7 Proven Strategies for Maintaining Your Lifestyle in Retirement on a Limited Income

Are you worried about maintaining your retirement lifestyle on a budget? Many retirees face the challenge of stretching their retirement savings to support their desired way of life.

As a life coach, I have guided many retirees through financial planning challenges, including budgeting for retirement and exploring fixed income investments. In my experience, strategic planning can make a significant difference in managing your retirement lifestyle on a budget.

In this blog, you’ll discover actionable steps to ensure your financial resources support your desired lifestyle through budgeting, maximizing Social Security benefits, reducing expenses, and smart investment strategies. We’ll explore topics like downsizing in retirement, part-time work opportunities, and leveraging senior discounts and savings.

Let’s dive in to learn about healthcare cost management, tax-efficient withdrawal strategies, and low-cost living options for retirees.

Understanding the Challenges of Retirement

Many retirees worry about outliving their savings when trying to maintain a retirement lifestyle on a budget. This fear is common and very real.

Without strategic planning, maintaining your desired lifestyle can seem impossible. Several clients initially struggle with the uncertainty of future expenses, market fluctuations, and budgeting for retirement.

In my experience, people often find themselves unprepared for unexpected costs. Health issues and long-term care can quickly drain savings, making healthcare cost management crucial.

Strategic planning is essential. Without it, the risk of financial instability increases significantly, affecting your retirement lifestyle on a budget.

By addressing these challenges head-on, including exploring tax-efficient withdrawal strategies, you can secure a more comfortable and confident retirement.

Key Steps to Ensure Financial Stability in Retirement

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress towards a retirement lifestyle on budget:

- Create a detailed budget for retirement expenses: List and categorize all expected expenses for budgeting for retirement.

- Maximize Social Security benefits strategically: Research the optimal claiming age and coordinate spousal benefits for Social Security maximization.

- Explore part-time work or consulting opportunities: Leverage skills for additional income through part-time work in retirement.

- Downsize housing to reduce costs and free up equity: Evaluate current costs and potential savings through downsizing in retirement.

- Implement the Bucket Strategy for income stability: Divide assets into short-term, intermediate-term, and long-term buckets, including fixed income investments.

- Utilize tax-advantaged accounts like IRAs and 401(k)s: Maximize contributions and explore Roth conversions for tax-efficient withdrawal strategies.

- Prioritize health with preventive care and insurance: Maintain health to avoid costly medical bills and focus on healthcare cost management.

Let’s dive in to explore how these strategies can help you achieve a retirement lifestyle on budget!

1: Create a detailed budget for retirement expenses

Creating a detailed budget for retirement expenses is crucial to ensure financial stability and maintain a comfortable retirement lifestyle on a budget.

Actionable Steps:

- List all expected monthly and annual expenses, categorizing them into essentials and discretionary for effective budgeting for retirement.

- Use online budgeting tools or retirement calculators to project expenses over the next 20-30 years, considering fixed income investments and Social Security maximization.

- Regularly review and adjust the budget to reflect any changes in income or expenses, including potential part-time work in retirement.

Explanation:

Having a clear budget helps you manage your resources effectively, reducing the risk of outliving your savings. By categorizing expenses and using tools like retirement calculators, you can plan more accurately for a retirement lifestyle on a budget.

Regular reviews ensure your budget remains relevant, adapting to changes. For more detailed guidance, consider using resources like USA.gov’s budgeting tools.

Key benefits of creating a detailed retirement budget:

- Identifies potential financial gaps early, helping with healthcare cost management

- Helps prioritize spending and savings, including strategies for stretching retirement savings

- Provides peace of mind through clear financial planning, including tax-efficient withdrawal strategies

Budgeting is the foundation of a successful retirement plan, setting the stage for other strategies like downsizing in retirement or exploring low-cost living options for retirees.

2: Maximize Social Security benefits strategically

Maximizing Social Security benefits is crucial for maintaining your retirement lifestyle on a budget and ensuring a stable fixed income during retirement.

Actionable Steps:

- Research the optimal age to start claiming Social Security benefits to maximize payouts and support your retirement lifestyle on a budget.

- Attend a Social Security workshop or consult with a financial advisor to get personalized advice on Social Security maximization.

- Consider spousal benefits and how to coordinate claims for maximum household benefit, enhancing your budgeting for retirement.

Explanation:

Understanding the best time to claim Social Security benefits can significantly impact your retirement income and help in stretching retirement savings.

By attending workshops or consulting with advisors, you can make more informed decisions about Social Security maximization. Coordinating spousal benefits can further enhance your household’s financial security and contribute to a comfortable retirement lifestyle on a budget.

For more detailed guidance, consider visiting Investopedia’s retirement planning resources.

Taking these steps can provide a solid foundation for your retirement planning and help manage your retirement lifestyle on a budget effectively.

3: Explore part-time work or consulting opportunities

Exploring part-time work or consulting opportunities can supplement your income and provide financial stability in retirement, helping you maintain a comfortable retirement lifestyle on a budget.

Actionable Steps:

- Identify skills and experiences that can be leveraged for part-time work in retirement or consulting.

- Network with former colleagues or join professional groups to find opportunities for stretching retirement savings.

- Set realistic goals for the number of hours to work per week and the income needed to supplement retirement savings and manage healthcare costs.

Explanation:

Engaging in part-time work or consulting can provide extra income and keep you mentally active while budgeting for retirement. Networking can open doors to opportunities that match your skills and help with tax-efficient withdrawal strategies.

Setting realistic work goals ensures you balance income needs with personal time. For more detailed guidance, you might find Nitra’s resources helpful in avoiding lifestyle creep while maximizing income.

Benefits of part-time work in retirement:

- Supplements retirement income and assists with fixed income investments

- Keeps skills sharp and mind engaged

- Provides social interaction and purpose while maintaining a retirement lifestyle on a budget

Balancing work and leisure is key to enjoying your retirement and maximizing Social Security benefits.

4: Downsize housing to reduce costs and free up equity

Downsizing housing can significantly reduce living costs and unlock equity for a retirement lifestyle on a budget.

Actionable Steps:

- Evaluate your current housing costs and potential savings from downsizing in retirement.

- Research smaller homes or senior living communities that fit your needs and budget for retirement.

- Plan and execute the downsizing process, including selling your current home and moving to low-cost living options for retirees.

Explanation:

By downsizing, you can lower your housing expenses and free up equity for other retirement needs, supporting budgeting for retirement.

This approach can make your financial resources more manageable and increase your overall financial stability, helping to stretch retirement savings.

For more detailed guidance, consider visiting NCOA’s resources on downsizing and retirement planning.

This strategy helps ensure a comfortable retirement lifestyle on a budget by aligning housing costs with your financial goals.

5: Implement the Bucket Strategy for income stability

Implementing the Bucket Strategy can provide income stability and help manage market risks during retirement, supporting a comfortable retirement lifestyle on a budget.

Actionable Steps:

- Divide retirement assets into three buckets: short-term, intermediate-term, and long-term, considering fixed income investments and Social Security maximization.

- Allocate funds to each bucket based on timeframes and risk tolerance, aiding in budgeting for retirement.

- Regularly rebalance the buckets to ensure funds are appropriately allocated as market conditions change, helping stretch retirement savings.

Explanation:

The Bucket Strategy helps manage risk by spreading assets across different timeframes. This approach provides peace of mind during market fluctuations and supports a retirement lifestyle on a budget.

For more detailed guidance, consider visiting Elevation Financial’s resources on income strategies.

This strategy ensures a more stable and predictable income stream during retirement, contributing to effective tax-efficient withdrawal strategies.

6: Utilize tax-advantaged accounts like IRAs and 401(k)s

Using tax-advantaged accounts can significantly boost your retirement savings and minimize tax liabilities, helping you maintain your desired retirement lifestyle on a budget.

Actionable Steps:

- Maximize contributions: Contribute the maximum amount to your IRAs and 401(k)s each year, including catch-up contributions if you are eligible, to support budgeting for retirement.

- Explore Roth conversions: Convert traditional IRAs to Roth IRAs to take advantage of tax-free withdrawals in retirement, enhancing your fixed income investments strategy.

- Develop a tax-efficient withdrawal strategy: Work with a tax advisor to plan withdrawals that minimize taxes and extend the life of your savings, crucial for stretching retirement savings.

Explanation:

These steps help you maximize retirement savings and reduce future tax burdens. By making the most of contributions and considering Roth conversions, you can secure a more tax-efficient retirement and maintain your desired retirement lifestyle on a budget.

For more guidance, visit Investopedia’s retirement planning resources. This approach ensures your savings last longer and supports your desired lifestyle while managing healthcare costs and exploring low-cost living options for retirees.

7: Prioritize health with preventive care and insurance

Prioritizing health with preventive care and insurance is essential to maintaining a comfortable retirement lifestyle on a budget and managing healthcare costs effectively.

Actionable Steps:

- Schedule regular check-ups: Book annual health exams and preventive screenings to catch issues early, a crucial aspect of healthcare cost management in retirement.

- Review and update insurance: Ensure your health insurance coverage meets your needs and includes necessary services to support your retirement lifestyle on a budget.

- Consider long-term care insurance: Protect against the high costs of prolonged care by investing in long-term care insurance, an important strategy for stretching retirement savings.

Explanation:

These steps help you stay healthy and avoid unexpected medical expenses, which can quickly deplete savings. Regular check-ups and screenings catch health issues early, reducing costly treatments later and supporting a sustainable retirement lifestyle on a budget.

Updating your insurance ensures you have coverage for necessary services. Long-term care insurance protects against high costs of extended care, an essential consideration when budgeting for retirement.

For more information, visit NCOA’s guide on long-term care insurance.

Key aspects of prioritizing health in retirement:

- Focuses on prevention to reduce long-term costs, a crucial part of healthcare cost management

- Ensures adequate insurance coverage for peace of mind while maintaining a retirement lifestyle on a budget

- Protects retirement savings from unexpected health expenses, supporting tax-efficient withdrawal strategies

Taking care of your health ensures your resources last longer, supporting your desired retirement lifestyle on a budget and allowing for potential low-cost living options for retirees.

Partner with Alleo for a Secure Retirement

We’ve explored the challenges of maintaining your retirement lifestyle on a budget. But did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to budgeting for retirement?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your specific financial needs and goals, including strategies for fixed income investments and Social Security maximization.

Alleo’s AI coach will guide you through each step, providing affordable and tailored coaching support. The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you explore options like downsizing in retirement or part-time work in retirement.

Ready to get started for free? Let me show you how to stretch your retirement savings!

Sign up for a free 14-day trial without needing a credit card and start planning your retirement lifestyle on a budget today.

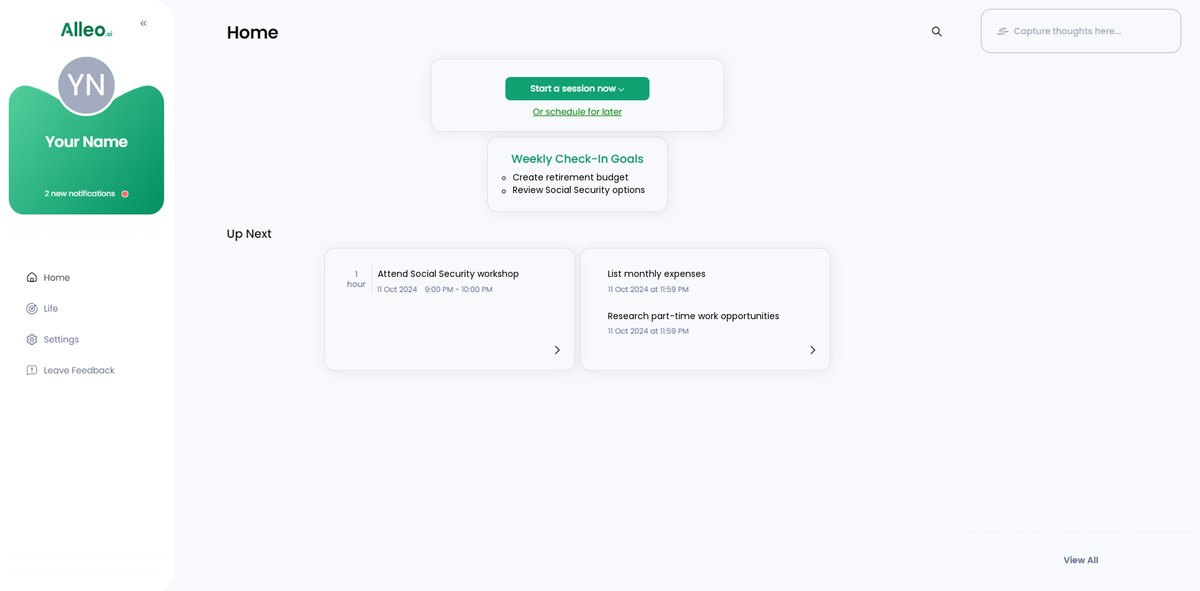

Step 1: Log In or Create Your Account

To begin your journey towards a secure retirement, log in to your existing Alleo account or create a new one to access personalized financial guidance and support.

Step 2: Choose “Improve Overall Well-being and Life Satisfaction”

Select this goal to address your retirement concerns holistically, as it encompasses financial stability, health, and personal fulfillment – key factors in maintaining your desired lifestyle on a limited income during retirement.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to address your retirement planning concerns and receive tailored strategies for maintaining your lifestyle on a limited income.

Step 4: Starting a Coaching Session

Begin your retirement planning journey with an intake session to set up your personalized financial plan, allowing our AI coach to understand your goals and guide you through strategies for maintaining your desired lifestyle on a limited income.

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app to find your retirement planning goals displayed on the home page, allowing you to easily track and manage your progress towards maintaining your desired lifestyle in retirement.

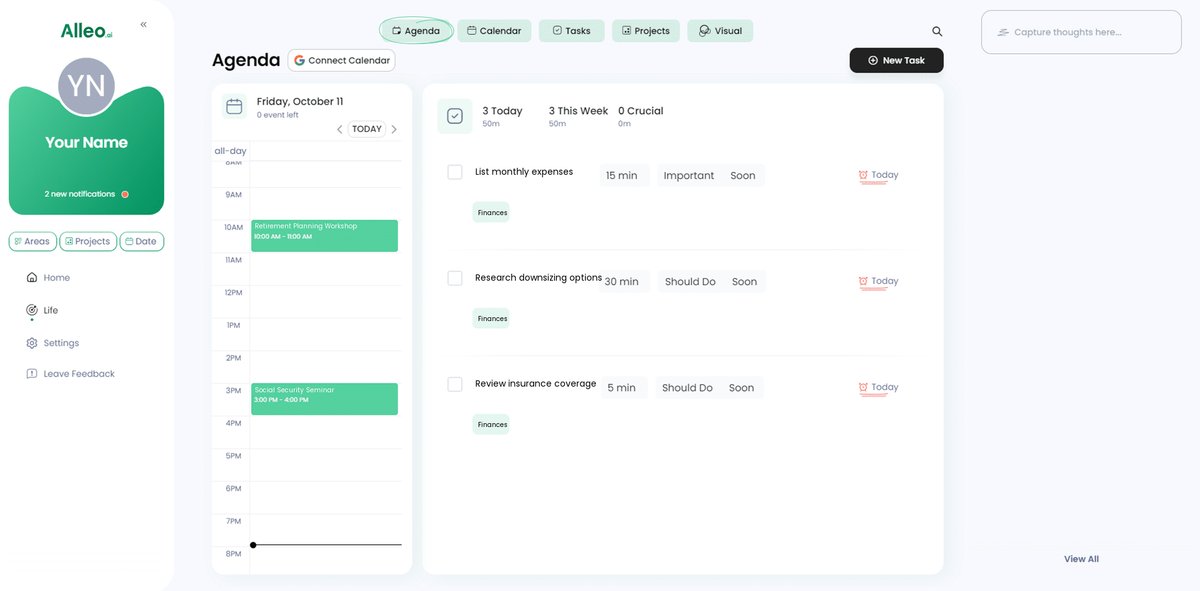

Step 6: Adding events to your calendar or app

Use the AI coach’s calendar and task features to add retirement planning events and milestones, allowing you to easily track your progress in maintaining your desired lifestyle on a limited income during retirement.

Final Thoughts on Maintaining Your Lifestyle in Retirement

As we wrap up, remember that maintaining your desired retirement lifestyle on a budget is achievable with the right strategies.

By focusing on budgeting for retirement, maximizing benefits like Social Security, and smart fixed income investments, you can secure a comfortable future.

It’s normal to feel uncertain, but with planning, you can confidently navigate retirement and explore low-cost living options for retirees.

Take action today and explore the detailed steps we discussed, including tax-efficient withdrawal strategies and healthcare cost management.

And don’t forget, Alleo is here to help you every step of the way in stretching retirement savings.

Try Alleo for free and start your journey to a secure and enjoyable retirement lifestyle on budget.