7 Smart Steps to Evaluate Free Retirement Consultations for Young Professionals

Are you uncertain about whether to accept complimentary retirement planning and investment consultation offered by Fidelity? Evaluating free retirement consultations can be a crucial step in your financial journey.

As a life coach, I’ve helped many professionals navigate these challenges. I understand the struggle between self-managing finances and seeking professional advice, especially when it comes to retirement planning for millennials and financial advice for young adults.

In this article, you’ll learn seven key steps to evaluate free retirement consultation services. I’ll guide you through researching advisor credentials, comparing fee structures, and more. These tips will help you in choosing a retirement advisor and optimizing your 401(k) investments.

Let’s dive into retirement savings strategies for beginners and long-term investment options for youth.

Understanding the Dilemma: Free Retirement Consultations

Navigating the complexities of evaluating free retirement consultations can be daunting. Many young professionals, especially those with side hustles, face uncertainties about whether these retirement planning for millennials services truly add value.

It’s common to wonder if self-managing your finances might be more effective than choosing a retirement advisor.

In my experience, people often find themselves torn between the allure of free financial consultations and the fear of hidden costs or biases. Accepting complimentary services can sometimes lead to doubts about the advisor’s true intentions when evaluating free retirement consultations.

Several clients report feeling overwhelmed by the sheer volume of information and options available for retirement savings strategies for beginners. This uncertainty can cause significant stress and indecision when comparing retirement consultation services.

Steps to Evaluate Free Retirement Consultation Services

Overcoming this challenge requires a few key steps when evaluating free retirement consultations. Here are the main areas to focus on to make progress in retirement planning for millennials:

- Research advisor credentials and certifications: Verify the financial advisor’s professional qualifications for retirement savings strategies.

- Compare fee structures and compensation models: Analyze the costs involved in choosing a retirement advisor and check for hidden fees.

- Check for fiduciary responsibility commitment: Ensure the advisor adheres to fiduciary standards when providing financial advice for young adults.

- Assess personalized planning approach offered: Evaluate the customization and depth of the retirement planning services.

- Evaluate digital tools and resources provided: Check the technology and resources the advisor offers for long-term investment options.

- Seek testimonials from other young professionals: Gather feedback from peers about the advisor’s services and 401(k) optimization tips.

- Schedule a brief intro call to gauge rapport: Assess your comfort level and the advisor’s responsiveness when comparing retirement consultation services.

Let’s dive into evaluating free retirement consultations!

1: Research advisor credentials and certifications

Evaluating the qualifications of retirement consultants is essential for ensuring you receive expert guidance when evaluating free retirement consultations.

Actionable Steps:

- Verify the advisor’s credentials on official registry websites.

- Confirm the credibility of the institutions issuing these certifications.

- Check if the advisor has ongoing education requirements for retirement planning for millennials.

Key credentials to look for in a retirement advisor when choosing a retirement advisor:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Retirement Income Certified Professional (RICP)

Explanation: Researching an advisor’s credentials ensures they have the necessary expertise and adhere to industry standards when providing financial advice for young adults. For instance, a Certified Plan Sponsor Professional (CPSP) indicates a strong understanding of retirement plan sponsorship.

This step helps you avoid unqualified advisors, ensuring your financial future is in capable hands when evaluating free retirement consultations.

Understanding these credentials allows you to make informed decisions about who to trust with your retirement planning and long-term investment options for youth.

2: Compare fee structures and compensation models

Evaluating fee structures and compensation models is crucial to understanding the true cost of retirement consultation services, especially when evaluating free retirement consultations.

Actionable Steps:

- Request a fee schedule: Ask the advisor for a detailed fee schedule and analyze the costs involved in retirement planning for millennials.

- Compare fees with industry standards: Use online resources to see if the fees align with what other professionals charge in the market for financial advice for young adults.

- Identify hidden charges: Determine if there are any additional fees or potential conflicts of interest by reviewing the advisor’s fine print when choosing a retirement advisor.

Explanation: Comparing fee structures helps you make informed financial decisions and avoid unexpected costs. For example, a fee-only advisor might be more transparent than a commission-based one when offering free financial consultations.

Understanding these models ensures you pick an advisor who aligns with your financial goals and retirement savings strategies for beginners. For more insights, check out Investopedia’s tips on financial planning for young investors.

Taking these steps can save you from hidden costs and ensure your advisor’s interests align with yours when evaluating free retirement consultations and comparing retirement consultation services.

3: Check for fiduciary responsibility commitment

Evaluating an advisor’s fiduciary responsibility is crucial to ensure they act in your best financial interest when evaluating free retirement consultations.

Actionable Steps:

- Ask the advisor directly: Inquire if they adhere to fiduciary standards and are legally obligated to prioritize your financial well-being when choosing a retirement advisor.

- Request a written statement: Obtain a document from the advisor confirming their commitment to fiduciary duty and ethical practices in retirement planning for millennials.

- Research past complaints: Look up any previous issues or complaints related to fiduciary breaches on regulatory websites when evaluating financial advisor credentials.

Explanation: Ensuring your advisor is committed to fiduciary responsibility helps protect your financial interests during free financial consultations.

According to the Certified Plan Sponsor Professional (CPSP) handbook, fiduciary standards are vital for ethical conduct in retirement planning. This step ensures your advisor is trustworthy and prioritizes your long-term goals when evaluating free retirement consultations.

Taking these steps helps you secure reliable and ethical financial advice for young adults.

4: Assess personalized planning approach offered

When evaluating free retirement consultations, assessing how personalized the planning approach is can significantly impact your retirement success.

Actionable Steps:

- Request a sample financial plan: Ask the advisor to provide a sample plan to see the level of customization, which is crucial when choosing a retirement advisor.

- Check for specific tax strategies: Ensure the plan includes tailored tax strategies that match your unique financial situation, an important aspect of retirement planning for millennials.

- Verify coverage of variable income: Confirm the plan addresses side hustle income and other variable earnings specific to your lifestyle, a key consideration in financial advice for young adults.

Key elements of a personalized retirement plan:

- Customized investment strategy, including long-term investment options for youth

- Tailored risk management approach

- Individualized retirement income projections and 401(k) optimization tips

Explanation: Personalization in financial planning ensures that your unique needs are met, increasing the likelihood of achieving your retirement savings strategies for beginners.

According to a study by ASPPA, personalized plans lead to better retirement readiness.

This step in evaluating free retirement consultations ensures your advisor is committed to providing tailored advice that aligns with your specific financial situation and supports retirement goal setting for professionals.

Assessing these aspects helps ensure that your financial plan is comprehensive and tailored to your unique needs when comparing retirement consultation services.

5: Evaluate digital tools and resources provided

Assessing the digital tools and resources provided by an advisor can greatly enhance your retirement planning experience and is a crucial step when evaluating free retirement consultations.

Actionable Steps:

- Test provided financial planning software: Use the advisor’s recommended tools to see if they meet your needs for retirement savings strategies for beginners.

- Check integration with existing systems: Ensure the new tools work seamlessly with your current financial management practices, including 401(k) optimization tips.

- Assess user-friendliness: Evaluate how easy the tools are to use and their accessibility from different devices, especially for retirement planning for millennials.

Explanation: Evaluating digital tools helps ensure you have the best resources for effective financial planning and choosing a retirement advisor.

According to ASPPA, digital and hybrid advice services are increasingly popular among DIY investors seeking financial advice for young adults.

This step helps you choose tools that enhance your financial decision-making and simplify complex tasks when comparing retirement consultation services.

Taking these steps ensures that the digital resources provided by your advisor are both effective and user-friendly for long-term investment options for youth.

6: Seek testimonials from other young professionals

Knowing what others have experienced can provide valuable insights into evaluating free retirement consultations and their effectiveness for young adults.

Actionable Steps:

- Join online forums: Participate in discussions on platforms like Reddit or LinkedIn to ask for recommendations and reviews from peers about retirement planning for millennials.

- Request references: Ask the advisor for contact details of former clients who are willing to share their experiences with free financial consultations.

- Engage on social media: Use Twitter or Facebook groups to connect with other young professionals who can provide feedback on choosing a retirement advisor.

Questions to ask when seeking testimonials:

- How responsive is the advisor to your retirement savings strategies for beginners?

- Has the advisor’s guidance improved your financial situation and long-term investment options?

- Would you recommend this advisor to a friend looking for 401(k) optimization tips?

Explanation: Hearing from others who have already navigated similar decisions can help you avoid common pitfalls and make informed choices when evaluating free retirement consultations.

According to a study by ASPPA, personalized feedback significantly improves retirement readiness. Therefore, seeking testimonials ensures you get unbiased opinions and practical advice on retirement goal setting for professionals.

This step can give you confidence in your decision and help you find an advisor who aligns with your goals when comparing retirement consultation services.

7: Schedule a brief intro call to gauge rapport

Scheduling a brief intro call with a retirement advisor helps ensure a good fit and effective communication when evaluating free retirement consultations.

Actionable Steps:

- Schedule a 15-minute introductory call: Arrange a short call to discuss your needs and get a feel for the advisor’s approach to retirement planning for millennials.

- Prepare a list of questions: Compile questions about their experience, planning style, and how they handle clients with side hustles, focusing on retirement savings strategies for beginners.

- Assess comfort level: During the call, evaluate your comfort with the advisor’s communication style and responsiveness in providing financial advice for young adults.

Explanation: These steps are vital to ensure you feel comfortable and confident with your retirement advisor.

Building rapport is crucial for a successful advisor-client relationship when choosing a retirement advisor.

According to Financial Samurai, differing expectations and communication styles can impact the retirement planning process.

Therefore, a brief call can help you decide if the advisor is a good match for your needs when evaluating free retirement consultations.

This initial conversation can set the tone for a productive and trustworthy relationship with your advisor, focusing on long-term investment options for youth and 401(k) optimization tips.

Partner with Alleo to Evaluate Free Retirement Consultations

We’ve explored the challenges of evaluating free retirement consultations and the steps to navigate them. But did you know you can work with Alleo to make this process of evaluating free retirement consultations easier and faster?

With Alleo, you can set up an account and create a personalized retirement planning for millennials plan. Alleo’s AI coach will provide tailored coaching support to tackle these challenges, including choosing a retirement advisor and optimizing your 401(k).

The coach offers full coaching sessions, just like a human coach, and includes a free 14-day trial with no credit card required. This is perfect for those seeking free financial consultations and advice for young adults.

Alleo will follow up on your progress, handle any changes, and keep you accountable through text and push notifications. This support is crucial when setting retirement goals for professionals and exploring long-term investment options for youth.

Ready to get started for free and begin evaluating free retirement consultations? Let me show you how!

Step 1: Log In or Create Your Account

To start evaluating free retirement consultations with our AI coach, log in to your existing Alleo account or create a new one in just a few clicks.

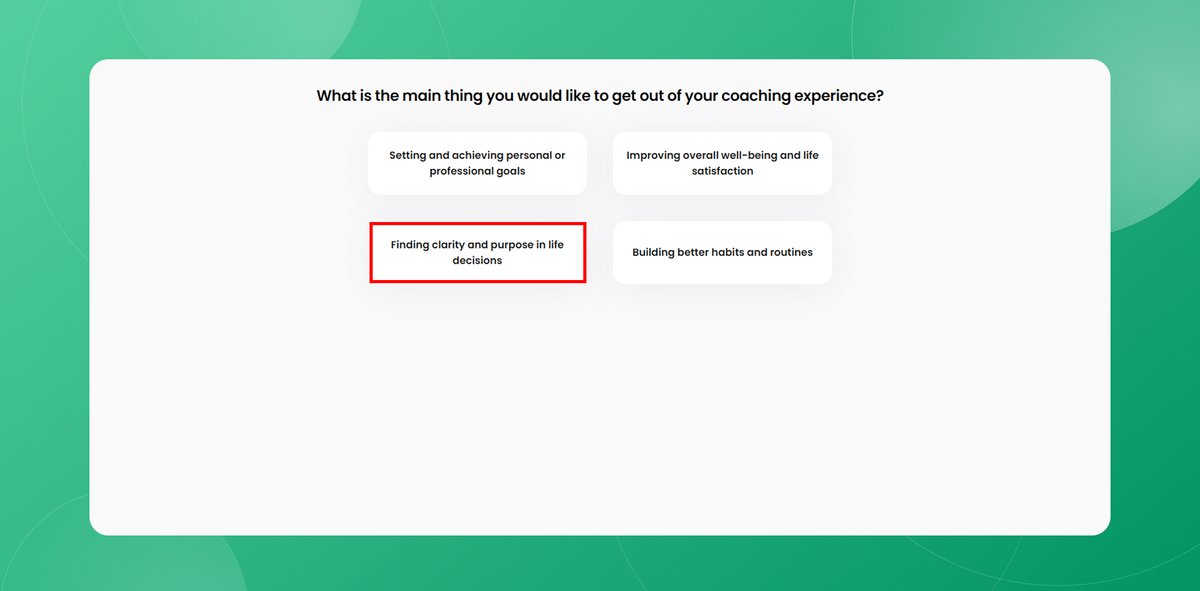

Step 2: Choose Your Focus Area

Select “Finding clarity and purpose in life decisions” as your goal to help navigate the complexities of retirement planning and free consultations, aligning your financial choices with your broader life objectives.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on in Alleo, aligning with your goal of evaluating free retirement consultations and making informed financial decisions for your future.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your retirement planning goals and create a personalized roadmap to evaluate free consultation offers effectively.

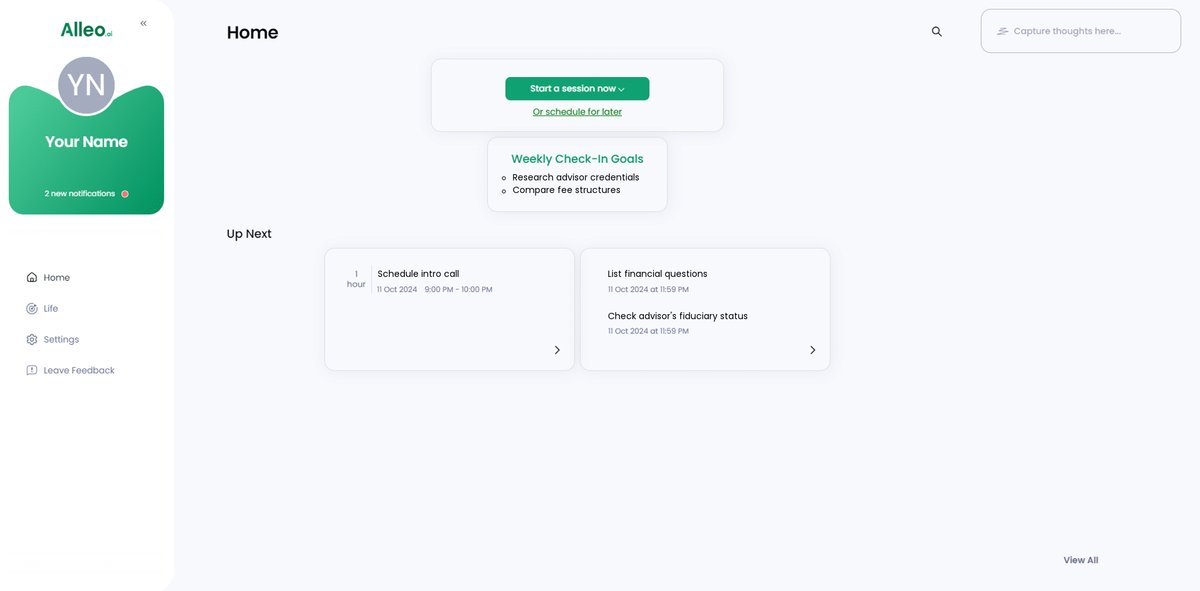

Step 5: Viewing and managing goals after the session

After your retirement planning coaching session, check the Alleo app’s home page to review and manage the personalized goals you discussed, ensuring you stay on track with your financial objectives.

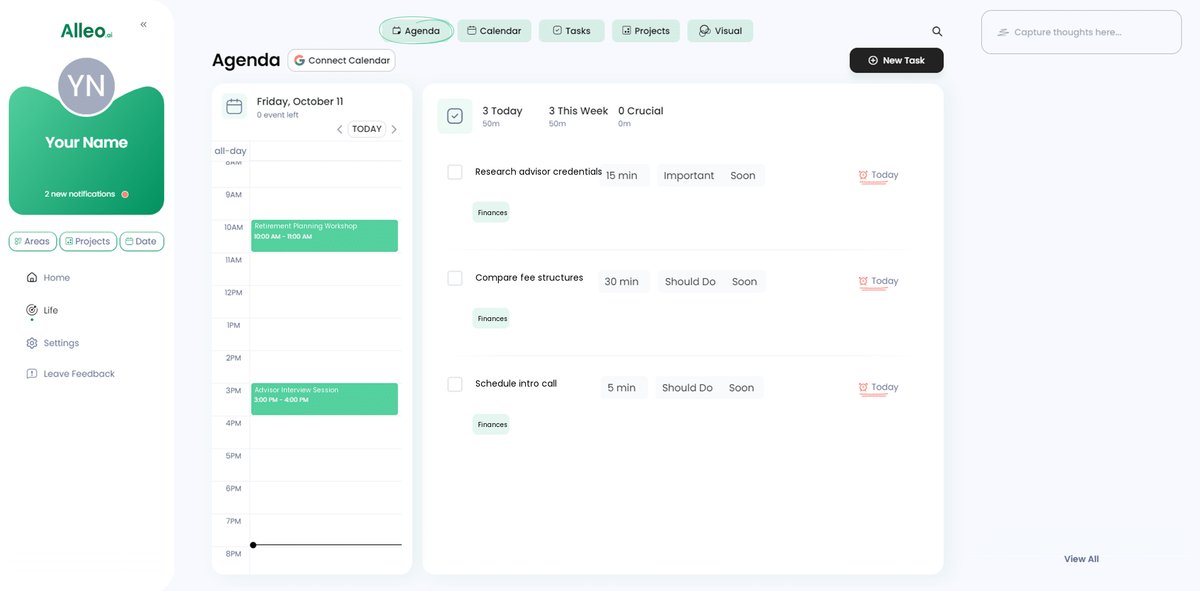

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule and track important dates related to your retirement planning process, such as advisor meetings or deadlines for reviewing financial documents, helping you stay organized and accountable as you evaluate free retirement consultation services.

Wrapping Up: Make Informed Choices for Your Future

Evaluating free retirement consultations can be challenging, especially for young professionals with side hustles seeking retirement planning for millennials.

Remember, assessing financial advisor credentials, fee structures, and personalization is crucial when choosing a retirement advisor.

Always check for fiduciary responsibility and evaluate digital tools provided for retirement savings strategies for beginners.

Don’t forget to seek testimonials and schedule an intro call when comparing retirement consultation services.

Empower yourself with knowledge about long-term investment options for youth and make informed financial decisions.

You’re not alone in this journey—I’ve helped many professionals like you with retirement goal setting for professionals.

Partner with Alleo to simplify this process and stay on track with your goals, including 401(k) optimization tips.

Try Alleo for free today and take control of your financial future through free financial consultations.