7 Essential Strategies for Financial Planning in Michigan’s Uncertain Economy

Are you struggling to navigate Michigan’s economic uncertainties while ensuring your clients’ financial security? Michigan financial planning strategies are crucial in these challenging times.

As a financial coach, I’ve helped many advisors like you address these challenges effectively. In my experience, diverse strategies are crucial during unpredictable times, especially when dealing with economic uncertainty in Michigan.

In this article, you’ll learn specific strategies to optimize portfolios, maintain cash reserves, and leverage tax advantages in Michigan. We’ll also cover monitoring Michigan economic trends and educating clients on Social Security and retirement planning in Michigan.

Let’s dive into these Michigan financial planning strategies.

Understanding Michigan’s Financial Challenges

Navigating Michigan’s economic uncertainties is no easy feat. The Trump administration’s policies could significantly impact local investments and Michigan financial planning strategies. Economic uncertainty in Michigan continues to shape the financial landscape.

Many financial advisors in Michigan struggle to keep up with these changes. The unpredictable nature of the economy makes it even harder for those focusing on retirement planning in Michigan.

I’ve seen clients face difficulties in securing stable returns. They often worry about market volatility and how it affects their portfolios, highlighting the importance of diversifying investments in Michigan.

These challenges highlight the need for adaptable strategies. By understanding these issues, you can better prepare and support your clients with effective Michigan financial planning strategies and long-term financial goals in uncertain times.

Proven Strategies to Navigate Michigan’s Economic Uncertainties

Overcoming this challenge requires a few key Michigan financial planning strategies. Here are the main areas to focus on to make progress in light of economic uncertainty in Michigan.

- Diversify portfolios to spread risk: Invest across different asset classes and regularly review allocations, considering Michigan investment opportunities.

- Maintain cash reserves for market volatility: Establish and adjust cash reserves based on financial goals, implementing Michigan savings strategies.

- Review and adjust retirement plans regularly: Schedule annual reviews and adjust contributions as needed for effective retirement planning in Michigan.

- Optimize tax strategies for Michigan residents: Analyze tax situations and implement tax-advantaged Michigan tax planning strategies.

- Monitor local economic indicators for trends: Track unemployment rates and business conditions to stay informed about Michigan economic trends.

- Implement flexible budgeting techniques: Develop adaptable budgeting plans and use financial tools for budget management tips tailored to Michigan’s economy.

- Educate clients on Social Security benefits: Conduct workshops and provide personalized consultations, a crucial aspect of Michigan financial planning strategies.

Let’s dive in to explore these financial advisors in Michigan recommendations for long-term financial goals in uncertain times!

1: Diversify portfolios to spread risk

Diversification is vital in Michigan’s uncertain economic climate to minimize risk and stabilize returns. This is a key Michigan financial planning strategy in the face of current economic trends.

Actionable Steps:

- Evaluate current portfolio allocations: Assess your clients’ portfolios to identify any overexposure to specific asset classes in Michigan.

- Invest in a variety of asset classes: Allocate investments across stocks, bonds, and alternatives to reduce risk and explore Michigan investment opportunities.

- Regularly review and rebalance portfolios: Schedule periodic reviews to adjust allocations and maintain diversification, adapting to economic uncertainty in Michigan.

Explanation:

These steps help mitigate risks associated with market volatility. By spreading investments, you reduce the impact of any single asset’s poor performance, which is crucial for retirement planning in Michigan.

Regular reviews ensure portfolios stay aligned with clients’ goals and market conditions. Diversifying and rebalancing is supported by industry experts who recommend this approach in times of economic uncertainty.

Key benefits of diversification include:

- Reduced overall portfolio risk

- Potential for more stable returns

- Protection against market sector downturns

These methods will help protect your clients’ investments and enhance their financial stability, supporting long-term financial goals in uncertain times for Michigan residents.

2: Maintain cash reserves for market volatility

Maintaining cash reserves is essential to protect against market volatility and ensure financial stability, especially when considering Michigan financial planning strategies.

Actionable Steps:

- Set a cash reserve target: Calculate a reserve based on your clients’ risk tolerance and financial objectives, taking into account Michigan economic trends.

- Create a high-yield savings account: Place emergency funds in a separate high-yield account for easy access and growth, a strategy recommended by financial advisors in Michigan.

- Review reserves quarterly: Regularly assess and adjust cash reserves to align with changing financial goals and retirement planning in Michigan.

Explanation:

These steps help mitigate the impact of market fluctuations. Setting aside cash reserves provides a financial cushion during downturns, ensuring your clients can meet their needs without liquidating investments, which is crucial for Michigan investment opportunities.

According to JPMorgan’s insights, effective liquidity management is crucial in uncertain times.

Properly maintaining cash reserves fosters financial resilience, an important aspect of Michigan financial planning strategies.

3: Review and adjust retirement plans regularly

Regularly reviewing and adjusting retirement plans is essential to ensure they remain aligned with your clients’ evolving financial goals and market conditions, especially in Michigan’s dynamic economic landscape.

Actionable Steps:

- Schedule annual reviews: Meet with clients yearly to reassess their retirement plans based on their current financial situation and objectives, considering Michigan economic trends.

- Adjust contributions and investments: Tailor contribution levels and investment options to reflect any changes in clients’ circumstances or market trends, focusing on Michigan investment opportunities.

- Educate on different plan types: Inform clients about the benefits and limitations of various retirement plans, including SEPs, SIMPLEs, 401(k)s, and Cash Balance plans, as part of comprehensive Michigan financial planning strategies.

Explanation:

These steps are crucial for adapting to market fluctuations and personal changes. Annual reviews ensure plans stay relevant and effective, especially for retirement planning in Michigan.

Educating clients on their options, such as those found in NBER’s insights, empowers them to make informed decisions. Adjusting contributions and investments helps optimize their retirement savings, considering Michigan tax planning strategies.

This proactive approach ensures your clients’ retirement plans are always optimized for their long-term financial security, even amid economic uncertainty in Michigan.

4: Optimize tax strategies for Michigan residents

Optimizing tax strategies is essential for maximizing your clients’ financial outcomes in Michigan’s uncertain economy. This is a crucial aspect of Michigan financial planning strategies.

Actionable Steps:

- Analyze current tax situations: Review clients’ tax returns to pinpoint savings opportunities and improve Michigan tax planning strategies.

- Implement tax-advantaged strategies: Utilize tools like municipal bonds or tax-deferred accounts to reduce tax liability, considering Michigan investment opportunities.

- Stay updated on tax law changes: Monitor state and federal tax laws to provide timely advice, especially for financial advisors in Michigan.

Explanation:

These steps help clients save on taxes while staying compliant. By implementing tax-advantaged strategies and staying informed, you can optimize their financial plans and address economic uncertainty in Michigan.

According to MICPA, staying updated on tax laws is crucial for effective planning.

Consider these tax optimization strategies:

- Maximize contributions to tax-advantaged accounts, aligning with retirement planning Michigan goals

- Explore opportunities for tax-loss harvesting as part of diversifying investments in Michigan

- Utilize Michigan-specific tax credits and deductions to enhance Michigan savings strategies

These methods will enhance your clients’ financial stability and preparedness, supporting long-term financial goals in uncertain times.

Next, let’s explore the importance of monitoring local economic indicators and Michigan economic trends.

5: Monitor local economic indicators for trends

Monitoring local economic indicators is essential to adjust Michigan financial planning strategies effectively.

Actionable Steps:

- Track key indicators: Follow unemployment rates, business conditions, and other Michigan economic trends.

- Use reputable sources: Gather information from trusted organizations like the Conference Board.

- Adjust strategies accordingly: Modify financial plans based on trends and forecasts, considering Michigan investment opportunities and economic uncertainty in Michigan.

Explanation:

These steps help you stay informed about Michigan’s economic conditions, allowing for timely adjustments to your Michigan financial planning strategies.

By using reliable data, you can better anticipate market changes and prepare your clients for long-term financial goals in uncertain times.

Staying updated ensures your financial plans remain relevant and effective, especially for retirement planning in Michigan.

Staying informed about local economic trends is crucial for financial advisors in Michigan to provide the best advice to their clients.

6: Implement flexible budgeting techniques

Adopting flexible budgeting techniques is crucial for navigating Michigan’s economic uncertainties and implementing effective Michigan financial planning strategies.

Actionable Steps:

- Develop personalized budgeting plans: Tailor budgets to account for fluctuations in income and expenses, considering Michigan economic trends.

- Use financial tools and apps: Leverage technology to track spending and savings goals, essential for budget management tips in Michigan.

- Include discretionary spending categories: Create budgets that allow for flexible spending to adapt to changing financial circumstances and economic uncertainty in Michigan.

Explanation:

These steps help you manage your clients’ finances more effectively during economic instability. Personalized budgets and financial tools ensure better tracking and adjustments, which are key Michigan financial planning strategies.

Including discretionary categories allows for adaptability. According to Kenan Institute insights, flexibility is key to building financial resilience in uncertain times.

Key components of a flexible budget:

- Variable expense categories

- Regular review and adjustment periods

- Emergency fund allocation

Implementing flexible budgeting techniques supports long-term financial stability and is crucial for retirement planning in Michigan.

Partner with Alleo to Navigate Financial Uncertainty in Michigan

We’ve explored Michigan financial planning strategies to navigate the state’s economic uncertainties and the benefits for your clients. But did you know Alleo can make this journey easier and faster for financial advisors in Michigan?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your clients’ needs, addressing Michigan economic trends and retirement planning in Michigan.

Alleo’s AI coach provides full coaching sessions like any human coach. The coach will follow up on progress, handle changes, and keep you accountable via text and push notifications, helping you manage budget management tips and Michigan investment opportunities.

Ready to get started for free and tackle economic uncertainty in Michigan?

Let me show you how to implement effective Michigan financial planning strategies!

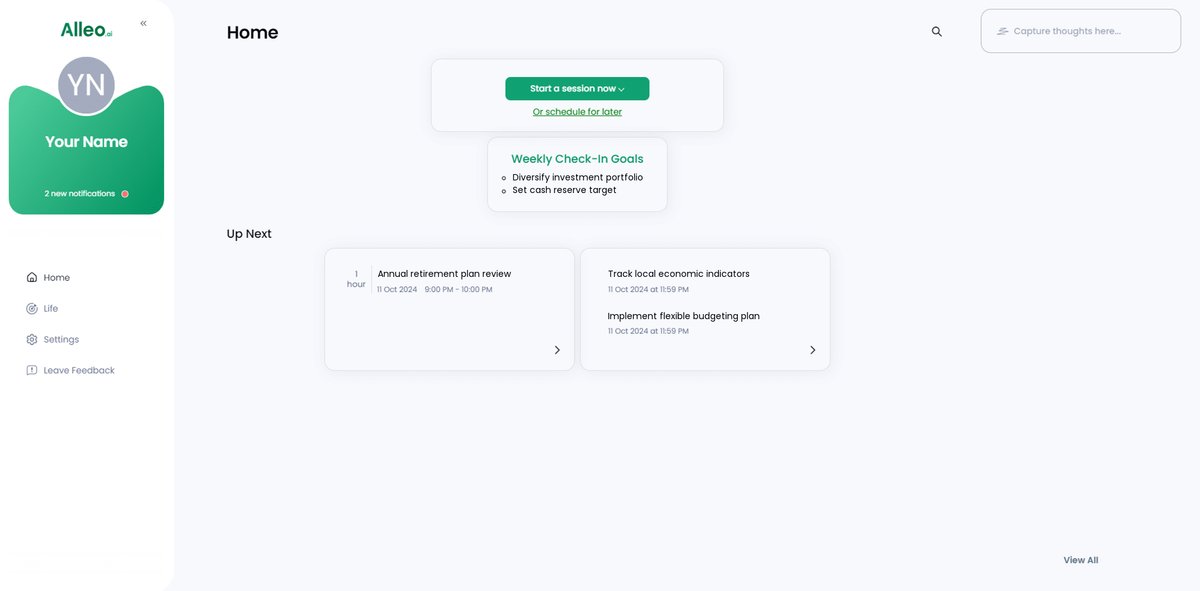

Step 1: Log In or Create Your Account

To start navigating Michigan’s economic uncertainties with our AI coach, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” as your goal to develop consistent financial practices that will help you navigate Michigan’s economic uncertainties and better serve your clients.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to directly address the economic uncertainties in Michigan and optimize your financial strategies. This selection allows the AI coach to provide targeted advice on portfolio diversification, cash reserves management, and tax optimization, aligning perfectly with the challenges discussed in the article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by initiating an intake session, where our AI coach will help you set up a personalized financial plan tailored to navigate Michigan’s economic uncertainties.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the financial goals you discussed, allowing you to track progress and adjust strategies as you navigate Michigan’s economic uncertainties.

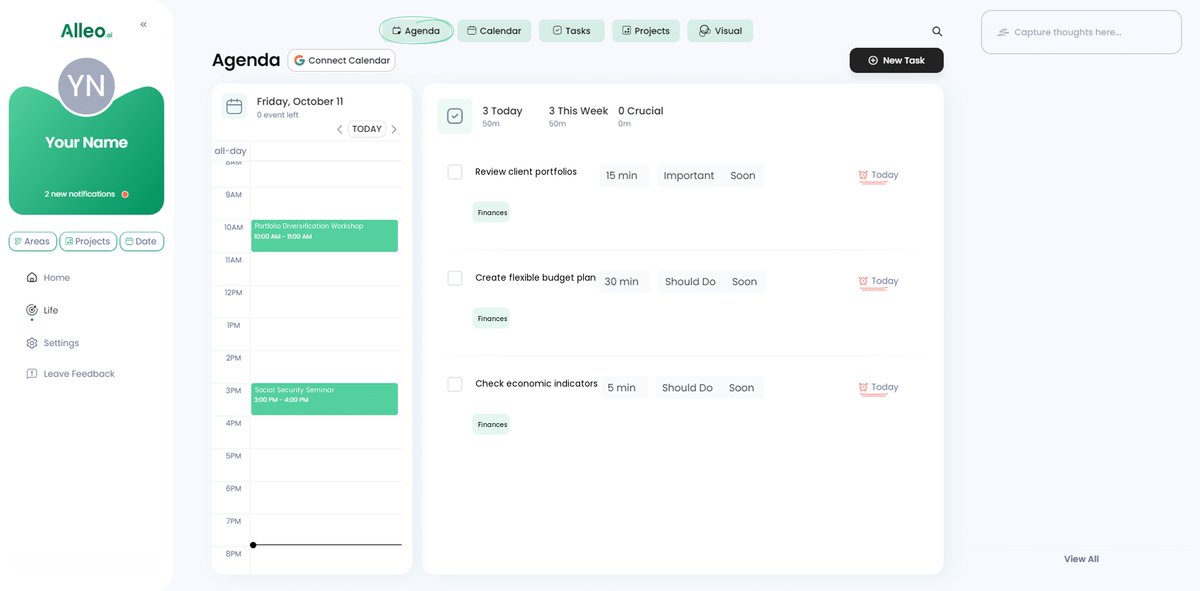

Step 6: Adding Events to Your Calendar or App

Use the calendar and task features in the Alleo app to track your progress on implementing financial strategies, allowing you to easily schedule portfolio reviews, budget check-ins, and client education sessions while monitoring your advancement in navigating Michigan’s economic uncertainties.

Bringing It All Together

Transitioning from understanding Michigan’s economic challenges to implementing practical Michigan financial planning strategies can feel overwhelming. But with the right approaches, you can confidently navigate these uncertainties in Michigan’s economic landscape.

Remember, diversifying investments in Michigan, maintaining cash reserves, and optimizing Michigan tax planning strategies are essential steps. Additionally, regularly reviewing retirement planning in Michigan, monitoring economic indicators, and implementing flexible budget management tips will fortify your clients’ financial stability amid economic uncertainty in Michigan.

Educating clients on Social Security benefits further enhances their retirement planning. These actionable Michigan financial planning strategies will empower you and your clients to pursue long-term financial goals in uncertain times.

Consider how Alleo can support financial advisors in Michigan on this journey. With personalized planning and AI coaching, Alleo simplifies financial management and helps explore Michigan investment opportunities.

Take the leap. Try Alleo for free and transform your approach to Michigan financial planning strategies today.