7 Smart Strategies for Empty Nesters Considering Rental Property Investment

Are you an empty nester considering whether to use a paid-off property as a rental investment or sell it? This decision is crucial for retirement planning with rental properties.

As a life coach, I’ve guided many through this exact dilemma. It’s a decision that blends financial planning for empty nesters with lifestyle changes, often addressing empty nest syndrome and real estate investing.

In this article, we’ll explore the best strategies for rental investment for empty nesters. You’ll learn how to evaluate rental income potential, manage property tasks, and weigh the pros and cons of selling versus renting. We’ll cover topics like passive income through rental properties and tax benefits of rental property ownership.

Let’s dive in to discover how rental property investment for empty nesters can diversify your retirement portfolio with real estate.

The Dilemma of Renting vs. Selling

Deciding whether to rent out or sell a property can be daunting, especially for empty nesters considering rental investment. Many clients initially struggle with the potential management responsibilities that come with renting.

You may worry about handling maintenance, tenant issues, and unexpected costs when exploring rental property investment for empty nesters.

On the other hand, selling might mean missing out on potential rental income and passive income through rental properties. In my experience, people often find it challenging to predict the financial implications accurately, particularly when considering real estate investing after kids leave home.

The emotional attachment to a home adds another layer of complexity, often intertwined with empty nest syndrome and real estate investing.

It’s a tough decision, balancing financial benefits against lifestyle impacts. You’ll need to weigh these factors carefully to make the best choice for your future, considering aspects like tax benefits of rental property ownership and retirement planning with rental properties.

Strategic Steps for Empty Nesters Considering Rental Property Investment

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for rental investment for empty nesters to make progress.

- Consult a fee-only Certified Financial Planner: Get unbiased advice to set clear financial goals for empty nest syndrome and real estate investing.

- Evaluate property’s rental income potential: Research local rental rates and calculate potential passive income through rental properties.

- Assess personal capacity for property management: Weigh the pros and cons of self-managing versus hiring a manager, considering property management tips for new landlords.

- Compare ROI of renting vs. selling the property: Calculate and compare the return on investment for both options in rental property investment for empty nesters.

- Research local rental market trends and demands: Analyze current trends and attend local real estate workshops to aid in choosing the right rental property location.

- Consider tax implications of rental income: Consult a tax advisor to understand deductions and liabilities, including tax benefits of rental property ownership.

- Explore low-maintenance property upgrades: Identify and plan for upgrades that enhance rental appeal, contributing to retirement planning with rental properties.

Let’s dive into rental investment for empty nesters!

1: Consult a fee-only Certified Financial Planner

Consulting a fee-only Certified Financial Planner (CFP) is crucial for making informed financial decisions, especially when considering rental investment for empty nesters.

Actionable Steps:

- Schedule a consultation: Set up a meeting with a fee-only CFP to get unbiased advice tailored to your situation, including rental property investment for empty nesters.

- Prepare financial documents: Gather relevant financial records and property details to discuss during the consultation, focusing on retirement planning with rental properties.

- Set clear goals: Define your financial objectives and goals to maximize the benefits of the meeting, considering passive income through rental properties.

Explanation:

These steps matter because a fee-only CFP provides objective guidance, helping you navigate complex financial decisions without conflicts of interest, particularly for real estate investing after kids leave home.

According to the Berkeley Parents Network, consulting a fee-only advisor can prevent potential conflicts and ensure advice is in your best interest, which is crucial for empty nesters considering rental investment.

This consultation helps align your rental property investment with your long-term financial goals, addressing empty nest syndrome and real estate investing.

Key benefits of working with a fee-only CFP for rental investment for empty nesters:

- Unbiased financial advice on diversifying retirement portfolio with real estate

- Customized investment strategies for choosing the right rental property location

- Comprehensive financial planning, including tax benefits of rental property ownership

Taking these steps helps lay a solid foundation for your financial planning journey, especially when considering rental investment for empty nesters.

2: Evaluate property’s rental income potential

Understanding the potential rental income is crucial when deciding whether to rent out your property, especially for empty nesters considering rental investment.

Actionable Steps:

- Research local rental rates: Investigate the rental prices of similar properties in your area using online platforms or consulting a real estate agent. This is essential for rental property investment for empty nesters.

- Calculate potential rental income: Estimate your rental income by considering factors like occupancy rates and seasonal demand. This step is crucial for financial planning for empty nesters.

- Conduct a cost-benefit analysis: Compare the potential rental income with the expected expenses, including maintenance and management costs. This analysis is key for retirement planning with rental properties.

Explanation:

These steps matter because knowing the potential rental income helps you make an informed decision. Analyzing local rental rates and calculating income provides a realistic view of what to expect, which is vital for empty nesters exploring passive income through rental properties.

According to Investopedia, understanding these aspects is key to assessing the financial viability of renting your property. This analysis will guide you in balancing potential income with the responsibilities of property management, an important consideration for those dealing with empty nest syndrome and real estate investing.

Next, let’s assess your personal capacity for property management.

3: Assess personal capacity for property management

Evaluating your ability to manage rental properties is essential to make an informed decision about rental investment for empty nesters.

Actionable Steps:

- Evaluate your willingness and time: Consider your enthusiasm and availability for handling property management tasks, such as maintenance and tenant relations, when exploring rental property investment for empty nesters.

- Consider hiring a management company: If direct management is not feasible, explore the option of hiring a professional property management company, which can be beneficial for empty nesters seeking passive income through rental properties.

- List pros and cons: Create a detailed list of the advantages and disadvantages of self-managing versus outsourcing management to make an informed choice about real estate investing after kids leave home.

Explanation:

These steps matter because understanding your capacity helps you avoid overwhelm and maintain a balanced lifestyle when considering rental investment for empty nesters.

According to Pacaso, many empty nesters prefer low-maintenance homes, suggesting a potential preference for professional management in rental property investments.

Evaluating these factors will guide you in making a decision that aligns with your personal and financial goals for retirement planning with rental properties.

Next, let’s compare the ROI of renting versus selling your property.

4: Compare ROI of renting vs. selling the property

Understanding the return on investment (ROI) for both renting and selling is vital for making an informed decision, especially for empty nesters considering rental investment.

Actionable Steps:

- Calculate rental ROI: Assess all potential costs, including maintenance, taxes, and management fees, against the expected rental income for your rental property investment as an empty nester.

- Evaluate selling ROI: Determine the current market value of your property and subtract any associated selling costs to find the net profit, considering this as part of your financial planning for empty nesters.

- Compare long-term benefits: Analyze how each option aligns with your financial goals, considering factors like cash flow and asset appreciation, which is crucial for retirement planning with rental properties.

Explanation:

These steps matter because they provide a clear financial picture of both options. By calculating the ROI, you can see which choice offers better returns for rental investment for empty nesters.

According to Investopedia, understanding these financial metrics is essential for making informed investment decisions. This analysis helps you align your decision with your long-term financial objectives, including diversifying retirement portfolio with real estate.

Factors to consider when comparing ROI:

- Long-term appreciation potential in real estate investing after kids leave home

- Tax benefits of rental property ownership

- Current market conditions for choosing the right rental property location

Now, let’s move on to researching local rental market trends and demands.

5: Research local rental market trends and demands

Understanding local rental market trends and demands is crucial for making informed decisions about your rental investment for empty nesters.

Actionable Steps:

- Analyze current rental trends: Review local rental market reports and data to identify trends such as vacancy rates and average rental prices for rental property investment for empty nesters.

- Evaluate demand factors: Investigate key demand drivers like proximity to schools, public transportation, and employment hubs when choosing the right rental property location.

- Attend real estate seminars: Participate in local real estate investment seminars to gain insights on financial planning for empty nesters and network with industry experts.

Explanation:

These steps matter because staying informed about market trends ensures your rental investment for empty nesters decisions are timely and relevant.

By analyzing rental trends and demand factors, you can better understand the market’s dynamics for real estate investing after kids leave home.

According to Investopedia, knowing these aspects is essential for assessing the viability of a rental property.

Attending seminars further enhances your market knowledge and helps you make well-informed choices about passive income through rental properties.

Next, let’s consider the tax benefits of rental property ownership.

6: Consider tax implications of rental income

Understanding the tax implications of rental income is crucial for maximizing your returns, especially when considering rental investment for empty nesters.

Actionable Steps:

- Consult a tax advisor: Schedule a meeting with a tax professional to understand deductions and liabilities associated with rental income for empty nesters exploring real estate investing after kids leave home.

- Explore tax strategies: Investigate tax strategies like depreciation and expense deductions that can maximize your rental property investment for empty nesters.

- Review local and federal tax benefits: Stay informed about any local or federal tax incentives available for rental property ownership, which can aid in financial planning for empty nesters.

Explanation:

These steps matter because they help you optimize your rental income by minimizing tax liabilities, an important aspect of retirement planning with rental properties.

According to Investopedia, understanding tax implications is essential for effective financial planning.

Consulting a tax advisor ensures that you leverage all available benefits and make informed decisions about your rental property, which is crucial for empty nesters diversifying retirement portfolio with real estate.

Next, let’s explore low-maintenance property upgrades.

7: Explore low-maintenance property upgrades

Exploring low-maintenance property upgrades can significantly enhance the rental appeal of your property, making it an ideal rental investment for empty nesters.

Actionable Steps:

- Install energy-efficient appliances: Replace old appliances with energy-efficient models to reduce utility costs and attract eco-conscious tenants, a key consideration in rental property investment for empty nesters.

- Upgrade to durable flooring: Choose materials like tile or hardwood that require less maintenance and have a longer lifespan, essential for empty nesters seeking passive income through rental properties.

- Implement smart home features: Add smart thermostats and security systems to increase convenience and appeal to tech-savvy renters, enhancing the property’s value for retirement planning with rental properties.

Explanation:

These steps matter because they help reduce ongoing maintenance costs and increase your property’s attractiveness to potential renters, which is crucial for empty nesters diversifying retirement portfolio with real estate.

According to NAAHQ, renters will pay a premium for features that enhance convenience and reduce maintenance.

By making these upgrades, you can achieve higher rental income while minimizing the effort required to maintain the property, an important aspect of financial planning for empty nesters.

Popular low-maintenance upgrades:

- Low-maintenance landscaping

- High-quality, durable paint

- Water-efficient plumbing fixtures

Taking these steps ensures your property is low-maintenance and appealing, making it easier to manage and more attractive to renters, which is beneficial for empty nesters exploring real estate investing after kids leave home.

Partner with Alleo for Your Real Estate Investment Journey

We’ve explored the challenges of deciding to rent or sell your property, the financial implications, and the steps to take for rental investment for empty nesters. But did you know you can work directly with Alleo to make this decision easier and faster?

Alleo is an AI life coach and organizer that helps empty nesters with financial planning for rental property investment and decision-making. Setting up an account is simple and quick.

Start by creating a personalized plan tailored to your specific needs, including strategies for real estate investing after kids leave home.

Once your plan is set, Alleo will guide you through each step. The AI coach provides full coaching sessions that mimic human coaches, ensuring you get the support you need for passive income through rental properties.

Alleo will follow up on your progress, handle any changes, and keep you accountable with text and push notifications, helping you navigate empty nest syndrome and real estate investing.

Plus, you can try Alleo for free with a 14-day trial, no credit card required. This gives you a risk-free opportunity to experience the benefits of rental property investment for empty nesters.

Ready to get started for free? Let me show you how!

Step 1: Start Your Journey with Alleo

Log in to your existing Alleo account or create a new one to begin your personalized property investment planning with our AI coach.

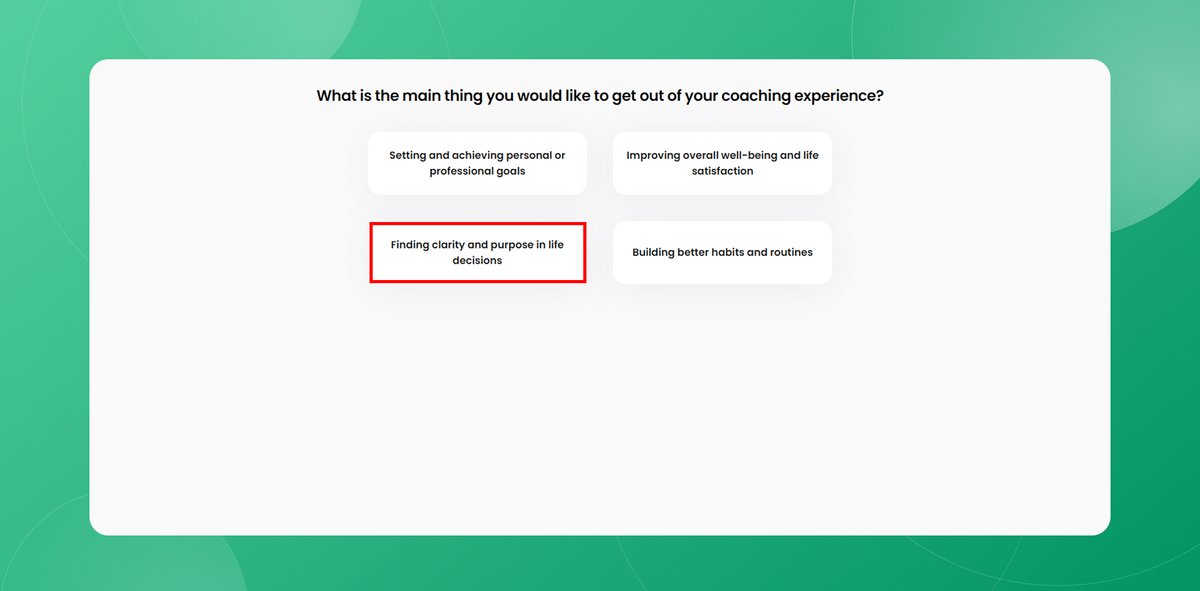

Step 2: Choose Your Focus Area

Select “Finding clarity and purpose in life decisions” to help navigate your property investment choices, aligning your financial goals with your new empty nester lifestyle and future aspirations.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to get tailored guidance on rental property investments, tax implications, and financial planning strategies that will help you make the best decision for your empty nester situation.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by initiating an intake session, where you’ll discuss your property investment goals and create a personalized plan to guide your decision-making process between renting or selling your empty nest home.

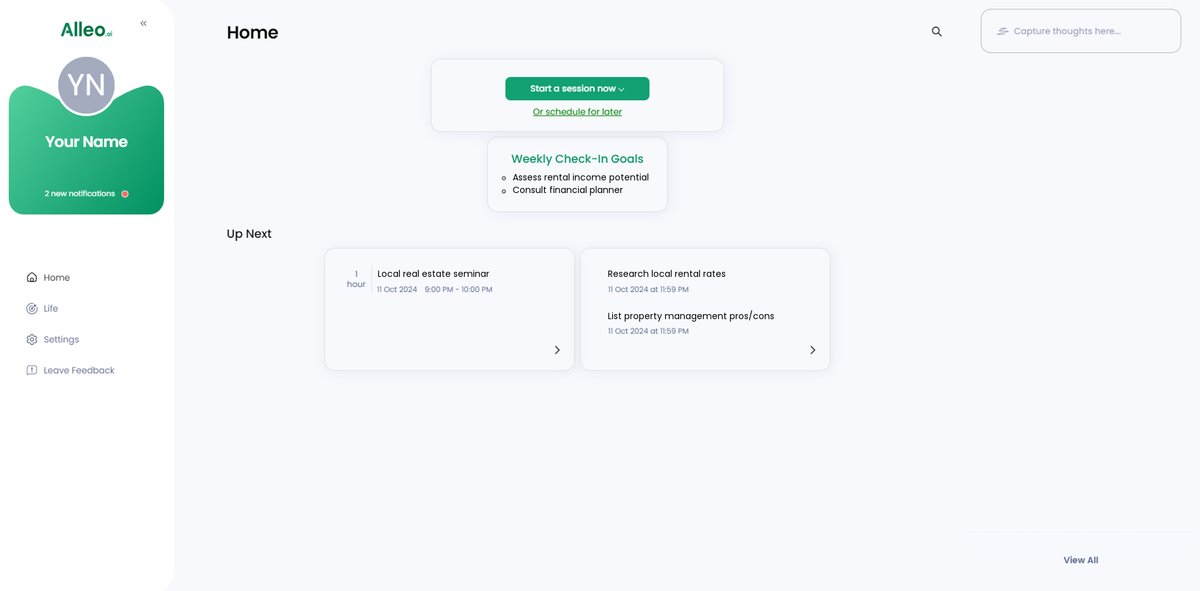

Step 5: Viewing and Managing Goals After the Session

After your coaching session on rental property investment, check the Alleo app’s home page to review and manage the financial and property management goals you discussed, allowing you to track your progress and make adjustments as needed.

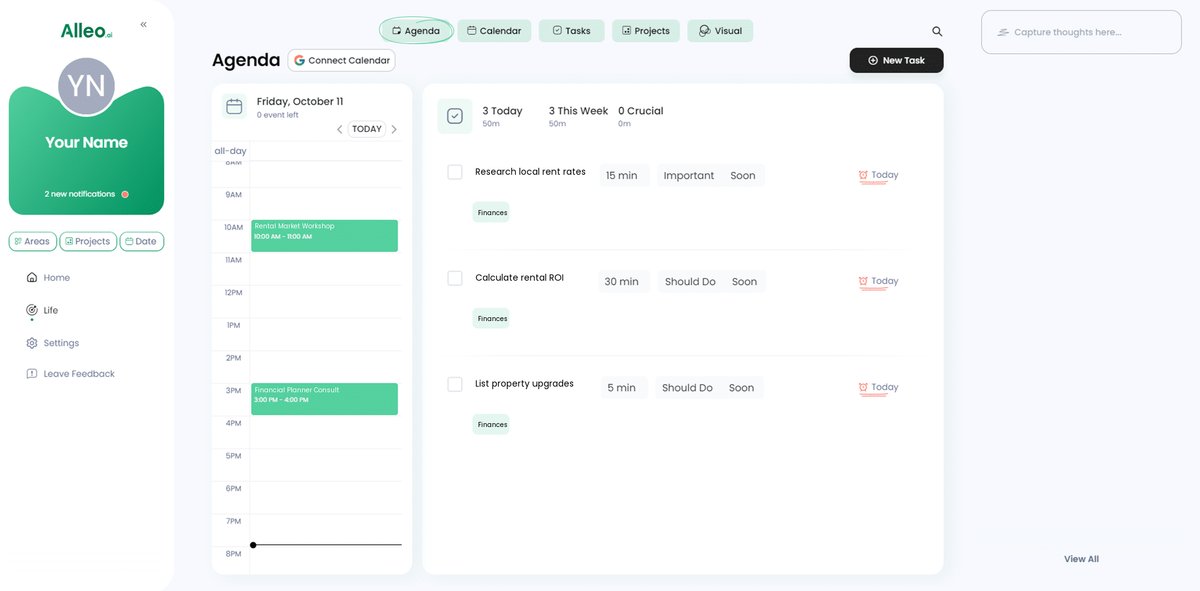

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important dates related to your rental property decision, such as meetings with financial advisors, property inspections, or deadlines for gathering market research.

Making the Best Decision for Your Future

We’ve covered a lot of ground, addressing the challenges and strategies for rental investment for empty nesters considering property investment. It’s a big decision that impacts your financial future and lifestyle.

Remember, consulting a fee-only Certified Financial Planner is crucial for unbiased advice on real estate investing after kids leave home. Evaluating your property’s rental income potential and assessing your capacity for property management are essential steps for new landlords.

Comparing the ROI of renting versus selling helps you see the clear financial picture for empty nesters exploring passive income through rental properties.

Researching local rental market trends and understanding tax benefits of rental property ownership further inform your decision. Exploring low-maintenance property upgrades can enhance rental appeal and ease management for empty nesters diving into rental property investment.

I empathize with the weight of this decision. You’re not alone in this journey of financial planning for empty nesters.

Consider using Alleo, your AI life coach, to streamline these steps. Alleo supports you through each stage of retirement planning with rental properties and decision-making.

Take action now. You’ve got this!