7 Proven Steps to Create a Business Plan for New Entrepreneurs Combining Finance and Consulting

Are you a side hustler struggling to create a comprehensive business plan that combines financial planning with consulting? A well-crafted business plan finance consulting approach is essential for success.

Creating a solid business plan is crucial for new entrepreneurs. As a life coach, I’ve helped many professionals navigate these challenges, including developing business plan templates and financial projections for startups.

In this article, you’ll discover actionable strategies to define your business idea, project startup costs, and develop a unique value proposition. You’ll also learn how to create a marketing strategy and integrate consulting services into your business model. We’ll explore entrepreneurial strategies, market analysis techniques, and funding options for new businesses.

Let’s dive into the world of business plan finance consulting.

Understanding the Challenges of Business Planning for Side Hustlers

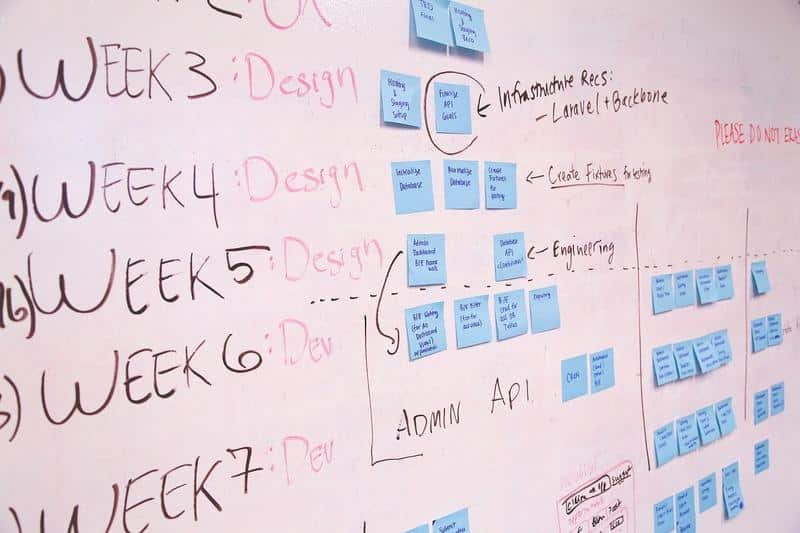

Many side hustlers find business plan finance consulting overwhelming. Combining financial projections for startups with consulting business models demands a lot of effort and expertise.

In my experience, people often underestimate these complexities. They struggle to balance day jobs with the demands of their side businesses, often lacking a proper business plan template.

Moreover, integrating financial projections with actionable entrepreneurial strategies can be daunting. I frequently see clients benefit from structured approaches like SWOT analysis for entrepreneurs, yet they often lack the tools to implement them.

It’s not just about numbers; it’s about creating a sustainable and profitable business. The struggle with business plan finance consulting is real, but solutions exist to simplify this process.

The Benefits of Hiring a Life Coach

Have you ever felt stuck in life, unsure of how to move forward or achieve your goals? If so, you’re not alone. Many people struggle with personal and professional challenges that can seem overwhelming, whether in business plan finance consulting or other fields.

This is where a life coach can make a significant difference, much like a consultant in the business world.

A life coach is a professional who helps individuals identify and achieve their personal and professional objectives, similar to how a business plan template guides entrepreneurs. They provide guidance, support, and accountability to help you overcome obstacles and reach your full potential.

Here are some key benefits of working with a life coach:

- Clarity and Direction: A life coach helps you gain clarity about your goals and values, providing a clear roadmap for your future, much like a business plan executive summary.

- Accountability: Regular check-ins and goal-setting sessions keep you accountable and motivated to make progress, similar to financial projections for startups.

- Improved Self-Awareness: Through coaching, you’ll gain deeper insights into your strengths, weaknesses, and patterns of behavior, akin to a SWOT analysis for entrepreneurs.

- Enhanced Decision-Making: A coach can help you develop better decision-making skills and confidence in your choices, essential in business plan finance consulting.

- Accelerated Personal Growth: With targeted guidance, you can achieve your goals faster and more efficiently than on your own, much like implementing effective entrepreneurial strategies.

Life coaching can be particularly beneficial during times of transition or when facing significant life challenges. Whether you’re seeking career advancement, improving relationships, or simply want to live a more fulfilling life, a coach can provide the support and tools you need to succeed, similar to how a consulting business model aids organizations.

Are you ready to take the next step in your personal development journey?

Consider reaching out to a qualified life coach today and start working towards the life you’ve always dreamed of, just as you would approach business plan finance consulting for your career.

Steps to Create an Effective Business Plan Combining Finance and Consulting

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in your business plan finance consulting journey:

- Define Business Idea and Target Market: Conduct market analysis techniques and validate your business plan template.

- Outline Financial Projections for Startups and Startup Costs: Calculate costs and prepare financial projections.

- Develop a Unique Value Proposition: Identify your differentiators and craft a compelling business plan executive summary.

- Create a Marketing and Sales Strategy: Develop a marketing plan and set measurable goals for your consulting business model.

- Draft Operational and Management Plans: Define business processes and management structure using entrepreneurial strategies.

- Integrate Consulting Services into Offerings: Identify where consulting adds value and develop packages for your business plan finance consulting firm.

- Design Financial Model with Forecasting Tools: Choose cash flow forecasting tools and build a comprehensive model for your business plan finance consulting practice.

Let’s dive in!

1: Define business idea and target market

Defining your business idea and target market is crucial for the success of your side hustle, especially when developing a business plan for finance consulting.

Actionable Steps:

- Conduct market research to identify opportunities. Use online tools and surveys to gather data on potential markets and perform a thorough market analysis.

- Validate your business idea through feedback from potential customers. Create a minimum viable product (MVP) and collect user feedback to refine your consulting business model.

- Define your target market with detailed buyer personas. Use demographic and psychographic data to create accurate personas, essential for effective entrepreneurial strategies.

Explanation: Understanding your target market helps you tailor your products and services to meet specific needs, a key aspect of business plan finance consulting.

Market research and customer feedback ensure your idea is viable and attractive to your audience. Detailed buyer personas provide insights into customer behavior, aiding in effective marketing strategies and informing your business plan template.

According to SBA, knowing your market is key to creating a solid business plan.

Key benefits of defining your target market include:

- Improved product-market fit

- More effective marketing campaigns

- Better allocation of resources

This foundational step sets the stage for the rest of your business planning process, including developing financial projections for startups and creating a robust business plan executive summary.

2: Outline financial projections and startup costs

Outlining financial projections and startup costs is essential to ensure your business’s financial health, especially when considering business plan finance consulting services.

Actionable Steps:

- Calculate all initial startup costs, including equipment, marketing, and salaries, using a comprehensive business plan template.

- Develop financial projections for startups for the first year, using financial forecasting tools to predict revenue and expenses.

- Prepare a break-even analysis to determine the sales volume needed to cover costs, a crucial step in any consulting business model.

Explanation: Understanding your financial needs and projections helps you allocate resources effectively and plan for future growth, key entrepreneurial strategies in business plan finance consulting.

Accurate financial planning can attract investors and lenders. For more detailed guidelines, check out this SBA resource on startup costs.

With a solid grasp of your financial landscape, you’re ready to develop a compelling value proposition.

3: Develop a unique value proposition

Creating a unique value proposition is essential for differentiating your business plan finance consulting service and attracting customers.

Actionable Steps:

- Analyze competitors: Identify what makes your business plan finance consulting unique by comparing it to competitors. Highlight your differentiators in your business plan template.

- Craft a compelling value proposition statement: Focus on the benefits your consulting business model offers to customers, making it clear and concise.

- Test your value proposition with potential startups: Gather feedback on your financial projections for startups and refine your message accordingly.

Explanation: These entrepreneurial strategies matter because a strong value proposition clarifies why customers should choose your business plan finance consulting.

It’s crucial for marketing and customer retention. According to Binghamton University, defining your value proposition can significantly impact your business success.

With a solid value proposition, you’re better positioned to create an effective market analysis technique and sales strategy for your business plan finance consulting.

4: Create a marketing and sales strategy

Creating a marketing and sales strategy is crucial for reaching your target audience and driving business growth. This is especially important in business plan finance consulting, where a well-crafted strategy can set you apart from competitors.

Actionable Steps:

- Develop a comprehensive marketing plan: Outline your approach using multiple channels like social media, email, and content marketing. Incorporate market analysis techniques to inform your strategy.

- Set measurable marketing goals: Use SMART criteria to define specific, measurable, achievable, relevant, and time-bound objectives. This is essential for financial projections for startups.

- Establish a structured sales process: Detail the steps from lead generation to closing a sale to ensure consistency and efficiency. This is a key component of any consulting business model.

Explanation: These steps matter because a well-rounded marketing and sales strategy helps attract and retain customers, driving your business forward. This is particularly true in business plan finance consulting.

Setting measurable goals ensures you can track progress and adjust as needed. To learn more about creating effective plans, visit this SBA resource.

Key elements of an effective marketing strategy include:

- Clear brand messaging

- Targeted content creation

- Consistent social media presence

Next, let’s explore how to draft operational and management plans.

5: Draft operational and management plans

Drafting operational and management plans is vital for ensuring smooth day-to-day operations and long-term growth in your business plan finance consulting venture.

Actionable Steps:

- Define business processes: Create standard operating procedures (SOPs) for all daily tasks to ensure consistency in your consulting business model.

- Develop a management structure: Assign roles and responsibilities clearly within your team to streamline decision-making and support entrepreneurial strategies.

- Plan for scalability: Outline how your business plan finance consulting practice will grow and adapt over time, anticipating future needs and incorporating market analysis techniques.

Explanation: These steps matter because they establish a strong foundation for your business operations and financial projections for startups.

Clear processes and a defined management structure improve efficiency and accountability in your business plan template.

Planning for scalability ensures your business can grow sustainably. For more insights, visit this SBA resource on operational planning and funding options for new businesses.

By drafting comprehensive operational and management plans, you set the stage for successful growth and adaptability in your business plan finance consulting practice.

6: Integrate consulting services into offerings

Integrating business plan finance consulting services into your offerings can significantly enhance the value you provide to customers.

Actionable Steps:

- Analyze customer needs: Identify areas where consulting can add value by analyzing customer feedback and market analysis techniques.

- Develop consulting packages: Create tiered packages offering different levels of service to cater to diverse client needs, including financial projections for startups.

- Promote your consulting services: Use targeted marketing campaigns to highlight the benefits of your consulting business model and offerings.

Explanation: These steps matter because they help you diversify your revenue streams and build stronger customer relationships through business plan finance consulting.

Consulting services can address specific customer pain points, making your business more indispensable in areas like cash flow forecasting and risk assessment in business planning.

For more insights, visit this LivePlan resource on comprehensive planning.

Integrating consulting services sets you apart and adds substantial value to your business model, especially when offering expertise in areas like business plan templates and SWOT analysis for entrepreneurs.

Partner with Alleo to Master Business Planning

We’ve explored the challenges of creating a comprehensive business plan combining financial planning with consulting. But did you know you can work directly with Alleo to make this journey easier and faster when developing your business plan finance consulting strategy?

Alleo, your AI life coach, provides affordable and tailored coaching support for side hustlers. With full coaching sessions like any human coach, Alleo helps you define business ideas, project startup costs, create financial projections for startups, and develop marketing strategies and market analysis techniques.

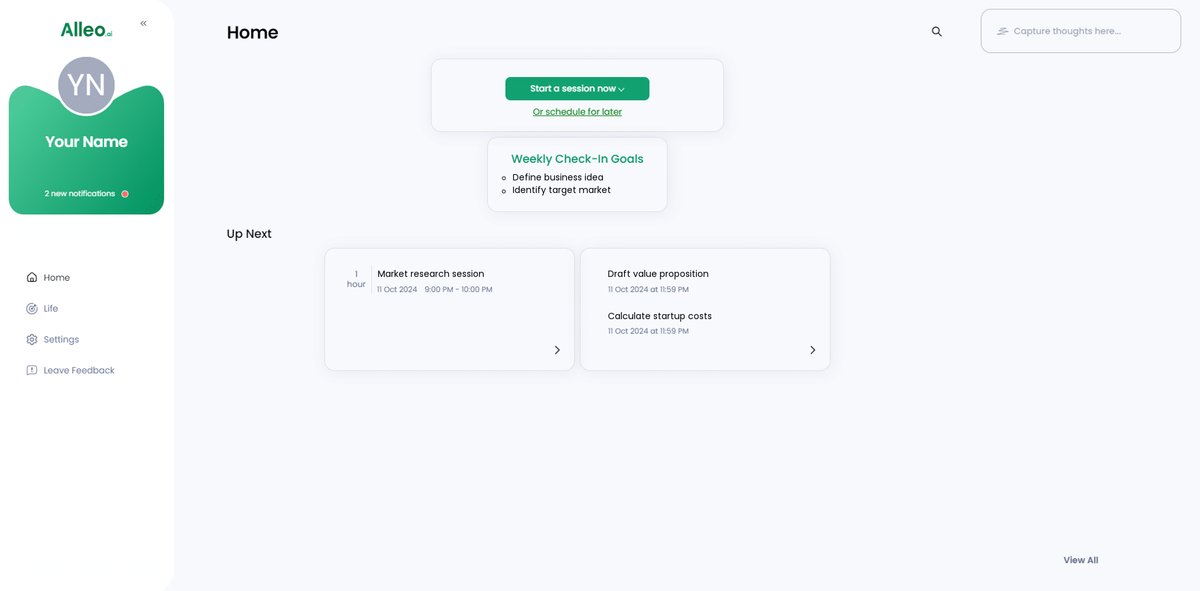

Setting up an account is simple. Create a personalized plan and start working with Alleo’s coach to overcome specific challenges in your consulting business model and entrepreneurial strategies.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, ensuring you stay on track with your business plan finance consulting goals.

Ready to get started for free? Let me show you how to create your business plan template and explore funding options for new businesses!

Step 1: Log In or Create Your Account

To start your business planning journey with Alleo, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your business planning efforts with your overall aspirations, helping you create a more focused and effective strategy for your side hustle.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to get tailored guidance on creating a comprehensive business plan that combines financial planning with consulting for your side hustle. This selection will help you navigate the challenges of projecting startup costs, developing financial models, and integrating profitable consulting services into your business offerings.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to establish your personalized business plan and set clear goals for your side hustle’s growth.

Step 5: Viewing and managing goals after the session

After your coaching session with Alleo, check the app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable as you work on your comprehensive business plan.

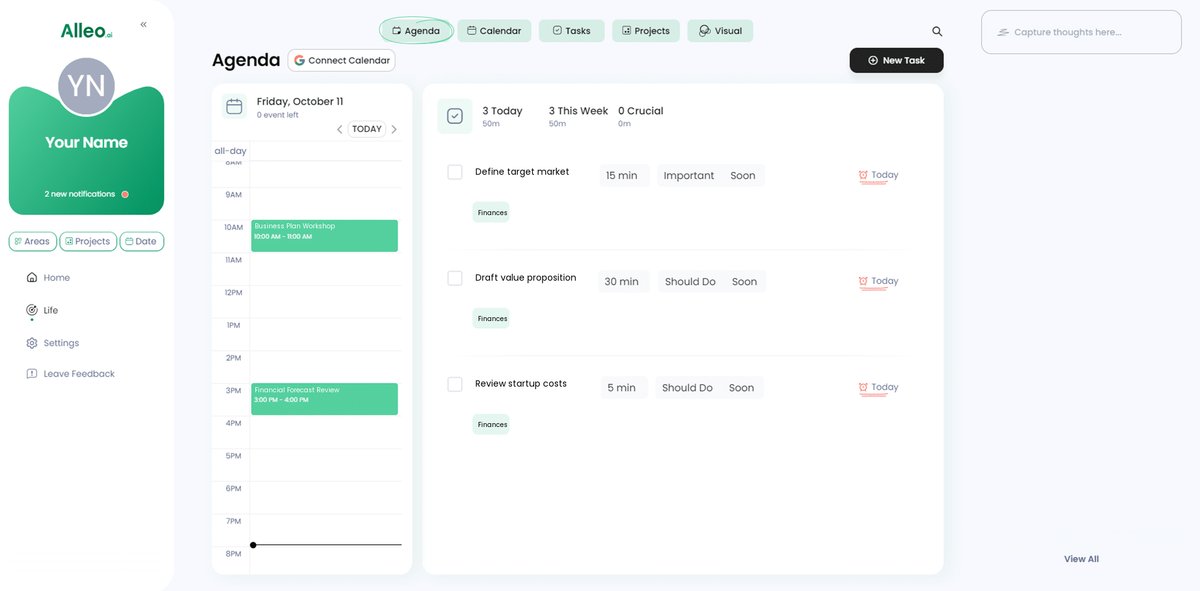

Step 6: Adding events to your calendar or app

Use the calendar and task features in Alleo to schedule and track your progress on business planning activities, helping you stay organized and accountable as you work through each step of creating your comprehensive business plan.

Wrapping Up Your Business Plan Journey

You’ve learned the key steps to create a comprehensive business plan combining finance and consulting.

Business plan finance consulting can be tough, especially when balancing a side hustle. But with determination, it’s entirely achievable.

Remember, defining your business idea, outlining financial projections for startups, and creating a marketing strategy are crucial steps.

Integrating consulting business models and designing a financial model will set you apart from competitors.

I know it’s a lot to take in.

But you’re not alone in this journey.

Alleo is here to guide you every step of the way.

Start using Alleo today and transform your side hustle into a thriving business with expert business plan finance consulting.