How to Plan for Retirement Without Expensive Financial Advisors: 6 Simple Steps

Are you trying to plan your retirement without falling prey to expensive financial advisors? Discover effective DIY retirement planning strategies that can help you secure your future.

As a life coach, I’ve helped many individuals navigate these financial challenges. My experience has shown that planning for retirement can be both empowering and cost-effective. With the right retirement savings strategies and low-cost retirement tools, you can take control of your financial future.

In this blog, you’ll discover practical DIY retirement planning strategies to secure your retirement, avoid hidden fees, and maintain financial independence. You’ll learn about low-cost investment options, using free resources like retirement calculators, and maximizing tax-advantaged accounts such as 401(k)s and IRAs. We’ll explore IRA investment tips and personal finance for retirement to help you build a solid foundation for your golden years.

Let’s dive into these retirement budgeting techniques and long-term financial planning strategies.

The Hidden Costs of Relying on Expensive Financial Advisors

Many people fall into the trap of high-cost financial advisors, not realizing the hidden fees that lurk beneath. These fees can significantly eat into your retirement savings, leaving you with less than you anticipated when pursuing DIY retirement planning strategies.

I’ve seen several clients suffer setbacks due to advice from advisors who prioritize their commissions over your interests. It’s disheartening, but you’re not alone in this struggle with personal finance for retirement.

In my experience, people often find themselves paying for services they don’t need. This includes unnecessary investment products that only benefit the advisor, rather than focusing on low-cost retirement tools and retirement savings strategies.

Navigating DIY retirement planning on your own can seem daunting, but with the right tools and knowledge, such as retirement calculators and 401(k) optimization techniques, it’s entirely possible.

Your Roadmap to Retirement Planning Without Expensive Advisors

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with DIY retirement planning strategies:

- Educate yourself on basic retirement planning: Read reliable sources and attend webinars on personal finance for retirement.

- Utilize free online retirement calculators: Find the right retirement calculator and track your progress using low-cost retirement tools.

- Invest in low-cost index funds: Choose the right funds and monitor your portfolio for effective IRA investment tips.

- Maximize contributions to tax-advantaged accounts: Utilize all available accounts, including 401(k) optimization and catch-up contributions for self-directed retirement accounts.

- Create a budget to increase retirement savings: Analyze spending and set savings goals with retirement budgeting techniques.

- Seek advice from fee-only financial planners: Find a fiduciary advisor and evaluate their advice for long-term financial planning.

Let’s dive into these DIY retirement planning strategies!

1: Educate yourself on basic retirement planning

Understanding the basics of retirement planning is essential to gaining confidence in your financial future and developing effective DIY retirement planning strategies.

Actionable Steps:

- Start reading reputable sources like Investopedia or NerdWallet for 30 minutes daily to grasp retirement concepts and personal finance for retirement.

- Enroll in a free online course on DIY retirement planning and complete it within the next month.

- Sign up for and attend at least one free webinar on retirement savings strategies each quarter.

Explanation: Gaining knowledge from trusted resources ensures you make informed decisions. Reading articles and attending webinars provide insights into retirement planning trends and long-term financial planning strategies.

For example, reading resources from NerdWallet helps you understand different fee structures and investment options. This knowledge empowers you to plan independently and avoid costly mistakes in your DIY retirement planning.

Key benefits of self-education in retirement planning:

- Builds confidence in financial decision-making for retirement budgeting techniques

- Reduces reliance on expensive advisors by utilizing low-cost retirement tools

- Helps identify personalized strategies for your situation, such as 401(k) optimization and IRA investment tips

Starting with these steps, you’ll build a solid foundation for your retirement planning journey and develop effective DIY retirement planning strategies.

2: Utilize free online retirement calculators

Using free online retirement calculators is crucial for DIY retirement planning strategies and estimating your retirement needs while tracking your progress.

Actionable Steps:

- Find a reliable calculator: Use low-cost retirement tools like the AARP or NerdWallet calculators to estimate your retirement needs.

- Adjust inputs regularly: Update your financial data as your situation changes to keep your estimates accurate for effective retirement savings strategies.

- Track your progress: Set a reminder to review your retirement calculator results every six months as part of your long-term financial planning.

Explanation: These calculators provide a clear picture of how much you need to save, helping you stay on track with your DIY retirement planning.

Regularly updating your inputs ensures your plan reflects your current financial status for personal finance for retirement.

For instance, tools like NerdWallet’s calculator offer personalized insights based on your data, making it easier to plan effectively.

By using these tools, you can confidently manage your retirement savings and make informed decisions for your self-directed retirement accounts.

3: Invest in low-cost index funds

Investing in low-cost index funds is a smart DIY retirement planning strategy to grow your retirement savings without high fees.

Actionable Steps:

- Research and select funds: Choose three to five low-cost index funds that match your risk tolerance for your self-directed retirement accounts.

- Allocate savings: Dedicate a specific percentage of your monthly savings to these funds as part of your retirement savings strategies.

- Monitor quarterly: Review and rebalance your portfolio every three months to maintain desired asset allocation, an essential aspect of long-term financial planning.

Explanation: These steps help you minimize fees while maximizing returns, aligning with long-term retirement goals and personal finance for retirement.

Low-cost index funds are efficient and effective, as highlighted by NerdWallet. They offer diversification and lower management costs, making them ideal for DIY retirement planning.

Advantages of low-cost index funds for retirement:

- Lower fees mean more of your money stays invested, optimizing your 401(k) and IRA investments

- Broad market exposure reduces individual stock risk, a key principle in DIY retirement planning strategies

- Simple to manage, ideal for DIY investors using retirement budgeting techniques

By following these steps, you can confidently manage your investment portfolio as part of your DIY retirement planning approach.

4: Maximize contributions to tax-advantaged accounts

Maximizing your contributions to tax-advantaged accounts is a crucial DIY retirement planning strategy for boosting your retirement savings and reducing your taxable income.

Actionable Steps:

- Max out contributions: Contribute up to the annual limit for your 401(k) or Roth 401(k) to capitalize on tax benefits and optimize your retirement savings strategy.

- Open an IRA: If you haven’t already, open and contribute to an IRA or Roth IRA to diversify your retirement savings and explore self-directed retirement accounts.

- Utilize catch-up contributions: If you are over 50, take advantage of catch-up contributions to add extra savings as part of your long-term financial planning.

Explanation: These steps ensure you’re making the most of available tax benefits while implementing effective DIY retirement planning strategies.

Contributing to both 401(k) and IRA accounts can significantly increase your retirement funds. For instance, Investopedia highlights the importance of fully utilizing these accounts to maximize your retirement savings.

Taking these actions helps secure a more comfortable and financially stable retirement through personal finance for retirement strategies.

Next, let’s explore how creating a budget can further enhance your retirement savings and support your DIY retirement planning efforts.

5: Create a budget to increase retirement savings

Creating a budget is crucial for enhancing your retirement savings and ensuring financial stability, making it a key DIY retirement planning strategy.

Actionable Steps:

- Track your monthly expenses: Use a budgeting app or retirement calculator to monitor and categorize all your spending for one month.

- Identify and reduce non-essential spending: Analyze your tracked expenses and cut back on unnecessary items to boost your retirement savings.

- Set a monthly savings target: Establish a specific amount to save for retirement every month and automate these contributions, optimizing your 401(k) or IRA investments.

Explanation: Following these retirement budgeting techniques helps you control your spending and increases your retirement savings.

Budgeting ensures you allocate funds efficiently, making it easier to meet your long-term financial planning goals. For more insights on personal finance for retirement, check out CalPERS’ guide on financial planning.

By creating a budget, you take an essential step toward a secure retirement and implement effective DIY retirement planning strategies.

Next, let’s explore how seeking advice from fee-only financial planners can further assist you with self-directed retirement accounts.

6: Seek advice from fee-only financial planners

Seeking advice from fee-only financial planners can provide you with unbiased, professional guidance for DIY retirement planning strategies without the high costs of commission-based advisors.

Actionable Steps:

- Search for a fiduciary advisor: Use directories like NAPFA to find a fee-only advisor in your area for retirement savings strategies.

- Schedule a consultation: Discuss your retirement goals and receive a personalized plan from the advisor, including IRA investment tips.

- Compare recommendations: Evaluate the advisor’s suggestions against your independent research to ensure they align with your long-term financial planning goals.

Explanation: These steps help you benefit from professional advice while avoiding conflicts of interest. Fee-only advisors prioritize your best interests since they don’t earn commissions on products they recommend, supporting your DIY retirement planning efforts.

For example, according to NerdWallet, fee-only advisors face fewer conflicts of interest compared to commission-based advisors.

Key questions to ask a potential fee-only advisor for personal finance for retirement:

- What is your fee structure and how are you compensated?

- What is your approach to retirement planning and 401(k) optimization?

- How often will we review and adjust my retirement plan using low-cost retirement tools?

Taking these steps ensures that you receive reliable advice to enhance your retirement planning and retirement budgeting techniques.

Next, let’s look at how using our product can further assist you with self-directed retirement accounts.

Partner with Alleo on Your Retirement Planning Journey

We’ve explored the challenges of DIY retirement planning without expensive advisors. Did you know you can work directly with Alleo to make this easier and enhance your retirement savings strategies?

Setting up an account is simple and free for 14 days. Alleo’s AI coach will help you create a personalized plan, acting as your low-cost retirement tool for long-term financial planning.

The coach follows up on your progress, handles changes, and keeps you accountable via text and notifications. Alleo provides tailored, affordable support, ensuring you stay on track with your personal finance for retirement goals.

Ready to get started for free with DIY retirement planning strategies?

Let me show you how to optimize your retirement planning journey!

Step 1: Access Your Alleo Account

To begin your retirement planning journey with Alleo, simply Log in to your account or create a new one to access personalized guidance and support from our AI coach.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” from the list of goals to focus on establishing consistent financial practices that will support your retirement planning efforts without relying on expensive advisors.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to receive tailored guidance on retirement planning, budgeting, and investment strategies, aligning perfectly with your goal of managing retirement without expensive advisors.

Step 4: Starting a Coaching Session

Begin your retirement planning journey with Alleo by scheduling an intake session, where our AI coach will guide you through setting up a personalized plan tailored to your financial goals and circumstances.

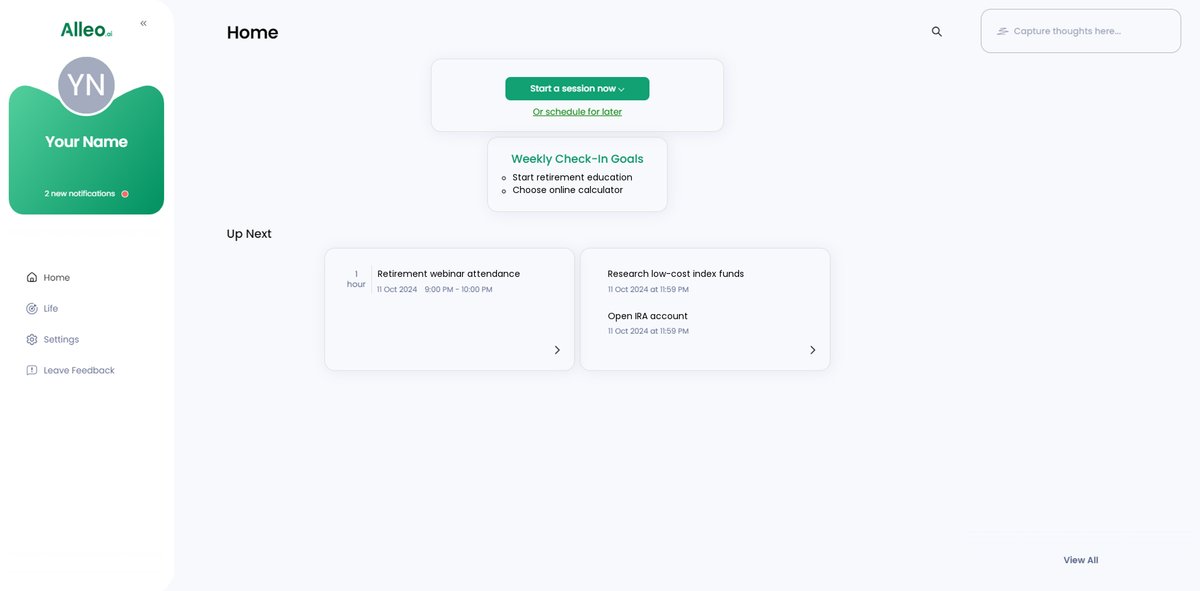

![]()

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to review and manage the retirement planning goals you discussed, ensuring you stay on track with your personalized financial strategy.

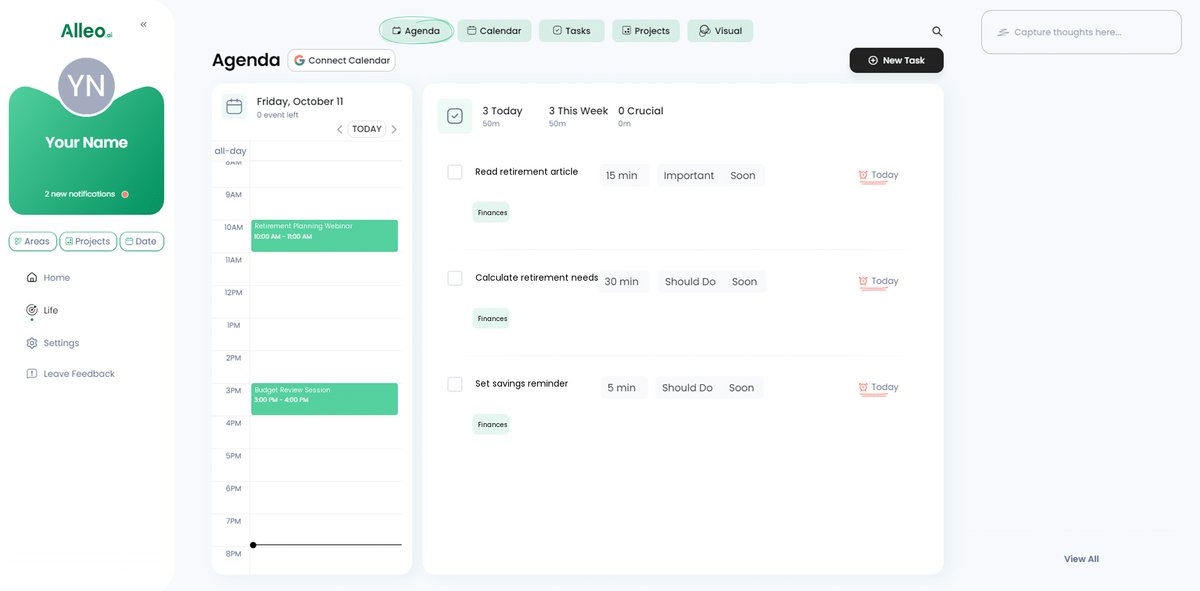

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your retirement planning activities, such as reviewing your investments or updating your budget, ensuring you stay on top of your financial goals.

Your Path to a Secure Retirement

With these practical DIY retirement planning strategies, you’re well on your way to planning a secure retirement without high-cost advisors. You’ve got the knowledge and tools to take control of your long-term financial planning.

Remember, it’s about making informed decisions for your retirement savings strategies. You don’t need to spend a fortune to get good advice on personal finance for retirement.

Keep learning and adjusting your retirement budgeting techniques as you go.

You can do this DIY retirement planning.

And don’t forget, Alleo is here to help you stay on track with your self-directed retirement accounts. With personalized support and reminders, Alleo ensures you never miss a step in optimizing your 401(k) or implementing IRA investment tips.

Take action today with low-cost retirement tools. Your future self will thank you for mastering these DIY retirement planning strategies.