Unlock Financial Success: The Ultimate Guide to Long-Term Budget Planning Tools

Are you an event planner struggling with long-term budget planning?

As a coach, I’ve seen many planners face this challenge. They juggle immediate expenses but lack a focus on future financial projections using long-term budget planning tools.

In this article, you’ll discover the best budget planning tool for long-term financial projections. We’ll explore actionable strategies to enhance your financial planning, including affordable budgeting apps and cost-effective retirement planning tools.

Ready to transform your budgeting process with personal finance projection tools?

Let’s dive into multi-year budget planning solutions.

Understanding the Challenges in Long-Term Budget Planning

Many event planners struggle with traditional budget tools. These tools often focus on immediate expenses, leaving long-term financial projections in the dark. A comprehensive long-term budget planning tool is essential for success.

This gap can lead to financial surprises and stress. Several clients report the frustration of unforeseen costs disrupting their budgets. Affordable budgeting apps can help mitigate these issues.

Moreover, without a focus on future planning, it’s hard to make informed decisions. Event cancellations or market changes can wreak havoc on an unprepared budget. Long-term financial planning tools offer valuable insights for such scenarios.

I often see planners benefit from tools that offer long-term insights. These future expense prediction tools help them anticipate trends and adapt strategies accordingly. Personal finance projection tools can be particularly useful in this regard.

In short, ensuring your financial planning includes future projections is crucial. It provides stability and peace of mind. Utilizing a long-term budget planning tool can make all the difference in achieving financial goals.

Effective Strategies for Long-term Budget Planning

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with long-term budget planning tools:

- Implement cloud-based forecasting software: Use financial forecasting software for accessibility and collaboration.

- Integrate scenario planning and analysis features: Plan for multiple financial outcomes using long-term financial planning tools.

- Set up rolling forecasts for continuous updates: Regularly update financial projections with affordable budgeting apps.

- Utilize AI for data-driven financial projections: Enhance data analysis using personal finance projection tools.

- Create customizable dashboards for quick insights: Design dashboards for easy interpretation with low-cost financial modeling software.

- Incorporate long-term goal setting and tracking: Set and track financial goals using economical financial goal setting apps.

- Enable real-time collaboration for team planning: Facilitate team access and meetings with multi-year budget planning solutions.

Let’s dive in!

1: Implement cloud-based forecasting software

Using cloud-based forecasting software is crucial for enhanced accessibility and collaboration in long-term budget planning.

Actionable Steps:

- Research and select a reputable long-term budget planning tool that aligns with your specific needs.

- Set up the software and ensure all team members receive adequate training on this financial forecasting software.

- Regularly update the software with current data for maintaining accurate forecasts and future expense predictions.

Explanation:

These steps help ensure your financial projections are accurate and up-to-date. Cloud-based tools provide real-time updates and enhance team collaboration for effective long-term financial planning.

For more detailed insights, visit Cube Software. Accurate forecasting supports better decision-making and reduces financial surprises in your long-term budget planning.

Key benefits of cloud-based forecasting software:

- Improved accessibility for remote teams using affordable budgeting apps

- Real-time data updates and synchronization for personal finance projection tools

- Enhanced collaboration features for multi-year budget planning solutions

Implementing cloud-based forecasting software sets a solid foundation for your long-term budget planning tool strategy.

2: Integrate scenario planning and analysis features

Integrating scenario planning and analysis features is essential for anticipating potential financial outcomes and staying prepared with your long-term budget planning tool.

Actionable Steps:

- Identify key scenarios that could impact your financial projections, such as market changes or event cancellations, using financial forecasting software.

- Use scenario planning tools to create multiple financial models based on these scenarios and review them regularly as part of your long-term financial planning strategy.

- Adjust scenarios based on new data and insights to keep your financial plans accurate and adaptable, utilizing future expense prediction tools.

Explanation:

These steps help you anticipate and prepare for various financial outcomes, reducing the risk of unforeseen disruptions. Scenario planning tools offer valuable insights that inform better decision-making in your long-term budget planning process.

For more detailed guidance, visit Cube Software. Implementing these features ensures your budget planning is robust and flexible, similar to multi-year budget planning solutions.

This approach sets a proactive foundation, allowing you to swiftly adapt to changing conditions using your long-term budget planning tool.

3: Set up rolling forecasts for continuous updates

Setting up rolling forecasts ensures your budget stays relevant and responsive to changes, making it an essential feature of any long-term budget planning tool.

Actionable Steps:

- Establish a regular update schedule: Plan to update your financial projections quarterly or monthly using financial forecasting software.

- Incorporate key financial metrics: Include essential KPIs in your forecasts for comprehensive insights, which is crucial for long-term financial planning tools.

- Use insights for adjustments: Regularly adjust your budget based on the latest forecasting data, utilizing affordable budgeting apps for efficiency.

Explanation:

These steps help maintain accurate and responsive financial plans. They enable you to adapt to market changes and avoid financial surprises, which is the core purpose of personal finance projection tools.

For more detailed guidance, visit OneStream. Consistent updates and data-driven adjustments enhance your planning process, especially when using multi-year budget planning solutions.

This approach keeps your financial planning proactive and adaptable, aligning with the goals of long-term budget planning tools.

4: Utilize AI for data-driven financial projections

Leveraging AI in financial projections is vital for event planners aiming for accuracy and efficiency in long-term budget planning.

Actionable Steps:

- Integrate AI tools into your financial planning process to enhance data analysis and forecasting, acting as a long-term budget planning tool.

- Identify patterns and trends in historical data using AI, ensuring more accurate future projections with financial forecasting software.

- Leverage AI-generated insights to inform strategic financial decisions, enhancing overall budget planning and serving as future expense prediction tools.

Explanation:

These steps are critical as they enable precise and efficient financial projections. AI tools can analyze vast amounts of data, identifying trends that might be missed otherwise.

This improves forecasting accuracy and informs better decision-making. For more details, visit Cube Software.

Using AI ensures your financial plans are data-driven and reliable, much like affordable budgeting apps and personal finance projection tools.

Key advantages of AI in financial projections:

- Faster data processing and analysis

- Identification of complex patterns and trends

- Reduced human error in forecasting

Embracing AI transforms your budget planning process, making it more robust and insightful, similar to using multi-year budget planning solutions.

5: Create customizable dashboards for quick insights

Creating customizable dashboards is crucial for event planners to quickly interpret financial data and make informed decisions, especially when using a long-term budget planning tool.

Actionable Steps:

- Design dashboards tailored to your event planning team’s specific needs, ensuring they display relevant financial metrics and function as effective future expense prediction tools.

- Include visualizations like charts and graphs for easy data interpretation and quick insights, similar to those found in financial forecasting software.

- Regularly update dashboards based on team feedback and evolving business requirements to keep them relevant and useful, much like multi-year budget planning solutions.

Explanation:

These steps enable event planners to quickly access and interpret financial data. Custom dashboards help in visualizing key metrics, which aids in better decision-making, similar to affordable budgeting apps.

For more guidance, visit Cube Software. By keeping dashboards updated, you ensure they remain a valuable tool for your team, functioning as long-term financial planning tools.

This approach makes your financial data accessible and actionable, supporting proactive planning and serving as cost-effective retirement planning tools.

6: Incorporate long-term goal setting and tracking

Incorporating long-term goal setting and tracking is essential for ensuring your financial plans align with your business objectives. Using a long-term budget planning tool can significantly enhance this process.

Actionable Steps:

- Define clear long-term financial goals: Align these goals with your overall business objectives to ensure consistency. Utilize future expense prediction tools for accurate planning.

- Use goal-setting tools: Track your progress within your budget planning software or affordable budgeting apps for continuous monitoring.

- Review and adjust goals periodically: Reflect changes in business conditions and ensure goals stay relevant. Leverage financial forecasting software to aid in this process.

Explanation:

These steps are crucial because they help maintain a clear focus on long-term objectives.

Tracking progress regularly ensures that your goals align with your evolving business needs. For more insights, visit NerdWallet.

Adapting goals based on current data ensures that your financial strategy remains effective and relevant. Long-term financial planning tools can assist in this adaptation process.

Setting and tracking long-term goals keeps your budget planning aligned with your business vision. Multi-year budget planning solutions can provide valuable support in this endeavor.

7: Enable real-time collaboration for team planning

Enabling real-time collaboration for team planning is vital for seamless communication and effective budget management using a long-term budget planning tool.

Actionable Steps:

- Set up collaboration features within your financial forecasting software for team access and shared insights.

- Schedule regular team meetings to review financial projections and make collaborative decisions using long-term financial planning tools.

- Encourage team members to share insights and feedback for continuous improvement of your multi-year budget planning solutions.

Explanation:

These steps enhance team coordination and ensure everyone is on the same page regarding financial goals. Real-time collaboration tools help in making timely adjustments and informed decisions, similar to affordable budgeting apps.

For more information, visit Massachusetts Budgeting and Long-Range Financial Planning. Effective collaboration fosters a proactive and responsive budget planning process.

Benefits of real-time collaboration in budget planning:

- Improved communication across departments

- Faster decision-making processes

- Greater transparency in financial planning

Implementing these steps ensures your team works together efficiently, driving better financial outcomes with your long-term budget planning tool.

Transform Your Budget Planning with Alleo

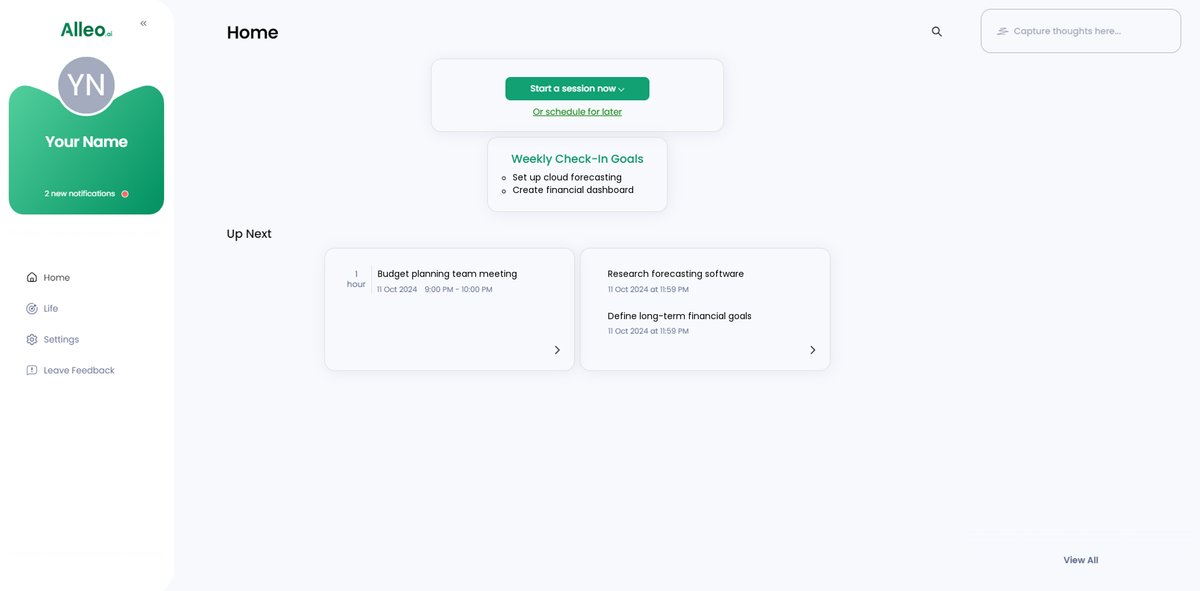

We’ve explored the challenges of long-term budget planning and effective strategies to tackle them. Did you know you can work directly with Alleo, a powerful long-term budget planning tool, to streamline this process?

Setting up an Alleo account is easy. Begin with a free 14-day trial—no credit card required. As an affordable budgeting app, Alleo offers cost-effective retirement planning tools without breaking the bank.

Alleo’s AI coach, acting as your personal finance projection tool, will help you create a personalized budget plan tailored to your specific needs. The coach provides continuous support, monitors progress, and sends reminders via text and push notifications to keep you on track with your multi-year budget planning solutions.

Ready to get started for free with this economical financial goal setting app? Let me show you how our long-term financial planning tool works!

Step 1: Log In or Create Your Account

To begin your journey with Alleo’s AI coach for budget planning, Log in to your account or create a new one to access personalized financial guidance tailored to your event planning needs.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus your budget planning efforts. This goal directly addresses the need for consistent, long-term financial practices that will help you overcome challenges in forecasting and managing event planning budgets effectively.

Step 3: Select ‘Finances’ as Your Focus Area

Choose ‘Finances’ as your primary focus area to align the AI coach with your long-term budget planning needs, enabling personalized guidance for improved financial projections and strategic decision-making in event planning.

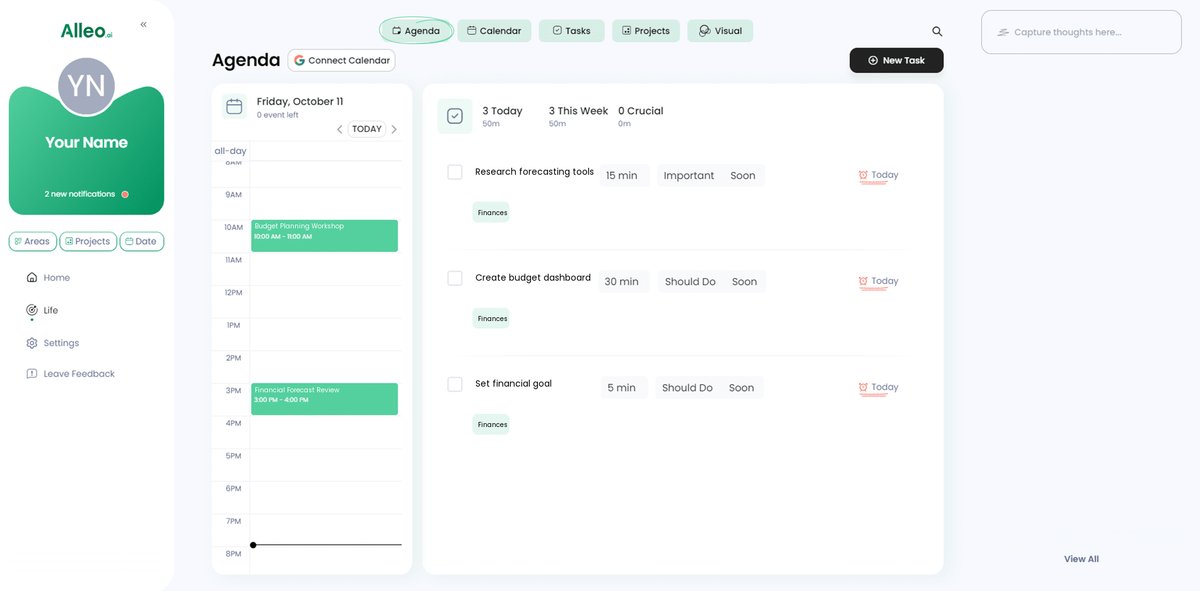

Step 4: Starting a coaching session

Begin with an intake session where you’ll work with Alleo’s AI coach to set up your personalized budget plan, ensuring your long-term financial projections align with your event planning goals.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track progress and make adjustments as needed for your long-term budget planning.

Step 6: Adding events to your calendar or app

Use the Alleo app’s calendar and task features to add your budget planning events and deadlines, allowing you to easily track your progress in solving long-term financial projection challenges.

Your Path to Stress-Free Budget Planning

As we wrap up, let’s reflect on the strategies we’ve explored. Implementing these steps can transform how you approach long-term budget planning.

I know firsthand how challenging it can be to juggle immediate expenses while planning for the future using affordable budgeting apps.

But with the right long-term financial planning tools, you can achieve financial stability and peace of mind.

Start by exploring cloud-based financial forecasting software and integrating scenario planning.

Leverage AI for accurate projections and create customizable dashboards for quick insights using personal finance projection tools.

Set long-term goals and track them diligently with economical financial goal setting apps.

Enable real-time collaboration to keep your team aligned using multi-year budget planning solutions.

Alleo can help you with all these strategies and more as a comprehensive long-term budget planning tool.

Try Alleo for free and see the difference it makes in your budgeting process.

You deserve a tool that supports your long-term financial success.

Take the first step today with our cost-effective retirement planning tools.