Best Retirement Planning Strategies for Active Seniors: Revolutionize Your Approach

Are you unsure about how to fill your retirement years with purpose and efficiently manage your savings? Retirement planning for active seniors can be challenging, but it’s crucial for a fulfilling post-career life.

As a life coach, I’ve guided many empty nesters through the maze of retirement planning. In my experience, it’s common to feel uncertain about balancing active years, quieter times, and future care needs. Retirement income planning for seniors often involves considering various active lifestyle retirement options.

In this article, you’ll discover practical strategies to create a balanced and fulfilling retirement plan. We will dive into holistic spending plans, tax-efficient withdrawals, health prioritization, and more. These senior financial management tips will help you navigate healthcare costs in retirement and explore investment strategies for senior citizens.

Let’s dive in.

Understanding the Challenges of Retirement for Active Seniors

When it comes to retirement planning for active seniors, many empty nesters face a daunting question:

“How do I fill my time meaningfully?”

This uncertainty can be overwhelming. In my experience, many clients struggle to balance their active years with quieter times and future care needs, including healthcare costs in retirement.

For instance, some people find it tough to transition from an active work life to a more relaxed pace. They worry about how to use their savings wisely, which is where retirement income planning for seniors becomes crucial.

Without a clear plan, this can lead to anxiety and stress.

Another challenge is maintaining a sense of purpose. Many clients report feeling lost without the daily structure of a job, highlighting the importance of considering post-retirement career opportunities.

This shift can affect their overall well-being and happiness, emphasizing the need for healthy aging and retirement planning.

Addressing these challenges is crucial. It’s not just about having enough money but also about finding fulfillment and stability through active lifestyle retirement options.

By tackling these issues head-on, you can create a retirement plan that truly supports your lifestyle and goals, incorporating aspects like travel and retirement budgeting and investment strategies for senior citizens.

Strategic Steps for a Fulfilling Retirement

Overcoming this challenge requires a few key steps in retirement planning for active seniors. Here are the main areas to focus on to make progress.

- Create a holistic retirement spending plan: Identify and categorize expenses, and set realistic financial goals for retirement income planning for seniors.

- Develop a tax-efficient withdrawal strategy: Optimize withdrawal sequences and plan for required minimum distributions (RMDs), considering investment strategies for senior citizens.

- Prioritize health with preventive care programs: Engage in regular physical activity and schedule health check-ups, focusing on healthy aging and retirement planning.

- Build social connections through community groups: Join local clubs and volunteer, exploring active lifestyle retirement options.

- Explore guaranteed income options for stability: Consider annuities and leverage pensions and Social Security optimization for seniors.

- Design a flexible phased retirement approach: Gradually reduce working hours and pursue new hobbies, including post-retirement career opportunities.

Let’s dive in!

1: Create a holistic retirement spending plan

Creating a holistic retirement spending plan is crucial for managing your savings effectively and ensuring a balanced retirement for active seniors. This is a key aspect of retirement planning for active seniors.

Actionable Steps:

- Identify and categorize expenses: List your monthly and annual expenses, differentiating between needs and wants, including healthcare costs in retirement.

- Set realistic financial goals: Define short-term and long-term financial goals, such as travel and retirement budgeting or exploring post-retirement career opportunities.

- Use a budgeting tool: Track and adjust spending according to lifestyle changes by using a reliable budgeting tool for senior financial management.

Key benefits of a holistic retirement spending plan:

- Provides clarity on your financial situation

- Helps prioritize spending and saving

- Reduces financial stress and uncertainty

Explanation: Identifying and categorizing expenses helps you understand where your money goes and make informed decisions about retirement income planning for seniors.

Setting realistic financial goals provides direction and motivation for active lifestyle retirement options.

Utilizing a budgeting tool ensures you can track and adjust your spending based on lifestyle changes. For more on creating effective spending plans, check out this resource.

By following these steps, you can create a spending plan that supports your lifestyle and financial goals, contributing to healthy aging and retirement planning.

2: Develop a tax-efficient withdrawal strategy

Developing a tax-efficient withdrawal strategy is crucial for maximizing your retirement savings and minimizing tax liabilities in your retirement planning for active seniors.

Actionable Steps:

- Start with withdrawing from taxable accounts: Prioritize withdrawals from taxable accounts before touching tax-deferred accounts to optimize tax efficiency in retirement income planning for seniors.

- Utilize Roth IRAs strategically: Plan your withdrawals to include Roth IRAs for tax-free income, reducing your overall tax burden and supporting an active lifestyle retirement.

- Calculate and schedule RMDs: Ensure you accurately calculate and schedule your required minimum distributions (RMDs) to avoid hefty penalties, a key aspect of senior financial management.

Explanation: Incorporating a tax-efficient withdrawal strategy allows you to stretch your retirement savings further while minimizing taxes, essential for healthy aging and retirement planning.

By starting with taxable accounts and utilizing Roth IRAs, you can effectively manage your tax liabilities and optimize your social security benefits for seniors.

Additionally, planning for RMDs ensures you meet IRS requirements and avoid penalties. For more detailed strategies, refer to this resource.

By following these steps, you can secure a more financially stable and tax-efficient retirement, allowing for travel and retirement budgeting while considering healthcare costs in retirement.

3: Prioritize health with preventive care programs

Prioritizing health with preventive care programs is crucial for maintaining independence and enjoying an active retirement. This is a key aspect of retirement planning for active seniors.

Actionable Steps:

- Engage in regular physical activity: Join local fitness classes or walking groups tailored to seniors. Set weekly exercise goals and track your progress using a fitness app. This supports healthy aging and retirement planning.

- Schedule regular health check-ups: Make appointments for annual physicals and screenings. Participate in preventive care programs offered by your healthcare provider to manage healthcare costs in retirement.

Explanation: By engaging in regular physical activity and scheduling health check-ups, you stay proactive about your health as part of your retirement income planning for seniors.

Preventive care helps catch potential issues early, reducing long-term health costs. For more on maintaining health in retirement, check out this resource.

Taking care of your health ensures you can enjoy your retirement to the fullest, enabling you to pursue active lifestyle retirement options.

4: Build social connections through community groups

Building social connections through community groups is essential for a fulfilling and engaging retirement, especially when considering retirement planning for active seniors.

Actionable Steps:

- Join local clubs and organizations: Research and join clubs that match your interests, like book clubs or gardening groups, as part of active lifestyle retirement options.

- Volunteer and mentor: Offer your time and skills to local charities or non-profits. Mentor younger generations through community programs, which can be part of post-retirement career opportunities.

Benefits of strong social connections in retirement:

- Improved mental and emotional well-being, contributing to healthy aging and retirement planning

- Increased sense of purpose and fulfillment

- Access to support networks and resources, which can assist with senior financial management tips

Explanation: Engaging in community groups helps combat loneliness and provides a sense of purpose. Activities like volunteering and joining clubs can significantly improve your mental well-being, which is crucial for retirement planning for active seniors.

For more insights on this topic, check out this resource.

Connecting with others fosters a sense of belonging and enriches your retirement experience, complementing other aspects of retirement planning such as estate planning for active retirees.

5: Explore guaranteed income options for stability

Exploring guaranteed income options is crucial for ensuring financial stability during retirement planning for active seniors.

Actionable Steps:

- Consider annuities: Research different types of annuities and consult a financial advisor. Evaluate the benefits and drawbacks of annuities in your retirement income planning for seniors.

- Maximize Social Security benefits: Delay claiming Social Security benefits if possible to increase your monthly payout. Understand and utilize any available pension benefits as part of your social security optimization for seniors strategy.

Explanation: Guaranteed income options like annuities and Social Security provide a steady income stream, reducing financial stress for active seniors planning retirement.

By delaying Social Security claims, you can increase your monthly benefits, improving long-term financial security. For more insights on retirement planning for active seniors, explore this resource.

Achieving financial stability through guaranteed income options allows you to enjoy your retirement with peace of mind, supporting an active lifestyle retirement option.

6: Design a flexible phased retirement approach

Designing a flexible phased retirement approach is essential for transitioning smoothly into retirement planning for active seniors while maintaining purpose and financial stability.

Actionable Steps:

- Negotiate a part-time or flexible work schedule: Discuss with your employer about reducing your working hours gradually. This helps you adjust to a new routine while still earning retirement income.

- Explore freelance or consulting opportunities: Use your skills to take on short-term projects or consulting work. This keeps you engaged and provides additional income, supporting active lifestyle retirement options.

- Pursue new hobbies and passions: Identify activities you enjoy and can transition into retirement. Enroll in courses or workshops to develop new skills and hobbies, promoting healthy aging and retirement planning.

Key advantages of a phased retirement approach:

- Gradual adjustment to retirement lifestyle

- Continued income and financial stability, aiding senior financial management

- Opportunity to explore new interests and post-retirement career opportunities

Explanation: Implementing a phased retirement approach allows you to ease into retirement without a sudden stop in income or activity.

Gradually reducing work hours and exploring new interests can provide a sense of purpose and financial stability. For more insights on this strategy, check out this resource.

Taking these steps ensures a balanced and fulfilling transition into retirement planning for active seniors.

Partner with Alleo for a Fulfilling Retirement

We’ve explored the challenges of retirement planning for active seniors and the key strategies to overcome them. Did you know you can work directly with Alleo to make this journey easier, especially when it comes to retirement income planning for seniors?

Setting up an account is simple. Create a personalized plan with Alleo’s AI coach to address your unique retirement needs, including active lifestyle retirement options and senior financial management tips.

The coach provides full coaching sessions like any human coach, ensuring you’re on track with your retirement planning for active seniors, covering aspects such as healthy aging and retirement planning.

The Alleo coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, helping you navigate everything from post-retirement career opportunities to social security optimization for seniors.

Ready to get started for free? Let me show you how to begin your journey towards a fulfilling retirement!

Step 1: Log In or Create Your Alleo Account

To begin your personalized retirement journey, Log in to your account or create a new one to access Alleo’s AI coach and start building your tailored retirement plan.

Step 2: Choose “Improving overall well-being and life satisfaction”

Select this goal to address the challenges of retirement planning, including finding purpose, managing finances, and maintaining health, which are key to a fulfilling retirement as discussed in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area to address your retirement planning concerns and create a stable financial foundation for your golden years. This selection aligns with the article’s emphasis on holistic spending plans and tax-efficient strategies, helping you make the most of your retirement savings.

Step 4: Starting a Coaching Session

Begin your retirement planning journey with an intake session, where Alleo’s AI coach will help you set up a personalized plan tailored to your unique retirement goals and challenges.

Step 5: Viewing and Managing Goals After the Session

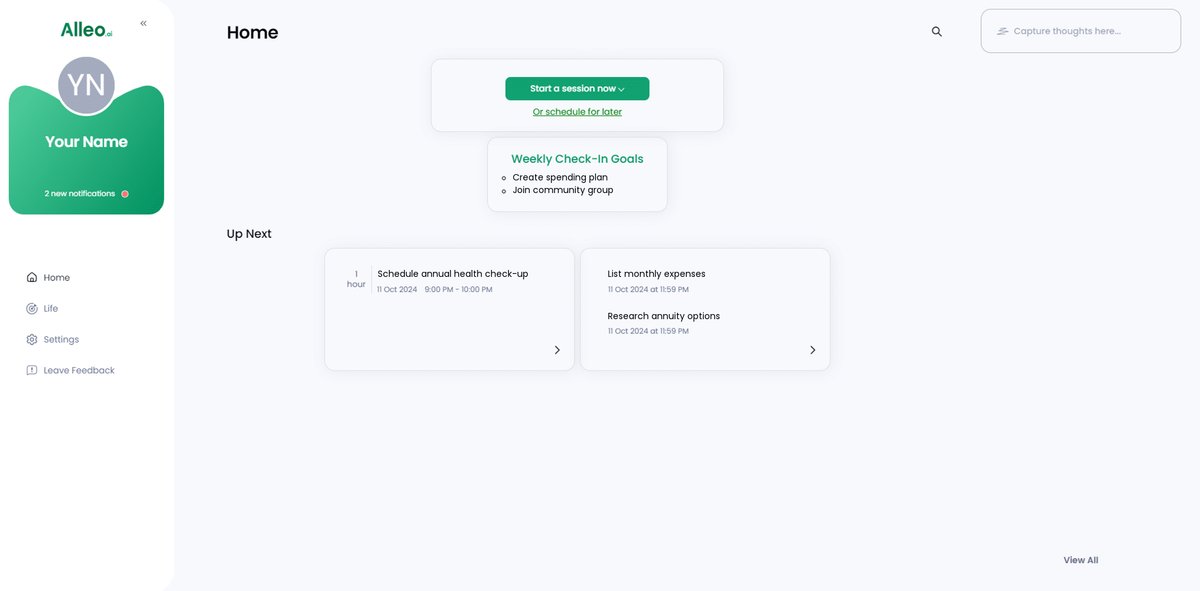

After your coaching session, easily access and manage the retirement goals you discussed by checking the home page of the Alleo app, where you can track your progress and make adjustments as needed to stay on course with your personalized retirement plan.

Step 6: Adding events to your calendar or app

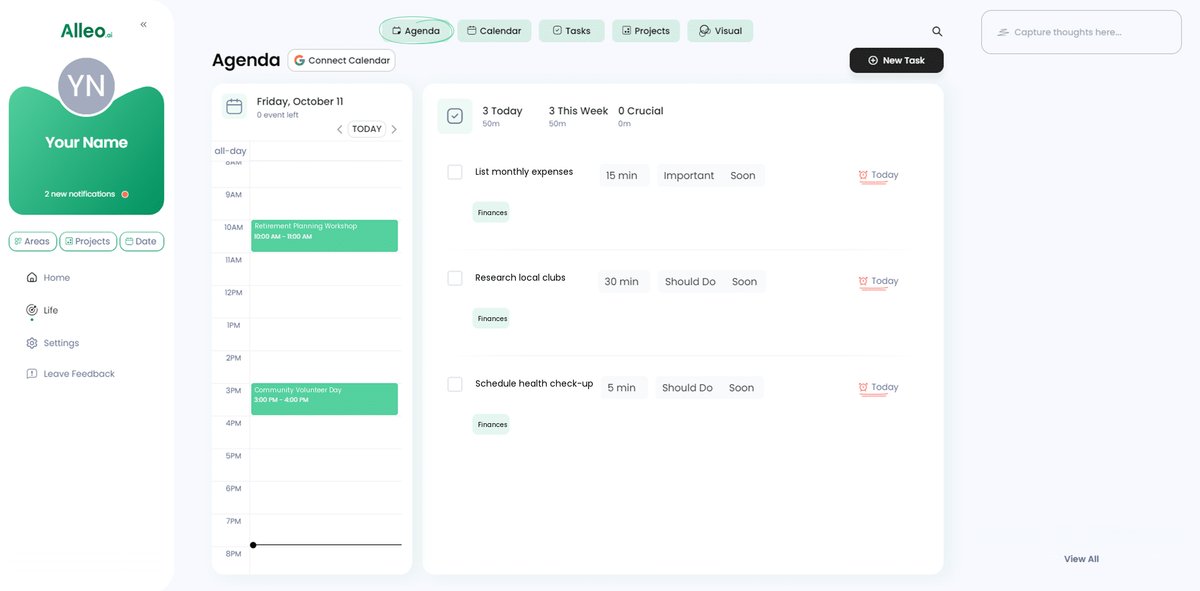

Use Alleo’s calendar and task features to schedule and track your retirement planning activities, such as health check-ups, community events, or financial review sessions, helping you stay organized and accountable in achieving your retirement goals.

Embrace a Fulfilling Retirement Journey

Transitioning into retirement can be challenging, but you now have the tools to create a meaningful retirement planning for active seniors strategy.

By focusing on holistic spending, tax-efficient withdrawals, healthy aging and retirement planning, social connections, guaranteed income, and flexible retirement, you can achieve a balanced retirement. Remember, it’s not just about retirement income planning for seniors but also about finding joy and purpose through active lifestyle retirement options.

Take these actionable steps to start your senior financial management journey today.

And don’t forget, Alleo is here to help you every step of the way. Our personalized AI coach will ensure you stay on track, making retirement planning for active seniors easier and more enjoyable.

Ready to start? Try Alleo for free now and explore post-retirement career opportunities.