How Financial Advisors Can Master Respectful Family Planning Discussions: A Comprehensive Guide

Have you ever found yourself in a tough spot discussing family planning with a client, worried about overstepping boundaries?

As a life coach, I’ve guided many professionals through similar challenges. Respectful family planning discussions are crucial for building trust and effective financial advising, especially when it comes to wealth management for families.

In this article, you’ll learn actionable steps to engage in respectful family planning discussions without imposing personal values. You will discover how to ask open-ended questions, highlight financial impacts, offer diverse resources on family financial planning, and practice active listening – essential financial advisor communication skills.

Let’s dive into tactful financial counseling and sensitive financial discussions.

Understanding the Challenges in Family Planning Discussions

Talking about family planning can be daunting for financial advisors. Many clients initially struggle with sharing personal details in sensitive financial discussions, fearing judgment or misunderstanding.

This creates a barrier to open communication in respectful family planning discussions.

In my experience, addressing diverse family structures adds another layer of complexity to family financial planning. Advisors must balance empathy with professionalism, ensuring they respect each client’s unique situation when discussing financial goals with clients.

Failing to navigate these challenges in wealth management for families can lead to lost trust and clients.

Additionally, discussing sensitive topics without imposing personal values is tough. It’s crucial to approach these respectful family planning discussions with care and neutrality, focusing on the client’s needs and goals in generational wealth transfer and estate planning conversations.

This requires skill and practice in financial advisor communication skills, but the payoff is significant—stronger client relationships and better financial outcomes in family money management.

Four Key Strategies for Respectful Family Planning Discussions

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in respectful family planning discussions.

- Use open-ended questions about family goals: This encourages clients to share their vision for generational wealth transfer without feeling judged.

- Highlight financial impacts of family choices: Show how different scenarios affect finances and family money management.

- Offer resources on diverse family structures: Provide educational materials and expert connections for estate planning conversations.

- Practice active listening without judgment: Ensure clients feel heard and respected during sensitive financial discussions.

Let’s dive into these strategies for tactful financial counseling and wealth management for families!

1: Use open-ended questions about family goals

Asking open-ended questions helps clients share their family goals without feeling judged, setting the stage for respectful family planning discussions.

Actionable Steps:

- Begin meetings by asking, “What are your long-term family goals for wealth management?”

- Follow up with, “How do you see your financial situation supporting these goals in your family financial planning?”

- Use tools like family goal worksheets during sensitive financial discussions.

Explanation:

These steps matter because they encourage clients to open up about their aspirations. This helps build trust and tailor financial advice to their needs, essential for tactful financial counseling.

According to Berkeley Parents Network, understanding diverse family structures is crucial for effective financial planning. Creating an open dialogue paves the way for more meaningful conversations about generational wealth transfer.

Key benefits of open-ended questions in family planning discussions:

- Encourages deeper reflection on personal goals for estate planning conversations

- Reduces feelings of judgment or pressure in inheritance planning advice

- Allows for more personalized financial advice in family money management

These techniques set the stage for deeper discussions about family planning and improve financial advisor communication skills.

2: Highlight financial impacts of family choices

Understanding the financial impacts of family choices is crucial for clients when planning their futures, especially in respectful family planning discussions.

Actionable Steps:

- Present case studies showing different family planning scenarios and their financial outcomes, focusing on generational wealth transfer.

- Create visual aids, such as charts and graphs, to illustrate potential financial consequences in family money management.

- Offer personalized financial simulations based on client data to provide concrete examples for wealth management for families.

Explanation:

These steps are important because they make sensitive financial discussions relatable and informative. By using case studies and visual aids, you help clients visualize how their choices affect their finances during respectful family planning discussions.

According to Berkeley Parents Network, understanding diverse family structures is essential for effective financial planning. Personalized simulations offer a concrete understanding of possible financial futures, aiding in estate planning conversations.

This approach ensures clients feel informed and confident in their decisions, enhancing financial advisor communication skills for tactful financial counseling.

3: Offer resources on diverse family structures

Providing resources on diverse family structures helps clients feel understood and supported during respectful family planning discussions.

Actionable Steps:

- Compile and share a list of resources (books, articles, websites) on various family structures and family financial planning.

- Host informational webinars or workshops on financial planning for different family types, focusing on sensitive financial discussions.

- Connect clients with specialized advisors or support groups tailored to their family situations for wealth management for families.

Explanation:

These steps matter because they educate clients on financial considerations specific to their family setup, facilitating generational wealth transfer discussions.

For example, the Berkeley Parents Network emphasizes understanding diverse family structures for effective financial planning.

Providing resources fosters informed decision-making and builds trust, enhancing financial advisor communication skills.

Common types of family structures to consider in family money management:

- Single-parent households

- Blended families

- Same-sex couples with children

- Multi-generational families

Offering resources ensures clients feel supported and confident in their financial planning, enabling tactful financial counseling and estate planning conversations.

4: Practice active listening without judgment

Active listening without judgment is crucial for financial advisors to ensure clients feel respected and understood during respectful family planning discussions.

Actionable Steps:

- Use reflective listening techniques, such as paraphrasing clients’ concerns to show you understand their perspectives in sensitive financial discussions.

- Pause before responding to allow clients time to express themselves fully and thoughtfully about family financial planning.

- Attend active listening workshops to continuously improve your financial advisor communication skills.

Explanation:

These steps matter because they help build rapport and trust with clients. Reflective listening ensures clients feel heard and respected, which is essential in respectful family planning discussions and wealth management for families.

According to Raymone Jackson, valuing and respecting differing perspectives is the foundation of an inclusive culture. This proactive approach enhances client relationships and fosters a respectful dialogue in estate planning conversations.

Effective active listening techniques for financial advisors in family money management:

- Maintain eye contact and open body language

- Avoid interrupting or offering premature solutions in generational wealth transfer discussions

- Ask clarifying questions to ensure understanding during inheritance planning advice

This approach ensures clients feel respected and valued during respectful family planning discussions and other sensitive financial discussions.

Partner with Alleo for Respectful Family Planning Conversations

We’ve explored the challenges of discussing family planning respectfully. Did you know you can work with Alleo to make respectful family planning discussions easier and faster?

Alleo offers tailored coaching for sensitive financial discussions at an affordable rate. Set up an account, create a personalized plan for family financial planning, and get full coaching sessions like any human coach specializing in wealth management for families.

Alleo AI coach provides ongoing support for estate planning conversations, follows up on progress, handles changes, and keeps you accountable via text and push notifications, enhancing your financial advisor communication skills.

Ready to get started for free? Let me show you how to improve your tactful financial counseling approach!

Step 1: Log In or Create Your Alleo Account

To start your journey towards respectful family planning discussions, log in to your existing Alleo account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” from the goal options to develop consistent practices for respectful family planning discussions, enhancing your ability to engage clients effectively and sensitively.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to address family planning challenges and improve your financial advising skills. This selection will provide you with targeted guidance on discussing financial impacts of family choices and offering resources on diverse family structures, aligning perfectly with the strategies outlined in the article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to discuss your family planning communication goals and create a personalized coaching plan that aligns with the strategies outlined in this article.

Step 5: Viewing and Managing Goals After the Session

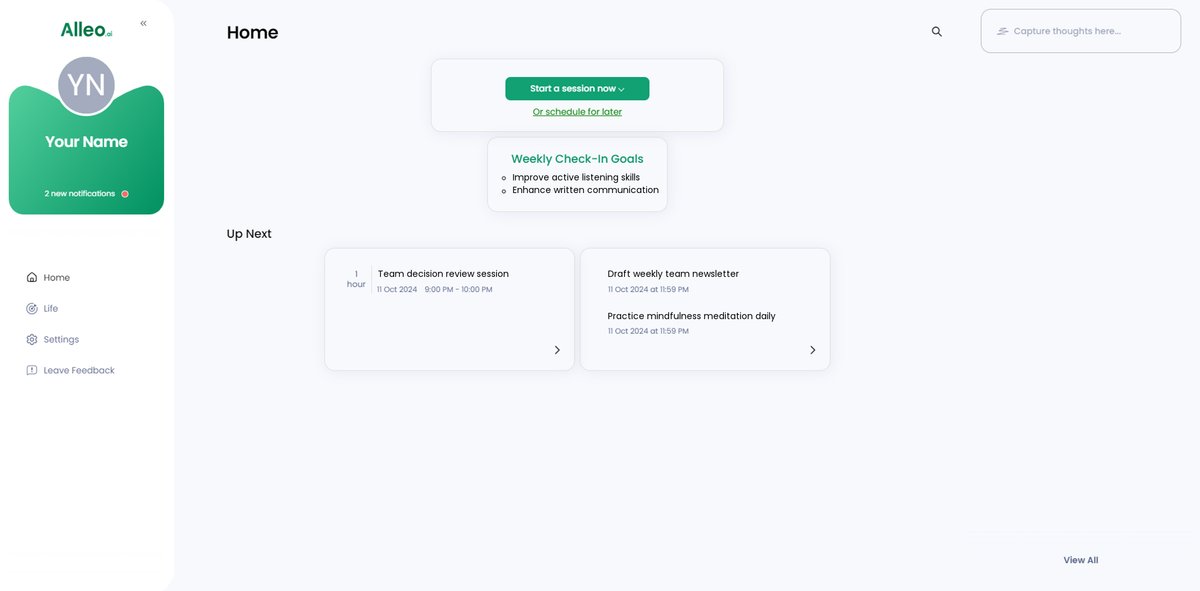

After your coaching session on family planning discussions, check the Alleo app’s home page to review and manage the goals you set, ensuring you stay on track with implementing respectful communication strategies with your clients.

Step 6: Adding events to your calendar or app

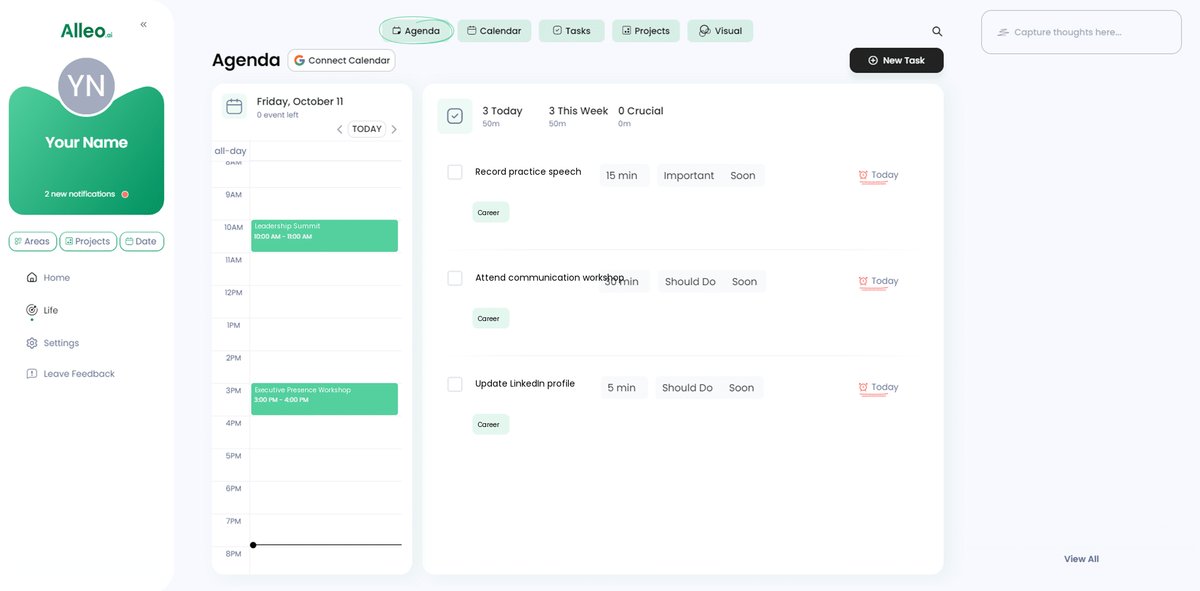

Use Alleo’s calendar and task features to schedule and track your progress on implementing respectful family planning discussion strategies, helping you stay accountable and measure your success over time.

Wrapping Up: Empowering Respectful Family Planning Conversations

We’ve discussed how to approach respectful family planning discussions with empathy and sensitivity. It’s clear that open-ended questions, highlighting financial impacts, offering diverse resources, and active listening are key strategies for wealth management for families.

Implementing these steps can transform your client relationships in family financial planning. You’ll build trust and create personalized financial plans that truly align with your clients’ goals, including generational wealth transfer and estate planning conversations.

I know tactful financial counseling can be challenging, but with practice, you’ll improve your financial advisor communication skills. Remember, Alleo is here to support you in discussing financial goals with clients every step of the way.

Try Alleo for free and see how it can enhance your approach to sensitive financial discussions and family money management. Start today and make a positive impact on your clients’ lives through respectful family planning discussions.