How to Navigate Legal Complexities: 4 Essential Strategies for Small Business Owners

Ever felt overwhelmed by the maze of regulatory changes affecting your small business? Legal compliance for small businesses can be a daunting challenge.

As a life coach, I’ve seen firsthand how these complexities can hinder growth and lead to hefty penalties. Small business law advice is crucial for navigating these waters.

In this article, you’ll discover strategies to navigate legal challenges. We’ll cover consulting experts on business regulations for startups, leveraging free resources, tracking compliance, and joining local associations to stay informed about legal pitfalls for entrepreneurs.

Ready to streamline your legal compliance for small businesses? Let’s dive in and explore how to protect your small business from liability and understand contract laws for small companies.

The Challenge of Staying Compliant Amidst Regulatory Changes

Navigating the ever-changing landscape of regulations can be daunting for accountants and small business owners. Many clients initially struggle to keep up with new rules while managing everyday operations. Legal compliance for small businesses is a critical aspect that cannot be overlooked.

The constant updates to business regulations for startups can feel overwhelming.

Balancing professional legal advice with internal compliance efforts is tricky. Small businesses often lack the resources to hire full-time legal experts to handle small business law advice.

This dilemma can lead to costly mistakes and hefty fines, exposing entrepreneurs to legal pitfalls.

Consider the financial impact: non-compliance can drain your resources and stifle growth. Staying compliant is not just about avoiding penalties; it’s about ensuring your business thrives. Legal compliance for small businesses is essential for long-term success.

Strategic Steps to Navigate Legal Complexities

Overcoming legal compliance challenges for small businesses requires a few key steps. Here are the main areas to focus on to make progress with legal compliance for small businesses:

- Consult with a small business legal expert: Regular consultations help stay updated on business regulations for startups and regulatory changes.

- Utilize free legal resources and webinars: Leverage online libraries and attend webinars for valuable insights on small business law advice and intellectual property rights for small businesses.

- Implement a compliance tracking system: Use tools to track deadlines and regulatory updates, helping avoid legal pitfalls for entrepreneurs.

- Join a local business association for support: Network and gain insights from other small business owners on topics like employment law for small business owners and tax regulations for small enterprises.

Let’s dive into these strategies for legal compliance for small businesses!

1: Consult with a small business legal expert

Regular consultations with a small business legal expert can keep you informed about regulatory changes and help prevent compliance issues for legal compliance for small businesses.

Actionable Steps:

- Schedule quarterly consultations with a legal expert to stay updated on new regulations and business regulations for startups.

- Develop a legal audit plan to identify and address potential compliance gaps and legal pitfalls for entrepreneurs.

- Create a legal advisory board with professionals from different legal backgrounds to address small business law advice.

Key benefits of working with a legal expert:

- Tailored advice for your specific business needs, including small business liability protection

- Proactive risk management strategies for legal compliance for small businesses

- Access to a network of legal professionals experienced in contract laws for small companies

Explanation: These steps matter because they provide a structured approach to staying compliant and avoiding costly mistakes in legal compliance for small businesses.

By scheduling regular consultations and developing a legal audit plan, you ensure that your business remains up-to-date with changing regulations, including employment law for small business owners and tax regulations for small enterprises.

Creating a legal advisory board offers diverse expertise, which is invaluable for addressing various legal challenges, including intellectual property rights for small businesses. For more detailed information, consider visiting the JDSupra website.

By following these steps, you can better navigate legal complexities, including business licenses and permits for startups, and focus on growing your business.

2: Utilize free legal resources and webinars

Using free legal resources and attending webinars can keep you informed about legal compliance for small businesses without breaking the bank.

Actionable Steps:

- Register for monthly webinars hosted by reputable legal organizations to stay updated on compliance topics and small business law advice.

- Frequently visit government websites like the FDA for free legal resources and guidelines on business regulations for startups.

- Join online communities and forums focused on small business legal issues to share insights and advice on legal pitfalls for entrepreneurs.

Explanation: These steps matter because they provide you with up-to-date information and valuable insights from experts at no cost, helping with legal compliance for small businesses.

Leveraging such resources helps ensure your business remains compliant and can avoid penalties related to small business liability protection. For instance, the FDA website offers extensive guidelines and updates on regulatory requirements, which can be crucial for your business.

Taking advantage of these resources allows you to stay informed about legal compliance for small businesses and focus on growing your business while navigating contract laws for small companies.

3: Implement a compliance tracking system

Implementing a compliance tracking system is crucial for legal compliance for small businesses, helping them stay on top of regulatory changes and deadlines.

Actionable Steps:

- Adopt compliance management software. Choose a tool that sends automatic reminders for filing reports and renewing permits, essential for small business law advice.

- Develop a compliance calendar. Create a shared calendar with your team that includes all key regulatory dates and events, helping manage business regulations for startups.

- Assign a compliance officer. Designate a team member responsible for monitoring changes and ensuring timely compliance, crucial for avoiding legal pitfalls for entrepreneurs.

Essential features of an effective compliance tracking system:

- Automated alerts and notifications

- Document management and version control

- Reporting and analytics capabilities

Explanation: These steps matter because they help you stay organized and proactive in managing legal compliance for small businesses. By using software, you ensure that nothing falls through the cracks.

A shared calendar keeps everyone on the same page, and a designated compliance officer ensures accountability. For more insights on small business liability protection, check out the BetterLegal resource.

By implementing these measures, you can focus on growing your business without worrying about regulatory pitfalls or tax regulations for small enterprises.

4: Join a local business association for support

Joining a local business association can provide essential support and resources for navigating legal complexities, including legal compliance for small businesses.

Actionable Steps:

- Become a member of your local chamber of commerce. Attend monthly meetings to network and gain insights from fellow small business owners on small business law advice and business regulations for startups.

- Participate in mentoring programs. Pair with an experienced business owner who can provide guidance on legal matters and help you avoid legal pitfalls for entrepreneurs.

- Engage in advocacy efforts. Join advocacy groups and participate in campaigns to voice concerns and suggest improvements to current regulations affecting small business liability protection.

Ways to maximize your business association membership:

- Volunteer for leadership positions

- Contribute to industry publications on topics like contract laws for small companies

- Sponsor or host events focused on legal compliance for small businesses

Explanation: These steps matter because they offer valuable networking opportunities, mentorship, and a platform to influence regulatory changes related to employment law for small business owners and tax regulations for small enterprises.

Being part of a business association can provide access to resources and collective knowledge that can help you stay compliant with business licenses and permits for startups.

For example, the U.S. Department of Commerce offers resources for minority business enterprises, which can be incredibly helpful for understanding intellectual property rights for small businesses.

Joining a local business association can create a strong support network to help you manage legal complexities effectively and ensure legal compliance for small businesses.

Partner with Alleo to Navigate Legal Complexities

We’ve explored the challenges of staying compliant amidst regulatory changes. Did you know you can work directly with Alleo to make this journey easier and faster for legal compliance for small businesses?

Setting up an account with Alleo is simple. Create a personalized compliance plan tailored to your business needs, addressing small business law advice and business regulations for startups.

Alleo’s AI coach provides affordable, tailored coaching support, just like a human coach. The coach follows up on your progress and handles any changes, helping you avoid legal pitfalls for entrepreneurs.

It keeps you accountable via text and push notifications, ensuring you stay on top of contract laws for small companies and employment law for small business owners.

Ready to get started for free? Let me show you how to enhance your small business liability protection!

Step 1: Logging in or Creating an Account

To begin navigating legal complexities with Alleo’s AI coach, Log in to your account or create a new one to access personalized compliance support tailored to your small business needs.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a consistent compliance tracking system, helping you stay on top of regulatory changes and deadlines without feeling overwhelmed.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to tackle the legal complexities and compliance challenges affecting your small business’s financial health and growth potential.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with the AI coach to create a personalized compliance plan tailored to your business’s unique legal challenges.

Step 5: Viewing and managing goals after the session

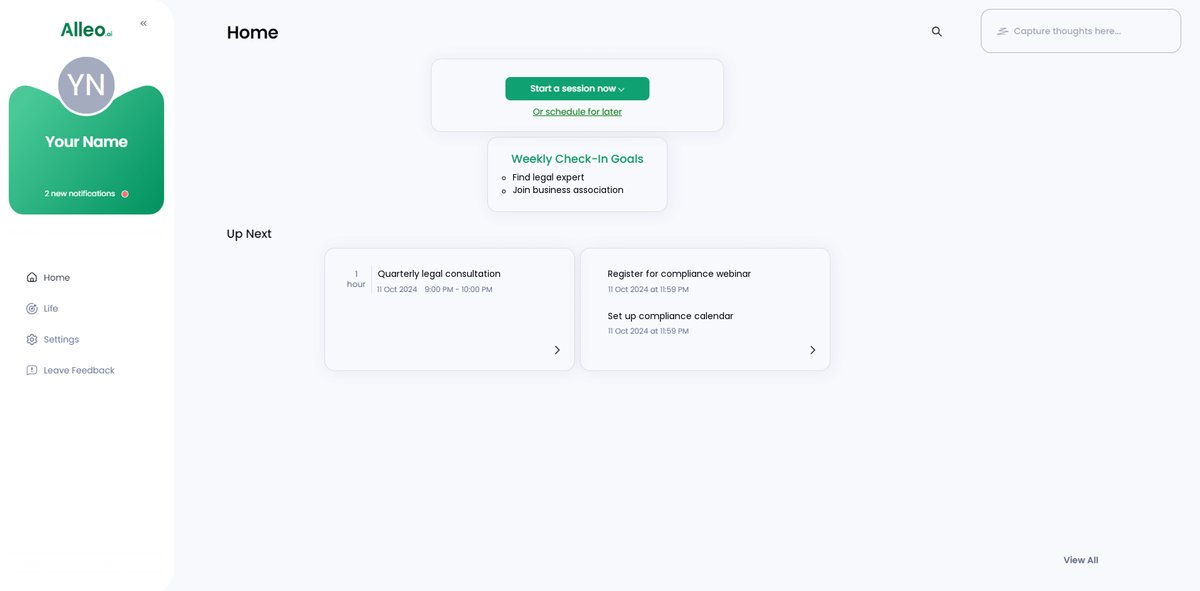

After your coaching session, open the Alleo app to view and manage the goals you discussed, which will be displayed on the home page for easy access and tracking.

Step 6: Adding events to your calendar or app

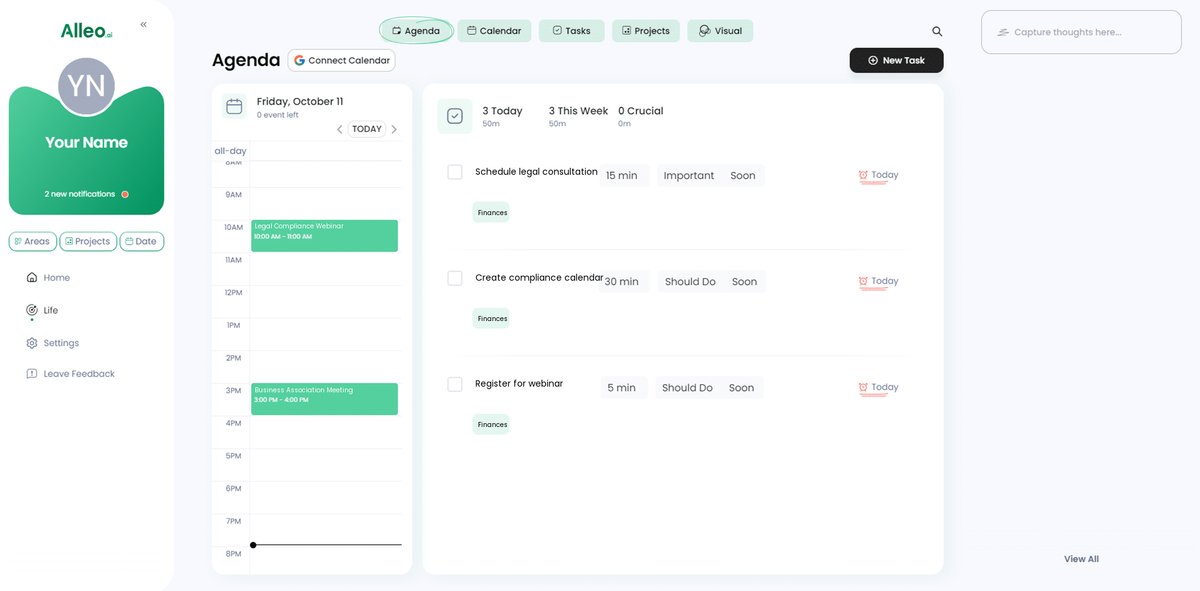

Use the calendar and task features in Alleo to track your progress in solving legal compliance challenges, allowing you to easily add important dates, deadlines, and regulatory events to stay organized and on top of your business’s legal requirements.

Wrapping It All Up: Navigating Legal Complexities with Confidence

Let’s bring everything together.

We’ve discussed how legal compliance for small businesses can be overwhelming but manageable with the right strategies. By consulting legal experts for small business law advice, utilizing free resources on business regulations for startups, tracking compliance, and joining local associations, you can navigate these challenges effectively.

Remember, you’re not alone in this journey. Many small business owners face similar hurdles when dealing with legal pitfalls for entrepreneurs.

With Alleo by your side, you have a powerful tool to help keep you on track with small business liability protection and contract laws for small companies.

Why not give Alleo a try? It could be the support you need to focus on growth and success while managing intellectual property rights for small businesses and employment law for small business owners.

Start now and see the difference in handling tax regulations for small enterprises and securing business licenses and permits for startups.