7 Proven Strategies for Tech Professionals: Mastering Risk Management in Volatile Markets

Are you grappling with sudden market volatility and struggling to manage risks effectively in your tech projects? Risk management for tech professionals has become increasingly crucial in today’s uncertain landscape.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, adapting risk management strategies is crucial in the fast-paced tech industry, especially when it comes to volatile market risk mitigation strategies.

In this article, you’ll discover dynamic risk assessment techniques for tech companies, AI for market trend analysis, cross-functional teams, enhanced cybersecurity risk management in volatile markets, agile risk management approaches for tech startups, scenario planning, and data analytics for tech industry financial risk management.

Let’s dive in to explore how tech professionals can adapt to market uncertainty in IT.

Understanding the Risk Management Challenges in Tech

Navigating risk management for tech professionals is tough. Many clients initially struggle with identifying the full scope of risks they face in the volatile market.

This can lead to project delays, financial losses, and cybersecurity threats, highlighting the need for robust tech industry financial risk management.

Inadequate risk management often results in missed deadlines and increased costs. I often see tech professionals overwhelmed by the rapid changes in market conditions, emphasizing the importance of adapting to market uncertainty in IT.

This highlights the need for dynamic and adaptive strategies in risk management for tech professionals.

Without proper risk management, even small issues can escalate. The consequences can be severe, affecting both project outcomes and overall business stability, underscoring the importance of risk assessment techniques for tech companies.

A Roadmap to Effective Risk Management for Tech Professionals

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for effective risk management for tech professionals to make progress in volatile markets.

- Implement dynamic risk assessment frameworks: Regularly update criteria and involve cross-departmental stakeholders to adapt to market uncertainty in IT.

- Utilize AI for real-time market trend analysis: Adopt AI tools to monitor trends and automate alerts, enhancing tech industry financial risk management.

- Develop cross-functional risk response teams: Form dedicated teams with clear communication channels and conduct regular drills to improve risk management for tech professionals.

- Enhance cybersecurity measures for data protection: Conduct audits, implement multi-layered security, and provide ongoing training for cybersecurity risk management in volatile markets.

- Adopt agile project management for flexibility: Transition to agile methods, conduct reviews, and foster continuous improvement as part of agile risk management approaches for tech startups.

- Conduct regular scenario planning exercises: Organize workshops, analyze scenarios, and update plans accordingly to mitigate volatile market risks.

- Leverage data analytics for informed decisions: Integrate analytics tools, train teams, and monitor KPIs regularly to enhance risk assessment techniques for tech companies.

Let’s dive in!

1: Implement dynamic risk assessment frameworks

Adapting dynamic risk assessment frameworks is essential for risk management for tech professionals in volatile tech markets.

Actionable Steps:

- Update criteria regularly: Schedule quarterly reviews to keep risk assessment techniques for tech companies current.

- Involve cross-departmental stakeholders: Conduct monthly meetings with key team members from various departments to enhance tech industry financial risk management.

- Utilize risk management software: Integrate tools that offer real-time updates and analytics to streamline assessments and aid in adapting to market uncertainty in IT.

Explanation:

Consistently updating risk assessment criteria ensures that you stay ahead of market changes, crucial for volatile market risk mitigation strategies.

Engaging stakeholders from different departments provides diverse perspectives, enhancing risk identification and supporting agile risk management approaches for tech startups.

Using risk management software, as suggested by AuditBoard, automates processes, making assessments more efficient for risk management for tech professionals.

These steps help you mitigate risks effectively, aligning with industry best practices for cybersecurity risk management in volatile markets.

Transitioning to the next part, let’s explore how AI can enhance real-time market trend analysis for risk management for tech professionals.

2: Utilize AI for real-time market trend analysis

Utilizing AI for real-time market trend analysis is crucial for risk management for tech professionals staying ahead in volatile tech markets.

Actionable Steps:

- Implement AI-powered tools: Subscribe to an AI-driven market analysis platform to monitor trends and patterns, enhancing tech industry financial risk management.

- Train team members: Organize bi-monthly training sessions on using AI tools and their applications for adapting to market uncertainty in IT.

- Set up automated alerts: Configure AI tools to send real-time notifications on significant market changes, supporting volatile market risk mitigation strategies.

Explanation:

These steps are vital as they enable you to react swiftly to market shifts. AI tools provide a competitive edge by offering real-time insights and predictive capabilities, essential for risk management for tech professionals.

This aligns with the trend of increasing emphasis on data analytics in financial risk management. By training your team and automating alerts, you ensure that you are always prepared for market changes, improving risk assessment techniques for tech companies.

Key benefits of AI in market trend analysis include:

- Rapid identification of emerging patterns, aiding in economic forecasting for tech industry risk management

- Enhanced accuracy in market predictions, supporting hedging strategies for tech professionals

- Improved decision-making speed, crucial for agile risk management approaches for tech startups

Transitioning to the next part, let’s explore developing cross-functional risk response teams.

3: Develop cross-functional risk response teams

Building cross-functional risk response teams is crucial for addressing the multifaceted challenges in tech projects and implementing effective risk management for tech professionals.

Actionable Steps:

- Form a dedicated risk response team: Identify and assign team members from key departments to ensure diverse expertise in volatile market risk mitigation strategies.

- Establish clear communication channels: Use collaboration tools like Slack or Microsoft Teams for real-time communication to enhance tech industry financial risk management.

- Conduct regular drills: Schedule quarterly simulation exercises to test and refine response strategies, adapting to market uncertainty in IT.

Explanation:

These steps are vital as they ensure a coordinated approach to risk management for tech professionals. Diverse expertise enhances problem-solving, while clear communication and regular drills improve readiness and support risk assessment techniques for tech companies.

According to Cube Software, cross-functional collaboration is key to effective risk management. This approach aligns with best practices, helping you stay prepared and resilient in volatile markets.

Next, let’s explore enhancing cybersecurity measures for data protection, an essential aspect of risk management for tech professionals.

4: Enhance cybersecurity measures for data protection

Enhancing cybersecurity measures is vital for protecting sensitive data in today’s tech industry, forming a crucial part of risk management for tech professionals.

Actionable Steps:

- Conduct comprehensive cybersecurity audits: Hire external auditors to perform annual cybersecurity assessments and identify vulnerabilities, essential for cybersecurity risk management in volatile markets.

- Implement multi-layered security protocols: Introduce two-factor authentication and encryption for sensitive data to enhance protection, addressing tech industry financial risk management concerns.

- Provide ongoing cybersecurity training: Offer monthly workshops and online courses to keep employees updated on the latest threats and practices, a key aspect of risk management for tech professionals.

Explanation:

Taking these steps will ensure your data remains secure, protecting your projects and business operations while adapting to market uncertainty in IT.

By conducting regular audits and implementing multi-layered security, you reduce the risk of breaches. Ongoing training keeps your team informed about evolving cyber threats, crucial for risk management for tech professionals.

According to Cube Software, these measures are essential for maintaining robust cybersecurity in volatile markets.

Next, let’s explore adopting agile project management for flexibility.

5: Adopt agile project management for flexibility

Adopting agile project management is crucial for maintaining flexibility in the fast-paced tech industry and is a key component of risk management for tech professionals.

Actionable Steps:

- Transition to agile project management: Train project managers and teams on agile methodologies to ensure a smooth transition and enhance tech industry financial risk management.

- Conduct regular sprint reviews: Schedule bi-weekly sprint review meetings to assess progress and adapt plans as needed, supporting agile risk management approaches for tech startups.

- Foster a culture of continuous improvement: Encourage team members to provide feedback and suggest improvements during retrospectives, aiding in adapting to market uncertainty in IT.

Explanation:

These steps are essential as they enhance your team’s ability to adapt to changing conditions swiftly. Agile methodologies foster flexibility and continuous improvement, which are critical in volatile markets and crucial for risk management for tech professionals.

According to MBG CPA, dynamic approaches like agile project management help businesses remain competitive and resilient. This ensures you can respond promptly to market changes and maintain project momentum, effectively mitigating volatile market risks.

Core principles of agile project management include:

- Iterative development cycles

- Continuous feedback and adaptation

- Cross-functional team collaboration

Next, let’s explore conducting regular scenario planning exercises as part of comprehensive risk management for tech professionals.

6: Conduct regular scenario planning exercises

Conducting regular scenario planning exercises is crucial for risk management for tech professionals, helping prepare your team to handle unexpected market changes and risks.

Actionable Steps:

- Organize quarterly scenario planning workshops: Gather key stakeholders every quarter to discuss potential market disruptions and develop volatile market risk mitigation strategies.

- Analyze multiple risk scenarios: Create detailed scenarios for various market conditions and evaluate their potential impact on your projects, enhancing your tech industry financial risk management.

- Update risk management plans: Revise and refine your risk management strategies based on the insights gained from each scenario planning session, focusing on adapting to market uncertainty in IT.

Explanation:

These steps help you stay proactive and prepared for potential market disruptions. Scenario planning allows you to anticipate changes and develop robust response strategies, essential for risk management for tech professionals.

According to FERMA, adapting insurance strategies to market conditions is essential for managing risks effectively. Regular scenario planning ensures your risk management plans remain relevant and effective, particularly in addressing cybersecurity risk management in volatile markets.

Transitioning to the next part, let’s explore leveraging data analytics for informed decisions in risk management for tech professionals.

7: Leverage data analytics for informed decisions

Utilizing data analytics is crucial for making informed decisions in volatile tech markets, forming a key component of risk management for tech professionals.

Actionable Steps:

- Implement advanced data analytics tools: Adopt a data analytics platform that offers predictive insights and real-time data integration for effective tech industry financial risk management.

- Train teams on data-driven decision-making: Conduct workshops to enhance your team’s ability to leverage data analytics effectively, focusing on adapting to market uncertainty in IT.

- Monitor key performance indicators (KPIs): Establish dashboards to track KPIs and review them monthly to adjust strategies accordingly, supporting agile risk management approaches for tech startups.

Explanation:

These steps matter because data-driven decision-making provides a competitive edge by offering actionable insights and enhancing risk management efficiency for tech professionals.

According to Cube Software, integrating advanced analytics tools helps businesses predict and mitigate risks. Training your team ensures they can utilize these tools effectively, while regular KPI monitoring keeps your strategies aligned with market conditions, essential for volatile market risk mitigation strategies.

Key advantages of data-driven decision-making:

- Enhanced risk prediction accuracy, crucial for risk assessment techniques for tech companies

- Improved operational efficiency

- Better resource allocation, supporting diversification in tech investment portfolios

Leveraging data analytics ensures you remain agile and informed, ready to tackle any market volatility, a core aspect of risk management for tech professionals.

Partner with Alleo for Effective Risk Management

We’ve explored the challenges of adapting risk management strategies for tech professionals in volatile tech markets and the steps to overcome them. But did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to volatile market risk mitigation strategies?

Setting up an account with Alleo is simple. Sign up for a free 14-day trial, no credit card required. This is perfect for tech industry professionals looking to enhance their financial risk management skills.

Create a personalized plan with our AI coach tailored to your risk management needs in the tech sector. Alleo’s coach will follow up on your progress and handle changes as they arise, helping you adapt to market uncertainty in IT.

Stay accountable with timely text and push notifications, ensuring you stay on top of your risk assessment techniques for tech companies.

Ready to get started for free? Let me show you how to improve your risk management for tech professionals!

Step 1: Log In or Create Your Account

To start managing risks effectively, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose Your Risk Management Focus

Select “Setting and achieving personal or professional goals” to start tackling your specific risk management challenges, aligning your efforts with the strategies outlined in the article to navigate market volatility effectively.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area to address the risk management challenges in your tech projects, aligning our AI coach’s guidance with your professional goals for navigating market volatility and enhancing your risk management strategies.

Step 4: Starting a coaching session

Begin your risk management journey with an intake session, where our AI coach will help you set up a personalized plan tailored to your tech project’s specific needs and market challenges.

Step 5: Viewing and Managing Goals After the Session

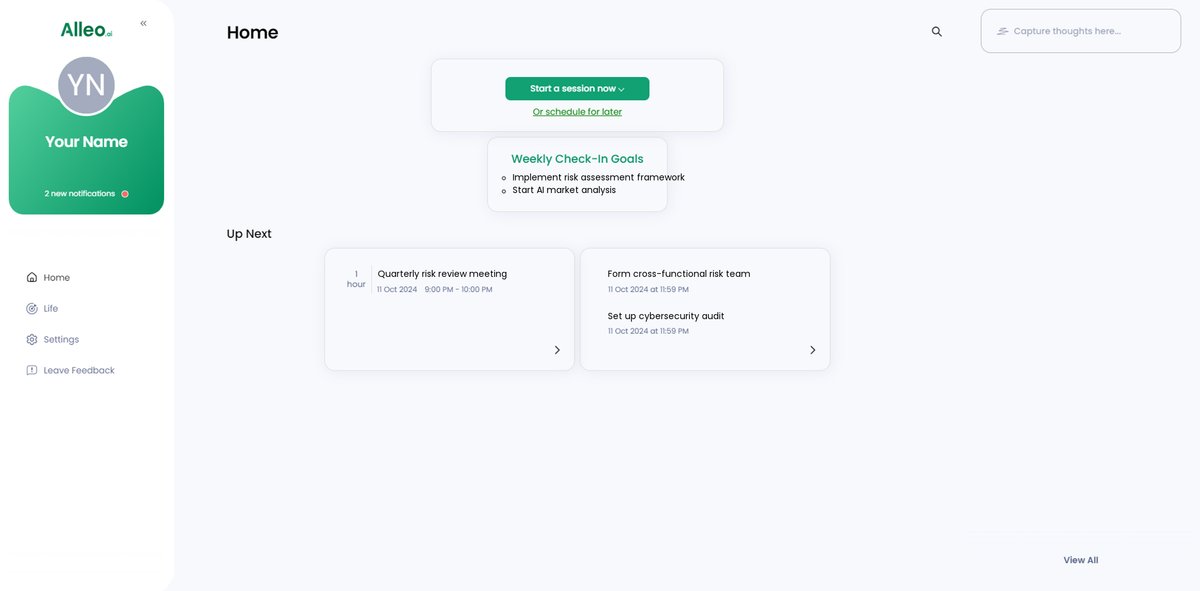

After your AI coaching session on risk management strategies, check the app’s home page to view and manage the goals you discussed, allowing you to track your progress in implementing effective risk management practices.

Step 6: Adding events to your calendar or app

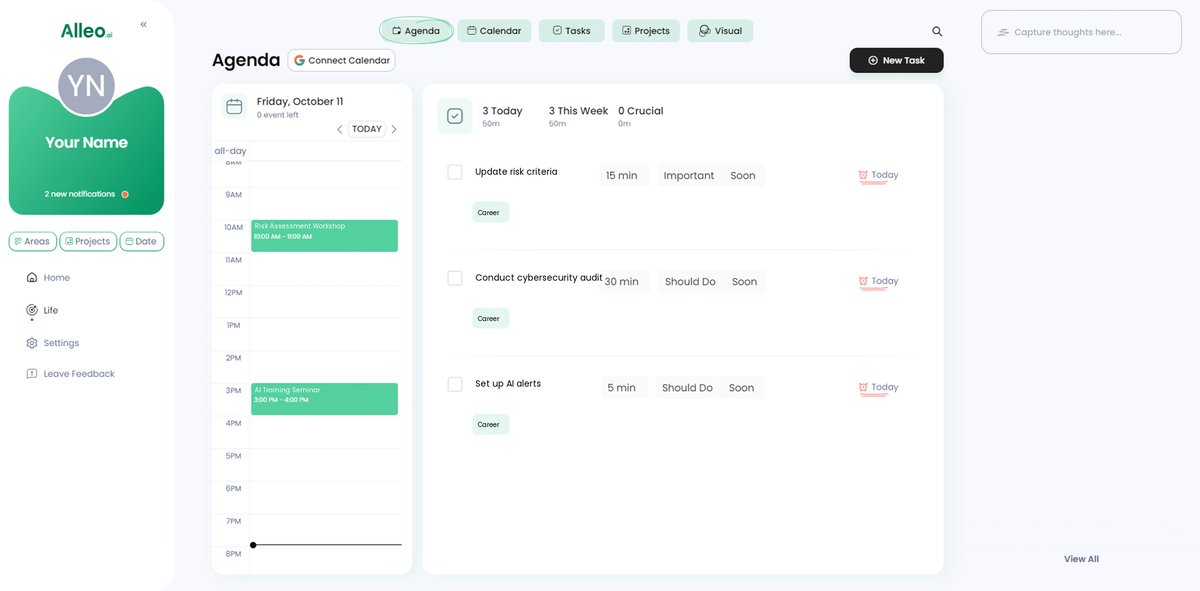

Use the calendar and task features in the Alleo app to schedule and track your risk management activities, helping you stay on top of your progress as you implement the strategies discussed in this article.

Bringing It All Together: Your Path to Effective Risk Management

As we wrap up, let’s remember how crucial adaptive risk management for tech professionals is in today’s volatile market. The strategies we’ve discussed can help you navigate market uncertainty with confidence.

Take action now. Implement dynamic risk assessment techniques for tech companies, utilize AI for economic forecasting, and develop cross-functional teams for tech industry financial risk management.

Enhance cybersecurity risk management in volatile markets, adopt agile risk management approaches for tech startups, conduct scenario planning, and leverage data analytics for adapting to market uncertainty in IT.

I understand the challenges you face in tech industry financial risk management. You don’t have to tackle them alone.

Remember, Alleo is here to support you with risk management for tech professionals. Sign up for a free 14-day trial and start managing risks more effectively today.

Ready to transform your risk management approach and implement volatile market risk mitigation strategies? Let’s get started!