CFO’s Guide: Best Practices to Prevent Recurring Cash Flow Crises

Are you constantly facing cash flow crises despite your best efforts to manage your finances? Preventing recurring cash flow crises is crucial for business success.

As a life coach, I’ve seen many small business owners struggle with this exact issue. It’s a common problem that can be tackled with the right cash flow management strategies.

In this article, you’ll uncover actionable steps to prevent recurring cash flow crises. We’ll discuss effective financial forecasting techniques, budgeting and cost control measures, risk management, and more.

Ready to transform your financial management and optimize your working capital?

Let’s dive in to explore revenue acceleration tactics and expense reduction methods.

![]()

Understanding the Root Causes of Cash Flow Crises

Cash flow crises often stem from inadequate financial planning and poor risk management. Many clients initially struggle with keeping track of their cash inflows and outflows, leading to repeated financial strain. Preventing recurring cash flow crises requires implementing effective cash flow management strategies and financial forecasting techniques.

Recurring cash flow issues can severely impact your business growth and stability. I’ve seen clients face halted operations and missed growth opportunities due to these problems. Working capital optimization and expense reduction methods are crucial for avoiding such situations.

Consider a business that repeatedly hit cash flow crises, failing to pay suppliers on time. This disrupted their supply chain and strained relationships. Implementing revenue acceleration tactics and cash reserve planning could have helped prevent these issues.

These issues highlight the importance of understanding and addressing the underlying causes of cash flow problems. Proper planning, forecasting, and risk management are crucial. Debt management for CFOs, financial risk mitigation, accounts receivable improvement, and budgeting and cost control measures all play vital roles in preventing recurring cash flow crises.

A Roadmap to Prevent Recurring Cash Flow Crises

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in preventing recurring cash flow crises:

- Implement robust cash flow forecasting system: Use historical data and economic trends to predict inflows and outflows, employing financial forecasting techniques.

- Develop detailed budgets with KPI monitoring: Create comprehensive budgets and monitor key performance indicators for effective working capital optimization.

- Create contingency plans for financial risks: Identify risks and develop plans to mitigate them, incorporating financial risk mitigation strategies.

- Automate AP processes to improve cash management: Streamline invoicing and bill payments using automation tools, enhancing accounts receivable improvement.

- Conduct regular financial audits and reviews: Schedule regular audits to review financial health and implement improvements, focusing on budgeting and cost control measures.

Let’s dive in!

1: Implement robust cash flow forecasting system

Implementing a robust cash flow forecasting system is essential for preventing recurring cash flow crises and optimizing working capital.

Actionable Steps:

- Analyze historical data: Examine past financial records to identify patterns in cash inflows and outflows, a key financial forecasting technique.

- Use forecasting tools: Adopt tools like Excel or specialized software to create monthly cash flow forecasts and enhance cash flow management strategies.

- Involve multiple departments: Schedule regular meetings with department heads to gather input and update forecasts, improving budgeting and cost control measures.

Explanation: Accurate cash flow forecasting allows you to anticipate future financial needs and avoid surprises, crucial for preventing recurring cash flow crises.

By leveraging historical data and involving various departments, you ensure a comprehensive and realistic forecast. This proactive approach connects with industry trends, such as the growing importance of financial forecasting highlighted in Emeritus.

Key benefits of robust cash flow forecasting include:

- Early detection of potential cash shortages, aiding in financial risk mitigation

- Improved decision-making for investments and cash reserve planning

- Enhanced credibility with stakeholders and better debt management for CFOs

These steps will help you maintain a clear view of your cash flow, setting the stage for effective financial planning and preventing recurring cash flow crises.

2: Develop detailed budgets with KPI monitoring

Developing detailed budgets with KPI monitoring is vital for preventing recurring cash flow crises and maintaining financial health.

Actionable Steps:

- Create comprehensive budgets: Use budgeting and cost control measures through software to include operating expenses, capital expenditures, and revenue projections.

- Identify and monitor KPIs: Establish KPIs such as gross margin, net profit margin, and liquidity ratios for financial risk mitigation, and review them monthly.

- Adjust budgets based on KPI performance: Implement a quarterly budget review process to make necessary adjustments and optimize working capital.

Explanation: Creating detailed budgets and monitoring KPIs help you stay on track with your financial goals and prevent recurring cash flow crises.

By regularly reviewing KPIs, you can make informed decisions and adjust budgets as needed. This aligns with the growing importance of financial forecasting techniques and cash flow management strategies, as highlighted in Levy.

This structured approach ensures your business remains financially stable and prepared for growth while preventing recurring cash flow crises.

![]()

3: Create contingency plans for financial risks

Creating contingency plans for financial risks is crucial to protect your business from unexpected financial challenges and prevent recurring cash flow crises.

Actionable Steps:

- Conduct a risk assessment: Identify potential financial risks and their impact on cash flow through a workshop with key stakeholders, focusing on financial risk mitigation and working capital optimization.

- Develop detailed contingency plans: Create specific plans for each identified risk, defining steps to mitigate them and allocating resources accordingly, incorporating cash flow management strategies and expense reduction methods.

- Review and update plans regularly: Schedule bi-annual reviews of your contingency plans to ensure they remain current and effective, utilizing financial forecasting techniques.

Explanation: These steps are vital to prepare for financial uncertainties and maintain stability. By assessing risks and having detailed contingency plans in place, you can quickly respond to challenges and prevent recurring cash flow crises.

Regular reviews ensure your plans remain relevant, as highlighted by CFO Selections in their insights on managing cash deficits.

Common financial risks to address in your contingency plans:

- Economic downturns

- Loss of major clients

- Unexpected legal issues

Implementing these measures will help safeguard your business against unforeseen financial disruptions and contribute to preventing recurring cash flow crises.

4: Automate AP processes to improve cash management

Automating AP processes is crucial for enhancing cash management and reducing manual errors, which is key to preventing recurring cash flow crises.

Actionable Steps:

- Adopt AP automation software: Research and implement AP automation software that integrates with your accounting system for better working capital optimization.

- Set up automated workflows: Configure the software to send automatic payment reminders and follow-up notifications, improving accounts receivable and expense reduction methods.

- Analyze AP data: Use the software’s analytics to generate reports and gain insights into AP performance, aiding in financial forecasting techniques.

Explanation: Automation streamlines invoicing and bill payments, ensuring timely payments and reducing the risk of errors, which are essential cash flow management strategies.

This aligns with trends in financial automation, as highlighted in Brex’s insights on improving financial operations.

These steps will help you maintain better control over your cash flow and contribute to effective budgeting and cost control measures.

5: Conduct regular financial audits and reviews

Conducting regular financial audits and reviews is essential for maintaining transparency and ensuring financial health, which is crucial in preventing recurring cash flow crises.

Actionable Steps:

- Schedule internal audits: Develop an annual audit plan and assign responsibilities to the finance team, focusing on cash flow management strategies.

- Hire external auditors: Engage a reputable auditing firm for yearly external audits to gain an objective assessment of your financial forecasting techniques.

- Implement audit recommendations: Create an action plan to address audit findings and track progress on implementing changes, including working capital optimization.

Explanation: Regular audits help identify discrepancies and improve financial controls, ensuring your business stays on track and prevents recurring cash flow crises.

By engaging external auditors, you gain unbiased insights and enhance credibility. This approach aligns with the importance of financial audits highlighted in Jitasa’s insights on nonprofit financial management and supports effective expense reduction methods.

Key areas to focus on during financial audits:

- Accuracy of financial statements and cash reserve planning

- Compliance with accounting standards and debt management for CFOs

- Effectiveness of internal controls and financial risk mitigation

These steps will help you maintain robust financial oversight, ensuring long-term stability and preventing recurring cash flow crises through improved accounts receivable and budgeting and cost control measures.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of preventing recurring cash flow crises and the steps to overcome them. Did you know you can work directly with Alleo to make this journey easier and faster?

Alleo offers affordable, tailored coaching support to address your cash flow management strategies. With full coaching sessions like any human coach, Alleo ensures you master financial planning, risk mitigation, and working capital optimization.

Setting up your account is simple. Create a personalized plan with Alleo’s AI coach to tackle your specific challenges, including expense reduction methods and revenue acceleration tactics.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you with budgeting and cost control measures.

Ready to get started for free and learn more about preventing recurring cash flow crises? Let me show you how!

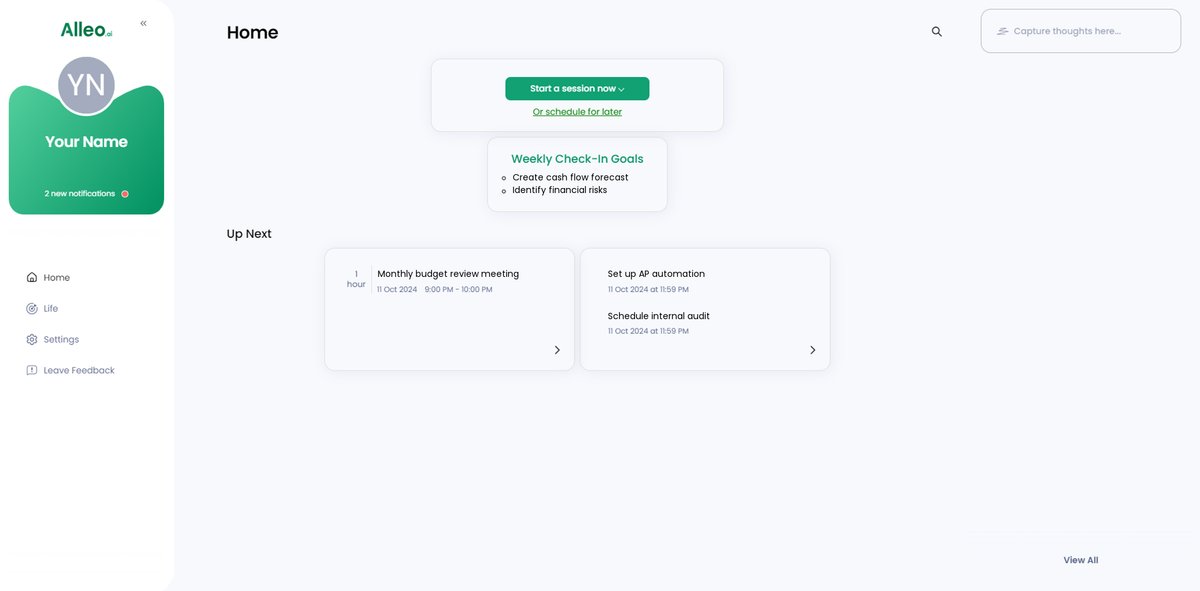

Step 1: Log In or Create Your Account

To begin your journey towards better cash flow management, log in to your existing Alleo account or create a new one if you’re just getting started.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish consistent financial practices that will help prevent recurring cash flow crises and improve your overall business stability.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to directly address your cash flow challenges and receive tailored guidance on implementing effective financial management strategies.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your cash flow challenges and set up a personalized plan to prevent recurring crises.

Step 5: Viewing and managing goals after the session

After your coaching session on preventing cash flow crises, check the Alleo app’s home page to view and manage the financial goals you discussed, ensuring you stay on track with your cash flow management strategies.

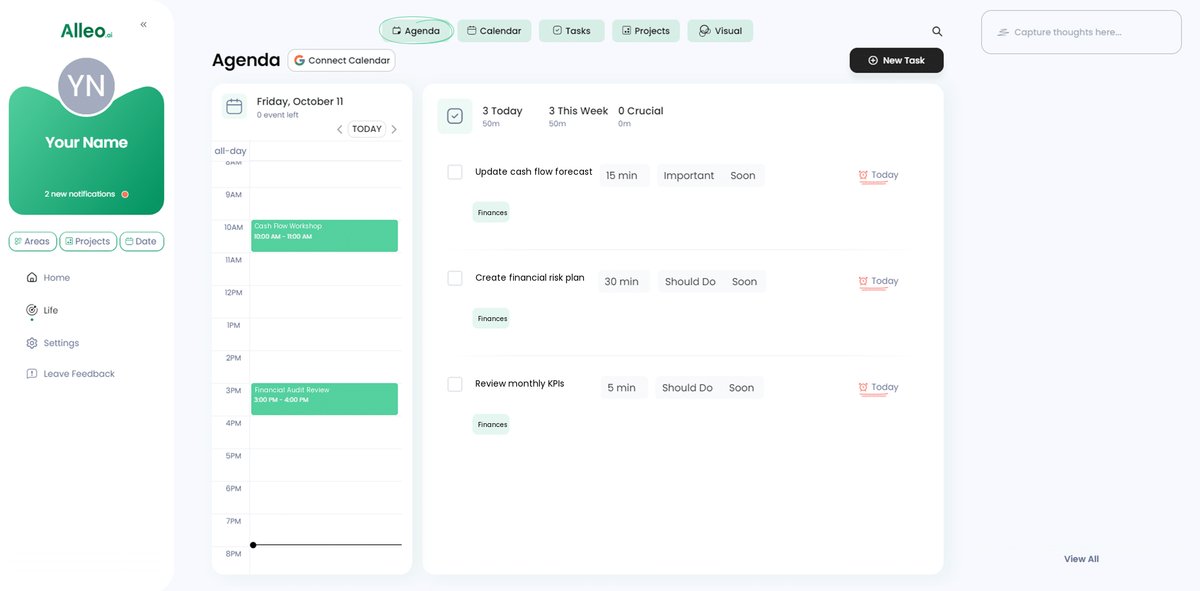

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your progress on implementing cash flow management strategies, ensuring you stay accountable to your financial goals.

Wrapping Up Your Cash Flow Strategy

As we’ve discussed, preventing recurring cash flow crises can be a real challenge for small businesses. But with the right cash flow management strategies, you can overcome these hurdles and ensure your business thrives.

Effective cash flow management involves robust financial forecasting techniques, detailed budgeting and cost control measures, financial risk mitigation, automation, and regular audits. These steps are essential to maintaining financial stability and promoting growth through working capital optimization.

I know it’s not always easy to implement expense reduction methods and revenue acceleration tactics. But with dedication and the right tools, you can do this.

Remember, Alleo is here to help. Our AI-driven coach provides personalized support to keep your finances on track, assisting with cash reserve planning and debt management for CFOs.

Take the first step towards financial stability and preventing recurring cash flow crises. Try Alleo for free today and transform your cash flow management with accounts receivable improvement and other key strategies.