5 Essential Steps for Millennials to Protect Personal Data After Financial Institution Breaches

Imagine waking up one morning to find that your financial information has been compromised due to a data breach at your trusted financial institution. This is the unfortunate reality for 77,000 Fidelity customers, highlighting the need to protect data after financial breaches.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience helping clients protect their personal information online, I’ve seen the impact of financial breaches firsthand, especially on millennials concerned about digital privacy.

In this article, you’ll discover proven strategies millennials can use to protect their personal data after a financial institution breach. These include:

- Enabling multi-factor authentication for enhanced mobile banking safety

- Freezing credit reports as a post-breach security measure

- Using secure password managers for effective password management strategies

- Monitoring credit reports regularly

- Signing up for identity theft prevention services for young adults

Let’s dive into these data security for millennials techniques.

Understanding the Gravity of Financial Data Breaches

Data breaches at financial institutions like Fidelity are not just minor inconveniences. They pose significant risks to your personal and financial security. Learning how to protect data after financial breach is crucial for all consumers.

Many clients initially struggle with the overwhelming implications of such breaches, especially when it comes to implementing post-breach security measures.

Millennials face unique vulnerabilities in the digital age. The constant use of online services and financial apps can expose you to more risks, making data security for millennials a pressing concern.

It’s crucial to understand the severity of these breaches and the importance of protecting personal information online.

In my experience, people often find the aftermath of a breach to be deeply unsettling. The potential for identity theft and financial loss is real, highlighting the need for robust identity theft prevention for young adults.

It’s painful to see trust in financial institutions shaken so severely, emphasizing the importance of financial institution cybersecurity.

If you’re an accountant, managing sensitive financial information adds another layer of risk. Protecting your clients’ data becomes a top priority, which includes implementing digital privacy for millennials.

The importance of robust data security cannot be overstated, especially when it comes to mobile banking safety tips.

To mitigate these risks, it’s essential to stay informed and proactive. By implementing strict security measures, such as password management strategies and two-factor authentication, you can safeguard your personal data and maintain trust in your financial dealings.

Essential Steps to Safeguard Your Data After a Breach

Overcoming this challenge requires a few key steps to protect data after a financial breach. Here are the main areas to focus on to make progress.

- Enable Multi-Factor Authentication: Add an extra layer of security to your accounts, enhancing digital privacy for millennials.

- Freeze Credit Reports with All Three Bureaus: Protect your credit from unauthorized access, a crucial post-breach security measure.

- Use a Secure Password Manager for Accounts: Manage and update your passwords securely, implementing effective password management strategies.

- Monitor Credit Reports and Bank Statements: Regularly check for any unusual activity, essential for protecting personal information online.

- Sign Up for Identity Theft Protection Services: Gain comprehensive monitoring and recovery assistance, vital for identity theft prevention for young adults.

Let’s dive in to explore these financial institution cybersecurity measures!

1: Enable multi-factor authentication

Implementing multi-factor authentication (MFA) is crucial for enhancing the security of your financial accounts and helping protect data after financial breach.

Actionable Steps:

- Set up MFA on all financial accounts: Begin by enabling MFA on your bank accounts and financial apps to prevent unauthorized access and improve financial institution cybersecurity.

- Use MFA applications for account verification: Utilize apps like Google Authenticator to generate one-time passwords (OTPs) or receive push notifications, enhancing digital privacy for millennials.

- Regularly update MFA settings: Change your MFA methods annually or when switching devices to maintain high security and protect personal information online.

Explanation:

These steps significantly reduce the risk of unauthorized access to your accounts. By ensuring that any login attempt requires multiple forms of verification, you add a robust layer of protection and implement effective post-breach security measures.

According to Finopotamus, millennials prioritize security features like MFA when choosing financial institutions. This proactive approach aligns with current industry trends and enhances your data security.

Key benefits of MFA include:

- Significantly reduces the risk of unauthorized access

- Provides an additional layer of security beyond passwords

- Aligns with current best practices in cybersecurity and identity theft prevention for young adults

Securing your accounts with MFA is a foundational step in protecting your personal data after financial breach. Next, we’ll explore how to freeze your credit reports with all three bureaus.

2: Freeze credit reports with all three bureaus

Freezing your credit reports with all three bureaus is crucial to protect data after financial breach and prevent unauthorized access to your credit.

Actionable Steps:

- Contact Equifax, Experian, and TransUnion to initiate a credit freeze: Visit each bureau’s website and follow the steps to freeze your credit, enhancing your financial institution cybersecurity.

- Use secure methods to manage and temporarily lift the freeze when necessary: Utilize a secure online account with each bureau for managing credit freeze status, an essential part of protecting personal information online.

Explanation:

These steps are vital because freezing your credit makes it harder for identity thieves to open new accounts in your name, a key aspect of identity theft prevention for young adults.

This proactive measure aligns with industry trends and enhances your data security, particularly important for digital privacy for millennials.

According to Reckon, credit freezing is a recommended defense against identity theft following data breaches, serving as an effective post-breach security measure.

Next, we’ll explore the importance of using a secure password manager for your accounts, a crucial part of password management strategies.

3: Use a secure password manager for accounts

Using a secure password manager is essential for safeguarding your personal data from breaches and helping to protect data after financial breach.

Actionable Steps:

- Choose a reputable password manager: Select a trusted service like Bitwarden to store and manage all your account passwords securely, enhancing your digital privacy for millennials.

- Regularly update passwords: Set reminders to update your passwords every three months to keep them secure, a crucial password management strategy.

- Enable two-factor authentication within the password manager: Use 2FA to add another layer of security to your password vault, emphasizing the two-factor authentication importance.

Explanation:

These steps are critical because they help you maintain strong, unique passwords for all your accounts, reducing the risk of unauthorized access and supporting identity theft prevention for young adults.

According to TechTarget, using a password manager is an effective strategy to protect personally identifiable information (PII).

Ensuring your passwords are up-to-date and adding 2FA within the manager further enhances your security, contributing to protecting personal information online.

Key features to look for in a password manager:

- End-to-end encryption for stored passwords

- Cross-platform compatibility for easy access

- Password generation capabilities for strong, unique passwords

Next, we’ll explore the importance of monitoring your credit reports and bank statements.

4: Monitor credit reports and bank statements

Regularly monitoring credit reports and bank statements is vital for detecting any unusual activity early and helping protect data after a financial breach.

Actionable Steps:

- Set up alerts on your bank accounts: Use mobile banking apps to receive instant notifications for all account transactions, enhancing mobile banking safety tips.

- Regularly check your credit reports from all three bureaus: Set quarterly reminders to review credit reports from Equifax, Experian, and TransUnion as part of your post-breach security measures.

- Report any suspicious activity immediately: Contact your bank’s fraud department if you notice unauthorized charges, a crucial step in identity theft prevention for young adults.

Explanation:

These steps are crucial because they help you identify and respond to fraudulent activity quickly. By staying vigilant, you can minimize potential damage to your financial health and protect data after a financial breach.

According to Hapo, regularly monitoring your credit and bank statements is key to protecting your identity after a data breach.

Taking these precautions ensures that any suspicious activity is caught early. Next, we’ll explore the importance of signing up for identity theft protection services.

5: Sign up for identity theft protection services

Signing up for identity theft protection services is crucial to protect data after a financial breach and safeguard your personal information online.

Actionable Steps:

- Research and enroll in a trusted identity theft protection service: Choose a service like LifeLock or IdentityGuard that offers extensive monitoring and recovery assistance, enhancing your financial institution cybersecurity.

- Review reports and alerts regularly: Stay informed about potential threats by checking monthly reports from your protection service, a key post-breach security measure.

- Utilize additional features offered: Activate dark web monitoring to detect compromised personal information early, an essential step in digital privacy for millennials.

Explanation:

These steps are essential because they provide comprehensive protection and early detection of identity theft. By using services like LifeLock or IdentityGuard, you align with industry best practices for data security and identity theft prevention for young adults.

According to PR Newswire, 76% of adults feel more secure with a provider offering identity protection services. This proactive approach enhances your data security and peace of mind.

Benefits of identity theft protection services:

- Continuous monitoring of personal and financial information

- Alerts for potential fraudulent activity

- Assistance with recovery if identity theft occurs

Taking these steps ensures robust protection against identity theft. Now, let’s explore how Alleo can help you implement these solutions effectively to protect data after a financial breach.

Partner with Alleo to Protect Your Data

We’ve explored how to protect data after financial breach and the steps involved. But did you know you can work directly with Alleo to make this easier for millennials and young adults?

Set up an account with Alleo and create a personalized plan for digital privacy. Alleo’s AI coach offers tailored support for managing your data security needs and implementing post-breach security measures.

The coach will help you:

- Set up MFA (two-factor authentication importance)

- Freeze your credit

- Choose a password manager for effective password management strategies

- Monitor your credit

- Sign up for identity theft prevention services

The AI coach keeps you on track with text and push notifications. You’ll get reminders, progress checks, and guidance on protecting personal information online whenever you need it.

Ready to get started for free?

Let me show you how to enhance your financial institution cybersecurity!

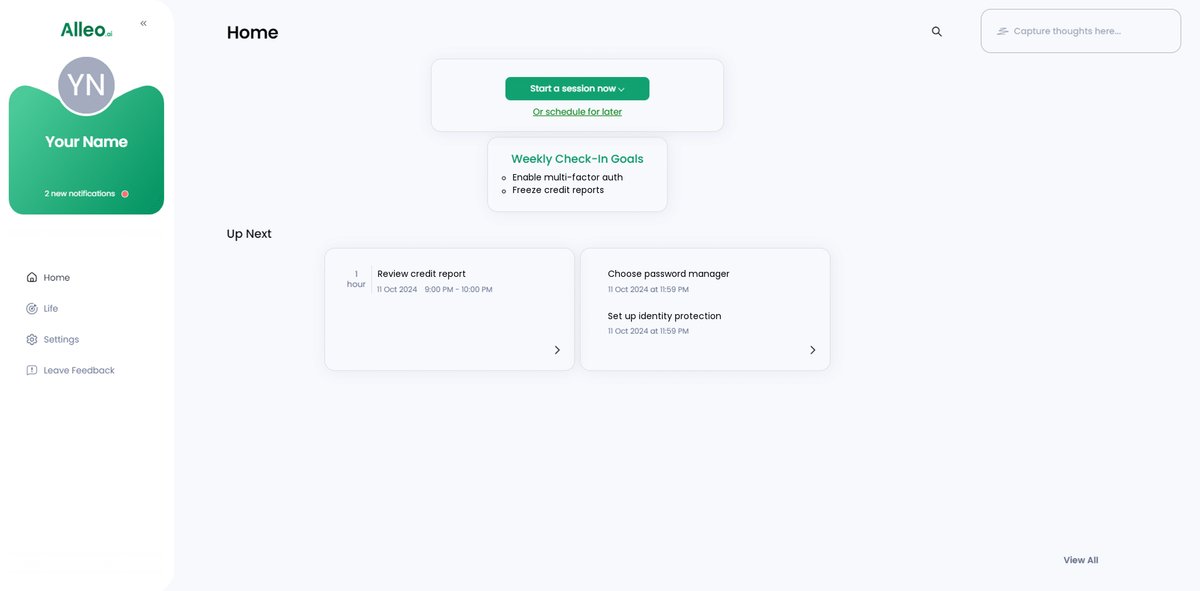

Step 1: Access Your Alleo Account

Log in to your existing Alleo account or create a new one to start protecting your personal data after the Fidelity breach.

Step 2: Choose “Building better habits and routines”

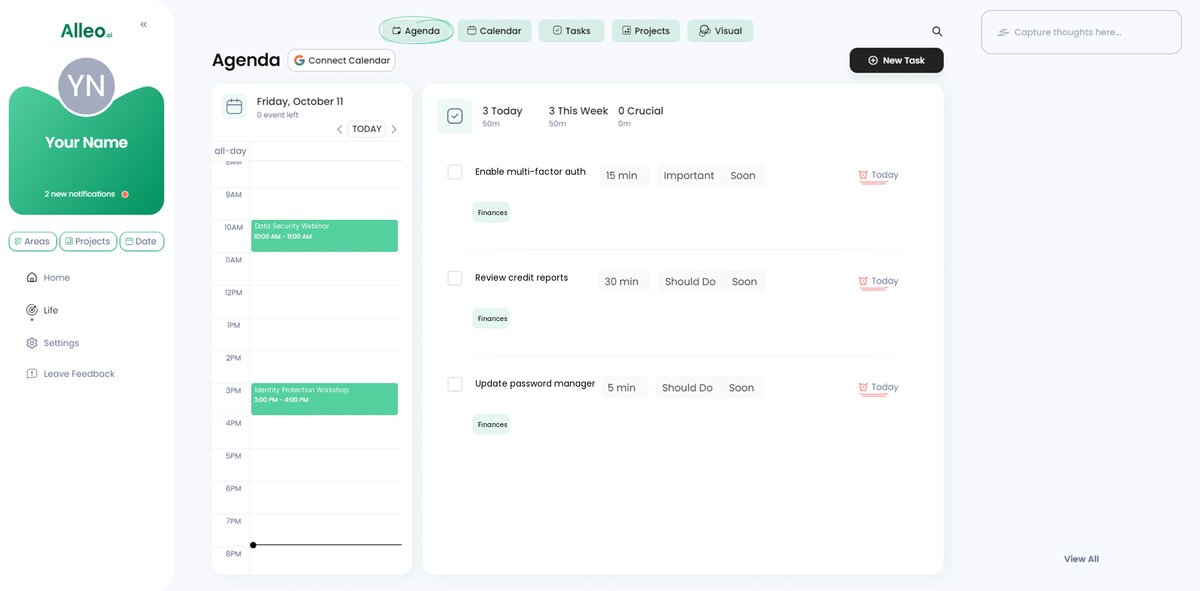

Click on “Building better habits and routines” to focus on developing consistent practices that will enhance your data security, such as regularly updating passwords and monitoring financial statements, helping you maintain a strong defense against potential breaches.

Step 3: Select “Finances” as Your Focus Area

Choose the “Finances” life area in Alleo to get personalized guidance on protecting your personal data and financial information after a data breach, ensuring you implement all the necessary security measures effectively.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with the AI coach to create a personalized plan for safeguarding your financial data and implementing the security measures discussed in the article.

Step 5: Viewing and managing goals after the session

After your coaching session on data protection, check the Alleo app’s home page to view and manage the personalized goals you discussed, such as setting up multi-factor authentication or freezing your credit reports.

6: Add events to your calendar or app

Schedule key dates for data protection tasks in your calendar or Alleo app, allowing you to track your progress in safeguarding your personal information and staying on top of regular security check-ups.

Securing Your Future: Protecting Your Personal Data

As we wrap up our discussion, remember that protecting your personal information online is crucial, especially when you need to protect data after financial breach.

Taking these steps ensures your financial security and helps with post-breach security measures.

It’s understandable to feel overwhelmed by the risk of data breaches. However, you now have actionable strategies to safeguard your information and enhance your digital privacy for millennials.

Implementing two-factor authentication importance, freezing your credit, using secure password management strategies, monitoring your accounts, and signing up for identity theft prevention for young adults services are key.

You’re not alone in this journey to improve your financial institution cybersecurity.

Alleo is here to help with data security for millennials.

With Alleo, you can create a personalized plan to protect data after financial breach effortlessly.

Take control of your financial security today with mobile banking safety tips.

Sign up for Alleo and start securing your future with effective credit monitoring services for millennials.