7 Powerful Techniques to Manage Mortgage Stress for Parents with High Payments

Are you feeling overwhelmed by the weight of high mortgage payments while trying to balance parenting and work?

As a life coach, I’ve guided many parents through these exact challenges. I understand how managing high mortgage payments as parents can strain your finances and limit your work flexibility, especially with a $990 per week mortgage.

In this article, you will discover high-level strategies to manage this financial stress, including practical steps, government assistance programs for homeowners, and lifestyle adjustments for reducing household expenses and improving work-life balance for stressed parents.

Let’s dive in to explore mortgage stress relief strategies and budgeting tips for homeowners.

Understanding the Financial Strain of High Mortgage Payments

Managing high mortgage payments for parents, such as $990 per week, is a significant challenge. It’s more than just a financial issue; it affects your entire life and can lead to severe mortgage stress.

Many parents find it nearly impossible to reduce work hours to help with childcare due to this burden, impacting their work-life balance.

In my experience, people often feel trapped in a cycle of stress and financial strain. This intense pressure can prevent you from spending quality time with your family, making budgeting tips for homeowners crucial.

Parental stress is further amplified by economic pressures, making every day feel overwhelming. Exploring refinancing options for high mortgages might provide some relief.

Balancing a high mortgage with childcare is not easy. But, with the right strategies and support, such as financial planning for parents and mortgage stress relief strategies, it’s possible to overcome this hurdle and find balance.

Strategic Steps to Manage Mortgage Stress

Overcoming this challenge requires a few key steps for managing high mortgage payments parents face. Here are the main areas to focus on to make progress:

- Contact Mortgage Servicer for Relief Options: Discuss potential relief strategies such as forbearance or loan modification for mortgage stress relief.

- Create a Strict Budget for Essential Expenses: Identify and cut non-essential costs to manage your finances better, a crucial aspect of financial planning for parents.

- Explore Government Assistance Programs: Apply for programs like the Homeowner Assistance Fund, which offers government assistance programs for homeowners.

- Negotiate Flexible Work Arrangements: Talk to your employer about flexible hours or remote work to improve work-life balance for stressed parents.

- Seek Free Housing Counseling Services: Utilize HUD-approved housing counselors for personalized advice on managing high mortgage payments.

- Implement Energy-Saving Measures at Home: Save on utility bills with energy-efficient practices, a key strategy for reducing household expenses.

- Consider Renting Out a Room for Extra Income: Generate additional income by renting a spare room, one of many side hustle ideas for extra income.

Let’s dive in to explore these budgeting tips for homeowners and refinancing options for high mortgages!

1: Contact mortgage servicer for relief options

Reaching out to your mortgage servicer for relief options can significantly reduce your financial stress when managing high mortgage payments as parents.

Actionable Steps:

- Call your mortgage servicer to discuss potential relief options such as forbearance or loan modification for mortgage stress relief.

- Prepare and submit a detailed financial statement to your servicer to support your request for assistance with high mortgage payments.

- Follow up regularly to ensure your application is being processed and to negotiate the best possible terms for managing high mortgage payments as parents.

Explanation: Taking these steps can make a huge difference in managing mortgage stress. Relief options like forbearance or loan modifications can provide temporary financial reprieve, which is crucial for maintaining stability and work-life balance for stressed parents.

Consistent follow-up ensures that your application progresses smoothly. According to Maryland’s Department of Labor, the sooner you contact your servicer, the more options you will have for managing high mortgage payments.

Key benefits of contacting your mortgage servicer:

- Access to personalized relief options and refinancing options for high mortgages

- Potential for reduced or suspended payments, helping with budgeting tips for homeowners

- Expert guidance on navigating financial hardship and financial planning for parents

By proactively seeking relief, you can better manage your mortgage payments and focus more on your family while managing high mortgage payments as parents.

2: Create a strict budget for essential expenses

Creating a strict budget for essential expenses is crucial for managing high mortgage payments parents face and maintaining financial stability.

Actionable Steps:

- List all monthly expenses and categorize them as essential or non-essential. This helps you identify where your money is going and is key to managing mortgage stress.

- Cut non-essential costs by reducing dining out, entertainment, and other discretionary spending. Focus on essentials only to aid in mortgage stress relief strategies.

- Use budgeting apps to track spending and ensure you stick to the budget. Apps can provide reminders and insights into your spending habits, supporting financial planning for parents.

Explanation:

Focusing on essential expenses can significantly ease financial stress. By cutting non-essential costs, you can redirect funds to crucial areas like your mortgage, which is essential for managing high mortgage payments parents struggle with.

Utilizing budgeting apps ensures you stay on track and manage your finances effectively. According to USA.gov, proactive financial management is key to avoiding foreclosure and maintaining stability, which is crucial for parents managing high mortgage payments.

Taking control of your spending is the first step towards financial freedom and effective management of high mortgage payments for parents.

3: Explore government assistance programs

Exploring government assistance programs can significantly ease the financial burden of managing high mortgage payments for parents.

Actionable Steps:

- Research and apply for programs like the Homeowner Assistance Fund and Child Care Assistance Program to aid in mortgage stress relief strategies.

- Check eligibility and apply for local or state government assistance programs for homeowners offering financial relief for families in need.

- Attend workshops or webinars on how to navigate and maximize government aid for your situation, focusing on financial planning for parents.

Explanation:

Taking advantage of government assistance programs can provide crucial financial support, allowing you to manage high mortgage payments more effectively as parents.

For example, the Homeowner Assistance Fund offers relief options that can help you stay afloat during tough times. According to USA.gov, these programs are designed to prevent foreclosure and stabilize your finances, providing essential budgeting tips for homeowners.

Exploring these resources can make a significant difference in your financial stability and peace of mind, helping parents in managing high mortgage payments and reducing household expenses.

4: Negotiate flexible work arrangements

Negotiating flexible work arrangements is crucial for managing high mortgage payments and childcare duties, especially for parents seeking mortgage stress relief strategies.

Actionable Steps:

- Discuss flexible work options with your employer, such as remote work or flexible hours. This can help balance your work and home life, essential for work-life balance for stressed parents.

- Propose a job-sharing arrangement with a colleague to reduce your individual workload and maintain income stability, which is vital for financial planning for parents.

- Consider a temporary reduction in work hours with a clear plan to return to full-time work once financial stability improves, a strategy for managing high mortgage payments parents often overlook.

Explanation:

These steps are vital to balancing work and family responsibilities while managing mortgage stress. Flexible work arrangements can offer the necessary balance and alleviate some of the financial pressures for parents managing high mortgage payments.

According to NCOA, maintaining open communication with your employer about your needs can increase your chances of finding a suitable arrangement.

Benefits of flexible work arrangements:

- Improved work-life balance

- Reduced commuting costs, contributing to reducing household expenses

- Increased productivity and job satisfaction

Taking control of your work schedule can help you manage both your financial and family obligations effectively, a key aspect of managing high mortgage payments for parents.

5: Seek free housing counseling services

Seeking free housing counseling services is crucial in managing mortgage stress and avoiding foreclosure, especially for parents managing high mortgage payments.

Actionable Steps:

- Schedule an appointment with a HUD-approved housing counselor for personalized advice tailored to your financial situation, including mortgage stress relief strategies.

- Attend free workshops or seminars on managing mortgage stress and avoiding foreclosure to gain valuable insights on budgeting tips for homeowners.

- Utilize online resources and tools provided by housing counseling agencies to stay informed about refinancing options for high mortgages and government assistance programs for homeowners.

Explanation:

These steps matter because they provide expert guidance and support during financial hardships. Housing counselors can offer strategies and resources to help you manage your mortgage stress effectively, including financial planning for parents.

According to the USA.gov, working with a housing counselor can significantly improve your chances of avoiding foreclosure and maintaining financial stability while managing high mortgage payments.

Getting professional help can be a game-changer in navigating your financial challenges and achieving work-life balance for stressed parents.

6: Implement energy-saving measures at home

Implementing energy-saving measures at home can significantly reduce utility bills, helping you manage mortgage stress more effectively, especially when managing high mortgage payments as parents.

Actionable Steps:

- Conduct a home energy audit to identify areas where you can save on utility bills. This can highlight energy waste and opportunities for efficiency, contributing to reducing household expenses.

- Invest in energy-efficient appliances and light bulbs to reduce electricity costs. These upgrades can lower your monthly energy expenses, aiding in budgeting tips for homeowners.

- Practice simple energy-saving habits, such as unplugging devices when not in use and using programmable thermostats. Small changes can add up to significant savings, supporting financial planning for parents.

Explanation:

These steps matter because they provide immediate and long-term savings, helping to ease financial pressure and offering mortgage stress relief strategies.

According to NCOA, adopting energy-saving measures can significantly lower utility bills, freeing up funds for mortgage payments and other essentials.

Reducing energy consumption not only saves money but also contributes to a more sustainable lifestyle, supporting work-life balance for stressed parents.

Quick energy-saving tips:

- Use natural light when possible

- Seal air leaks around windows and doors

- Lower your water heater temperature

Making these adjustments can help you better manage your finances and reduce overall stress when managing high mortgage payments as parents.

7: Consider renting out a room for extra income

Renting out a room can provide a significant financial boost, helping parents manage high mortgage payments and alleviate mortgage stress.

Actionable Steps:

- List a spare room on short-term rental platforms like Airbnb. Ensure your listing is detailed and appealing to attract renters, which can be an effective side hustle idea for extra income.

- Screen potential renters carefully. Conduct background checks and interviews to ensure safety and compatibility, maintaining work-life balance for stressed parents.

- Use the extra income to pay down your mortgage faster. Alternatively, build an emergency fund to enhance financial stability and assist in managing high mortgage payments for parents.

Explanation:

These steps matter because renting out a room can generate additional income, making it easier to handle mortgage payments. This approach offers a practical solution to financial strain and is one of several effective budgeting tips for homeowners.

According to Business Insider, leveraging extra income sources can significantly reduce financial stress and accelerate debt repayment, which is crucial for parents managing high mortgage payments.

Considering this option can help you achieve greater financial stability while managing your mortgage, complementing other mortgage stress relief strategies and financial planning for parents.

Work with Alleo to Manage Mortgage Stress

We’ve explored the challenges of managing high mortgage payments for parents. But did you know you can work directly with Alleo to make this journey easier and faster?

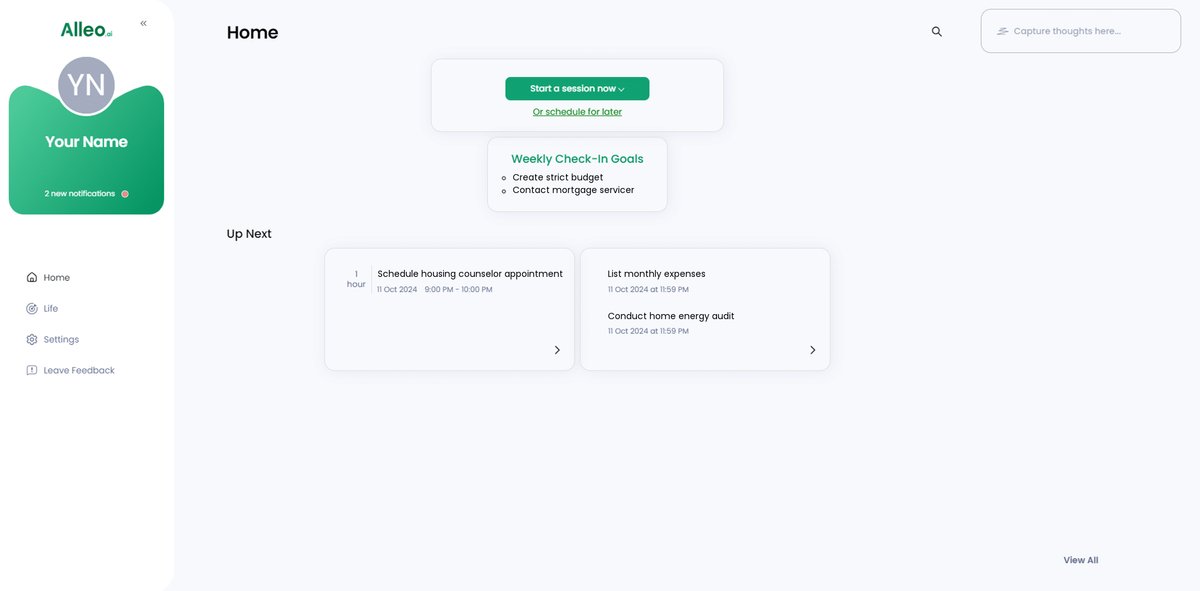

Set up an account and create a personalized plan tailored to your needs. Alleo’s AI coach provides full coaching sessions on mortgage stress relief strategies, just like a human coach.

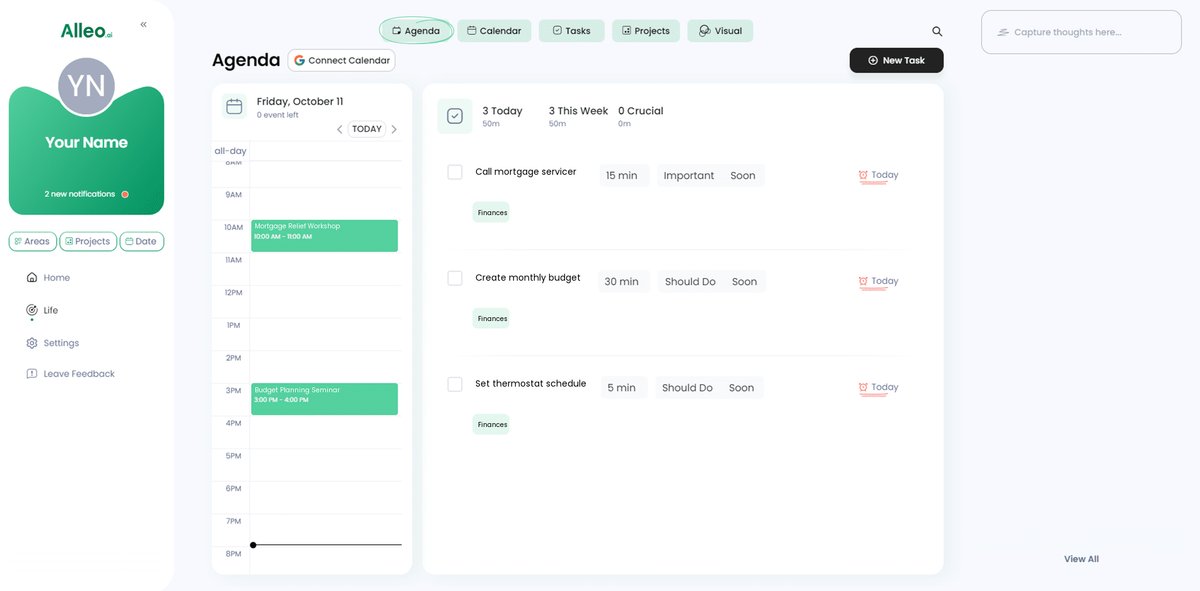

The coach follows up on your progress, handles changes, and keeps you accountable through text and push notifications, helping you with budgeting tips for homeowners and financial planning for parents.

Ready to get started for free and learn about refinancing options for high mortgages?

Let me show you how to start managing high mortgage payments as parents!

Step 1: Log In or Create Your Account

To start managing your mortgage stress with Alleo’s AI coach, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose “Improving overall well-being and life satisfaction”

Select this goal to address the root causes of your mortgage stress, focusing on holistic solutions that balance financial concerns with personal and family well-being.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to address your mortgage stress and receive tailored guidance on budgeting, exploring relief options, and managing high payments while balancing parenting responsibilities.

Step 4: Starting a coaching session

Begin your journey with Alleo by initiating an intake session, where you’ll discuss your mortgage stress and parenting challenges to create a personalized plan for managing your finances and work-life balance.

Step 5: Viewing and managing goals after the session

After your coaching session on managing mortgage stress, check the home page of the Alleo app to view and track the goals you discussed, allowing you to stay focused on improving your financial situation and work-life balance.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in managing mortgage stress, allowing you to easily schedule important financial tasks like contacting your mortgage servicer, attending housing counseling sessions, or implementing energy-saving measures at home.

Finding Balance and Financial Freedom

Managing high mortgage payments as parents is tough, but it’s not impossible. By taking proactive steps, you can regain control over your finances and find balance.

Remember, you’re not alone in this journey. Many parents face similar mortgage stress, and support is available.

From contacting your mortgage servicer to exploring government assistance programs for homeowners, each step can make a significant difference. Creating a strict budget and seeking housing counseling also provide great relief for managing high mortgage payments as parents.

Let’s not forget the importance of flexible work arrangements and energy-saving measures to reduce household expenses. Every bit helps in achieving work-life balance for stressed parents.

Consider renting out a room for additional income as a side hustle idea. Small changes lead to big impacts in financial planning for parents.

Finally, Alleo is here to help. With personalized coaching and reminders, managing your mortgage stress becomes easier.

Take the first step today. You’ve got this!