensuring you stay on track with your investment strategy.

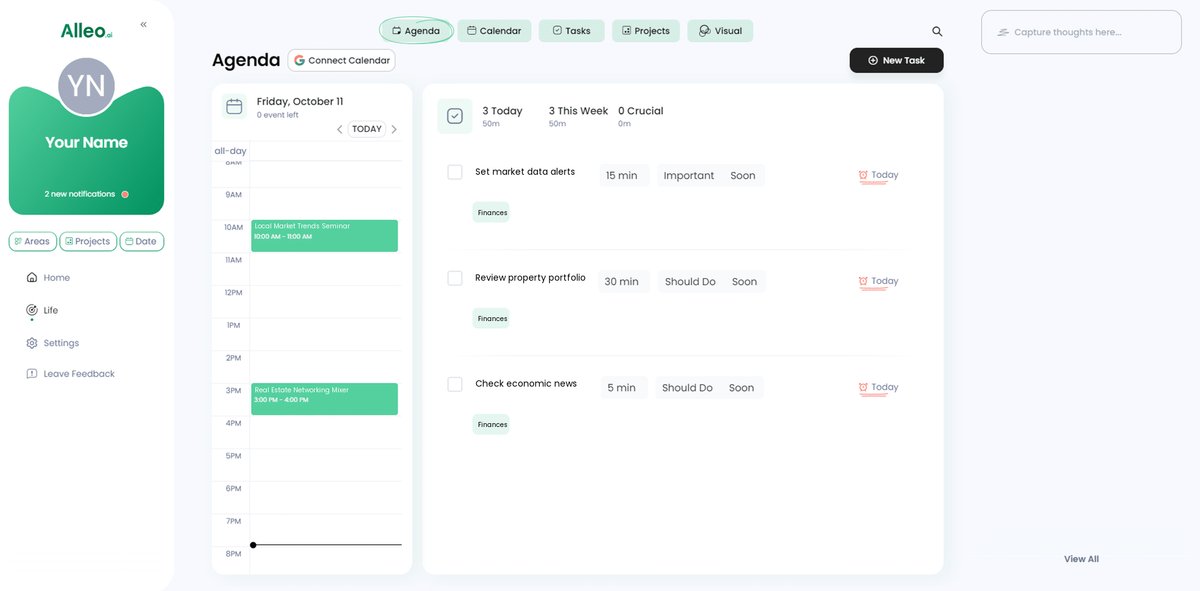

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule and track your real estate market monitoring activities, helping you stay organized and accountable as you navigate market fluctuations.

Wrapping Up: Mastering Market Fluctuations with Confidence

By now, you understand the complexity of timing real estate market fluctuations. It’s a tough challenge, but with the right strategies, you can navigate it successfully.

Remember, monitoring local market indicators, diversifying your portfolio, and focusing on long-term value are key steps in timing real estate purchases. Additionally, analyzing seasonal trends in property markets, building relationships, staying informed about economic indicators for real estate, and maintaining financial flexibility are crucial for navigating property market volatility.

I know it’s not easy, but you can master the art of timing real estate market fluctuations.

And, you don’t have to do it alone. Alleo is here to help you understand real estate market cycles.

Take advantage of Alleo’s tailored coaching to stay ahead of property price trends. Ready to turn your challenges into opportunities in real estate market forecasting? Try Alleo for free and experience the difference in your approach to investment timing in real estate.