7 Fundamental Principles: How Event Planners Can Simplify Budgeting for Better Financial Control

Imagine effortlessly managing your event budget with a few clicks and keystrokes, ensuring every dollar is accounted for in real-time. This is the essence of event budget simplification tips that can transform your planning process.

As a life coach, I’ve helped many event planners navigate these challenges. I often encounter issues with complex budgeting software that lead to financial mismanagement. Implementing cost-effective event planning tips can make a significant difference in streamlining event finances.

In this post, you’ll discover strategies to simplify budgeting and enhance financial control. We’ll explore practical event budget tracking tools and techniques to streamline your expense tracking. These financial strategies for event organizers will help you master budget-friendly event planning techniques.

Let’s dive in to explore event budget simplification tips that will revolutionize your approach to event planning budget management.

The Challenges of Complex Budgeting Software

Managing event budgets can be overwhelming, particularly when dealing with complicated software. Several clients report difficulties in tracking expenses accurately, highlighting the need for event budget simplification tips.

This often leads to financial mismanagement and stress, impacting overall event planning budget management.

In my experience, people often find that avoiding proper expense management for event professionals results in potential budget overruns. This can jeopardize the entire event and affect accurate event cost estimation.

It’s crucial to find a more user-friendly approach to streamlining event finances.

Many event planners struggle with these issues. They need solutions that are intuitive and efficient, such as effective event budget tracking tools.

Ensuring financial health through simplified budgeting can make a significant difference in cost-effective event planning.

Ultimately, a clear, straightforward system is essential for success in event budget simplification. Let’s explore how to achieve this through budget-friendly event planning techniques.

Key Steps to Simplify Budgeting for Event Planners

Overcoming budgeting challenges involves a few strategic actions. Here are the main areas to focus on to make progress with event budget simplification tips:

- Use centralized budget management software: Select and implement software that consolidates all budget data for streamlining event finances.

- Create a detailed event expense template: Develop and customize templates for thorough expense tracking and accurate event cost estimation.

- Set up automated expense tracking systems: Integrate tools for real-time tracking and notifications to enhance event planning budget management.

- Implement regular budget review meetings: Schedule meetings to review and adjust budgets periodically, supporting financial forecasting in event planning.

- Utilize mobile apps for real-time expense input: Ensure team members can report expenses on-the-go, improving expense management for event professionals.

- Integrate financial data from multiple sources: Consolidate all relevant financial data into one platform for comprehensive event budget tracking.

- Develop custom budgeting workflows: Create tailored workflows to streamline budgeting tasks and support cost-effective event planning tips.

Let’s dive in to explore these event budget simplification tips further!

1: Use centralized budget management software

Implementing centralized budget management software is crucial for simplifying your event planning process and mastering event budget simplification tips.

Actionable Steps:

- Research and select event budget tracking tools that meet your needs.

- Implement the chosen software and transfer existing event planning budget management data.

- Train your team to maximize the software’s efficiency for streamlining event finances.

Explanation:

Using centralized software helps consolidate all budget-related information, making it easier to track expenses and avoid financial mismanagement, which is essential for cost-effective event planning tips.

According to Quickbase, project management software can reduce budget overruns by up to 28%. This ensures better financial control and accuracy in your event planning, supporting accurate event cost estimation.

Key benefits of centralized budget management software for event budget simplification tips:

- Improved financial visibility for event organizers

- Streamlined expense tracking for event professionals

- Enhanced collaboration among team members for efficient event planning budget management

This step sets the foundation for more efficient budget management, leading to smoother event execution and improved event ROI calculation methods.

2: Create a detailed event expense template

Creating a detailed event expense template is essential for tracking all potential costs and ensuring no expense is overlooked, making it a crucial step in event budget simplification.

Actionable Steps:

- Develop a comprehensive template that includes all possible expense categories for effective event planning budget management.

- Use past events as references to make sure every category is covered, aiding in accurate event cost estimation.

- Customize the template for each event, considering its unique requirements and financial strategies for event organizers.

- Adjust based on event size, type, and specific needs to support cost-effective event planning.

- Regularly update the template with new insights and learnings to streamline event finances.

- Review and refine the template after each event for continuous improvement in expense management for event professionals.

Explanation:

Developing a detailed expense template helps in maintaining financial oversight and avoiding unexpected costs, which is key to event budget simplification.

According to Vanco Payments, regular updates to your budgeting template ensure that it remains accurate and relevant to your needs, supporting budget-friendly event planning techniques.

This proactive approach can significantly enhance your financial control and event execution, improving event ROI calculation methods.

These steps will prepare you for any financial surprises and keep your event budget on track, utilizing effective event budget tracking tools.

3: Set up automated expense tracking systems

Setting up automated expense tracking systems can significantly enhance financial control for event planners, offering valuable event budget simplification tips.

Actionable Steps:

- Integrate automated tracking tools with your budget management software.

- Select tools that seamlessly sync with your existing event planning budget management software.

- Enable real-time expense tracking and notifications.

- Configuring settings to alert you of significant expenses or anomalies can be helpful for streamlining event finances.

- Monitor and adjust settings for optimal performance.

- Regularly reviewing tracking reports and tweaking settings as needed ensures accuracy in event cost estimation.

Explanation:

Automated expense tracking systems help you stay on top of your finances without manual effort. Real-time tracking provides immediate insights, ensuring you catch any discrepancies early, which is crucial for cost-effective event planning.

According to Nimblework, effective budget tracking is crucial for managing event finances. These event budget simplification tips will keep your budget on track, so you can focus on delivering a successful event.

These financial strategies for event organizers lay the groundwork for seamless financial management, leading to smoother event execution.

4: Implement regular budget review meetings

Regular budget review meetings are crucial for maintaining financial control and ensuring accurate expense tracking, which are key event budget simplification tips.

Actionable Steps:

- Schedule periodic budget review meetings with your team.

- Set a recurring calendar invite for bi-weekly or monthly reviews to streamline event finances.

- Prepare detailed budget reports to discuss during the meetings.

- Use visual aids like graphs and charts for clarity in event planning budget management.

Explanation:

Consistent budget review meetings help identify and address discrepancies early, ensuring financial accuracy. According to Vanco Payments, regular budget reviews are essential for maintaining financial health and are crucial financial strategies for event organizers.

These meetings can foster accountability and proactive financial management within your team, contributing to cost-effective event planning tips.

Key elements to cover in budget review meetings:

- Analysis of actual vs. projected expenses for accurate event cost estimation

- Identification of cost-saving opportunities

- Discussion of upcoming financial challenges in event planning

Regular reviews will keep your event finances on track and allow for timely adjustments, making them essential event budget simplification tips.

5: Utilize mobile apps for real-time expense input

Using mobile apps for real-time expense input can greatly enhance your event budget simplification efforts and improve overall financial strategies for event organizers.

Actionable Steps:

- Select mobile apps that offer seamless integration with your budget management software for streamlining event finances.

- Research and test apps to ensure compatibility and ease of use for effective event planning budget management.

- Train your team on how to use the mobile apps for immediate and accurate event cost estimation and expense reporting.

- Conduct hands-on training sessions and provide easy-to-follow user manuals for event budget tracking tools.

- Encourage consistent use of mobile apps by implementing a rewards system for timely and accurate expense input.

- Reward team members who regularly and accurately report expenses, promoting cost-effective event planning tips.

Explanation:

Mobile apps enable real-time tracking and reporting of expenses, which can prevent budget overruns and improve financial control. This approach is crucial for expense management for event professionals.

According to Vanco Payments, technology can greatly simplify budget management. This approach ensures that all expenses are promptly recorded, giving you a clear and up-to-date financial picture, which is essential for event ROI calculation methods.

These event budget simplification tips will help you maintain accurate financial records and streamline your budgeting process, supporting budget-friendly event planning techniques.

6: Integrate financial data from multiple sources

Integrating financial data from multiple sources is crucial for comprehensive budget management and is one of the key event budget simplification tips.

Actionable Steps:

- Identify all financial data sources relevant to your event budget.

- List sources like bank accounts, invoices, and vendor contracts for effective event planning budget management.

- Use integration tools to consolidate data into a single platform.

- Employ APIs or third-party services for seamless data integration, enhancing financial strategies for event organizers.

- Regularly audit integrated data for accuracy and consistency.

- Schedule periodic audits to ensure data integrity across all sources, improving event budget tracking tools.

Explanation:

Integrating financial data from various sources ensures that you have a complete and accurate picture of your event budget. This consolidation helps in maintaining financial transparency and control, which is essential for streamlining event finances.

According to Glide Solutions, integrating financial data can greatly enhance decision-making and streamline budget management. These steps will help you achieve a cohesive financial overview for better event planning and accurate event cost estimation.

These measures will ensure your financial data is accurate and up-to-date, laying the groundwork for seamless financial management and cost-effective event planning tips.

7: Develop custom budgeting workflows

Developing custom budgeting workflows is key to streamlining your budgeting process and enhancing financial control, making it an essential event budget simplification tip.

Actionable Steps:

- Analyze your current budgeting process to identify areas for improvement.

- Map out your workflow and pinpoint bottlenecks or inefficiencies in event planning budget management.

- Design custom workflows tailored to your event planning needs.

- Create step-by-step workflows that streamline budgeting tasks and enhance cost-effective event planning.

- Implement and refine workflows based on feedback and performance.

- Collect feedback from your team and adjust workflows for better results in streamlining event finances.

Explanation:

Custom budgeting workflows help you address specific needs and improve efficiency. By analyzing and refining your processes, you ensure smoother event planning and better financial control, contributing to accurate event cost estimation.

According to ClearPoint Strategy, customized workflows can greatly enhance project budget management. This proactive approach can significantly improve your event planning outcomes and assist in event ROI calculation methods.

Benefits of custom budgeting workflows:

- Increased efficiency in budget management for event professionals

- Reduced errors and inconsistencies in financial forecasting for event planning

- Better alignment with your specific event planning needs and budget-friendly event planning techniques

These steps will help you maintain a streamlined and effective budgeting process, setting the stage for successful events and simplifying event budget management.

Partner with Alleo to Simplify Event Budgeting

We’ve explored the challenges of complex budgeting software and how simplifying budgeting can enhance your financial control. But did you know you can work directly with Alleo to make event budget simplification easier and faster?

Setting up an account with Alleo is simple. First, create a profile and outline your specific event planning budget management needs.

Next, Alleo’s AI coach will develop a personalized plan to address your unique challenges in streamlining event finances. The coach will provide tailored financial strategies for event organizers and follow up on your progress.

You’ll receive text and push notifications to keep you accountable with your event budget tracking tools.

Ready to get started for free? Let me show you how to implement cost-effective event planning tips!

Step 1: Log In or Create Your Account

To begin simplifying your event budgeting process, Log in to your account or create a new one to access Alleo’s AI coach and personalized budgeting strategies.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on creating a structured approach to your event budgeting, helping you establish consistent practices that will simplify your financial management and lead to more successful events.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to address your event budgeting challenges, allowing Alleo’s AI coach to provide tailored strategies for simplifying your financial management and enhancing budget control.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where our AI coach will help you set up a personalized plan to simplify your event budgeting process and enhance financial control.

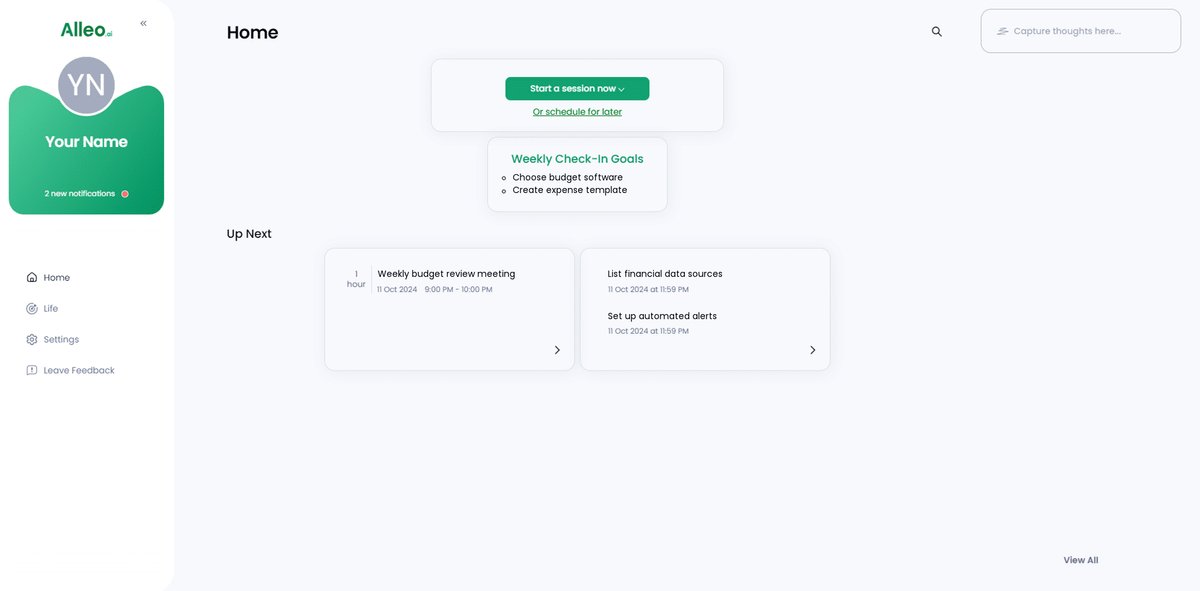

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable to your event budgeting objectives.

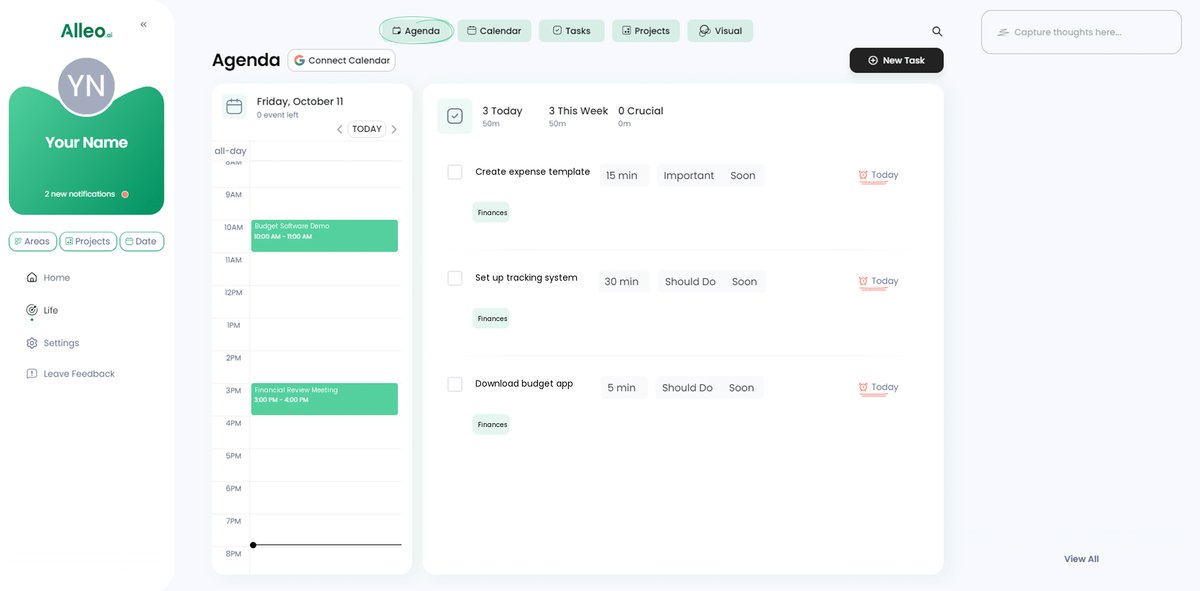

Step 6: Adding events to your calendar or app

Sync your event budget milestones with the Alleo app’s calendar and task features to easily track your progress and stay on top of important deadlines, ensuring you maintain financial control throughout your event planning process.

Bringing It All Together: Simplifying Your Event Budgeting

Stepping back, let’s reflect on the journey we’ve taken to conquer complex budgeting and explore event budget simplification tips.

We’ve discussed the pitfalls of complicated software and how it can derail your financial strategies for event organizers. By adopting a streamlined approach to event planning budget management, you can regain control and ensure every dollar is well spent.

It’s clear that centralized software, detailed templates, and automated tracking can make a huge difference in streamlining event finances. Regular budget reviews and mobile apps keep your finances transparent and up-to-date, essential for accurate event cost estimation.

Integrating data and custom workflows add the final touches to your budgeting strategy, enhancing your event ROI calculation methods.

I know these cost-effective event planning tips can transform how you manage event budgets.

Remember, you don’t have to tackle this alone.

Consider partnering with Alleo to simplify your budgeting process further. Ready to take the first step in implementing budget-friendly event planning techniques?

Try Alleo for free and see the difference it makes in your event planning and expense management for event professionals.