7 Essential Ways Event Planners Can Use NetSuite Planning and Budgeting for Efficient Budget Management

Have you ever felt overwhelmed by the complexity of NetSuite departmental budget planning for your events?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, event planners often struggle with manual processes and non-integrated tools when it comes to departmental budget allocation strategies.

In this article, you’ll learn how NetSuite Planning and Budgeting (NSPB) can transform your departmental budget planning. Discover strategies to improve efficiency and accuracy using NSPB budget planning techniques and financial forecasting with NSPB.

Let’s dive into optimizing budget processes with NSPB.

Understanding the Budget Planning Struggles of Event Planners

Budget planning can feel like navigating a maze. For many event planners, this task often involves juggling spreadsheets and manual processes, much like NetSuite departmental budget planning challenges faced by finance teams.

This not only consumes time but also increases the risk of errors, highlighting the need for optimizing budget processes with NSPB.

In my experience, event planners face unique challenges. Manual processes and non-integrated tools make it hard to keep track of expenses and revenue accurately, similar to issues addressed by NSPB budget planning techniques.

This often leads to budget overruns and stressed-out teams, a common problem before NSPB implementation in finance departments.

Imagine trying to coordinate multiple vendors without real-time budget updates. It’s a recipe for disaster, which is why financial forecasting with NSPB is crucial.

Poor budget planning can significantly impact event success and profitability, emphasizing the importance of departmental budget allocation strategies.

You need a solution that adapts to your needs. That’s where NetSuite Planning and Budgeting (NSPB) comes in, offering collaborative budgeting using NSPB.

Let’s explore how it can help with NetSuite departmental budget planning.

Overcoming this challenge in NetSuite departmental budget planning requires a few key steps. Here are the main areas to focus on to make progress:

- Integrate NSPB with departmental data sources: Automate data integration for real-time updates, enhancing NSPB budget planning techniques.

- Set up driver-based models for each department: Predict budget needs with tested models, improving financial forecasting with NSPB.

- Configure rolling forecasts for agile planning: Update budgets regularly and adapt to changes, optimizing budget processes with NSPB.

- Create scenario plans for departmental budgets: Simulate financial impacts and prepare for various outcomes, supporting departmental budget allocation strategies.

- Utilize NSPB’s P&L and cash flow capabilities: Monitor finances with regular reports, crucial for NSPB implementation in finance departments.

- Train department heads on NSPB functionalities: Provide comprehensive NSPB training for finance professionals and ongoing support.

- Implement continuous planning across departments: Foster a culture of continuous improvement, promoting collaborative budgeting using NSPB.

Let’s dive in!

1: Integrate NSPB with departmental data sources

Integrating NSPB with departmental data sources is crucial for real-time budget updates and accuracy in NetSuite departmental budget planning.

Actionable Steps:

- Identify key data sources: Pinpoint all essential data sources used by your departments, such as vendor contracts and expense reports, to enhance NSPB budget planning techniques.

- Automate data integration: Set up automated processes to ensure real-time data updates and accurate information flow, improving financial forecasting with NSPB.

- Regularly review settings: Continuously check and adjust data integration settings to maintain data accuracy and relevance in departmental budget allocation strategies.

Explanation: Streamlining data integration enhances budget accuracy and reduces manual errors. This step aligns with industry trends emphasizing real-time data updates and is crucial for NSPB implementation in finance departments.

For instance, initiatives like the Open Budget initiative highlight the importance of transparent and accurate budgeting processes.

Key benefits of integrating NSPB with departmental data sources for optimizing budget processes with NSPB:

- Improved data accuracy and reliability for NSPB for finance teams

- Reduced manual data entry and associated errors, leading to cost reduction through NSPB

- Enhanced real-time decision-making capabilities, improving NSPB and financial performance metrics

By ensuring seamless data integration, you can make informed financial decisions and optimize your event planning processes through collaborative budgeting using NSPB.

2: Set up driver-based models for each department

Setting up driver-based models for each department ensures precise and predictive NetSuite departmental budget planning.

Actionable Steps:

- Define key drivers: Identify the key factors that impact your department’s budget, such as venue costs, catering, and staffing, utilizing NSPB budget planning techniques.

- Create and test models: Develop models using these drivers to predict future budget needs, then test them for accuracy, enhancing financial forecasting with NSPB.

- Validate with historical data: Compare your models against past budget data and adjust as necessary to improve reliability, optimizing budget processes with NSPB.

Explanation: These steps are essential because they provide a structured approach to understanding and predicting budget needs for effective departmental budget allocation strategies.

By focusing on key drivers and validating models with historical data, you can create more accurate and adaptable budgets, a crucial aspect of NetSuite departmental budget planning.

This is in line with the shift towards agile planning, as discussed in the NetSuite Planning and Budgeting Guide.

Accurate driver-based models help you make informed financial decisions and enhance event success, supporting NSPB implementation in finance departments.

Implementing these models sets a strong foundation for the next steps in your budget planning process, facilitating collaborative budgeting using NSPB.

3: Configure rolling forecasts for agile planning

Configuring rolling forecasts is crucial for maintaining adaptability in your NetSuite departmental budget planning process.

Actionable Steps:

- Establish a rolling forecast process: Set up a monthly schedule to update budgets based on the most recent data, leveraging NSPB budget planning techniques.

- Train team members: Ensure that your team understands how to use rolling forecasts to adapt to changes effectively, incorporating NSPB training for finance professionals.

- Implement periodic reviews: Conduct regular reviews to refine the forecasting process and make necessary adjustments, focusing on optimizing budget processes with NSPB.

Explanation: These steps are essential to create a flexible NetSuite departmental budget planning system that can adapt to changes.

By establishing a rolling forecast process and training your team, you can ensure smoother operations and enhance financial forecasting with NSPB.

This approach aligns with industry trends towards agile planning, as highlighted in the NetSuite Planning and Budgeting Guide.

Continuous refinement through periodic reviews ensures that your forecasts remain accurate and relevant, supporting departmental budget allocation strategies.

By configuring rolling forecasts, you’ll be better prepared to respond to unexpected changes and enhance your event planning success using NSPB for finance teams.

Let’s move on to creating scenario plans for departmental budgets.

4: Create scenario plans for departmental budgets

Creating scenario plans for departmental budgets using NetSuite departmental budget planning is crucial for preparing for various potential outcomes.

Actionable Steps:

- Develop multiple budget scenarios: Identify and create different budget scenarios to address various potential event outcomes using NSPB budget planning techniques.

- Simulate financial impacts: Use NSPB to simulate the financial impact of each scenario, examining both best-case and worst-case scenarios for financial forecasting with NSPB.

- Present outcomes to stakeholders: Share these scenario outcomes with stakeholders to facilitate informed decision-making and collaborative budgeting using NSPB.

Explanation: These steps are essential for comprehensive NetSuite departmental budget planning, allowing you to anticipate and prepare for different financial situations.

By developing and simulating multiple scenarios, you can make more informed decisions and ensure better financial stability through optimizing budget processes with NSPB.

This approach aligns with the trend of increasing transparency and strategic planning in budgeting, as highlighted by the Open Budget initiative.

Scenario planning helps you stay agile and responsive to changes, thereby enhancing your event planning success and improving departmental budget allocation strategies.

These steps will set a strong foundation for utilizing NSPB’s P&L and cash flow capabilities effectively, supporting NSPB implementation in finance departments.

5: Utilize NSPB’s P&L and cash flow capabilities

Leveraging NSPB’s P&L and cash flow functionalities is vital for efficient financial management in event planning, especially when implementing NetSuite departmental budget planning.

Actionable Steps:

- Input all departmental income and expenses: Ensure all financial transactions are accurately recorded in the NSPB system for real-time tracking and effective departmental budget allocation strategies.

- Generate regular P&L and cash flow reports: Schedule automated reports to monitor financial health and identify any discrepancies, enhancing financial forecasting with NSPB.

- Analyze and act on insights: Use the data from these reports to make proactive decisions and adjust budgets as needed, optimizing budget processes with NSPB.

Explanation: These steps enhance financial visibility and decision-making, crucial for event planning success. Regularly monitoring P&L and cash flow reports helps identify trends and areas for improvement, supporting NSPB budget planning techniques.

This aligns with the increasing focus on strategic financial management in government agencies, as seen in the Office of the Chief Financial Officer. By utilizing these capabilities, you ensure better financial control and event profitability through NetSuite departmental budget planning.

Key advantages of utilizing NSPB’s P&L and cash flow capabilities:

- Improved financial transparency across departments

- Early detection of potential budget issues

- Enhanced ability to make data-driven financial decisions

Implementing these actions will strengthen your financial planning foundation and support NSPB implementation in finance departments.

6: Train department heads on NSPB functionalities

Training department heads on NSPB functionalities is crucial for maximizing the platform’s potential in NetSuite departmental budget planning.

Actionable Steps:

- Schedule comprehensive training sessions: Organize in-depth sessions to cover all key features and benefits of NSPB, tailored to your department’s specific needs for optimizing budget processes with NSPB.

- Create easy-to-follow guides: Develop step-by-step guides and video tutorials to help department heads navigate NSPB efficiently, focusing on departmental budget allocation strategies.

- Set up a support system: Establish a reliable support system for ongoing assistance and troubleshooting to ensure continuous learning and adaptation in NSPB implementation in finance departments.

Explanation: These steps matter because they empower department heads with the knowledge and tools to leverage NSPB effectively, enhancing overall NetSuite departmental budget planning efficiency.

Tailored training and continuous support align with the trend of strategic financial management and NSPB budget planning techniques.

For instance, the Healthcare Financial Management Association (HFMA) emphasizes the importance of educational resources for financial professionals.

By implementing these actions, you’ll ensure that your team can fully utilize NSPB’s capabilities, leading to better financial decisions and successful events through collaborative budgeting using NSPB.

Investing in comprehensive NSPB training for finance professionals will lay the groundwork for successful continuous planning across departments, improving financial forecasting with NSPB.

7: Implement continuous planning across departments

Implementing continuous planning across departments is essential for maintaining adaptability and improving budget accuracy in NetSuite departmental budget planning.

Actionable Steps:

- Foster a culture of continuous planning: Encourage departments to regularly update and review their budgets using NSPB budget planning techniques to reflect new data and insights.

- Regularly update planning processes: Gather feedback from departments and adjust planning methods to ensure they meet current needs, optimizing budget processes with NSPB.

- Monitor and measure effectiveness: Track the outcomes of continuous planning initiatives and make improvements based on NSPB and financial performance metrics.

Explanation: These steps help create a dynamic budget planning environment that can swiftly adapt to changes. Regular updates and feedback ensure relevance and accuracy in NetSuite departmental budget planning.

This aligns with the trend of increasing transparency and strategic planning in budgeting, as seen in the Open Budget initiative. Continuous planning helps departments remain proactive and responsive, enhancing overall event success through effective departmental budget allocation strategies.

Benefits of implementing continuous planning:

- Increased agility in responding to market changes through financial forecasting with NSPB

- Improved cross-departmental collaboration using collaborative budgeting with NSPB

- More accurate and up-to-date budgets, supporting cost reduction through NSPB

Implementing continuous planning is a crucial step toward efficient NetSuite departmental budget planning and management for finance teams.

Partner with Alleo to Optimize Your NetSuite Departmental Budget Planning

We’ve explored the challenges of NetSuite departmental budget planning for event planners and how NSPB can help with financial forecasting and cost reduction. But did you know you can work with Alleo to make this easier?

Set up an account, create a personalized plan for NSPB implementation in finance departments, and work with Alleo’s coach. The coach will follow up on progress and handle changes in your departmental budget allocation strategies.

They will keep you accountable via text and push notifications, ensuring you stay on track with optimizing budget processes with NSPB.

Ready to get started for free and improve your NSPB budget planning techniques? Let me show you how!

Step 1: Log In or Create Your Account

To start optimizing your event budget planning with NSPB, Log in to your account or create a new one to access Alleo’s AI coach and personalized planning tools.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish consistent practices for efficient budget planning, helping you overcome the challenges of manual processes and create a more streamlined approach to event financial management.

Step 3: Select ‘Finances’ as Your Focus Area

Choose ‘Finances’ as your focus area to align with your goal of improving budget planning for events. This selection will allow our AI coach to provide tailored guidance on optimizing your financial processes, helping you streamline your budget planning and enhance your event success using tools like NetSuite Planning and Budgeting.

Step 4: Starting a coaching session

Begin your journey with an intake session, where you’ll collaborate with your AI coach to establish your personalized budget planning goals and outline a strategic roadmap for optimizing your event finances using NSPB.

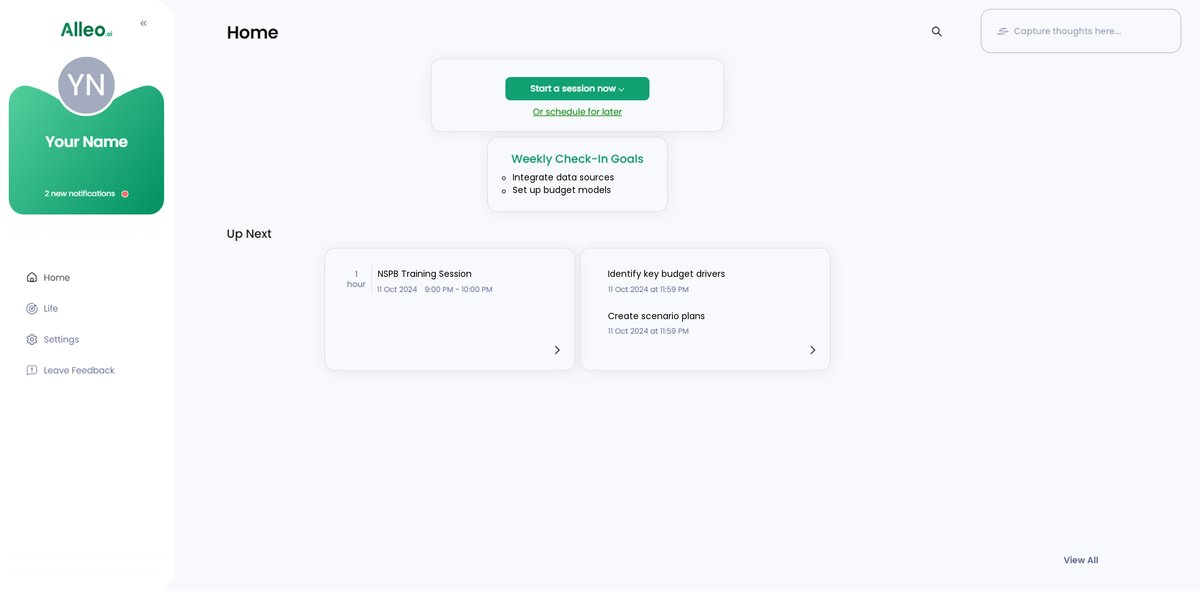

Step 5: Viewing and Managing Goals After the Session

After your coaching session, access the app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable in your budget planning journey.

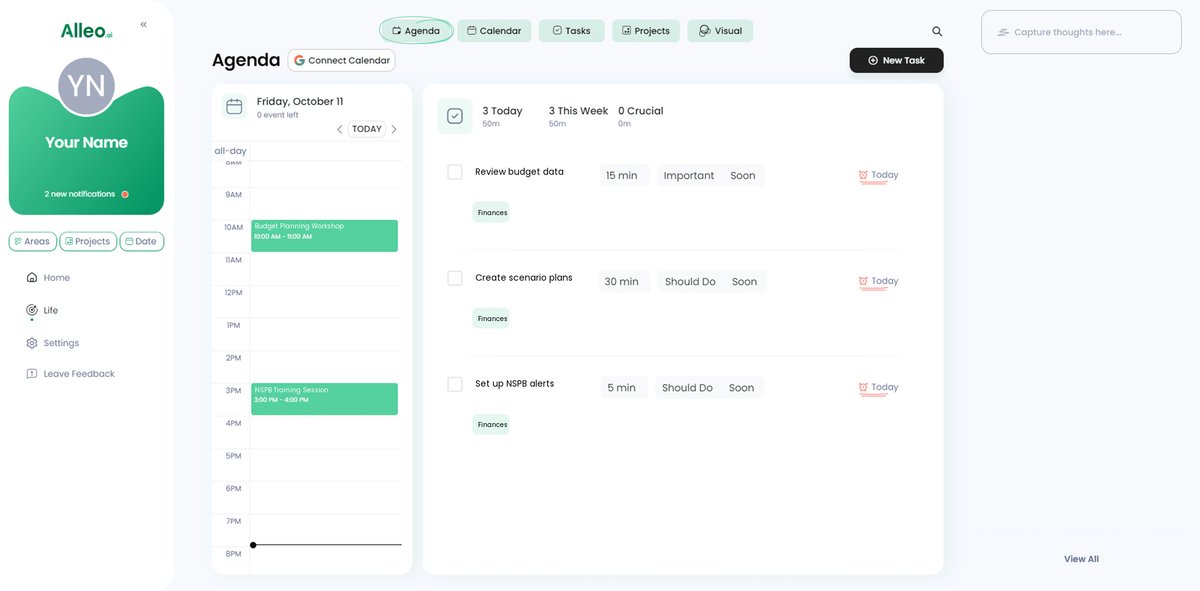

Step 6: Adding events to your calendar or app

Open the AI coach app, navigate to the calendar section, and input your budget planning events, allowing you to track your progress in solving financial challenges while leveraging the task features to stay organized and accountable.

Final Thoughts: Embrace Efficient Budget Planning with NSPB

After exploring these strategies, you now have a solid foundation to improve your NetSuite departmental budget planning.

Remember, NSPB can transform your processes, making them more efficient and accurate for departmental budget allocation strategies.

I’ve seen firsthand how it can reduce stress and enhance your event success through collaborative budgeting using NSPB.

Don’t let budget planning overwhelm you.

Take the first step today towards optimizing budget processes with NSPB.

Try NSPB with Alleo’s support for effective financial forecasting with NSPB.

It’s time to streamline your budget planning and achieve your goals using NSPB budget planning techniques.

You’ve got this.

Ready to get started for free? Let’s optimize your NetSuite departmental budget planning together.