7 Effective Steps to Initiate Retirement Planning Conversations with Your Spouse

Are you and your partner struggling to start retirement conversations with your spouse? Starting retirement conversations with your spouse can be challenging, even for couples with similar financial views.

As a life coach, I’ve helped many couples navigate these challenges in financial communication in marriage. It’s common to feel stuck when discussing retirement goals for couples.

In this article, you’ll discover practical strategies to initiate and structure these vital discussions about joint retirement planning. We’ll cover everything from setting a comfortable environment for discussing retirement savings with your partner to creating a shared vision for your future, including retirement lifestyle expectations and long-term financial planning for couples.

Let’s dive in to explore managing retirement investments together and budgeting for retirement as a team.

Common Hurdles in Retirement Planning Conversations

Starting retirement conversations with spouse can feel daunting. Many couples initially struggle to align their visions for retirement, especially when they haven’t discussed long-term financial planning for couples before.

In my experience, people often find these conversations uncomfortable because they reveal differences in financial priorities. Let’s face it, discussing retirement savings with partner can be stressful.

You might also face the challenge of balancing individual goals with shared aspirations. This can be particularly tough for empty nesters looking to align their post-retirement plans and retirement lifestyle expectations.

Aligning financial goals is crucial, yet it’s an ongoing struggle for many couples. Nearly three-quarters of couples report ongoing stress in financial communication in marriage, highlighting the need for effective communication strategies when managing retirement investments together.

Effective Steps for Initiating Retirement Planning Conversations

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress when starting retirement conversations with your spouse.

- Set a casual, comfortable time to talk finances: Schedule a relaxed setting to discuss finances and improve financial communication in marriage.

- Create a shared vision for retirement together: Align your individual retirement visions and establish retirement goals for couples.

- List current assets and debts transparently: Consolidate your financial lists for a clear overview, crucial for joint retirement planning strategies.

- Identify short and long-term financial goals: Set SMART goals for both short-term and long-term needs, discussing retirement savings with your partner.

- Discuss potential lifestyle changes in retirement: Consider changes that could impact your budget and retirement lifestyle expectations.

- Review employer-sponsored retirement benefits: Understand and maximize your benefits for managing retirement investments together.

- Schedule regular check-ins on financial progress: Regularly review and adjust your plans, addressing retirement concerns with your partner.

Let’s dive in!

1: Set a casual, comfortable time to talk finances

Creating a relaxed environment to discuss finances is crucial for open and productive conversations about retirement planning, especially when starting retirement conversations with spouse.

Actionable Steps:

- Schedule a monthly date night: Choose a relaxed setting free from distractions to talk about finances and discuss retirement savings with partner.

- Use conversation starters: Start with questions like, “What are your retirement goals for couples?” to ease into the topic.

- Establish ground rules: Agree on guidelines to keep the discussion positive and productive, fostering better financial communication in marriage.

Explanation: Setting a comfortable environment helps reduce stress and encourages honest communication, which is essential for aligning financial goals and developing joint retirement planning strategies.

According to AMG National Trust, having open financial conversations is vital for establishing realistic goals and managing retirement investments together.

This approach sets the stage for deeper financial discussions and helps build a strong foundation for shared retirement planning, including budgeting for retirement as a team and addressing retirement concerns with partner.

2: Create a shared vision for retirement together

Creating a shared vision for retirement is crucial to ensure that both partners are working towards common goals when starting retirement conversations with spouse.

Actionable Steps:

- Write down individual retirement visions: Each partner should document their personal retirement dreams and then compare notes to find common ground, fostering financial communication in marriage.

- Create a vision board together: Use images and words that represent your shared retirement goals for couples to create a visual representation.

- Discuss daily life and activities: Talk about how you envision spending your days and what activities you plan to engage in during retirement, addressing retirement lifestyle expectations.

Explanation: Taking these steps helps couples align their retirement goals and ensures both partners feel heard and valued in joint retirement planning strategies.

By fostering open conversations, you can create a unified plan that reflects both partners’ aspirations for discussing retirement savings with partner.

According to TFG Invest, open communication is essential for ensuring both spouses are prepared for major life changes.

This alignment paves the way for a cohesive retirement plan that meets both partners’ needs in long-term financial planning for couples.

3: List current assets and debts transparently

Understanding your financial standing is crucial for effective retirement planning and starting retirement conversations with your spouse.

Actionable Steps:

- List all assets and debts: Each partner should document their accounts, properties, and liabilities as part of joint retirement planning strategies.

- Use a financial planning app: Consolidate these lists into a single, comprehensive overview using a tool for long-term financial planning for couples.

- Review and discuss: Go over the compiled list to address any surprises or discrepancies, enhancing financial communication in marriage.

Key benefits of financial transparency:

- Builds trust between partners

- Provides a clear picture of your financial health

- Helps identify areas for improvement in retirement savings with partner

Explanation: Transparency in listing assets and debts ensures both partners are on the same page when discussing retirement savings with partner. This clarity is the foundation for informed decisions about retirement goals for couples.

According to AMG National Trust, open financial conversations are vital for realistic goal-setting.

Taking these steps helps build trust and paves the way for a cohesive financial plan, facilitating retirement income planning for spouses.

4: Identify short and long-term financial goals

Identifying short and long-term financial goals is essential for effective retirement planning and starting retirement conversations with spouse.

Actionable Steps:

- Set SMART goals: Establish specific, measurable, actionable, realistic, and time-bound goals for short-term needs, like emergency savings, and long-term needs, like retirement funds and joint retirement planning strategies.

- Prioritize goals: Rank these goals based on their importance and timeline to ensure you focus on what matters most when discussing retirement savings with partner.

- Assign responsibilities: Divide tasks and responsibilities for each goal to ensure accountability and progress in managing retirement investments together.

Explanation: Setting clear financial goals helps you stay on track and make informed decisions for long-term financial planning for couples.

This approach aligns with current trends in comprehensive financial planning and retirement lifestyle expectations.

According to Lanning Financial, financial planning goes beyond retirement planning by including other mid-range goals.

Ensuring both partners are involved in setting and prioritizing these goals fosters collaboration and shared responsibility in budgeting for retirement as a team.

Taking these steps ensures a well-rounded approach to your financial future and supports retirement income planning for spouses.

5: Discuss potential lifestyle changes in retirement

Discussing potential lifestyle changes in retirement is essential for starting retirement conversations with spouse and planning a fulfilling and realistic future together.

Actionable Steps:

- Discuss living arrangements: Consider whether you’ll downsize, relocate, or stay in your current home as part of your joint retirement planning strategies.

- Explore new hobbies: Talk about activities you plan to pursue that could affect your retirement budget and align with your retirement lifestyle expectations.

- Plan for healthcare costs: Discuss how your healthcare needs might change and prepare accordingly, addressing retirement concerns with partner.

Explanation: Addressing these lifestyle changes helps you anticipate and plan for future financial needs, promoting effective financial communication in marriage.

Open conversations about potential adjustments ensure both partners are on the same page when discussing retirement savings with partner.

According to AMG National Trust, aligning on retirement visions is crucial for realistic goal-setting and managing retirement investments together.

These discussions pave the way for a smoother transition into retirement and a shared understanding of future priorities, supporting long-term financial planning for couples.

6: Review employer-sponsored retirement benefits

Reviewing employer-sponsored retirement benefits is essential for maximizing your retirement savings and ensuring a secure future, which is crucial when starting retirement conversations with spouse.

Actionable Steps:

- Schedule a meeting with a financial advisor: Set up an appointment to discuss your employer-sponsored benefits and understand how they fit into your overall plan for joint retirement planning strategies.

- Review and update beneficiary designations: Ensure that all beneficiary information on retirement accounts is current and accurately reflects your wishes, an important aspect of financial communication in marriage.

- Maximize contributions: Increase your contributions to employer-sponsored plans, such as a 401(k) or pension, to take full advantage of any matching programs, which is crucial when discussing retirement savings with partner.

Common employer-sponsored retirement benefits:

- 401(k) or 403(b) plans

- Pension plans

- Stock options or employee stock purchase plans

Explanation: Understanding and optimizing employer-sponsored benefits can significantly impact your retirement readiness and is a key part of long-term financial planning for couples.

These steps ensure you utilize all available resources and avoid missing out on valuable opportunities when starting retirement conversations with spouse.

According to HR at the University of Kentucky, reviewing and updating benefits regularly is crucial for those nearing retirement.

Taking these steps helps build a robust retirement strategy and aligns with your long-term goals, supporting retirement goals for couples.

7: Schedule regular check-ins on financial progress

Regular financial check-ins are essential for starting retirement conversations with spouse and staying on track with your retirement goals.

Actionable Steps:

- Set quarterly meetings: Schedule these meetings to review your financial progress and make any necessary adjustments to your joint retirement planning strategies.

- Use financial tracking tools: Utilize apps or spreadsheets to monitor your savings and investment growth consistently, aiding in managing retirement investments together.

- Celebrate small milestones: Recognize and celebrate your achievements to stay motivated and committed to your shared retirement goals for couples.

Explanation: Regular check-ins help ensure you and your partner stay aligned with your financial goals and can make informed adjustments, fostering financial communication in marriage.

According to TFG Invest, consistent communication is crucial for keeping both spouses financially prepared for major life changes.

These steps foster ongoing collaboration and accountability in your retirement planning journey, supporting long-term financial planning for couples.

Partner with Alleo for Stress-Free Retirement Planning

We’ve explored the challenges of starting retirement conversations with your spouse and the benefits of solving them. But did you know you can work directly with Alleo to make this journey of joint retirement planning strategies easier and faster?

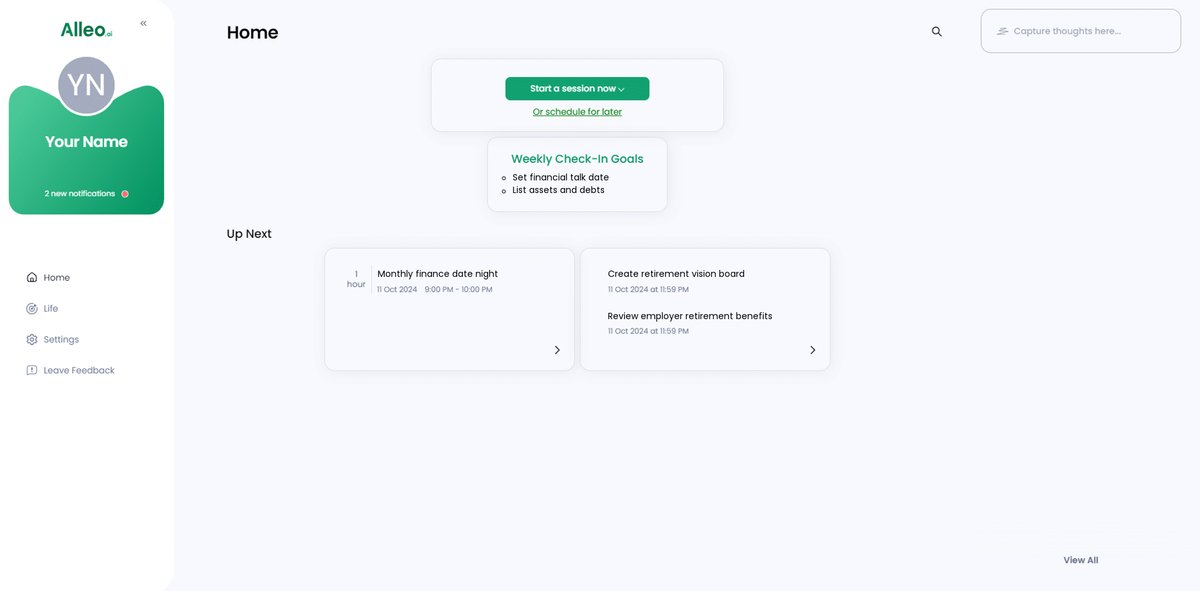

Setting up an Alleo account is simple. Create a personalized retirement plan with our AI coach, perfect for discussing retirement savings with your partner and managing retirement investments together.

Alleo provides tailored coaching sessions, just like a human coach, to help improve financial communication in marriage. The coach follows up on your progress and keeps you accountable via text and push notifications, assisting you in addressing retirement concerns with your partner.

Plus, you get a free 14-day trial with no credit card required, giving you time to explore budgeting for retirement as a team.

Ready to get started for free and begin starting retirement conversations with your spouse? Let me show you how!

Step 1: Log In or Create Your Alleo Account

To begin your journey towards stress-free retirement planning, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose “Improving overall well-being and life satisfaction”

Click on “Improving overall well-being and life satisfaction” to align your retirement planning with broader life goals, ensuring a more fulfilling and balanced approach to your future together.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to align with your retirement planning goals and receive tailored guidance on initiating crucial money conversations with your partner, helping you build a secure financial future together.

Step 4: Starting a coaching session

Begin your retirement planning journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized plan tailored to your financial goals and vision for the future.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, access the goals you discussed by checking the home page of the Alleo app, where you can easily view and manage your retirement planning objectives.

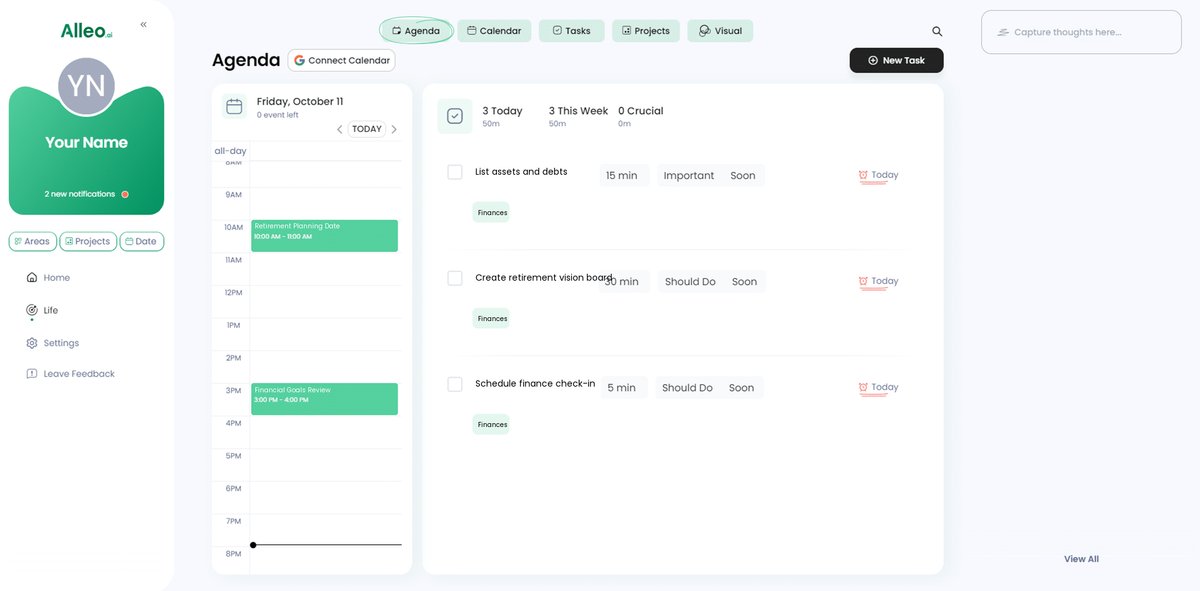

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to track your progress on retirement planning goals, allowing you to easily schedule and monitor your regular financial check-ins with your partner.

Wrapping Up Your Retirement Planning Journey

Understanding how to start retirement conversations with your spouse can be challenging. Yet, with the right approach to joint retirement planning strategies, it becomes a rewarding endeavor.

Remember, setting a comfortable environment is key for financial communication in marriage. This encourages open, honest discussions about your future together and retirement lifestyle expectations.

By creating a shared vision, listing assets transparently, and identifying retirement goals for couples, you lay a strong foundation. Regular check-ins ensure you stay on track with your long-term financial planning.

These steps in starting retirement conversations with your spouse may seem daunting, but you’re not alone. Alleo can help simplify this process of discussing retirement savings with your partner.

Empathize with your partner, take the first step in managing retirement investments together, and utilize Alleo for support. Start your journey towards a stress-free retirement today, focusing on budgeting for retirement as a team.