3 Proven Strategies for Retirement Planning with an Uninterested Spouse

Are you struggling to get on the same page with your spouse about your retirement plans? Aligning retirement goals with spouse can be challenging for many couples.

As a life coach, I’ve helped many empty nesters navigate these challenges. Communication and joint retirement decision-making are crucial for a peaceful retirement. Overcoming resistance to retirement planning is often a key hurdle.

In this article, I’ll share practical strategies to help you and your partner align on retirement goals, expected spending, and necessary savings. We’ll explore retirement communication with spouse and how to balance individual and shared retirement goals.

Let’s dive in.

Understanding the Disconnect in Retirement Planning

Many clients struggle with financial insecurity and a lack of direction when aligning retirement goals with spouse. This can be particularly hard when one partner is not financially engaged, leading to challenges in retirement communication with spouse.

The emotional toll of these disagreements can strain relationships. Financial stress often leads to anxiety and resentment, especially when addressing retirement concerns together.

I often see couples facing these challenges in joint retirement decision-making. They feel overwhelmed and unsure where to start with balancing individual and shared retirement goals.

Addressing these issues is essential for a peaceful and secure future. Overcoming these hurdles can lead to a stronger partnership and a clearer path to retirement, fostering compromise in retirement planning and motivating a partner for retirement savings.

Key Steps to Aligning Retirement Goals with Your Partner

Overcoming this challenge of aligning retirement goals with your spouse requires a few key steps. Here are the main areas to focus on to make progress in joint retirement decision-making.

- Schedule regular “retirement check-ins” together: Plan monthly or quarterly meetings to discuss retirement plans and improve retirement communication with spouse.

- Use visual aids to simplify financial concepts: Create charts and graphs to make finances easier to understand, aiding in spousal retirement education.

- Seek joint financial counseling or therapy: Consult a financial therapist to improve communication and cooperation, addressing retirement concerns together.

Let’s dive in to explore these strategies for aligning retirement goals with your spouse!

1: Schedule regular “retirement check-ins” together

Scheduling regular “retirement check-ins” can significantly improve alignment on retirement goals with your spouse and foster better retirement communication with your spouse.

Actionable Steps:

- Set a monthly or quarterly date for a “retirement check-in” meeting to focus on aligning retirement goals with spouse.

- SMART Goal: Schedule a 1-hour meeting every first Sunday of the month to review and discuss retirement plans, addressing retirement concerns together.

- Create a structured agenda for each meeting to ensure all key topics are covered, including financial goals for couples.

- SMART Goal: Develop an agenda template that includes budget review, goal setting, and addressing any concerns related to joint retirement decision-making.

- Keep a record of decisions made and tasks assigned during each meeting to track progress in aligning retirement goals with spouse.

- SMART Goal: Use a shared digital document to track progress and responsibilities for compromise in retirement planning.

Explanation:

These steps ensure consistent communication and proactive planning. Regular check-ins help prevent misunderstandings and align financial goals for couples, especially when overcoming resistance to retirement planning.

According to Kiplinger, nearly 7 in 10 couples find healthy ways to discuss financial differences and find compromise. By implementing these check-ins, you’re likely to improve financial harmony and strengthen your partnership in aligning retirement goals with spouse.

Key benefits of regular retirement check-ins:

- Improved financial transparency and spousal retirement education

- Better alignment on long-term goals and balancing individual and shared retirement goals

- Reduced financial stress in the relationship, especially when motivating a partner for retirement savings

Taking these steps can pave the way for a smoother retirement planning process, even for retirement planning in one-income households.

2: Use visual aids to simplify financial concepts

Visual aids can make complex financial concepts easier to understand and discuss with your partner, helping in aligning retirement goals with spouse.

Actionable Steps:

- Create charts and graphs to visually represent financial data and goals for joint retirement decision-making.

- SMART Goal: Use software like Excel or Google Sheets to generate monthly charts showing savings progress and projections for retirement communication with spouse.

- Utilize online tools and apps that offer visual financial planning aids for couples.

- SMART Goal: Integrate tools such as Mint or Personal Capital to provide a clear visual overview of finances and shared retirement goals.

- Develop a visual timeline of retirement milestones and goals to address retirement concerns together.

- SMART Goal: Create a timeline poster or digital graphic that outlines major financial milestones leading up to retirement, facilitating compromise in retirement planning.

Explanation:

These steps help demystify finances, making it easier for a less-engaged partner to participate in planning. Visual aids can bridge communication gaps, making discussions more productive and motivating a partner for retirement savings.

According to Slate, financial transparency is crucial for long-term relationship success. By using these tools, you can foster better understanding and cooperation in financial planning, overcoming resistance to retirement planning.

Effective types of visual aids for financial planning and aligning retirement goals with spouse:

- Pie charts for budget allocation in retirement planning for one-income households

- Line graphs for savings growth projections to help set financial goals for couples

- Infographics for retirement lifestyle goals, balancing individual and shared retirement goals

Taking these steps can pave the way towards a more harmonious retirement planning experience and improve spousal retirement education.

3: Seek joint financial counseling or therapy

Seeking professional financial counseling can bridge communication gaps and foster cooperation when aligning retirement goals with your spouse.

Actionable Steps:

- Find a certified financial therapist or counselor who specializes in working with couples on retirement communication.

- SMART Goal: Research and schedule an initial consultation with a financial therapist within the next two weeks to discuss joint retirement decision-making.

- Attend workshops or seminars together on financial planning and communication for retirement.

- SMART Goal: Enroll in a local or online financial planning workshop focused on financial goals for couples by the end of the month.

- Participate in regular sessions to address ongoing financial concerns and improve communication about retirement planning.

- SMART Goal: Commit to bi-weekly counseling sessions for the next six months to build financial harmony and address retirement concerns together.

Explanation:

These steps are crucial for enhancing communication and understanding between partners when aligning retirement goals. Professional guidance can help you navigate financial stress, overcome resistance to retirement planning, and find compromise in retirement planning.

According to the Financial Therapy Association, combining financial advice with emotional support is key to managing financial stress effectively, which is essential for motivating a partner for retirement savings.

What to expect from financial therapy:

- Improved financial communication skills for discussing retirement

- Strategies for resolving money-related conflicts and balancing individual and shared retirement goals

- Tools for aligning financial values and goals, including spousal retirement education

Taking these steps can pave the way towards a more harmonious retirement planning experience, even for one-income households.

Partner with Alleo on Your Retirement Planning Journey

We’ve explored strategies for aligning retirement goals with spouse, especially when dealing with a less-engaged partner. But did you know Alleo can make this journey of joint retirement decision-making smoother?

Alleo offers personalized coaching tailored to your unique retirement planning needs, including addressing retirement concerns together and overcoming resistance to retirement planning.

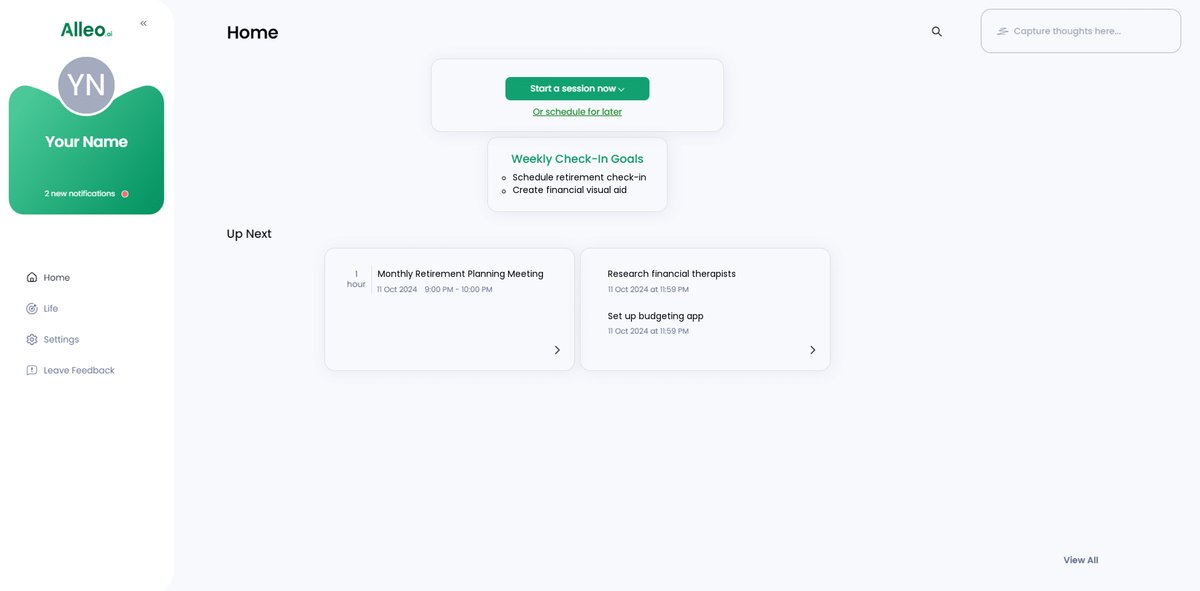

Setting up an account is easy. Simply sign up, create a personalized plan for balancing individual and shared retirement goals, and start working with Alleo’s AI coach.

The coach offers full coaching sessions on retirement communication with spouse and follows up on your progress. You’ll receive reminders and accountability through text and push notifications to help with motivating a partner for retirement savings.

Ready to get started for free on aligning retirement goals with spouse? Let me show you how!

Step 1: Log In or Create Your Account

To begin aligning your retirement goals with Alleo’s AI coach, simply Log in to your account or create a new one to start your personalized retirement planning journey.

Step 2: Choose “Improving overall well-being and life satisfaction”

Click on “Improving overall well-being and life satisfaction” to address the root of retirement planning challenges, as better life satisfaction can lead to more productive discussions with your partner and clearer financial goals.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to address your retirement planning challenges and align your goals with your partner, setting the foundation for a secure and harmonious financial future together.

Step 4: Starting a Coaching Session

Begin your retirement planning journey with Alleo by scheduling an intake session, where you’ll discuss your goals and create a personalized plan to align your retirement vision with your partner’s.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the retirement goals you discussed, ensuring you stay on track with your partner towards a harmonious financial future.

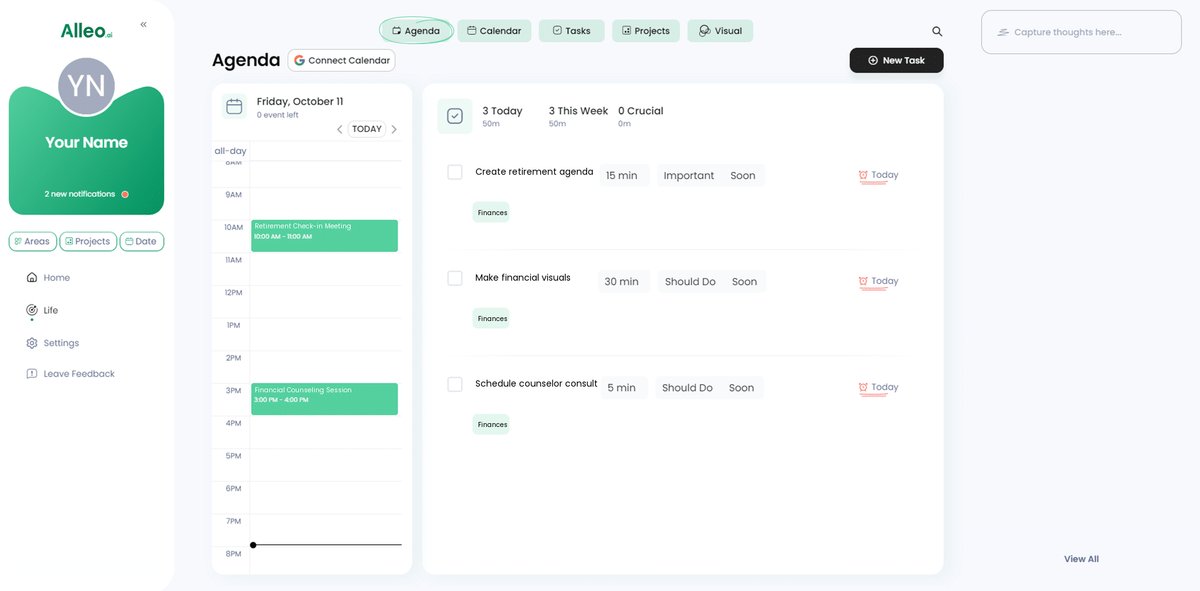

Step 6: Adding events to your calendar or app

Schedule your retirement check-ins and financial counseling sessions in the Alleo app’s calendar, where you can easily track your progress in addressing retirement planning challenges with your partner. The app’s task features allow you to set reminders for creating visual aids and following up on financial goals discussed during your meetings.

Wrapping Up Your Retirement Planning Journey

As we conclude, let’s reflect on how you can align your retirement goals with your spouse. Effective retirement communication with spouse is key.

It’s normal to face challenges in this area. However, you now have practical strategies for overcoming resistance to retirement planning.

Scheduling regular check-ins, using visual aids, and seeking professional counseling will help in joint retirement decision-making.

Remember, you’re not alone. Many couples experience similar struggles when balancing individual and shared retirement goals.

For personalized support in aligning retirement goals with spouse, consider using Alleo. It offers tools and coaching tailored to your unique needs.

Start today. Take the first step towards harmonious and secure retirement planning for couples.

Ready to try Alleo for free? Let’s make your shared financial goals for retirement a reality.