Balancing Long-Term Investment with Investor Pressure: 4 Fundamental Principles for Entrepreneurs

Are you constantly feeling the pressure to deliver quick returns while needing to invest significantly in research and capital expenditure? Balancing investment and investor pressure is a common challenge for startups and established companies alike.

Balancing these demands can be a daunting task, especially when it comes to sustainable business models and shareholder value creation.

As a life coach, I’ve helped many tech managers navigate these challenges, including investor relations management and entrepreneurial decision-making. Drawing from my experience, I understand the complexities you face in balancing innovation and financial stability.

In this article, you’ll discover actionable startup growth strategies to balance long-term investments with investor expectations. We’ll explore developing a strategic roadmap, setting realistic milestones, and diversifying funding sources. These insights will help you manage the delicate balance between short-term profitability and future gains.

Let’s dive into long-term business planning and strategic reinvestment techniques that can help you meet venture capital expectations.

Understanding the Investor Pressure Dilemma

Navigating the pressure from investors for quick returns can be overwhelming. This challenge often forces tech managers to make difficult decisions that could compromise long-term growth, highlighting the importance of balancing investment and investor pressure.

Many clients initially struggle with prioritizing significant capital expenditure and research investment. They face constant demands to deliver rapid financial results, which can lead to short-term thinking at the expense of sustainable business models.

In my experience, balancing investment and investor pressure requires a strategic approach. For example, tech managers must frequently justify their need for substantial investments while demonstrating immediate progress, a key aspect of investor relations management.

This is a painful issue. The constant tug-of-war between immediate returns and future gains can stifle innovation, affecting startup growth strategies.

Moreover, it can create stress and hinder a company’s ability to achieve its long-term vision, emphasizing the need for strategic reinvestment techniques and entrepreneurial decision-making that balance short-term profitability with future gains.

A Roadmap to Balancing Long-Term Investment with Investor Pressure

Overcoming this challenge of balancing investment and investor pressure requires a few key steps. Here are the main areas to focus on to make progress:

- Develop a Clear, Long-Term Strategic Roadmap: Define your long-term business planning goals and create a detailed timeline for sustainable business models.

- Set Realistic Milestones and Communicate Them: Break down goals into achievable milestones and keep investors informed, improving investor relations management.

- Diversify Funding Sources to Reduce Pressure: Explore alternative financing options and build relationships with multiple investors to balance venture capital expectations.

- Prioritize Initiatives with Both Short and Long ROI: Evaluate and invest in projects that offer both immediate and long-term returns, balancing short-term profitability vs. future gains.

Let’s dive in to these startup growth strategies for balancing investment and investor pressure!

1: Develop a clear, long-term strategic roadmap

Creating a strategic roadmap is essential for balancing investment and investor pressure while focusing on startup growth strategies.

Actionable Steps:

- Conduct a Vision Workshop: Gather your team to define long-term business planning goals and vision. Ensure everyone aligns with the strategic direction for balancing innovation and financial stability.

- Create a Timeline: Develop a detailed timeline outlining key milestones and deliverables for the next 1, 3, and 5 years, considering venture capital expectations.

- Use Scenario Planning: Anticipate various market conditions and plan for different scenarios to remain adaptable in balancing short-term profitability vs. future gains.

Explanation:

These steps help ensure your team is focused on long-term objectives while still meeting investor demands. By conducting a vision workshop, you create a unified direction for sustainable business models.

A timeline helps track progress, and scenario planning prepares you for market changes. For more insights on strategic planning, check out this article from Berkeley CEO Program.

Key benefits of a clear strategic roadmap for balancing investment and investor pressure:

- Aligns team efforts towards common goals in shareholder value creation

- Provides a framework for entrepreneurial decision-making

- Helps in communicating progress to stakeholders, improving investor relations management

Developing a clear roadmap is just the first step in balancing growth with investor pressure. Next, we will explore setting realistic milestones and communicating them effectively, focusing on strategic reinvestment techniques.

2: Set realistic milestones and communicate them

Setting realistic milestones and communicating them effectively is crucial for balancing investment and investor pressure while aligning your long-term goals with investor expectations.

Actionable Steps:

- Break Down Goals: Divide long-term objectives into smaller, achievable milestones. This will maintain momentum and demonstrate progress to investors, supporting sustainable business models.

- Schedule Regular Updates: Arrange periodic updates with investors to share progress and adjust plans as needed, enhancing investor relations management.

- Implement Transparent Reporting: Use a transparent reporting system to track milestones and KPIs, ensuring investors see the progress and supporting shareholder value creation.

Explanation:

These steps help ensure your efforts are visible, building trust and alignment with investors. Breaking down goals into milestones shows progress, balancing short-term profitability vs. future gains.

Regular updates and transparent reporting create a clear line of communication, essential for managing venture capital expectations. For more insights on balancing investment and investor pressure, check out this article from Columbia Business School.

Next, we will explore how to diversify funding sources to reduce investor pressure and support startup growth strategies.

3: Diversify funding sources to reduce pressure

Diversifying funding sources is crucial for balancing investment and investor pressure and achieving long-term goals in startup growth strategies.

Actionable Steps:

- Explore Alternative Financing: Look into grants, crowdfunding, and strategic partnerships to reduce reliance on a single funding source and improve investor relations management.

- Build Relationships with Multiple Investors: Cultivate relationships with a variety of investors to spread out financial pressure and support long-term business planning.

- Consider Revenue-Based Financing: For companies with recurring revenue, this can be a less risky alternative to traditional equity financing, balancing short-term profitability vs. future gains.

Explanation:

These steps help ensure financial stability and reduce the risk of over-reliance on one funding source. Exploring alternative financing options can provide additional capital while balancing innovation and financial stability.

Building relationships with multiple investors spreads financial risk and supports sustainable business models. Revenue-based financing offers a flexible approach for companies with steady revenue, aligning with venture capital expectations.

For more insights, check out this article from Arkone.

Advantages of diversified funding:

- Reduces dependence on a single investor, enhancing entrepreneurial decision-making

- Provides financial flexibility for strategic reinvestment techniques

- Mitigates risk in volatile markets, contributing to shareholder value creation

Next, we will explore how to prioritize initiatives with both short and long ROI.

4: Prioritize initiatives with both short and long ROI

Prioritizing initiatives that offer both short and long ROI is crucial to balancing investment and investor pressure while ensuring sustainable business models for startup growth strategies.

Actionable Steps:

- Evaluate Projects for Dual ROI: Assess potential projects based on their ability to deliver both short-term profitability and long-term business planning returns.

- Pilot Programs: Start with small-scale pilot programs to test the viability and ROI before committing significant resources, aiding in venture capital expectations management.

- Invest in Innovation and Efficiency: Focus on initiatives that improve operational efficiency and drive innovation, balancing immediate benefits with future gains and shareholder value creation.

Explanation:

These steps help ensure a balanced investment approach that meets both short-term and long-term objectives. Evaluating projects for dual ROI ensures that your efforts pay off now and in the future, crucial for balancing investment and investor pressure.

Small-scale pilot programs reduce risk while testing viability. Investing in innovation and efficiency drives sustainable growth, supporting strategic reinvestment techniques.

For more insights, check out this article on handling investor pressure.

Factors to consider when prioritizing initiatives:

- Potential for immediate impact

- Long-term strategic alignment

- Resource requirements and availability

This balanced approach helps align your strategic vision with investor relations management, supporting entrepreneurial decision-making in balancing innovation and financial stability.

Partner with Alleo on Your Strategic Journey

We’ve explored balancing investment and investor pressure and how solving it benefits your business. But did you know you can work with Alleo to make this process of balancing long-term business planning and short-term profitability easier?

Alleo, your AI coach, provides tailored coaching support for startup growth strategies at an affordable rate. Get full coaching sessions like a human coach and a free 14-day trial with no credit card required to enhance your investor relations management.

Setting up an account with Alleo is simple. Create a personalized plan to tackle specific challenges, like balancing investments and investor expectations while focusing on sustainable business models.

Alleo’s coach follows up on progress, handles changes, and keeps you accountable via text and push notifications, helping you navigate the complexities of balancing innovation and financial stability.

Ready to get started for free and improve your entrepreneurial decision-making? Let me show you how!

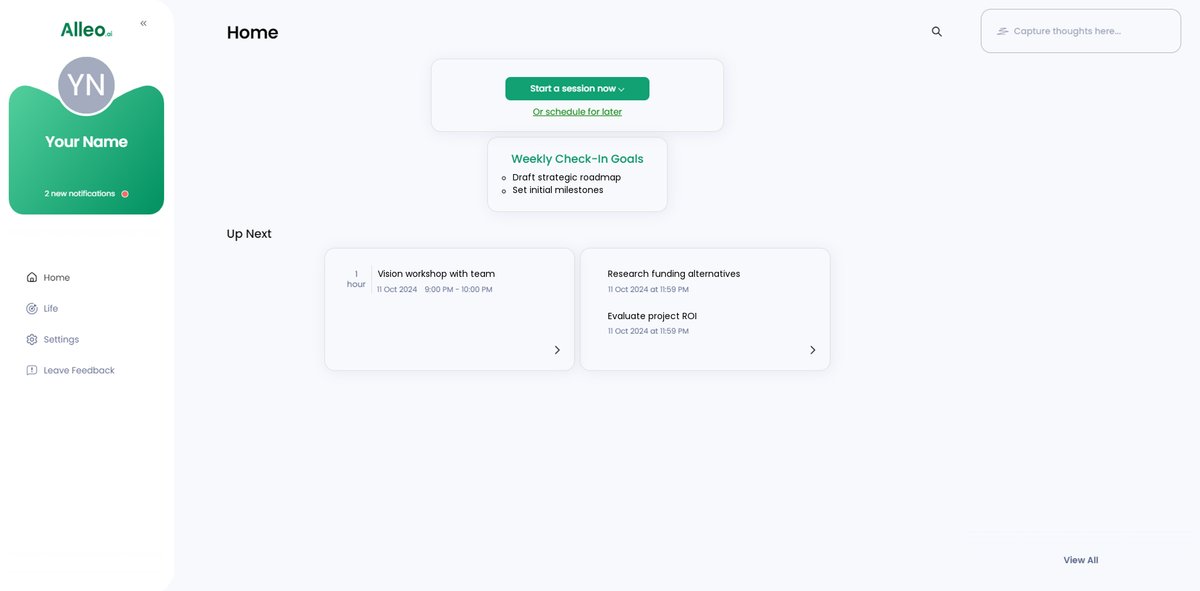

Step 1: Log In or Create Your Alleo Account

To begin your journey towards balancing long-term investments and investor expectations, log in to your Alleo account or create a new one to access personalized AI coaching support.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your long-term vision with short-term actions, helping you balance investor expectations and strategic growth effectively.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area in Alleo to tackle the challenge of balancing long-term investments with investor expectations, allowing you to develop strategies for sustainable growth while meeting short-term goals in your tech management role.

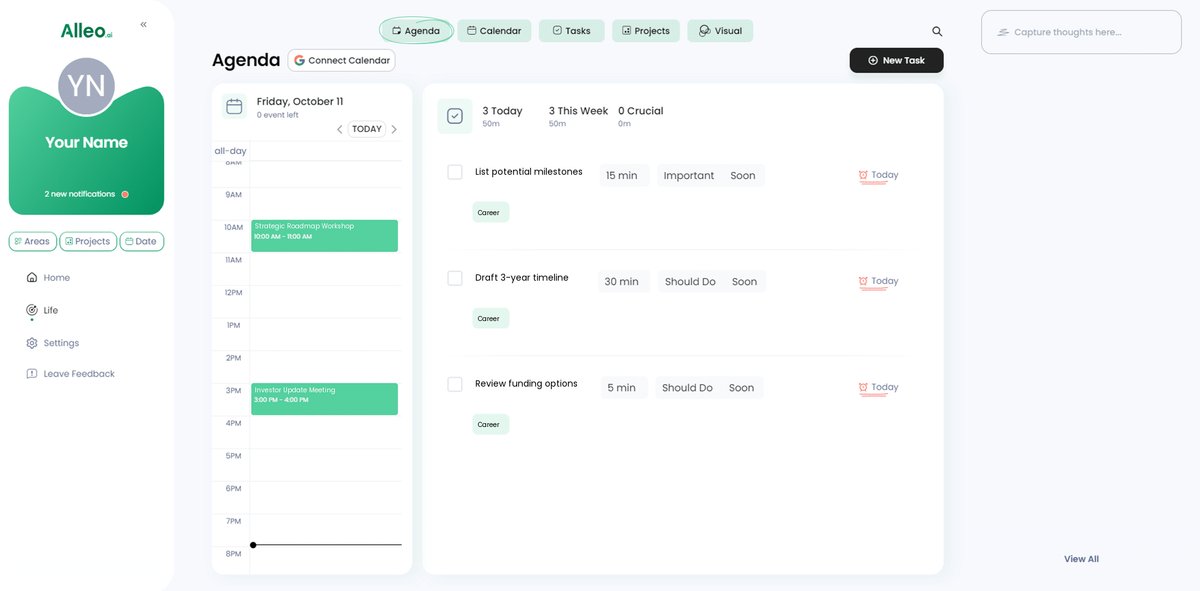

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your goals for balancing long-term investments and investor expectations, allowing the AI coach to create a personalized plan tailored to your specific challenges.

Step 5: Viewing and managing goals after the session

After your coaching session on balancing long-term investments with investor expectations, check your app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable to your strategic roadmap.

Step 6: Adding events to your calendar or app

Track your progress in balancing long-term investments and investor expectations by adding key milestones and tasks to the calendar and task features within the Alleo app, ensuring you stay on top of your strategic roadmap and communication schedule.

Bringing It All Together: Achieving Balance with Alleo

Balancing investment and investor pressure is challenging, but it’s possible with the right approach. We’ve discussed developing a strategic roadmap, setting realistic milestones, diversifying funding sources, and prioritizing initiatives with dual ROI for sustainable business models.

Empathizing with your struggles in startup growth strategies, I encourage you to implement these techniques for balancing innovation and financial stability. Remember, staying focused on both immediate and future goals can lead to sustainable growth and shareholder value creation.

Consider using Alleo to simplify this journey of long-term business planning. It offers personalized coaching and support, making it easier to navigate these challenges in entrepreneurial decision-making and investor relations management.

Try Alleo for free today, and take the first step toward achieving your strategic goals while balancing short-term profitability vs. future gains.