6 Powerful Strategies: Best Financial Podcasts for Busy Professionals Staying Market-Savvy

Are you struggling to stay updated with the latest market trends and economic conditions? As a busy professional, finding time to sift through traditional news sources like Bloomberg and WSJ can feel impossible. That’s where the best financial podcasts for professionals come in handy.

As a life coach, I’ve helped many professionals navigate these exact challenges. In my experience, staying market-savvy is essential for making informed decisions and providing valuable valuable advice to clients. Financial literacy for professionals is crucial, and on-the-go economic insights can be a game-changer.

In this article, I’ll share actionable strategies that include subscribing to the best financial podcasts for professionals, utilizing digital tools for quick market updates, and more. These tips will help you stay ahead without feeling overwhelmed, perfect for maintaining work-life balance while boosting your financial planning skills.

Let’s dive in and explore how commute-friendly market analysis and expert financial advice podcasts can transform your professional life.

The Challenge of Staying Informed in a Fast-Paced World

Navigating the sea of financial information can be overwhelming. Traditional news sources like Bloomberg and WSJ often require more time than busy professionals have for financial literacy.

As a consultant, you need to stay updated with investment trends to provide valuable advice to your clients. The best financial podcasts for professionals offer on-the-go economic insights.

Many clients initially struggle with the sheer volume of information. They spend hours sifting through articles and still feel out of the loop on career-focused money management.

It’s a common pain point.

Podcasts and digital tools can be game-changers for time-efficient financial learning. They offer a convenient way to integrate quick market updates into your daily routine.

By shifting to these modern solutions, like commute-friendly market analysis podcasts, you can stay ahead without feeling overwhelmed.

Your Roadmap to Staying Market-Savvy

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in financial literacy for professionals:

- Subscribe to HBR IdeaCast for business insights: Gain valuable on-the-go economic insights during commutes or workouts.

- Use NACUBO In Brief for economic trend updates: Stay updated on investment trends for busy individuals affecting higher education.

- Listen to the best financial podcasts for professionals during daily commute: Integrate time-efficient financial learning into your routine effortlessly.

- Follow financial experts on social media platforms: Get real-time updates and quick market updates from industry leaders.

- Utilize mobile banking apps for real-time updates: Receive instant market insights and alerts for career-focused money management.

- Join online communities for market discussions: Engage in discussions and learn from peers about work-life balance financial planning.

Let’s dive into these commute-friendly market analysis strategies!

1: Subscribe to HBR IdeaCast for business insights

Subscribing to HBR IdeaCast, one of the best financial podcasts for professionals, is vital for gaining business insights and staying market-savvy.

Actionable Steps:

- Subscribe to HBR IdeaCast and schedule time for listening during commutes or workouts. Aim to listen to at least two episodes weekly, enhancing your financial literacy for professionals.

- Take notes on key insights and share them with your team or clients. Create a summary document of actionable takeaways to implement in your consulting practice, focusing on investment trends for busy individuals.

- Engage with the podcast community by commenting on episodes and joining discussions. Participate in online forums or social media groups related to HBR IdeaCast topics, expanding your network for on-the-go economic insights.

Explanation: These steps matter because they help you integrate valuable business insights into your routine without feeling overwhelmed, offering time-efficient financial learning.

By engaging with the HBR IdeaCast community, you can stay updated with the latest trends and advice from industry experts, making it one of the best financial podcasts for professionals seeking career-focused money management advice.

According to Harvard Business Review, their podcasts offer in-depth coverage of essential business topics that can enhance your strategic thinking and client recommendations.

Key benefits of HBR IdeaCast include:

- Expert insights from industry leaders, akin to expert financial advice podcasts

- Practical strategies for business growth

- Exposure to diverse perspectives and case studies, offering commute-friendly market analysis

This approach ensures you stay informed efficiently, making it easier to provide informed advice to clients while maintaining work-life balance financial planning.

2: Use NACUBO In Brief for economic trend updates

Listening to NACUBO In Brief, one of the best financial podcasts for professionals, can provide you with comprehensive insights into economic trends affecting higher education.

Actionable Steps:

- Add NACUBO In Brief to your podcast rotation and listen to one episode per week. Reflect on its implications for your industry and boost your financial literacy for professionals.

- Integrate findings from NACUBO In Brief into your market analysis reports. Use the podcast insights to enhance your presentations and client recommendations, offering quick market updates podcasts can provide.

- Attend NACUBO webinars or events to deepen your understanding of discussed topics. Allocate time monthly to participate in at least one NACUBO event for time-efficient financial learning.

Explanation: These steps matter because they help you stay updated with investment trends for busy individuals that are crucial for informed decision-making.

By integrating insights from NACUBO In Brief into your practice, you can provide well-rounded advice to your clients, balancing career-focused money management with work-life balance financial planning.

According to NACUBO, their podcasts offer valuable perspectives on financial conditions impacting higher education, which can be applied to broader market analyses, making it an excellent source for on-the-go economic insights.

This approach ensures you’re well-informed, making your consulting advice more valuable and relevant, similar to expert financial advice podcasts.

3: Listen to finance podcasts during daily commute

Listening to the best financial podcasts for professionals during your daily commute can help you stay updated without disrupting your schedule, offering on-the-go economic insights.

Actionable Steps:

- Curate a playlist of top financial podcasts recommended for professionals. Include a mix of personal finance, investing, and market analysis podcasts for time-efficient financial learning.

- Set a daily listening schedule during your commute or other routine activities. Aim for 20-30 minutes of podcast content each day, focusing on quick market updates podcasts.

- Join podcast listener groups for networking and additional learning. Engage with fellow listeners to discuss episodes and share insights, enhancing your financial literacy for professionals.

Explanation: These steps matter because they integrate valuable financial insights into your daily routine, making it easier to stay updated on investment trends for busy individuals without feeling overwhelmed.

According to DealRoom, finance podcasts are an excellent medium for professionals to stay informed about market trends and economic conditions, offering expert financial advice podcasts.

This approach ensures you remain well-informed, making your consulting advice more relevant and valuable while supporting career-focused money management.

By incorporating these strategies, you can effortlessly keep up with the latest financial news and trends through commute-friendly market analysis and short-form business news podcasts, promoting work-life balance financial planning.

4: Follow financial experts on social media platforms

Following financial experts on social media platforms can provide real-time updates and insights from industry leaders, similar to how the best financial podcasts for professionals offer on-the-go economic insights.

Actionable Steps:

- Identify and follow top financial experts on platforms like Twitter, LinkedIn, and Instagram. Create a dedicated list or feed for quick access to their updates, akin to curating a playlist of short-form business news podcasts.

- Engage with their content by liking, commenting, and sharing posts. Participate in conversations to build your network and gain deeper insights, enhancing your financial literacy for professionals.

- Use social media tools to set alerts for posts from key influencers. Stay informed about breaking news and expert opinions in real-time, similar to quick market updates podcasts.

Top financial experts to follow on social media for investment trends for busy individuals:

- Warren Buffett (@WarrenBuffett)

- Ray Dalio (@RayDalio)

- Cathie Wood (@CathieDWood)

Explanation: These steps matter because they allow you to stay updated with the latest financial news and trends directly from industry leaders. By engaging with expert content, you can expand your network and deepen your understanding of market dynamics, complementing the insights from the best financial podcasts for professionals.

According to Pew Research, social media is becoming a significant news source, especially for real-time updates, making it a time-efficient financial learning tool.

This approach ensures you remain well-informed, making your consulting advice more valuable and relevant, aligning with career-focused money management strategies.

5: Utilize mobile banking apps for real-time updates

Mobile banking apps offer a convenient way to stay updated with real-time market insights, similar to how the best financial podcasts for professionals provide quick market updates.

Actionable Steps:

- Download and set up notifications for mobile banking apps that provide market insights. Choose apps with features like real-time news, alerts, and investment tracking, complementing on-the-go economic insights from podcasts.

- Regularly review app updates and integrate key information into your financial strategy. Allocate time weekly to assess and adjust your investment portfolio based on new data, enhancing your financial literacy for professionals.

- Explore app features like budgeting tools and financial calculators. Use these tools to enhance your financial planning and client advice, supporting work-life balance financial planning.

Explanation: These steps matter because they help you stay updated with real-time financial information, making it easier to provide informed advice, much like expert financial advice podcasts.

According to the FDIC, there is an increasing adoption of mobile banking as a primary method of account access. This ensures you remain well-informed, making your consulting advice more relevant and valuable, similar to short-form business news podcasts.

Using mobile banking apps efficiently can transform how you stay updated with market trends, complementing the best financial podcasts for professionals in providing time-efficient financial learning.

6: Join online communities for market discussions

Joining online communities for market discussions can help you stay informed and engage with the latest trends, including investment trends for busy individuals.

Actionable Steps:

- Join finance-related forums and groups on platforms like Reddit and LinkedIn. Participate in at least two discussions per week to stay engaged and enhance your financial literacy for professionals.

- Share your insights and ask questions to learn from others. Seek advice and feedback on specific market trends or investment strategies, including recommendations for the best financial podcasts for professionals.

- Attend virtual meetups or webinars hosted by these communities. Allocate time monthly to attend at least one virtual event for networking and learning about time-efficient financial learning techniques.

Explanation: These steps matter because they allow you to engage with peers and gain diverse perspectives on market trends and career-focused money management.

According to Pew Research, social media and online forums are becoming significant sources of news and information. This approach ensures you remain well-informed, making your consulting advice more valuable and relevant, especially when combined with on-the-go economic insights.

Benefits of joining online financial communities:

- Access to diverse perspectives and experiences

- Real-time discussions on market events and quick market updates

- Opportunities for networking and collaboration, including finding expert financial advice podcasts

By actively participating in these online communities, you can expand your network and stay ahead in the fast-paced world of finance, while maintaining work-life balance financial planning.

Work with Alleo to Stay Market-Savvy

We’ve explored the challenges busy consultants face in staying market-savvy, including finding the best financial podcasts for professionals. Solving these challenges can boost your career and client value through enhanced financial literacy for professionals.

But did you know you can work directly with Alleo to make this journey easier and faster? Our platform offers quick market updates podcasts and time-efficient financial learning resources.

Setting up an account with Alleo is simple. Start with a free 14-day trial, no credit card needed. Discover expert financial advice podcasts and on-the-go economic insights.

Create a personalized plan tailored to your needs, focusing on career-focused money management. Alleo’s AI coach offers full coaching sessions, just like a human coach, covering investment trends for busy individuals.

Alleo helps you stay accountable with progress updates, changes, and reminders via text and push notifications. Enjoy commute-friendly market analysis and short-form business news podcasts.

Ready to get started for free? Let me show you how to access the best financial podcasts for professionals while maintaining work-life balance financial planning!

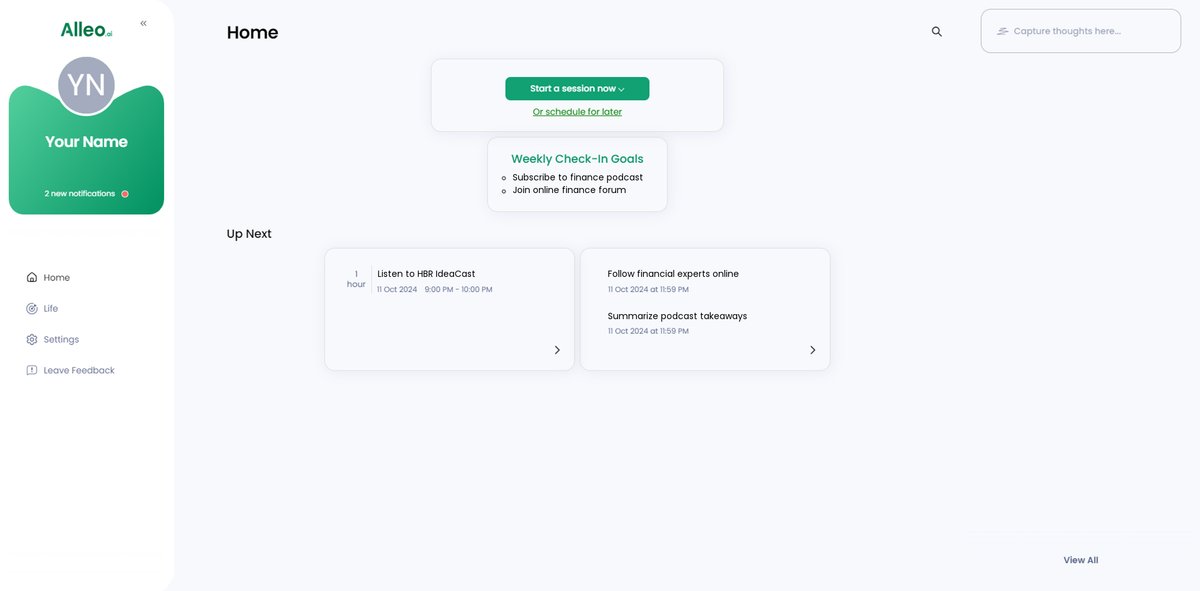

Step 1: Log In or Create Your Account

To start your journey towards staying market-savvy with our AI coach, simply Log in to your account or create a new one to begin your 14-day free trial and access personalized financial insights.

Step 2: Choose “Building better habits and routines” as your focus

Click on “Building better habits and routines” to start developing a structured approach to staying market-savvy, which will help you effortlessly integrate financial updates into your daily life and enhance your consulting expertise.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to align with your goal of staying market-savvy, enabling you to receive tailored guidance on financial trends, economic updates, and strategies for integrating market insights into your consulting practice.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your market-savvy goals and create a personalized plan to keep you informed and ahead in your consulting career.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the market-savvy goals you discussed, keeping you on track with your financial learning journey.

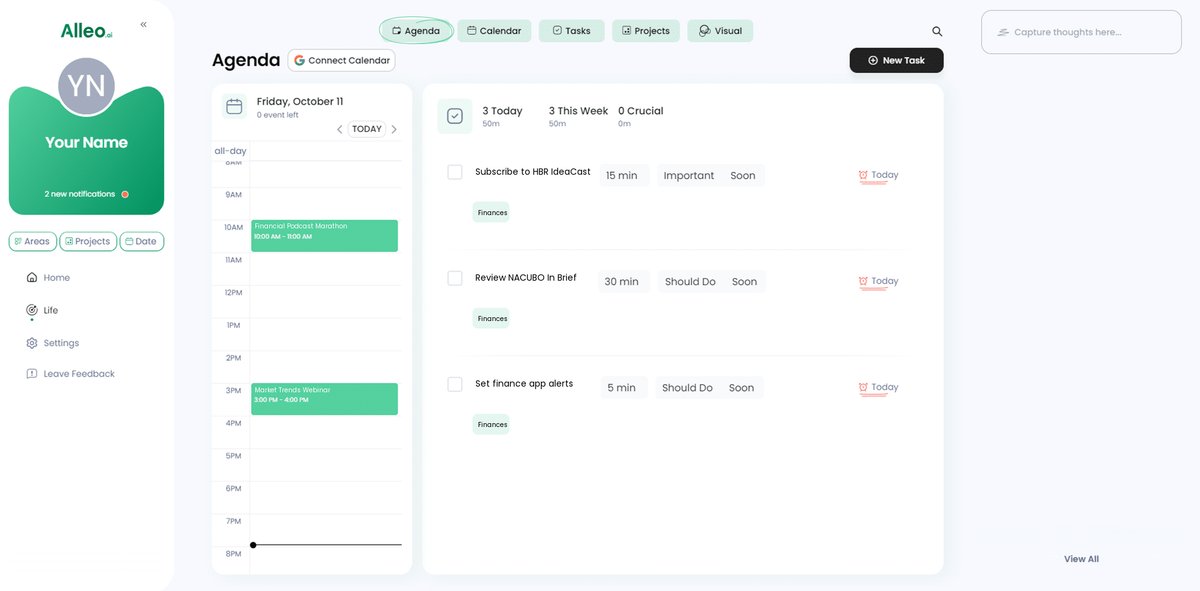

Step 6: Adding events to your calendar or app

Use the AI coach’s calendar and task features to add market-related events, podcast listening sessions, and community discussions, helping you track your progress in staying market-savvy and ensuring you never miss important financial updates or learning opportunities.

Keep Ahead with Ease: Your Path to Staying Market-Savvy

We’ve covered how crucial staying updated is for your consulting success, including listening to the best financial podcasts for professionals.

By integrating financial podcasts, digital tools, and mobile apps into your routine, you can stay informed effortlessly and boost your financial literacy as a professional.

Empathizing with your busy schedule, these strategies fit seamlessly into your day, offering time-efficient financial learning opportunities.

Remember, staying market-savvy doesn’t have to be overwhelming. Quick market updates podcasts can provide on-the-go economic insights.

You’ve got this!

Alleo can help you maintain this momentum while balancing work-life and financial planning.

With Alleo, you have an AI coach to keep you on track with career-focused money management.

Try Alleo’s free 14-day trial and see how it transforms your professional life, complementing expert financial advice podcasts.

Stay ahead, stay informed, and keep thriving with commute-friendly market analysis and short-form business news podcasts.