How to Plan for Retirement Together: 5 Essential Tips for Couples

Are you and your partner struggling to align your retirement goals and expectations? It’s a common challenge that many couples face when approaching couple retirement planning strategies.

As a life coach, I’ve guided numerous couples through the maze of retirement financial planning for couples. I understand how crucial it is for both partners to be on the same page when it comes to joint retirement savings strategies.

In this article, you’ll discover practical couple retirement planning strategies to plan your retirement together, ensuring a harmonious and financially secure future. We’ll explore retirement goals for married couples and the importance of communication about retirement plans.

Let’s dive in and explore how to balance individual and shared retirement needs.

Understanding the Challenges in Joint Retirement Planning

Couple retirement planning strategies can be challenging. Many couples face differing timelines and lifestyle expectations when it comes to retirement financial planning for couples.

This often leads to significant emotional and financial stress in managing retirement assets as a couple.

I often see couples struggle to align their retirement plans. One partner may want to travel, while the other prefers a quiet life at home, highlighting the importance of communication about retirement plans.

These differences in couples’ retirement lifestyle planning can create tension.

Without a unified plan for joint retirement savings strategies, you risk financial instability. It’s crucial to work together to avoid these pitfalls and balance individual and shared retirement needs.

By understanding these challenges in couple retirement planning strategies, you can start addressing them effectively.

Steps to Plan Your Retirement Together

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in couple retirement planning strategies:

- Align retirement goals and timelines together: Regularly discuss and synchronize your retirement aspirations and timelines, focusing on retirement goals for married couples.

- Create a joint retirement budget: Develop a comprehensive budget that includes both incomes and expenses, incorporating joint retirement savings strategies.

- Discuss and plan your ideal retirement lifestyle: Identify mutual interests and plan for a lifestyle that suits both partners, considering couples’ retirement lifestyle planning.

- Review and optimize shared retirement accounts: Consolidate accounts and optimize investments for better management, focusing on managing retirement assets as a couple.

- Consult a financial advisor as a couple: Seek professional guidance to ensure your retirement financial planning for couples is on track.

Let’s dive in!

1: Align retirement goals and timelines together

Aligning retirement goals and timelines is essential for a unified approach to your future and is a crucial aspect of couple retirement planning strategies.

Actionable Steps:

- Schedule regular, dedicated meetings to discuss retirement goals and timelines. Set specific dates and times for these discussions to ensure consistency and improve communication about retirement plans.

- Create a shared vision board that includes both partners’ retirement dreams and aspirations. Use this visual tool to facilitate conversations about your future and joint retirement savings strategies.

- Use a joint calendar to track important retirement milestones and deadlines. Ensure both partners are aware of and agree on these key dates for effective retirement financial planning for couples.

Key benefits of aligning retirement goals:

- Enhances communication and understanding between partners

- Reduces potential conflicts over future plans

- Increases the likelihood of achieving shared retirement objectives and retirement goals for married couples

Explanation:

These steps matter because consistent communication and shared planning help prevent misunderstandings and ensure both partners are on the same page when managing retirement assets as a couple.

A shared vision board can visualize goals, while a joint calendar keeps key dates in focus, aiding in couples’ retirement lifestyle planning.

According to Mumsnet, couples who plan together tend to achieve their retirement goals more effectively.

Let’s move on to creating a joint retirement budget.

2: Create a joint retirement budget

Creating a joint retirement budget is vital for couple retirement planning strategies and ensuring financial stability in your golden years.

Actionable Steps:

- List all expected sources of retirement income, including pensions, Social Security, and investments. Calculate a realistic monthly income projection for retirement income planning for couples.

- Identify and categorize all anticipated retirement expenses, such as housing, healthcare, and travel. Assign specific amounts to each category as part of your retirement financial planning for couples.

- Regularly review and adjust the budget to reflect any changes in income or expenses. Ensure both partners are involved in these financial decisions, balancing individual and shared retirement needs.

Explanation:

These steps matter because having a clear budget helps manage expectations and ensures both partners are on the same page for joint retirement savings strategies.

Regularly updating the budget keeps it accurate and reflective of your financial situation, which is crucial for couple retirement planning strategies.

According to Midland National, discussing shared goals and financial plans can help couples achieve financial success in retirement, emphasizing the importance of communication about retirement plans.

Next, let’s discuss planning your ideal retirement lifestyle for couples.

3: Discuss and plan your ideal retirement lifestyle

Discussing and planning your ideal retirement lifestyle together is crucial for ensuring both partners are satisfied with their future. This is a key aspect of couple retirement planning strategies.

Actionable Steps:

- List your top five retirement activities or goals. Share and compare these lists to find common interests and priorities, aligning your retirement goals for married couples.

- Research potential retirement locations that meet both partners’ preferences. Consider factors like climate, cost of living, and proximity to family as part of your couples’ retirement lifestyle planning.

- Set specific, measurable goals for your retirement lifestyle, such as “Spend three months each year traveling” or “Volunteer 10 hours a week,” focusing on balancing individual and shared retirement needs.

Factors to consider when planning your retirement lifestyle:

- Health and wellness needs, including long-term care considerations for couples

- Social connections and community involvement

- Personal growth and learning opportunities

Explanation:

These steps matter because aligning your retirement lifestyle goals reduces conflicts and ensures a fulfilling retirement. Planning together builds mutual understanding and satisfaction, which is essential in retirement financial planning for couples.

According to Midland National, discussing shared goals can help couples achieve financial success in retirement.

Next, let’s review and optimize your shared retirement accounts as part of your joint retirement savings strategies.

4: Review and optimize shared retirement accounts

Reviewing and optimizing your shared retirement accounts is critical for maximizing your financial security and is a key couple retirement planning strategy.

Actionable Steps:

- Consolidate individual retirement accounts where possible to simplify management and reduce fees. Consult with a financial advisor to ensure this is done correctly, as part of your retirement financial planning for couples.

- Analyze the investment strategies of each retirement account to ensure they align with your joint retirement goals. Adjust asset allocations as needed to support your retirement goals for married couples.

- Plan for tax efficiency by discussing Roth conversions or other tax strategies with a financial professional, focusing on managing retirement assets as a couple.

Explanation:

These steps matter because consolidating accounts simplifies management, reducing complexity and fees. Aligning investment strategies ensures your joint retirement savings strategies are met, while planning for tax efficiency can save money.

According to abrdn, tax-efficient planning is crucial for optimizing retirement income planning for couples.

Next, let’s discuss consulting a financial advisor as a couple to further enhance your couple retirement planning strategies.

5: Consult a financial advisor as a couple

Consulting a financial advisor as a couple is vital for ensuring your couple retirement planning strategies are well-structured and aligned.

Actionable Steps:

- Research and select a qualified financial advisor who specializes in retirement financial planning for couples. Schedule an initial consultation to discuss your needs and goals.

- Prepare for meetings with your advisor by gathering all relevant financial documents and creating a list of questions and concerns about your joint retirement savings strategies.

- Follow through on your advisor’s recommendations and schedule regular check-ins to monitor your progress and make adjustments as needed to your retirement goals for married couples.

Benefits of working with a financial advisor for couple retirement planning strategies:

- Expert guidance tailored to your unique situation, including managing retirement assets as a couple

- Objective perspective on financial decisions and communication about retirement plans

- Access to advanced planning strategies and tools for retirement income planning for couples

Explanation:

These steps matter because professional guidance can provide clarity and direction in your retirement planning. An advisor can help you navigate complex financial decisions and optimize your retirement strategy, including balancing individual and shared retirement needs.

According to Center for Retirement Research, working with an advisor provides the clarity that many couples lack on their own.

Taking these steps will help ensure your couple retirement planning strategies are cohesive and well-managed, addressing aspects like couples’ retirement lifestyle planning and long-term care considerations for couples.

Partner with Alleo on Your Retirement Journey

We’ve explored the challenges of couple retirement planning strategies and the steps to overcome them. But did you know you can work with Alleo to make this journey easier and faster for retirement financial planning for couples?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your joint retirement savings strategies and retirement goals for married couples.

Alleo’s coach provides affordable, tailored coaching support for managing retirement assets as a couple. You’ll have full coaching sessions, just like with a human coach, and a free 14-day trial requiring no credit card.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping with communication about retirement plans and balancing individual and shared retirement needs.

Ready to get started for free on your couple retirement planning strategies? Let me show you how!

Step 1: Log In or Create Your Account

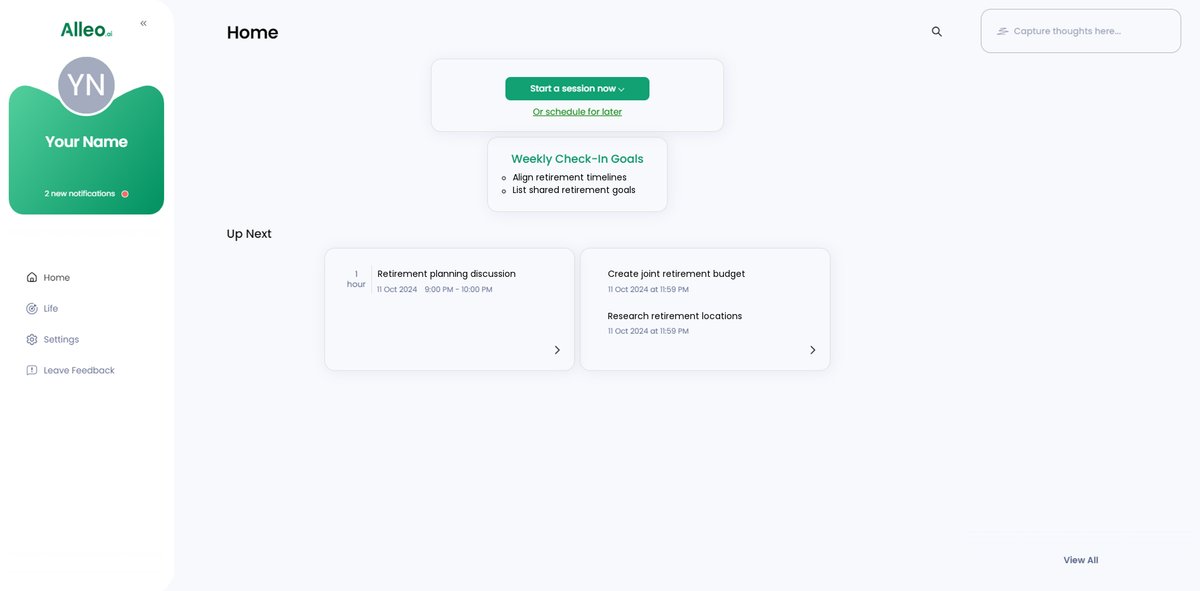

To begin your retirement planning journey with Alleo, log in to your existing account or create a new one to access personalized guidance and support for aligning your retirement goals as a couple.

Step 2: Choose “Improving overall well-being and life satisfaction”

Select “Improving overall well-being and life satisfaction” as your goal to address the challenges of joint retirement planning, helping you and your partner align your expectations and create a fulfilling retirement lifestyle together.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on with Alleo, as this aligns perfectly with your retirement planning goals and will help you create a solid financial foundation for your future together.

Step 4: Starting a Coaching Session

Begin your retirement planning journey with an intake session, where you’ll discuss your goals and create a personalized plan to align your retirement vision as a couple.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the retirement goals you discussed, allowing you to track your progress and stay aligned with your partner’s plans.

Step 6: Adding events to your calendar or app

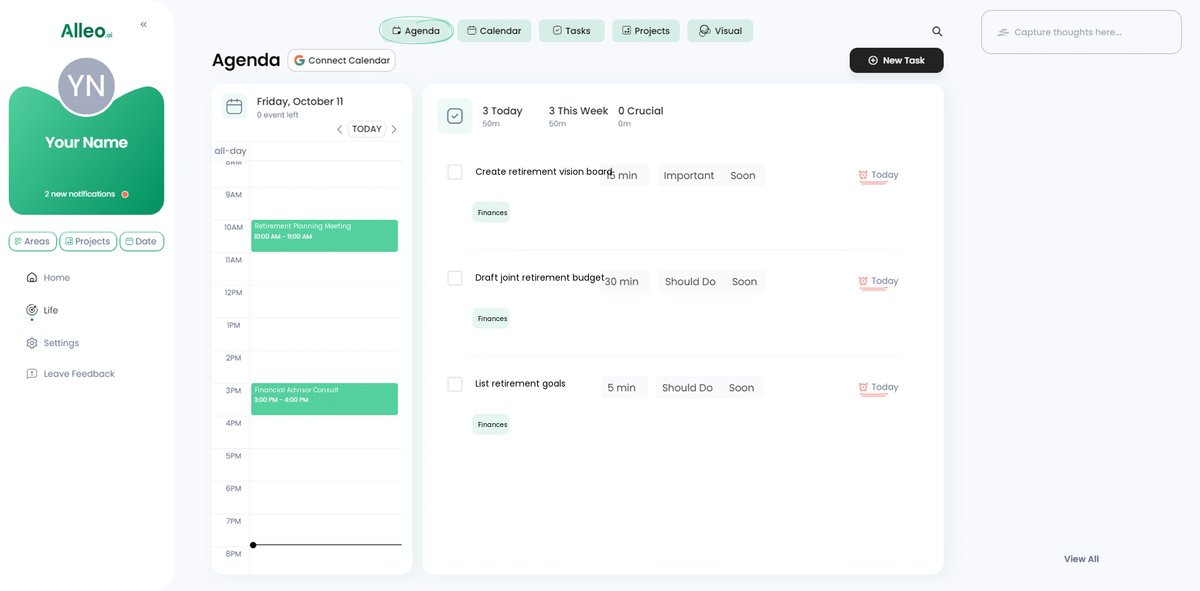

Use the calendar and task features in the Alleo app to track your progress on retirement planning activities, such as scheduling regular financial discussions with your partner or setting reminders for budget reviews.

Wrapping Up Your Retirement Planning Journey

Planning for retirement together takes effort and understanding. We’ve covered the essential couple retirement planning strategies to ensure a smooth journey.

Align your retirement goals for married couples, create a budget, and plan your ideal lifestyle. Optimize your joint retirement savings strategies and consult a financial advisor for retirement financial planning for couples.

Remember, it’s all about collaboration and compromise when managing retirement assets as a couple.

You can do this.

Take the first step today in your couple retirement planning strategies.

Start an open conversation with your partner about your future, focusing on communication about retirement plans.

And, consider trying Alleo for free to streamline your retirement income planning for couples.

You’ve got this!