5 Proven Strategies for Couples to Plan Retirement Together Effectively

Are you and your partner feeling overwhelmed by the complexities of couples retirement planning strategies?

As a life coach, I’ve helped many couples navigate the challenges of aligning their retirement goals. I understand the unique difficulties you face when trying to make joint financial goals in retirement and planning for your shared future.

In this blog, you’ll discover actionable steps to effectively plan your retirement together. We’ll cover strategies to ensure a financially secure and fulfilling future, including long-term savings strategies for partners and retirement income planning for spouses.

Let’s dive in.

Understanding the Challenges of Joint Retirement Planning

Aligning retirement goals with your partner can be incredibly challenging. Many couples find it difficult to balance individual dreams with shared financial realities when developing couples retirement planning strategies.

For instance, several clients report struggling with different expectations for spending in retirement. One partner might dream of traveling the world, while the other prefers a quiet, simpler lifestyle. This highlights the importance of balancing individual and shared retirement needs.

Moreover, navigating the financial landscape can be daunting. Understanding Social Security benefits for married retirees, managing rising healthcare costs, and ensuring sufficient long-term savings strategies for partners are common hurdles in retirement planning for couples.

In my experience, the stress of these decisions often leads to procrastination. This delay can create a feeling of uncertainty and insecurity about the future, emphasizing the need for effective retirement income planning for spouses.

Ultimately, effective joint retirement planning requires clear communication and a solid strategy. Let’s explore actionable steps to help you and your partner achieve this, focusing on joint financial goals in retirement.

Steps to Effective Joint Retirement Planning

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in couples retirement planning strategies:

- Discuss Retirement Goals and Lifestyle Together: Schedule regular discussions to align your retirement dreams and establish joint financial goals in retirement.

- Create a Joint Retirement Budget and Savings Plan: Assess your financial status and estimate future expenses, implementing long-term savings strategies for partners.

- Maximize Social Security Benefits as a Couple: Learn and strategize the best time to claim Social Security benefits for married retirees.

- Coordinate and Optimize Retirement Accounts: Review, consolidate, and diversify your accounts for effective retirement income planning for spouses.

- Seek Professional Financial Advice as a Team: Find a qualified advisor and schedule regular check-ins to enhance communication in retirement planning.

Let’s dive into these retirement planning for couples strategies!

1: Discuss retirement goals and lifestyle together

Discussing retirement goals and lifestyle with your partner is essential to ensure a harmonious and fulfilling future. This is a crucial step in couples retirement planning strategies.

Actionable Steps:

- Schedule regular discussions about retirement dreams and expectations.

- Set monthly ‘retirement planning for couples’ dates to discuss visions and goals.

- Create a vision board together to visualize your ideal retirement lifestyle.

- Collect images and ideas that represent your retirement dreams and keep the board in a visible place.

- Write down individual and shared retirement goals.

- Each partner lists their top three retirement desires and then combine them into a shared document, focusing on joint financial goals in retirement.

Explanation: These steps help you align your dreams and expectations, reducing potential conflicts.

Regular discussions and visualizations keep both partners engaged and focused on shared goals, which is crucial for balancing individual and shared retirement needs.

According to Forbes, aligning financial goals is crucial for effective retirement planning.

Key benefits of discussing retirement goals together:

- Improves communication and understanding between partners

- Helps identify potential conflicts early

- Creates a shared vision for the future, including long-term savings strategies for partners

Start these conversations today to build a solid foundation for your couples retirement planning strategies.

2: Create a joint retirement budget and savings plan

Creating a joint retirement budget and savings plan is crucial for couples retirement planning strategies, aligning your financial goals and ensuring a secure future.

Actionable Steps:

- Assess your current financial status and income sources.

- Use a budgeting tool to track current expenses and income for retirement planning for couples.

- Estimate future retirement expenses, including healthcare considerations for aging couples and leisure activities.

- Research costs for planned activities and potential medical expenses.

- Develop long-term savings strategies for partners that accommodate both partners’ contributions and joint financial goals in retirement.

- Set specific monthly savings targets for each partner based on their income and expenses.

Explanation: These steps help you understand your financial standing and prepare for future expenses.

Estimating costs and setting savings targets ensure you and your partner are on the same page for retirement income planning for spouses.

According to NCOA, many retirees rely heavily on Social Security benefits for married retirees, so planning ahead is critical.

Taking these steps now will help you build a solid financial foundation for your retirement.

3: Maximize Social Security benefits as a couple

Maximizing Social Security benefits is crucial for ensuring a stable income during retirement, making it an essential part of couples retirement planning strategies.

Actionable Steps:

- Learn about Social Security benefits and spousal options.

- Attend a Social Security workshop or webinar together to understand retirement income planning for spouses.

- Strategize the best time to claim benefits for maximum advantage.

- Use a Social Security calculator to determine optimal claiming ages, a key aspect of retirement planning for couples.

- Consider the impact of working longer on benefit amounts.

- Discuss the possibility of one or both partners working past traditional retirement age as part of your long-term savings strategies.

Explanation: These steps help you optimize Social Security benefits, ensuring you get the most out of what you’ve earned. Understanding spousal options and claiming strategies can significantly enhance your retirement income, contributing to your joint financial goals in retirement.

According to the NCOA, planning ahead is vital for maximizing benefits.

Factors that can affect your Social Security benefits:

- Age at which you start claiming benefits

- Length of your work history

- Earnings during your highest-paid years

These actions will help secure your financial future, giving you peace of mind as you approach retirement. Effective communication in retirement planning is crucial for balancing individual and shared retirement needs.

4: Coordinate and optimize retirement accounts

Coordinating and optimizing your retirement accounts is vital to ensure a balanced and efficient financial strategy for couples retirement planning.

Actionable Steps:

- Review all retirement accounts and their current statuses.

- Schedule a financial review meeting to go over each account and discuss joint financial goals in retirement.

- Consolidate accounts where possible to simplify management.

- Meet with a financial advisor to discuss consolidation options and long-term savings strategies for partners.

- Diversify investments to balance risk and growth potential.

- Reallocate assets to include a mix of stocks, bonds, and other investment vehicles, focusing on retirement income planning for spouses.

Explanation: These steps help you streamline your retirement planning for couples, making it easier to manage your finances and balance individual and shared retirement needs.

Consolidating accounts reduces complexity, while diversifying investments balances risk and growth. According to NBER, efficient coordination can significantly improve your retirement readiness. This is especially important when managing assets as a retired couple.

Taking these actions now will help secure and optimize your retirement savings, ensuring a stable financial future for couples approaching retirement.

5: Seek professional financial advice as a team

Seeking professional financial advice together is vital to ensure your couples retirement planning strategies are robust and aligned with both partners’ goals.

Actionable Steps:

- Find a qualified financial advisor who specializes in retirement planning for couples.

- Research and interview at least three potential advisors experienced in joint financial goals in retirement.

- Schedule regular check-ins with your advisor to stay on track with your long-term savings strategies for partners.

- Set quarterly meetings with your advisor to review progress and make adjustments to your retirement income planning for spouses.

- Take advantage of financial planning tools and resources provided by your advisor.

- Utilize online tools and personalized reports to monitor your retirement plan and manage assets as a retired couple.

Explanation: These steps ensure you receive expert guidance tailored to your unique needs. Regular check-ins keep you on track, and planning tools offer valuable insights for balancing individual and shared retirement needs.

According to RetireReadyTN, personalized retirement planning services significantly improve financial readiness.

Benefits of working with a financial advisor for couples retirement planning strategies:

- Access to expert knowledge and strategies for healthcare considerations for aging couples

- Objective perspective on your financial situation and Social Security benefits for married retirees

- Help in navigating complex financial decisions, including estate planning for couples nearing retirement

With professional advice, you can confidently navigate your retirement planning journey, ensuring effective communication in retirement planning between partners.

Enhance Your Retirement Planning with Alleo

We’ve explored the challenges of couples retirement planning strategies and the steps to achieve it. But did you know you can work with Alleo to simplify this journey in retirement planning for couples?

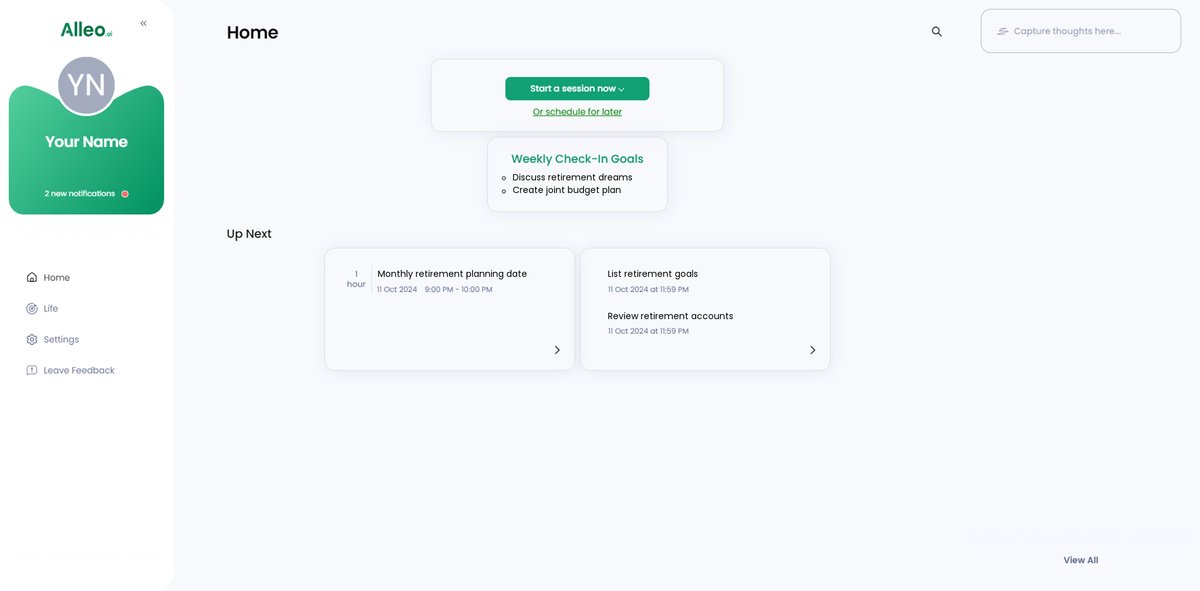

Alleo is an AI coach designed to assist you in retirement planning, helping partners set joint financial goals in retirement. It provides affordable, tailored coaching support for long-term savings strategies, just like a human coach.

With Alleo, you can set up an account, create a personalized plan for retirement income planning for spouses, and receive guidance on overcoming specific challenges in communication and balancing individual and shared retirement needs. Alleo’s coach keeps you accountable through follow-ups, text, and push notifications, supporting you in managing assets as a retired couple.

Ready to get started for free and explore couples retirement planning strategies? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards a secure retirement with Alleo, simply log in to your existing account or create a new one to access personalized retirement planning guidance.

Step 2: Choose Your Focus Area

Click on “Improving overall well-being and life satisfaction” to align your retirement planning with a holistic approach to your future happiness, addressing the challenges of joint retirement planning discussed in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to tackle retirement planning challenges head-on. This selection will provide tailored guidance on budgeting, maximizing Social Security benefits, and optimizing retirement accounts, helping you and your partner achieve a secure financial future together.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your retirement goals and create a personalized plan to guide your future coaching sessions.

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app to find your discussed retirement goals conveniently displayed on the home page, allowing you to easily review and manage your progress towards a secure financial future together.

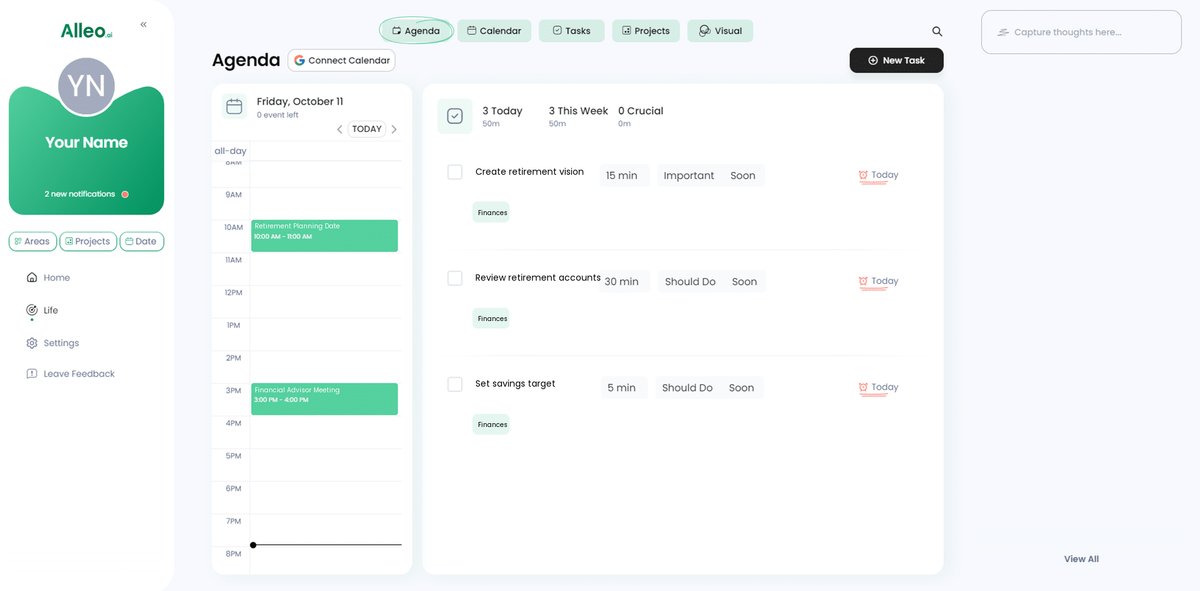

6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your retirement planning activities, such as financial review meetings or discussions with your partner, helping you stay on top of your goals and monitor your progress in solving retirement challenges together.

Securing Your Future Together

As you coordinate and optimize your retirement accounts, it’s crucial to keep the bigger picture in mind: a secure and fulfilling future together. Effective couples retirement planning strategies are essential for long-term success.

You’ve taken the first steps towards a harmonious retirement plan. Discussing joint financial goals in retirement, creating a budget, maximizing Social Security benefits for married retirees, and seeking professional advice are essential components of retirement planning for couples.

Remember, effective planning requires ongoing communication and regular financial check-ins. Balancing individual and shared retirement needs might seem overwhelming, but you’re not alone in managing assets as a retired couple.

Alleo is here to support you every step of the way in your retirement income planning for spouses.

Start your journey towards a financially secure and fulfilling retirement today. Try Alleo for free and take control of your future together with our couples retirement planning strategies.