6 Essential Best Practices for Entrepreneurs Managing Business Expenses and Receipts

Are you an event planner feeling overwhelmed by managing business expenses and receipts? Effective business expense tracking tips can make a world of difference.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience working with event planners, effective expense tracking is crucial for maintaining accurate financial records and managing cash flow.

In this article, you’ll discover best practices for separating finances, using digital tools like expense tracking software, categorizing expenses, and more. We’ll explore tax deductions for small businesses, digital receipt management, and bookkeeping tips for entrepreneurs.

Let’s dive in to these essential business expense tracking tips.

The Pain Points of Managing Expenses and Receipts

We’ve all been there. Managing expenses and receipts can be overwhelming for event planners seeking effective business expense tracking tips.

Many clients initially struggle with tracking every small transaction, leading to missed tax deductions for small businesses.

Financial mismanagement can cause severe stress. Inaccurate records might result in costly errors during tax season, impacting your business’s bottom line and cash flow management.

I often see clients benefit from streamlined systems and expense tracking software. Without proper organization, it’s easy to lose receipts, making it hard to justify expenses to the IRS and maintain proper financial record keeping.

This can lead to penalties or lost deductions, affecting budgeting for startups.

These challenges are frustrating, but they are solvable with proper business expense tracking tips.

Let’s explore how to tackle them effectively, including digital receipt management and bookkeeping tips for entrepreneurs.

Effective Strategies for Managing Business Expenses and Receipts

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with business expense tracking tips.

- Separate business and personal finances: Open a business bank account and use corporate credit cards to keep expenses distinct, aiding in financial record keeping.

- Use digital tools for expense tracking: Implement expense tracking software and mobile receipt scanning apps for accurate tracking and digital receipt management.

- Categorize expenses regularly: Develop a routine to review and categorize business expense categories monthly, which can help with tax deductions for small businesses.

- Implement a clear expense policy: Establish guidelines for allowable expenses and train stakeholders on the policy, including expense reimbursement policies.

- Scan and organize receipts digitally: Use a digital filing system and receipt management software to keep receipts organized, essential for bookkeeping tips for entrepreneurs.

- Set up a dedicated business bank account: Research and choose a suitable bank, then transition all transactions to the new account for better cash flow management.

Let’s dive in!

1: Separate business and personal finances

Separating business and personal finances is crucial for maintaining clear financial records and ensuring tax compliance. This is one of the most important business expense tracking tips for entrepreneurs.

Actionable Steps:

- Open a business bank account.

- Research banks and choose one with favorable features for business accounts.

- Track business transactions separately from personal ones for effective financial record keeping.

- Apply for a business credit card.

- Choose a card with rewards or cash back on business purchases.

- Use it exclusively for business-related expenses to simplify bookkeeping for entrepreneurs.

Explanation: Keeping business and personal finances separate simplifies accounting and ensures accurate financial reporting. This practice reduces the risk of missing tax deductions for small businesses and makes tax preparation smoother.

According to the IRS, maintaining distinct accounts for business transactions is essential for tax compliance and audit readiness.

Key benefits of separating finances include:

- Simplified tax preparation

- Improved financial clarity for cash flow management

- Enhanced professionalism

Implementing these steps will help you manage your finances more efficiently and improve your business expense tracking.

Next, let’s explore how digital tools can streamline expense tracking.

2: Use digital tools for expense tracking

Using digital tools for expense tracking is crucial for maintaining organized and accurate financial records, making it one of the essential business expense tracking tips.

Actionable Steps:

- Implement expense tracking software.

- Choose a tool like QuickBooks, FreshBooks, or Xero for efficient financial record keeping.

- Set up automatic transaction importing from bank accounts to streamline cash flow management.

- Use mobile receipt scanning apps for digital receipt management.

- Select an app like Expensify or Shoeboxed to simplify bookkeeping for entrepreneurs.

- Scan and categorize receipts immediately after purchases to maintain accurate business expense categories.

Explanation: Utilizing digital tools streamlines the tracking process, ensuring all expenses are accurately logged and categorized, which is crucial for identifying potential tax deductions for small businesses.

This practice not only simplifies tax preparation but also helps in maintaining clear financial records, aiding in budgeting for startups.

According to FreshBooks, mobile receipt scanning apps can significantly reduce the time spent on manual entry, thus increasing efficiency in business expense tracking.

These tools ensure you stay on top of your finances and avoid the hassle of misplaced receipts, which is particularly important when managing business credit card usage and expense reimbursement policies.

Next, let’s explore how categorizing expenses regularly can further streamline your expense tracking.

3: Categorize expenses regularly

Regularly categorizing expenses is essential for maintaining clarity and control over your financial records, making it one of the crucial business expense tracking tips.

Actionable Steps:

- Develop a monthly categorization routine.

- Set aside time each week to review and categorize expenses.

- Ensure all business expense categories are properly assigned by the end of each month.

- Use expense tracking software features.

- Utilize built-in categorization functions in your accounting software.

- Set up default categories and automate recurring expenses for better cash flow management.

Explanation: Regularly categorizing expenses helps you understand your spending patterns and identify cost-saving opportunities. It also simplifies tax preparation and ensures you do not miss out on tax deductions for small businesses.

According to Nuccounting, staying on top of expense categorization can significantly improve your financial management.

Establishing these habits will make your financial record keeping more efficient and accurate. Next, we will explore implementing a clear expense policy.

4: Implement a clear expense policy

Implementing a clear expense policy is vital for maintaining consistency and accuracy in financial management and is a crucial business expense tracking tip.

Actionable Steps:

- Establish guidelines for allowable expenses.

- Create a document outlining what constitutes a business expense and define business expense categories.

- Review and update the policy annually.

- Train employees or stakeholders on the policy.

- Hold a workshop or meeting to explain the expense policy and expense reimbursement policies.

- Ensure everyone understands and follows the guidelines.

- Create a procedure for expense reporting.

- Develop a standardized form for expense submissions, considering expense tracking software options.

- Set deadlines for submitting expense reports.

Explanation: A clear expense policy helps ensure that all business expenses are tracked and reported consistently. This practice minimizes the risk of errors and improves financial management and cash flow management.

According to the IRS, having a well-defined expense policy is crucial for tax compliance and efficient record-keeping, which can be beneficial for tax deductions for small businesses.

Key components of an effective expense policy:

- Clear spending limits

- Defined approval processes

- Specific documentation requirements for financial record keeping

Implementing these business expense tracking tips will streamline your expense management process and enhance financial accuracy, especially important for budgeting for startups.

Next, let’s explore how scanning and organizing receipts digitally can further simplify your tracking efforts.

5: Scan and organize receipts digitally

Efficiently scanning and organizing receipts digitally is essential for maintaining accurate financial records and ensuring tax compliance. This is one of the key business expense tracking tips that can significantly improve your financial record keeping.

Actionable Steps:

- Set up a digital filing system.

- Create folders for each month or category in a cloud storage service.

- Use tools like Google Drive or Dropbox for easy access and efficient expense tracking.

- Use receipt management software.

- Implement expense tracking software like Neat or Evernote for digital receipt management.

- Ensure all receipts are scanned and uploaded within a week of the transaction to maintain accurate business expense categories.

Explanation: Using digital tools to manage receipts can save time and reduce stress. It ensures that all receipts are organized and easily accessible when needed, which is crucial for tax deductions for small businesses.

According to Nuccounting, maintaining digital records improves financial tracking and tax preparation.

Implementing these steps will help you stay organized and compliant. Next, let’s explore setting up a dedicated business bank account for better cash flow management.

6: Set up a dedicated business bank account

Setting up a dedicated business bank account is essential for maintaining clear financial records and simplifying tax preparation, which is a crucial aspect of business expense tracking tips.

Actionable Steps:

- Research and choose a suitable bank.

- Compare features and fees of different business accounts.

- Select a bank that offers low fees or high-interest savings, supporting effective cash flow management.

- Transition all business transactions to the new account.

- Notify clients and vendors of your new account details.

- Update payment information for automated transactions, facilitating digital receipt management.

Explanation: Having a dedicated business bank account helps in separating personal and business finances, which simplifies accounting and ensures accurate financial record keeping.

According to the IRS, maintaining distinct accounts for business transactions is crucial for tax compliance and audit readiness, supporting tax deductions for small businesses.

Implementing these steps will help you manage your finances more efficiently and improve your business expense tracking tips.

Benefits of a dedicated business bank account:

- Simplified bookkeeping for entrepreneurs

- Increased credibility with clients

- Easier tax preparation and management of business expense categories

Next, let’s explore how Alleo can assist in managing your financial goals and budgeting for startups.

Streamline Your Expense Management with Alleo

We’ve explored challenges in managing expenses and receipts, and how to tackle them with business expense tracking tips. But did you know you can work directly with Alleo to make this process easier using our expense tracking software?

Alleo provides tailored coaching support for managing expenses and improving financial record keeping. Start with a free 14-day trial, no credit card required, to enhance your budgeting for startups and small businesses.

Set up an account, create a personalized plan, and track your progress with our digital receipt management system. Alleo’s AI coach will send follow-ups, handle changes, and keep you accountable via text and notifications, helping you master business expense categories and cash flow management.

Ready to get started for free and discover essential bookkeeping tips for entrepreneurs?

Let me show you how!

Step 1: Log In or Create Your Account

To start managing your expenses with Alleo, log in to your existing account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a consistent system for managing your business expenses and receipts, helping you stay organized and financially on track.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to tackle your expense management challenges head-on. This selection will provide you with tailored guidance and tools to streamline your business finances, helping you implement the strategies outlined in this article more effectively.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your expense management challenges and create a personalized plan to streamline your financial tracking and organization.

Step 5: Viewing and Managing Goals After the Session

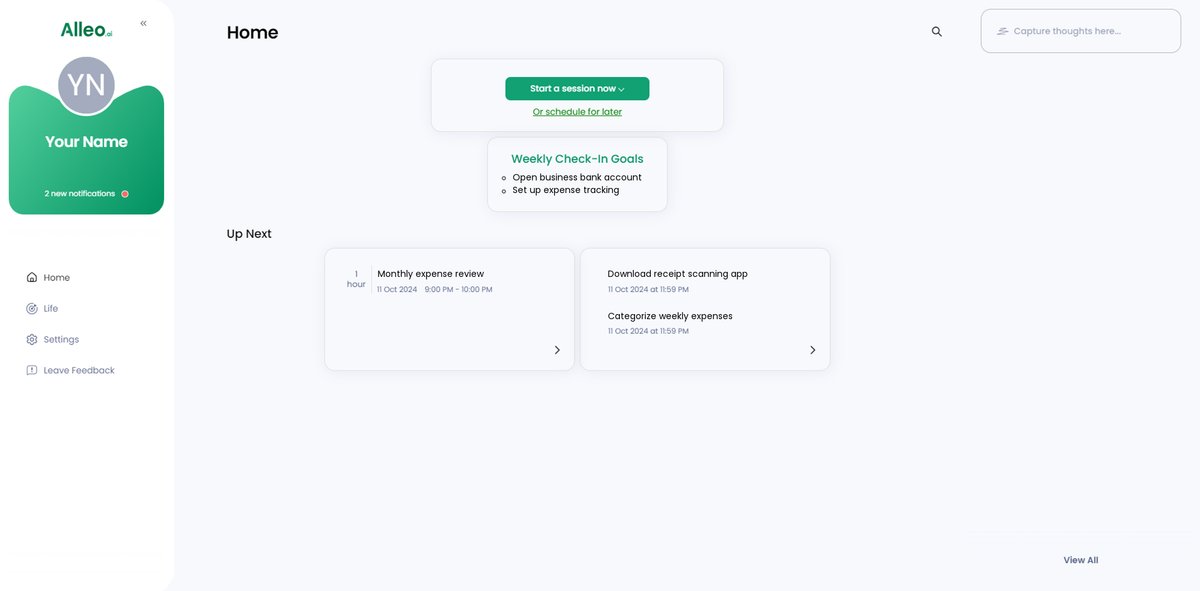

After your coaching session, you can easily view and manage the expense tracking goals you discussed by checking the home page of the Alleo app, where they will be prominently displayed for your reference and action.

Step 6: Adding events to your calendar or app

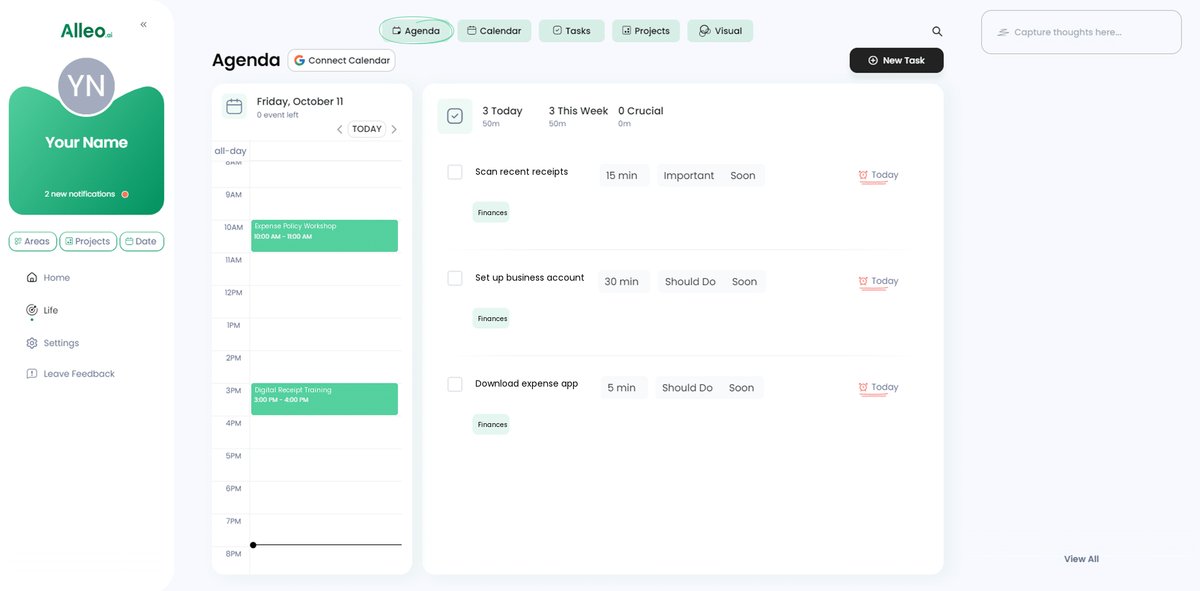

Use the calendar and task features in Alleo to schedule and track your progress on expense management activities, such as monthly categorization sessions or receipt scanning days, ensuring you stay on top of your financial organization goals.

Bringing It All Together: Simplify Your Expense Management

Managing business expense tracking doesn’t have to be overwhelming. By following these best practices for business expense tracking tips, you can streamline your financial management and avoid costly mistakes.

Remember, separating your finances, using digital receipt management tools, categorizing expenses for tax deductions, and implementing clear expense reimbursement policies are essential steps.

You can do this!

Additionally, scanning and organizing receipts digitally can save you time and stress. Setting up a dedicated business bank account for cash flow management ensures your financial records are always accurate.

I know it can be challenging, but you’re not alone. Alleo is here to help with expense tracking software.

Try Alleo for free and transform your business expense tracking today.