7 Essential Ways to Find Fee-Only Retirement Planners for Index Fund Strategies

Are you struggling to find fee-only retirement index fund advisors who prioritize your retirement goals instead of pushing high-commission products?

As a life coach, I’ve helped many empty nesters navigate these challenges. I’ve seen firsthand how the right fee-only financial advisor can make a significant difference in retirement planning services.

In this article, you’ll discover specific strategies to find trustworthy fee-only retirement index fund advisors and ensure they align with your index fund investing strategies for low-cost investment strategies.

Let’s dive in to explore fiduciary retirement planners and passive investing retirement plans.

The Hidden Pitfalls of Finding the Right Financial Advisor

Searching for the right financial advisor can be overwhelming. Many clients initially struggle with identifying hidden fees and conflicts of interest when seeking fee-only retirement index fund advisors.

Often, retirees find themselves tangled in complex fee structures. Advisors may push high-commission products that don’t align with your retirement planning services goals.

In my experience, this can lead to significant setbacks. Your retirement plans can suffer without proper fiduciary retirement planners.

It’s crucial to find an advisor with expertise in index fund strategies and a transparent fee-only structure for low-cost investment strategies.

Without the right guidance from fee-only financial advisors specializing in index fund investing, you risk compromising your financial security. Let’s explore how to navigate these challenges effectively with passive investing retirement plans.

Roadmap to Finding the Right Fee-Only Financial Planner

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in finding fee-only retirement index fund advisors:

- Search NAPFA for fee-only financial advisors: Use the advisor search tool on the NAPFA website to find fee-only retirement planners specializing in index fund investing in your area.

- Use online directories for CFP professionals: Check directories like the CFP Board’s tool for certified planners offering retirement planning services.

- Ask for referrals from friends and colleagues: Reach out to trusted contacts for recommendations on fiduciary retirement planners.

- Check local financial planning associations: Attend events and network for firsthand advice on low-cost investment strategies.

- Verify advisor credentials and fiduciary status: Confirm certifications through regulatory websites to ensure they’re commission-free financial advisors.

- Schedule initial consultations with 2-3 planners: Prepare questions about passive investing retirement plans and assess their responses.

- Inquire about index fund expertise and strategies: Ask about their experience with Vanguard index fund retirement strategies and retirement asset allocation.

Let’s dive in!

1: Search NAPFA for fee-only financial advisors

Finding a fee-only financial advisor through NAPFA ensures you’re working with a professional who prioritizes your interests, especially when seeking fee-only retirement index fund advisors.

Actionable Steps:

- Visit the NAPFA website and use their advisor search tool to find fee-only retirement planners in your area.

- Filter the search results based on specific needs, such as retirement planning services and index fund investing strategies.

- Create a shortlist of potential fiduciary retirement planners by reviewing their profiles and expertise in low-cost investment strategies.

Explanation: NAPFA (National Association of Personal Financial Advisors) is a trusted resource for finding fee-only advisors who adhere to fiduciary standards. This means they are obligated to act in your best interests when providing commission-free financial advice.

Utilizing NAPFA’s search tool helps you focus on qualified advisors who offer unbiased advice on passive investing retirement plans. To learn more about why fee-only retirement index fund advisors are beneficial, check out this Investopedia article on index fund strategies.

Taking these steps ensures you find a trustworthy advisor who aligns with your retirement goals and can guide you in retirement asset allocation using Vanguard index fund retirement strategies.

Next, we’ll explore how to use online directories for certified financial planners specializing in DIY retirement planning with index funds.

2: Use online directories for CFP professionals

Finding the right CFP professional online can streamline your search for a qualified financial advisor, including fee-only retirement index fund advisors.

Actionable Steps:

- Visit the CFP Board’s website and use the Find a CFP Professional tool to locate fee-only financial advisors.

- Enter your location and specific services needed, such as index fund investing or retirement planning services, to generate relevant results.

- Review profiles and client reviews carefully, looking for fiduciary retirement planners.

Key benefits of using online directories:

- Access to a wide pool of certified professionals, including those specializing in low-cost investment strategies

- Easy comparison of qualifications and specialties, such as passive investing retirement plans

- Time-efficient search process for finding experts in DIY retirement planning with index funds

Explanation: Using online directories like the CFP Board’s tool helps you find certified professionals who meet your specific needs, including those offering commission-free financial advice.

This method ensures you connect with advisors who have the right credentials and experience in retirement asset allocation and Vanguard index fund retirement strategies.

For more about the benefits of Certified Financial Planners, check out this Investopedia article.

Next, we’ll explore how to leverage referrals from friends and colleagues.

3: Ask for referrals from friends and colleagues

Leveraging your personal network is a powerful way to find a reliable fee-only financial planner, including fee-only retirement index fund advisors.

Actionable Steps:

- Reach out to trusted friends and family: Ask if they have worked with any fee-only advisors who specialize in retirement planning and index fund investing.

- Solicit recommendations from colleagues: Inquire with coworkers who may have experience with fee-only financial advisors and can provide reliable referrals for retirement planning services.

- Join retirement planning forums: Participate in online communities and post inquiries about trusted fee-only retirement index fund advisors and fiduciary retirement planners.

Explanation: These steps can help you gather firsthand recommendations, ensuring you connect with advisors who have a proven track record in low-cost investment strategies and passive investing retirement plans.

Personal referrals often come with insights into the advisor’s approach to retirement asset allocation and reliability.

For additional tips on finding financial advisors, you can explore this Berkeley Parents Network article.

Relying on personal networks adds a layer of trust to your search for fee-only retirement index fund advisors.

Using referrals can greatly streamline the process of finding a qualified advisor who specializes in commission-free financial advice and Vanguard index fund retirement strategies.

Next, we’ll discuss checking local financial planning associations.

4: Check local financial planning associations

Engaging with local financial planning associations can provide valuable insights and connections to trustworthy fee-only retirement index fund advisors.

Actionable Steps:

- Research local chapters: Find and visit local chapters of financial planning associations to gather information about their events and resources related to index fund investing and retirement planning services.

- Attend networking events: Participate in seminars, workshops, or networking events hosted by these associations to meet fee-only financial advisors and industry professionals specializing in low-cost investment strategies.

- Engage with speakers and attendees: Interact with speakers and attendees at these events to get firsthand recommendations and contact information of reputable fiduciary retirement planners who focus on passive investing retirement plans.

Explanation: These steps help you build a network of trusted fee-only retirement index fund advisors and gain insights into their expertise in DIY retirement planning with index funds.

Engaging with local associations ensures you connect with professionals who are well-regarded in the community and offer commission-free financial advice for retirement asset allocation.

For more on the benefits of connecting with financial planning associations, read this NAPFA article.

Next, we’ll discuss verifying advisor credentials and fiduciary status, including those who specialize in Vanguard index fund retirement strategies.

5: Verify advisor credentials and fiduciary status

Ensuring your fee-only retirement index fund advisor has the proper credentials and fiduciary status is crucial for your financial security and effective retirement planning services.

Actionable Steps:

- Confirm certifications: Check the fee-only financial advisor’s credentials on regulatory websites such as the SEC’s Investment Adviser Public Disclosure, particularly for those specializing in index fund investing.

- Verify fiduciary duty: Ask for a written statement confirming the fiduciary retirement planner’s responsibility to act in your best interests, especially when recommending low-cost investment strategies.

- Review regulatory records: Check for any disciplinary actions or complaints on the advisor’s record, ensuring they align with passive investing retirement plans.

Explanation: These steps ensure that your fee-only retirement index fund advisor is qualified and committed to acting in your best interests for retirement asset allocation.

Verifying credentials and fiduciary status helps you avoid advisors who may have conflicts of interest, which is particularly important when seeking commission-free financial advice. For more insights on this topic, visit this Investopedia article.

Next, we will discuss scheduling initial consultations with potential fee-only retirement index fund advisors.

6: Schedule initial consultations with 2-3 planners

Scheduling initial consultations with potential fee-only retirement index fund advisors is crucial to assess their fit for your retirement planning needs.

Actionable Steps:

- Contact shortlisted advisors: Reach out to 2-3 fee-only financial advisors and schedule initial consultations to discuss your retirement goals and index fund investing strategies.

- Prepare questions: Create a list of questions focusing on their approach to low-cost investment strategies and retirement planning services.

- Evaluate communication style: During the consultations, assess their responsiveness, transparency, and ability to explain passive investing retirement plans clearly.

Key questions to ask during consultations:

- How do you approach retirement planning for clients interested in DIY retirement planning with index funds?

- What is your investment philosophy regarding Vanguard index fund retirement strategies?

- How do you stay updated with the latest retirement asset allocation strategies?

Explanation: These steps help you gauge whether the fiduciary retirement planners align with your financial goals and have the necessary expertise.

Engaging with multiple fee-only retirement index fund advisors allows you to compare their approaches and choose the best fit for your commission-free financial advice needs.

For more insights, visit this Investopedia article.

Taking these steps ensures you select an advisor who truly understands your needs and can guide you effectively in index fund investing for retirement.

7: Inquire about index fund expertise and strategies

Understanding an advisor’s expertise in index fund strategies is vital for aligning with your retirement goals, especially when seeking fee-only retirement index fund advisors.

Actionable Steps:

- Ask about their experience: Inquire about specific instances where they have successfully used index funds in clients’ portfolios for retirement planning services.

- Request examples: Ask them to provide detailed examples of their low-cost investment strategies with index funds for passive investing retirement plans.

- Discuss their philosophy: Talk about their overall investment philosophy and how it aligns with a long-term, low-cost index fund approach for retirement asset allocation.

Red flags to watch for when discussing index fund strategies with fee-only financial advisors:

- Overemphasis on active management instead of index fund investing

- Reluctance to discuss fees and expenses related to retirement planning services

- Lack of clear explanations about diversification in passive investing retirement plans

Explanation: These steps help ensure that your fiduciary retirement planner is well-versed in index fund strategies, which are essential for a cost-effective and diversified retirement plan.

By focusing on their experience and approach, you can identify fee-only retirement index fund advisors who prioritize your financial security.

For more insights, visit this Investopedia article on index fund strategies.

Taking these steps ensures you select an advisor who aligns with your goals and can guide you effectively in Vanguard index fund retirement strategies.

Partner with Alleo for Your Retirement Planning

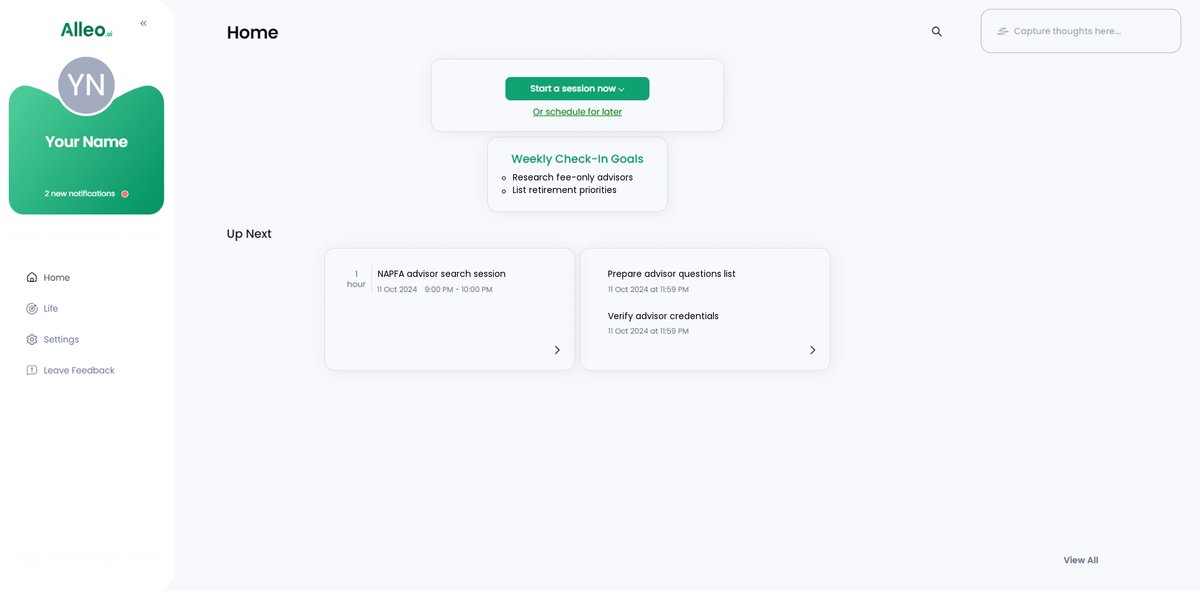

We’ve explored the challenges of finding fee-only retirement index fund advisors focusing on passive investing retirement plans. Did you know you can work with Alleo to make this journey easier and faster?

Set Up Your Account

Creating an account with Alleo is quick and easy. Start by signing up on the Alleo website for access to low-cost investment strategies.

Follow the prompts to set up your profile for DIY retirement planning with index funds.

Create a Personalized Plan

Once your account is set up, Alleo will guide you in creating a personalized retirement plan using index fund investing principles.

Tailor your plan to include your goals and preferences for retirement asset allocation.

Work with Alleo’s Coach

Alleo’s AI coach, acting as a fiduciary retirement planner, will support you through the entire process. It will provide reminders for consultations and follow-ups.

The coach will help you stay on track with your retirement goals, similar to fee-only financial advisors.

Stay Accountable

Alleo’s coach will follow up on your progress with retirement planning services. Expect regular check-ins and notifications to keep you accountable.

Your coach will handle any changes and adapt your plan as needed, offering commission-free financial advice.

Ready to get started for free? Let me show you how to begin with Vanguard index fund retirement strategies!

Step 1: Log In or Create Your Account

To begin your retirement planning journey with Alleo’s AI coach, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose Your Retirement Planning Focus

Click on “Setting and achieving personal or professional goals” to align your financial planning with your retirement objectives, ensuring your chosen advisor can effectively guide you towards your specific financial milestones.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to receive tailored guidance on finding a fee-only financial planner and optimizing your retirement strategy with index funds.

Step 4: Starting a Coaching Session

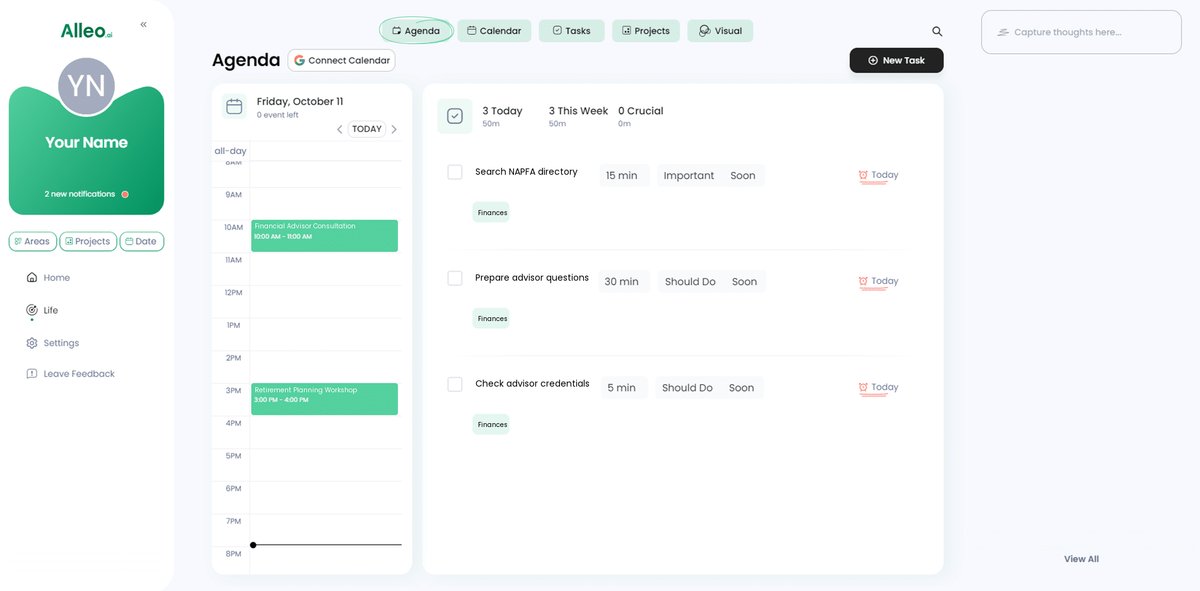

Begin your journey with Alleo by scheduling an intake session with your AI coach to establish your personalized retirement plan and set clear goals for your financial future.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to review and manage the retirement planning goals you discussed, ensuring you stay on track with your personalized financial strategy.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important events related to your retirement planning, such as advisor consultations, financial check-ins, and goal milestones, helping you stay organized and accountable throughout your journey.

Taking Control of Your Retirement Planning

Navigating retirement planning can feel overwhelming, but it doesn’t have to be. By following the steps outlined here, you can find fee-only retirement index fund advisors who align with your goals and provide low-cost investment strategies.

Remember, searching NAPFA, using online directories, and asking for referrals are key when looking for fee-only financial advisors. Don’t forget to verify credentials and schedule consultations with potential fiduciary retirement planners.

As you evaluate advisors, focus on their expertise with index fund investing and their fiduciary duty. This ensures they act in your best interest and can guide you in passive investing retirement plans.

Partnering with Alleo can simplify this process of finding fee-only retirement index fund advisors. Our tools and AI coach are here to support you every step of the way in your retirement asset allocation and planning.

Ready to take control of your retirement planning? Start your free trial with Alleo today and secure your financial future with expert guidance on Vanguard index fund retirement strategies!