7 Essential Strategies for Nonprofit Financial Managers to Track Allowances and Reserves

Imagine your nonprofit organization consistently meets its financial goals, with nonprofit allowance reserve tracking meticulously managed. Sounds like a dream, right?

As a life coach, I’ve helped many nonprofit leaders navigate budget management challenges and improve their nonprofit budgeting techniques. In my experience, effective methods to track and manage allowances and reserves are crucial for financial planning and cash flow forecasting for nonprofits.

In this article, you’ll learn specific strategies to enhance your financial management, including nonprofit allowance reserve tracking. We’ll cover comprehensive investment policies, reserve tracking tools, and automated nonprofit financial reporting systems. We’ll also touch on grant management for nonprofits and restricted funds accounting.

Let’s dive in.

Challenges in Tracking and Managing Allowances and Reserves

Let’s explore why managing allowances and reserves is so challenging for nonprofits. Many organizations struggle with nonprofit allowance reserve tracking due to complex financial landscapes and limited resources.

Accurate tracking is essential. Without it, funding shortfalls and operational inefficiencies often occur, impacting nonprofit budgeting techniques and grant management for nonprofits.

I’ve seen several clients initially struggle with maintaining financial transparency, particularly in restricted funds accounting.

I often hear about the consequences of poor financial management. These include missed opportunities for funding and increased risk of fraud, highlighting the importance of cash flow forecasting for nonprofits.

The pressure to meet financial goals can be overwhelming, especially when it comes to nonprofit financial reporting and endowment fund management.

Understanding these challenges is the first step. Next, we’ll discuss strategies to tackle them, including operating reserve policies and risk management in nonprofit finance.

Key Steps to Effective Financial Management in Nonprofits

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in nonprofit allowance reserve tracking and financial management.

- Implement a comprehensive investment policy: Review and develop tailored investment guidelines for endowment fund management.

- Establish a reserve tracking spreadsheet: Create and automate a user-friendly tracking tool for nonprofit allowance reserve tracking and restricted funds accounting.

- Set up automated financial reporting systems: Implement and integrate suitable financial software for nonprofit financial reporting and compliance.

- Develop clear allowance calculation methods: Standardize and regularly update calculation templates for nonprofit budgeting techniques.

- Create an internal control checklist: List and assign responsibility for all necessary controls, including risk management in nonprofit finance.

- Conduct regular financial health assessments: Schedule and act on annual assessments, including cash flow forecasting for nonprofits.

- Align development and finance departments: Hold joint meetings and set shared goals for effective grant management for nonprofits and donor-restricted asset tracking.

Let’s dive in!

1: Implement a comprehensive investment policy

A comprehensive investment policy is crucial for maintaining financial stability and achieving long-term goals, including effective nonprofit allowance reserve tracking.

Actionable Steps:

- Review existing investment policies to identify gaps and inconsistencies. Conduct quarterly reviews and adjustments, incorporating nonprofit budgeting techniques.

- Develop an investment policy statement tailored to your nonprofit’s goals. Include clear guidelines for asset allocation, risk tolerance, and liquidity needs, considering restricted funds accounting practices.

- Engage with a financial advisor specializing in nonprofits. Schedule bi-annual consultations to stay aligned with market trends and improve grant management for nonprofits.

Explanation:

These steps ensure that your investments align with your organization’s financial goals and risk tolerance, supporting effective nonprofit allowance reserve tracking.

Regular reviews help identify necessary adjustments, keeping your policy relevant and effective for cash flow forecasting for nonprofits.

Engaging with a specialized financial advisor provides expert insights, enhancing your investment strategy and nonprofit financial reporting practices.

For more detailed guidelines on investment policies, you can refer to the ACGA’s recommended charitable gift annuity standards of conduct.

Next, we’ll explore how to establish a reserve tracking spreadsheet to streamline your financial management and improve operating reserve policies.

2: Establish a reserve tracking spreadsheet

Establishing a nonprofit allowance reserve tracking spreadsheet is essential for maintaining transparency and ensuring accurate financial management.

Actionable Steps:

- Create a user-friendly spreadsheet to track all reserves and allowances. Include columns for date, amount, source, purpose, and remaining balance, incorporating nonprofit budgeting techniques.

- Train your finance team members on how to use the spreadsheet effectively for grant management for nonprofits. Conduct monthly training sessions and assessments to ensure proficiency in restricted funds accounting.

- Automate data entry processes to reduce errors and save time. Utilize tools like Excel macros or Google Sheets scripts for efficient cash flow forecasting for nonprofits.

Explanation:

These steps will help you streamline nonprofit financial reporting and improve accuracy. Training ensures everyone on your team can efficiently use the system for operating reserve policies, while automation minimizes human error in donor-restricted asset tracking.

For more insights on using technology in nonprofit financial management, visit Nonprofit Learning Lab.

Next, we’ll explore how to set up automated financial reporting systems to enhance financial oversight and risk management in nonprofit finance.

3: Set up automated financial reporting systems

Setting up automated financial reporting systems is crucial for enhancing oversight and ensuring timely insights into your nonprofit’s financial health, including nonprofit allowance reserve tracking.

Actionable Steps:

- Identify and implement a financial reporting software that suits your needs. Evaluate products based on ease of use, cost, and features, considering their capability for grant management for nonprofits.

- Integrate the software with your existing financial systems. Develop a step-by-step implementation plan to ensure seamless integration, including restricted funds accounting processes.

- Schedule regular automated reports to monitor financial health. Set weekly and monthly report generation schedules for consistent monitoring, including cash flow forecasting for nonprofits.

Key benefits of automated financial reporting include:

- Improved accuracy and reduced human error in nonprofit financial reporting

- Time savings for staff to focus on analysis and nonprofit budgeting techniques

- Real-time financial insights for decision-making, including operating reserve policies

Explanation:

These steps ensure that your financial data is always up to date, helping you make informed decisions. Automated reports save time and reduce errors, providing accurate insights into your financial status and supporting risk management in nonprofit finance.

For more on leveraging technology in nonprofit financial management, visit the Nonprofit Learning Lab.

Next, we’ll explore how to develop clear allowance calculation methods to further streamline financial management and improve nonprofit allowance reserve tracking.

4: Develop clear allowance calculation methods

Developing clear allowance calculation methods is essential for ensuring financial accuracy and transparency in your nonprofit organization’s allowance reserve tracking.

Actionable Steps:

- Define the types of allowances relevant to your organization, including those for nonprofit budgeting techniques. Document these definitions and share them with your team.

- Create standardized calculation templates for different allowances, incorporating grant management for nonprofits. Include formulas for consistent and accurate calculations.

- Regularly review and update calculation methods, considering restricted funds accounting. Schedule quarterly reviews and updates to stay current.

Explanation:

These steps will help streamline your financial management processes and improve accuracy in nonprofit allowance reserve tracking. By standardizing calculation templates, you ensure consistency and reduce errors in cash flow forecasting for nonprofits.

Regular reviews keep your methods up-to-date with industry standards for nonprofit financial reporting. For more insights on nonprofit financial management, visit Nonprofit Accounting Basics.

Next, we’ll dive into creating an internal control checklist to further enhance financial management and operating reserve policies.

5: Create an internal control checklist

Creating an internal control checklist is vital for maintaining financial integrity and accountability in your nonprofit organization, including effective nonprofit allowance reserve tracking.

Actionable Steps:

- List all necessary internal control procedures for financial management. Include controls for approvals, reconciliations, and documentation, incorporating nonprofit budgeting techniques.

- Assign specific team members responsibility for each control. Track completion and compliance monthly to ensure accountability, including grant management for nonprofits and restricted funds accounting.

- Conduct internal audits to ensure controls are effective. Perform bi-annual audits and address any identified issues promptly, considering cash flow forecasting for nonprofits.

Essential components of an effective internal control system:

- Clear segregation of duties

- Regular reconciliation of accounts

- Documented approval processes

Explanation:

These steps ensure that your organization maintains robust internal controls, reducing the risk of errors and fraud. Regular audits help identify weaknesses and improve processes, including nonprofit financial reporting and endowment fund management.

For further guidance on internal controls, you can refer to the Green Book, which provides comprehensive standards for internal control in nonprofit organizations, including operating reserve policies and risk management in nonprofit finance.

Next, we’ll dive into conducting regular financial health assessments to further enhance financial management, including nonprofit financial compliance and donor-restricted asset tracking.

6: Conduct regular financial health assessments

Conducting regular financial health assessments is crucial for maintaining transparency and ensuring long-term sustainability, including effective nonprofit allowance reserve tracking.

Actionable Steps:

- Schedule annual financial health assessments with external auditors. This ensures an unbiased evaluation of your financial status and nonprofit financial reporting practices.

- Use financial ratios and benchmarks to evaluate performance. Track liquidity ratios, reserve levels, and expense ratios, incorporating nonprofit budgeting techniques and cash flow forecasting for nonprofits.

- Develop action plans based on assessment results. Implement corrective actions within three months to address any weaknesses, focusing on areas like restricted funds accounting and operating reserve policies.

Explanation:

These steps help identify areas for improvement and ensure your nonprofit remains financially healthy. Regular assessments provide insights into your financial performance, including nonprofit allowance reserve tracking, and enable proactive management.

For more detailed guidance, you can refer to the Green Book, which offers comprehensive standards for internal control in nonprofit organizations, including risk management in nonprofit finance.

Next, we’ll dive into aligning development and finance departments to further enhance financial management, including grant management for nonprofits and donor-restricted asset tracking.

7: Align development and finance departments

Aligning your development and finance departments is crucial for cohesive financial planning, including nonprofit allowance reserve tracking, and achieving your nonprofit’s goals.

Actionable Steps:

- Hold regular joint meetings between development and finance teams. Schedule bi-weekly coordination meetings to discuss goals, progress, and nonprofit budgeting techniques.

- Develop shared goals and metrics for both departments. Create a collaborative goal-setting framework to ensure alignment, including cash flow forecasting for nonprofits.

- Implement cross-training programs for staff. Provide quarterly training sessions on key financial and fundraising concepts, such as restricted funds accounting and grant management for nonprofits.

Key benefits of aligning development and finance departments:

- Improved communication and collaboration

- More accurate financial forecasting and nonprofit financial reporting

- Enhanced strategic decision-making, including operating reserve policies

Explanation:

These steps foster collaboration and ensure that both departments work towards common objectives. Regular meetings and shared goals improve communication and efficiency in nonprofit allowance reserve tracking.

Cross-training enhances staff understanding of each other’s roles, promoting teamwork and improving risk management in nonprofit finance. For detailed guidance on nonprofit financial management, check out the resources available on ECFA’s Knowledge Center.

By aligning these departments, you can create a unified approach to financial management, including donor-restricted asset tracking and endowment fund management.

Partner with Alleo for Effective Financial Management

We’ve explored the challenges of nonprofit financial management, including nonprofit allowance reserve tracking, how solving them can benefit your organization, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster?

With Alleo, set up an account easily and create a personalized financial management plan. Work with Alleo’s AI coach to overcome tracking challenges, including restricted funds accounting and cash flow forecasting for nonprofits.

The coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, helping with nonprofit financial reporting and compliance.

Ready to get started for free? Let me show you how!

Sign up for a free 14-day trial, no credit card required. Improve your nonprofit budgeting techniques and grant management for nonprofits today.

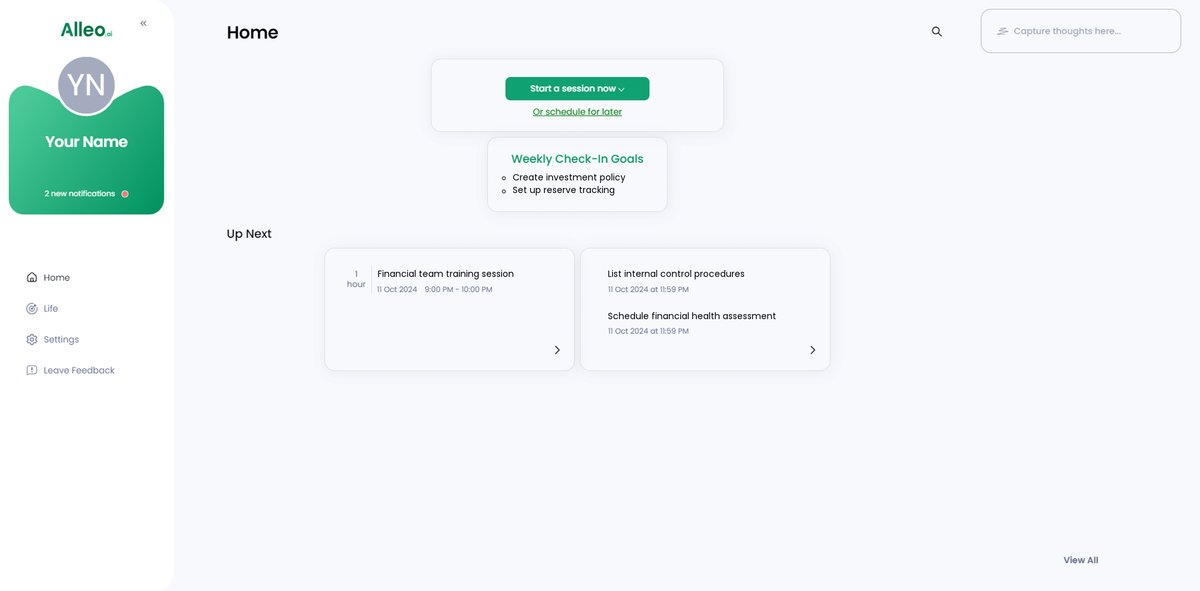

Step 1: Log In or Create Your Account

To begin your journey towards better nonprofit financial management, Log in to your account or create a new one to access Alleo’s AI coach and personalized financial planning tools.

Step 2: Choose “Building Better Habits and Routines”

Select “Building Better Habits and Routines” to create a solid foundation for effective financial management, helping you consistently track allowances and reserves, which is crucial for maintaining your nonprofit’s financial health.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to align Alleo’s AI coach with your nonprofit’s financial management goals, helping you implement effective strategies for tracking allowances and reserves, and improving overall financial health.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll work with our AI coach to create a personalized financial management plan tailored to your nonprofit’s specific needs and goals.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the financial management goals you discussed, allowing you to track progress and stay accountable to your nonprofit’s objectives.

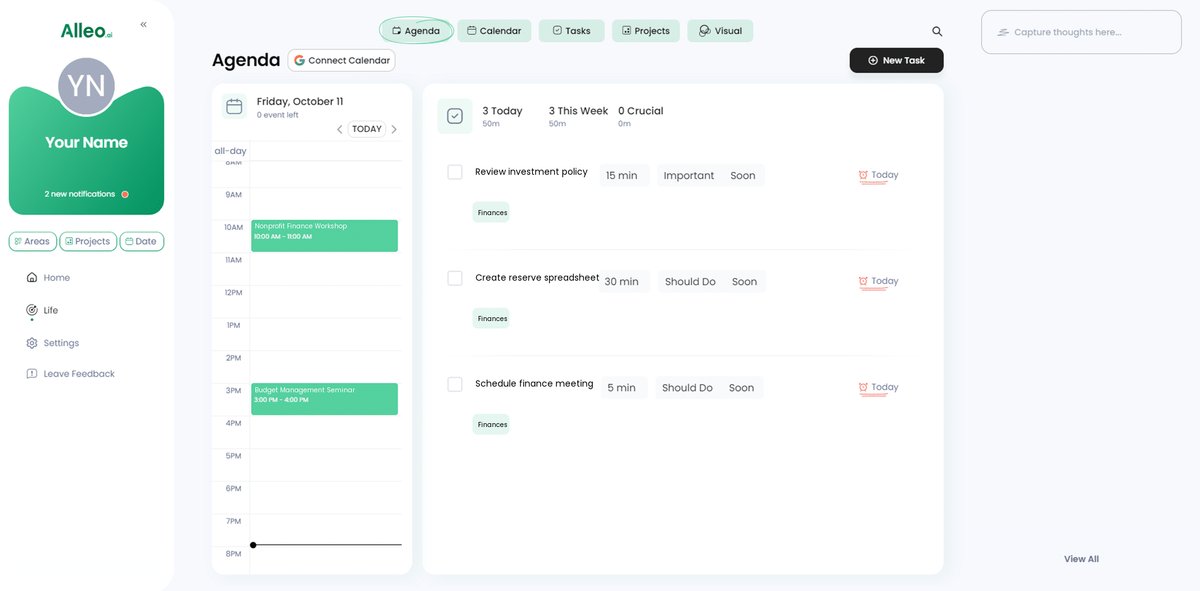

Step 6: Adding events to your calendar or app

Track your progress in solving financial management challenges by adding key events, such as quarterly reviews and financial health assessments, to your calendar or app, ensuring you stay on top of crucial deadlines and milestones in your nonprofit’s financial journey.

Bringing It All Together for Financial Success

You’ve learned about the essential strategies to improve your nonprofit’s financial management. By implementing a comprehensive investment policy, establishing a nonprofit allowance reserve tracking spreadsheet, setting up automated financial reporting systems, and more, you’re on the right path for effective grant management and restricted funds accounting.

Remember, each actionable step can make a significant difference in your nonprofit budgeting techniques. Start small, and gradually build on your progress with cash flow forecasting for nonprofits.

I know managing finances and donor-restricted asset tracking can feel overwhelming. But with dedication and the right tools for nonprofit financial reporting, you can achieve your financial goals and improve risk management in nonprofit finance.

Alleo is here to help with your nonprofit allowance reserve tracking needs. Try it for free and see how it can transform your financial management and support your operating reserve policies.

You’ve got this!