7 Essential Strategies for Small Businesses to Offer Profitable 0% APR Financing

Are you struggling to find a way to attract more customers without sacrificing your profitability? Many small business owners seek profitable 0% APR business financing options to achieve this balance.

As a business coach, I’ve helped numerous small business owners navigate these challenges. Many are unsure how to balance offering attractive financing options like 0% APR while keeping their businesses financially healthy and maintaining a strong business credit score.

In this post, you’ll discover actionable steps to create profitable 0% APR financing offers. We’ll explore strategic pricing, customer data analysis, and effective marketing techniques for maximizing working capital with 0% APR offers. These strategies can help with cash flow management for small businesses and provide alternative funding sources for SMEs.

Let’s dive in and explore how to leverage interest-free loan terms for entrepreneurs and debt-free business expansion strategies.

Understanding the Challenges of Balancing Profitability and Customer Attraction

Many small business owners struggle to attract customers while maintaining profitability. They often face high operational costs and cash flow management issues, which can impact their ability to secure profitable 0% APR business financing.

This balance becomes even more complex when considering financing options like 0% APR offers, such as 0% APR business credit cards or interest-free loan terms for entrepreneurs.

I frequently see business owners grappling with customer acquisition costs. These costs can quickly eat into profit margins, making it essential to explore alternative funding sources for SMEs.

It’s crucial to adopt a strategic pricing approach, especially when offering financing. This includes considering debt-free business expansion strategies and credit utilization tips for business owners.

You need a clear plan to ensure 0% APR offers don’t become a financial drain. By focusing on strategic pricing and customer data analysis, you can navigate these challenges effectively and maximize working capital with 0% APR offers.

A Strategic Roadmap to Profitable 0% APR Financing Offers

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with profitable 0% APR business financing.

- Analyze customer data to set optimal pricing: Use data to identify trends and preferences for better pricing strategies, improving your business credit score.

- Offer tiered 0% APR terms based on purchase amount: Encourage higher spending with multiple financing tiers, maximizing working capital with 0% APR offers.

- Implement a cash discount program: Incentivize immediate revenue through cash payment discounts, enhancing cash flow management for small businesses.

- Partner with lenders for 0% APR financing options: Collaborate with reputable lenders for favorable terms, exploring alternative funding sources for SMEs.

- Use 0% APR as loss leader for upselling: Attract customers and upsell higher-margin products, leveraging interest-free loan terms for entrepreneurs.

- Set minimum purchase thresholds for 0% APR offers: Establish minimum amounts to qualify for financing, implementing debt-free business expansion strategies.

- Integrate 0% APR with loyalty rewards program: Combine financing offers with loyalty rewards for retention, utilizing 0% APR business credit cards effectively.

Let’s dive into these profitable 0% APR business financing strategies!

1: Analyze customer data to set optimal pricing

Analyzing customer data is crucial for setting optimal pricing that balances profitability with customer attraction, especially when considering profitable 0% APR business financing options.

Actionable Steps:

- Collect and analyze customer purchasing data to identify trends and preferences. Use data analytics tools to segment customers based on purchase history and behaviors, which can inform your approach to 0% APR business credit cards.

- Identify high-margin products that can sustain 0% APR offers without significant losses. Adjust pricing strategies based on data insights, considering interest-free loan terms for entrepreneurs.

- Implement dynamic pricing models that reflect demand and customer willingness to pay. Regularly review and update pricing strategies to ensure competitiveness and profitability, while maximizing working capital with 0% APR offers.

Explanation: These steps help you understand customer behavior and tailor your pricing strategy to maximize profits. By leveraging data analytics, you can identify which products can support profitable 0% APR business financing and adjust pricing strategies accordingly.

This approach aligns with current industry trends, where businesses use data to drive decision-making. For more insights on data-driven pricing strategies, check out Investopedia’s guide on equity financing.

Key benefits of data-driven pricing include:

- Improved profit margins

- Enhanced customer satisfaction

- Increased market competitiveness

This data-driven approach ensures your pricing remains competitive while maintaining profitability, which is essential for effective cash flow management for small businesses.

2: Offer tiered 0% APR terms based on purchase amount

Offering tiered 0% APR terms based on purchase amount encourages customers to spend more while ensuring profitable 0% APR business financing.

Actionable Steps:

- Create multiple financing tiers: Develop several tiers of 0% APR offers (e.g., 6 months for purchases up to $500, 12 months for purchases over $1,000) to enhance small business financing options.

- Promote higher tiers: Communicate the benefits of higher tiers to customers through targeted marketing campaigns, focusing on interest-free loan terms for entrepreneurs.

- Monitor performance: Track conversion rates and average order values to assess the effectiveness of tiered offers and improve cash flow management for small businesses.

Explanation: These steps help you encourage higher spending and monitor the impact on sales, potentially improving your business credit score.

By developing multiple financing tiers, you can appeal to a broader range of customers seeking alternative funding sources for SMEs.

Promoting higher tiers through marketing campaigns can boost customer engagement and support debt-free business expansion strategies.

Monitoring performance ensures the strategy remains effective. For more insights on financing options, visit CNBC’s guide on no credit check business loans.

Implementing these tiers can significantly enhance your sales strategy and help in maximizing working capital with 0% APR offers.

3: Implement a cash discount program

Offering cash discounts can help you secure immediate revenue, which is crucial for maintaining healthy cash flow and exploring profitable 0% APR business financing options.

Actionable Steps:

- Promote cash discounts prominently: Highlight these discounts in-store and online to catch customer attention and improve cash flow management for small businesses.

- Train sales staff: Ensure your team can effectively communicate the benefits of cash payments to customers, including how it can help with short-term financing for startups.

- Monitor impact: Compare sales data before and after implementing the cash discount program to measure effectiveness and explore alternative funding sources for SMEs.

Explanation: These steps are essential for boosting immediate revenue and maintaining cash flow, which can be complemented by profitable 0% APR business financing strategies.

Promoting cash discounts and training staff ensures customers are aware and motivated to choose cash payments, potentially reducing the need for interest-free loan terms for entrepreneurs.

Monitoring the impact allows you to adjust strategies for optimal results. For more insights on optimizing cash flow, check out NerdWallet’s guide on small business grants.

Implementing a cash discount program can significantly enhance your financial stability and may improve your business credit score, opening doors to more profitable 0% APR business financing opportunities.

4: Partner with lenders for 0% APR financing options

Partnering with reputable lenders can help you offer attractive profitable 0% APR business financing options without straining your resources.

Actionable Steps:

- Research and shortlist potential lender partners: Identify lenders with favorable terms and a strong reputation for small business financing options.

- Negotiate favorable terms and establish agreements: Ensure mutually beneficial terms and formalize partnerships with clear agreements, including interest-free loan terms for entrepreneurs.

- Train staff on financing options: Equip your sales team with the knowledge to present 0% APR business credit cards and other financing options effectively to customers.

Explanation: These steps are crucial for integrating profitable 0% APR business financing seamlessly into your business model.

Collaborating with reputable lenders helps you offer competitive financing without bearing the full financial burden, aiding in cash flow management for small businesses.

By training your staff, you ensure that they can effectively communicate the benefits to customers. For more insights on financing options, visit CNBC’s guide on no credit check business loans.

These partnerships can significantly enhance your customer attraction and retention strategies, supporting debt-free business expansion strategies.

5: Use 0% APR as loss leader for upselling

Using 0% APR offers as a loss leader can attract customers and create opportunities for upselling higher-margin products, making profitable 0% APR business financing a strategic approach for small businesses.

Actionable Steps:

- Bundle high-margin products: Combine high-margin items with 0% APR offers to increase the average order value and maximize working capital with 0% APR offers.

- Train sales staff: Equip your team with upselling techniques and product knowledge to maximize opportunities, including educating them on 0% APR business credit cards and interest-free loan terms for entrepreneurs.

- Monitor sales data: Regularly track sales to identify successful upselling patterns and adjust strategies accordingly, focusing on cash flow management for small businesses.

Explanation: These steps help leverage profitable 0% APR business financing to boost overall sales. By bundling high-margin products, you can enhance profitability while utilizing short-term financing for startups.

Training staff ensures they can effectively upsell, while monitoring sales data allows for strategy adjustments. For more insights, check out CNBC’s guide on no credit check business loans.

Effective upselling strategies include:

- Suggesting complementary products

- Offering product upgrades

- Providing bundle deals

Implementing these strategies can significantly boost your sales and profitability while exploring alternative funding sources for SMEs and debt-free business expansion strategies.

6: Set minimum purchase thresholds for 0% APR offers

Setting minimum purchase thresholds for profitable 0% APR business financing offers is crucial for ensuring these offers remain profitable while providing valuable small business financing options.

Actionable Steps:

- Determine threshold amounts based on profitability analysis: Analyze your financial data to set minimum purchase amounts that ensure profitability, considering factors like business credit score improvement and cash flow management for small businesses.

- Clearly communicate minimum purchase requirements: Inform customers about the thresholds for 0% APR business credit cards through your website, in-store signage, and marketing materials.

- Adjust thresholds as needed: Regularly review sales data and customer feedback to refine the thresholds for optimal results, considering interest-free loan terms for entrepreneurs and short-term financing for startups.

Explanation: These steps help ensure that profitable 0% APR business financing offers do not negatively impact your profit margins.

By setting and communicating minimum purchase thresholds, you can manage customer expectations and maintain financial health while maximizing working capital with 0% APR offers.

Regular adjustments based on data will keep the strategy effective. For more insights, visit CNBC’s guide on no credit check business loans.

This approach ensures your 0% APR strategy supports both sales and profitability, aligning with debt-free business expansion strategies.

7: Integrate 0% APR with loyalty rewards program

Integrating profitable 0% APR business financing offers with a loyalty rewards program can enhance customer retention and boost long-term profitability for small businesses.

Actionable Steps:

- Design a loyalty program: Create a program that rewards customers for using 0% APR business financing. Offer points or discounts for financing purchases, improving cash flow management for small businesses.

- Promote the combined benefits: Highlight the advantages of interest-free loan terms for entrepreneurs and loyalty rewards through targeted marketing campaigns. Use emails and social media to reach your audience.

- Monitor and adjust: Track customer engagement and spending patterns. Adjust the program based on feedback and sales data to maximize its effectiveness and optimize short-term financing for startups.

Explanation: These steps help you leverage profitable 0% APR business financing offers to build customer loyalty and drive repeat sales. A well-designed loyalty program can reward customers for their loyalty while encouraging them to use small business financing options.

By monitoring and adjusting the program, you ensure it remains attractive and profitable. For more insights on creating effective loyalty programs, check out CNBC’s guide on no credit check business loans.

Key elements of a successful loyalty program:

- Easy-to-understand rewards structure

- Personalized offers based on customer behavior

- Seamless integration with existing purchasing processes, including 0% APR business credit cards

Implementing this strategy can significantly enhance your customer retention efforts and profitability, while helping with business credit score improvement and maximizing working capital with 0% APR offers.

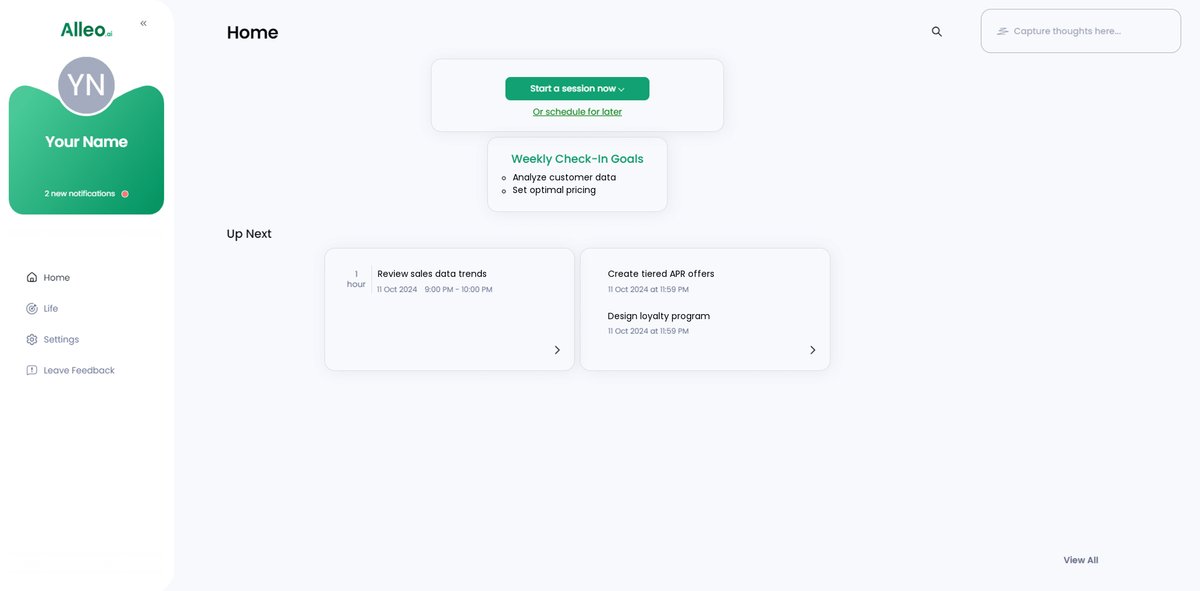

Partner with Alleo to Master 0% APR Financing Offers

We’ve explored the challenges of creating profitable 0% APR business financing offers and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster for your small business financing options?

At Alleo, our AI coach offers affordable, tailored coaching support for your specific needs, including maximizing working capital with 0% APR offers. Starting is simple.

Set up an account and create a personalized plan. Our coach will help you analyze customer data, set optimal pricing, and implement effective financing strategies, including exploring 0% APR business credit cards and interest-free loan terms for entrepreneurs.

Our AI coach provides full coaching sessions, just like a human coach, covering topics like cash flow management for small businesses and business credit score improvement. Plus, you get a free 14-day trial with no credit card required.

Our coach follows up on your progress and keeps you accountable with text and push notifications, helping you explore alternative funding sources for SMEs and debt-free business expansion strategies.

Ready to get started for free and learn about profitable 0% APR business financing? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards profitable 0% APR financing with our AI coach, simply log in to your existing account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent practices that will help you implement and maintain profitable 0% APR financing strategies in your business.

Step 3: Select “Finances” as Your Focus Area

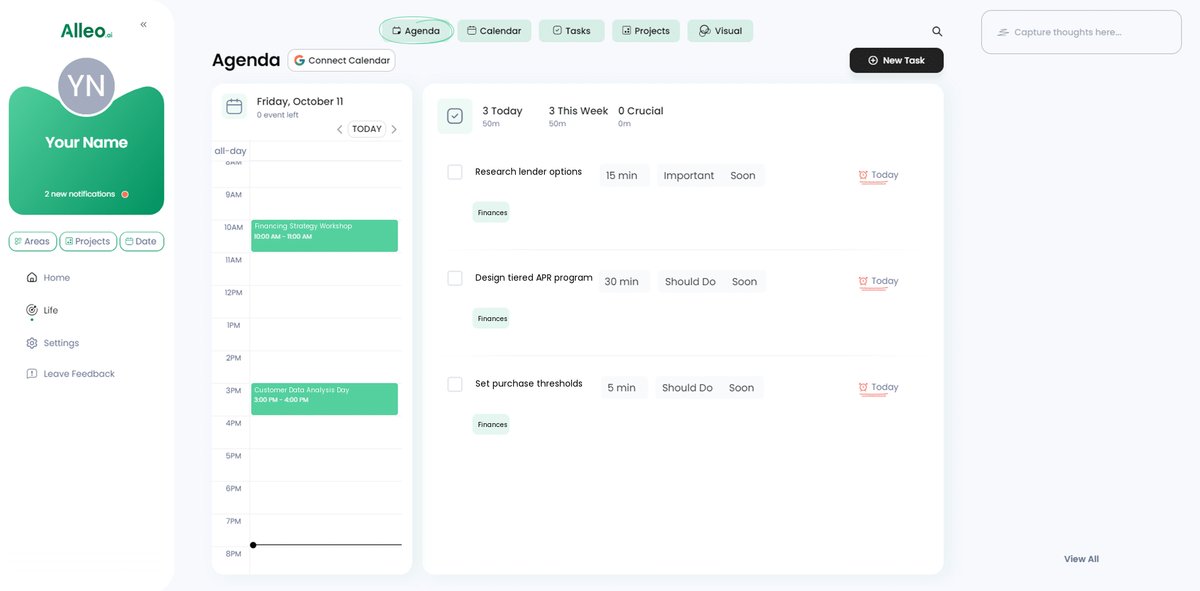

Choose “Finances” as your focus area to get tailored guidance on implementing profitable 0% APR financing strategies, helping you attract more customers while maintaining a healthy bottom line for your business.

Step 4: Starting a Coaching Session

Begin your journey with an intake session, where you’ll work with our AI coach to analyze your customer data and develop a personalized plan for implementing profitable 0% APR financing offers.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on creating profitable 0% APR financing offers, check the app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable to your business growth strategies.

Step 6: Adding events to your calendar or app

Track your progress in implementing profitable 0% APR financing strategies by adding key milestones and tasks to the AI coach’s calendar and task features, allowing you to stay organized and accountable as you work towards your business goals.

Wrapping Up: Your Path to Profitable 0% APR Financing

You’ve now got a comprehensive roadmap to create profitable 0% APR business financing offers. By analyzing customer data, offering tiered APR terms, and implementing cash flow management strategies like cash discount programs, you can attract more customers without sacrificing profitability.

Remember, partnering with reputable lenders and using 0% APR offers as a loss leader can further boost your sales. Setting minimum purchase thresholds and integrating APR with loyalty rewards adds another layer of strategic advantage for small business financing options.

I understand the challenges you face as a small business owner seeking alternative funding sources for SMEs. But with these steps, you can turn those challenges into opportunities for debt-free business expansion strategies.

Ready to take your business to the next level with interest-free loan terms for entrepreneurs?

Partner with Alleo and let our AI coach guide you through every step of maximizing working capital with 0% APR offers. Start your free 14-day trial today. Your journey to profitable 0% APR financing starts now!