5 Essential Strategies for Young Professionals to Diversify Investments and Track Net Worth

Are you struggling to diversify your investments for young professionals and track your net worth effectively?

As a life coach, I’ve helped many young professionals navigate these financial complexities. In my experience, setting up a diversified investment portfolio and tracking financial progress can be daunting for those building wealth in their 20s and 30s.

In this article, you’ll discover actionable strategies to diversify your investments, utilize net worth tracking tools, and create a solid financial plan for young adults. We’ll cover asset allocation strategies, long-term investing for millennials, and retirement savings for young professionals.

Let’s dive in.

Understanding Financial Management Challenges for Young Professionals

Financial management can be overwhelming for many young professionals. I often see clients confused about choosing the right investment options and effectively tracking financial progress, especially when it comes to diversifying investments for young professionals.

Navigating the complexities of diversified investments—like company stocks, cryptocurrencies, and traditional savings accounts—adds to the challenge of investment portfolio diversification.

Moreover, setting up a budget while managing debt and saving for the future can feel like a juggling act. This is where personal finance management apps can be particularly helpful for long-term investing for millennials.

When discussing finances with your partner, these challenges can become even more stressful, highlighting the importance of financial planning for young adults.

But don’t worry; you’re not alone. Many young professionals face these hurdles in building wealth in their 20s and 30s.

Let’s explore how to tackle them together, including asset allocation strategies and retirement savings for young professionals.

Key Steps to Diversify Investments and Track Net Worth

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for diversifying investments for young professionals and making progress:

- Set up a diversified ETF portfolio: Identify and select a mix of ETFs representing different asset classes, a crucial aspect of investment portfolio diversification.

- Use a net worth tracking app: Choose an app that integrates your financial accounts for automatic updates, essential for personal finance management.

- Contribute regularly to a Roth IRA: Automate contributions and adjust amounts based on your financial goals, focusing on retirement savings for young professionals.

- Create a budget to maximize investment potential: Use the 50/30/20 method to allocate income efficiently, a key strategy for building wealth in your 20s and 30s.

- Explore low-risk alternative investments: Consider bonds, CDs, or high-yield savings accounts for diversification, enhancing your asset allocation strategies.

Let’s dive into these steps for diversifying investments for young professionals!

1: Set up a diversified ETF portfolio

Creating a diversified ETF portfolio is essential for managing risk and maximizing returns, especially for young professionals diversifying investments.

Actionable Steps:

- Identify and select ETFs representing various asset classes like stocks, bonds, and real estate for investment portfolio diversification.

- Regularly review and adjust your ETF portfolio to maintain diversification and align with financial goals, using net worth tracking tools.

- Attend financial webinars or workshops to stay updated on the latest trends and best practices in ETF investing and financial planning for young adults.

Explanation: Diversifying investments for young professionals through an ETF portfolio helps spread risk across multiple asset classes, increasing the potential for stable returns.

Regular reviews ensure your investments align with your financial goals. Staying informed through webinars and workshops keeps you up-to-date with industry trends and asset allocation strategies.

For more information, visit Bookmap’s blog on smart money moves for young adults.

Key benefits of a diversified ETF portfolio include:

- Reduced overall investment risk

- Potential for more consistent returns

- Easier management of your investment strategy for long-term investing for millennials

By setting up a diversified ETF portfolio, you lay the groundwork for a robust financial future and retirement savings for young professionals.

2: Use a net worth tracking app

Using a net worth tracking app is essential for organizing and monitoring your financial health, especially when diversifying investments for young professionals.

Actionable Steps:

- Choose a reliable personal finance management app that integrates with your financial accounts for seamless updates on your investment portfolio diversification.

- Set up automatic updates and reminders to regularly check and record your net worth, facilitating long-term investing for millennials.

- Utilize the app’s features to set financial planning goals for young adults and track progress over time.

Explanation: Utilizing a net worth tracking tool helps you maintain a clear view of your financial situation and asset allocation strategies.

Regular updates ensure you stay informed about your financial progress and make necessary adjustments to your retirement savings as a young professional.

These apps often offer goal-setting features, making it easier to achieve financial milestones and manage risk in investing. For more information, visit Investopedia’s guide on personal finance, which highlights the importance of tracking net worth.

This way, you can stay on top of your finances and make informed decisions about building wealth in your 20s and 30s.

3: Contribute regularly to a Roth IRA

Contributing regularly to a Roth IRA is crucial for diversifying investments for young professionals and building a secure retirement.

Actionable Steps:

- Automate contributions: Set up automatic transfers from your paycheck to your Roth IRA to ensure consistent saving and support long-term investing for millennials.

- Adjust contributions: Regularly review and modify your contributions based on any changes in your income or financial goals, aligning with personal finance management apps.

- Maximize employer matching: Take full advantage of any employer matching contributions to boost your retirement savings for young professionals.

Explanation: Automating and adjusting your Roth IRA contributions helps you stay disciplined and take advantage of tax benefits. Regular reviews ensure your contributions align with your evolving financial situation and goals, supporting investment portfolio diversification.

For further insight, check out Financial Samurai’s guide on Roth IRA contributions.

Advantages of consistent Roth IRA contributions:

- Tax-free growth on investments

- Flexible withdrawal options in retirement

- Potential for higher long-term returns, supporting building wealth in your 20s and 30s

This strategy will help you steadily build a robust retirement fund while diversifying investments for young professionals.

4: Create a budget to maximize investment potential

Creating a budget is crucial to maximize your investment potential and ensure financial stability, especially when diversifying investments for young professionals.

Actionable Steps:

- Use the 50/30/20 method: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and investments, focusing on investment portfolio diversification.

- Track your spending: Identify areas to cut back on and increase investment contributions, utilizing net worth tracking tools.

- Utilize budgeting apps: Monitor and adjust your budget in real-time with personal finance management apps like Mint or YNAB.

Explanation: Establishing a budget helps you manage your finances effectively and prioritize investments, which is essential for building wealth in your 20s and 30s.

Tracking your spending allows you to identify unnecessary expenses and reallocate funds towards long-term investing for millennials.

For more tips on effective budgeting, visit Noble Bank’s guide on money management for young adults.

By creating a budget, you can enhance your investment potential and achieve your financial goals, including retirement savings for young professionals.

5: Explore low-risk alternative investments

Exploring low-risk alternative investments is crucial for young professionals to manage risk while diversifying their investment portfolios. This approach is key to investment portfolio diversification and building wealth in your 20s and 30s.

Actionable Steps:

- Research bonds and high-yield savings accounts: Investigate government and corporate bonds, as well as high-yield savings accounts, to find suitable low-risk options for diversifying investments for young professionals.

- Diversify within alternatives: Spread your investments across different types of low-risk alternatives to balance potential returns and risk, a crucial aspect of asset allocation strategies.

- Consult a financial advisor: Seek advice from a professional to understand the risks and benefits of various low-risk investments as part of financial planning for young adults.

Explanation: Incorporating low-risk alternatives into your investment strategy helps you achieve stability and reduce overall portfolio risk, which is essential for long-term investing for millennials.

Diversifying within these options ensures a balanced approach that aligns with your financial goals. For more insights on asset allocation, visit Investopedia’s guide on portfolio management.

Popular low-risk alternative investments include:

- Treasury securities

- Municipal bonds

- Certificates of Deposit (CDs)

This balanced approach will help secure your financial future while minimizing potential losses, an important aspect of risk management in investing for young professionals.

Partner with Alleo for Your Financial Journey

We’ve explored the challenges of diversifying investments for young professionals and tracking net worth for young professionals. Did you know you can work directly with Alleo to simplify this process of investment portfolio diversification?

Setting up an account is easy. Create a personalized plan with Alleo’s AI coach to tackle your financial challenges, including long-term investing for millennials and retirement savings for young professionals.

The coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, acting as one of the best personal finance management apps available.

Ready to get started for free? Let me show you how to begin building wealth in your 20s and 30s!

Step 1: Log In or Create Your Account

To begin your journey towards financial growth, log in to your existing Alleo account or create a new one to access personalized guidance on investment diversification and net worth tracking.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a solid foundation for managing your finances effectively, helping you consistently track your net worth and maintain a diversified investment strategy.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to tackle investment diversification and net worth tracking challenges head-on, aligning perfectly with the strategies discussed in this article for improving your financial health.

Step 4: Starting a coaching session

Begin your financial journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized plan to diversify your investments and track your net worth effectively.

Step 5: Viewing and Managing Goals After the Session

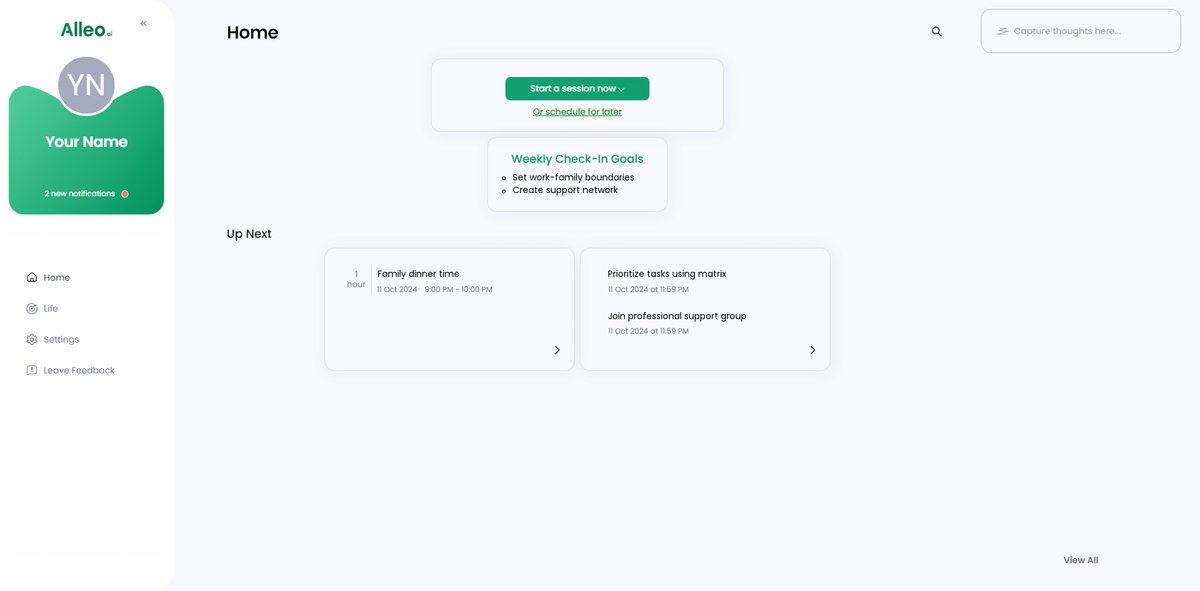

After your coaching session, check the app’s home page to review and manage the financial goals you discussed, allowing you to track your progress towards diversifying investments and improving your net worth.

Step 6: Adding events to your calendar or app

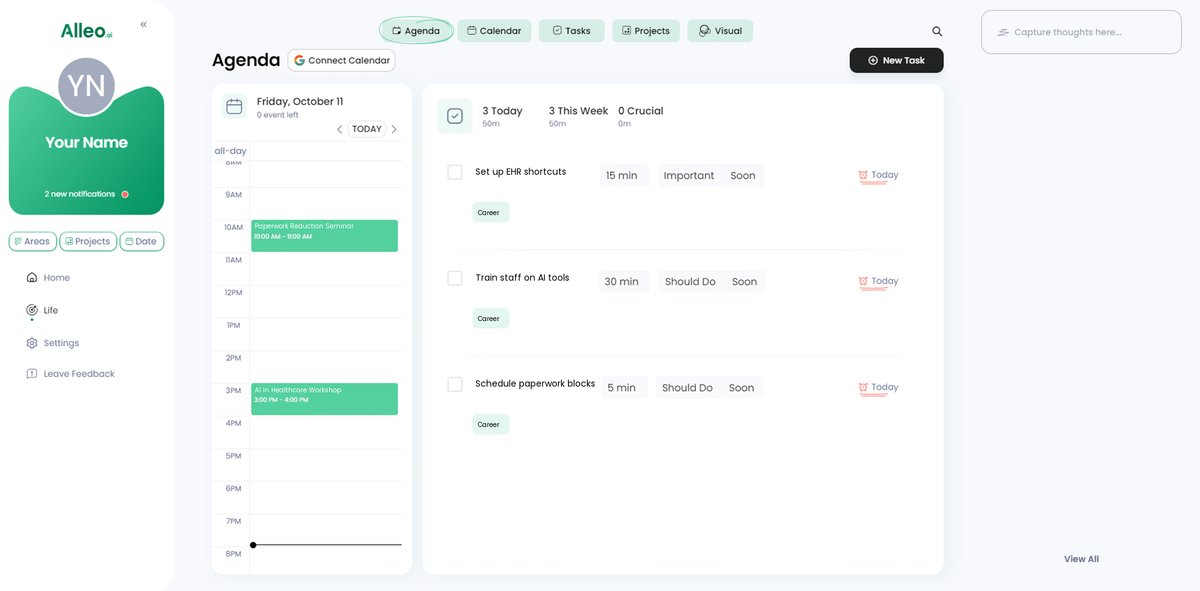

Use the calendar and task features in the Alleo app to add important financial events and deadlines, helping you track your progress in diversifying investments and monitoring your net worth over time.

Wrapping Up Your Financial Journey

We’ve covered a lot, haven’t we? It’s time to take a moment and reflect on your financial journey, especially when it comes to diversifying investments for young professionals.

Remember, investment portfolio diversification and tracking your net worth doesn’t have to be overwhelming. Start by setting up a diversified ETF portfolio and using net worth tracking tools.

Regular contributions to a Roth IRA, effective budgeting, and exploring low-risk investments can also make a big difference in long-term investing for millennials.

These steps can help you build a solid financial future and are crucial for retirement savings for young professionals.

And remember, you don’t have to do it alone. Alleo is here to support you every step of the way with personal finance management apps.

Give it a try for free and see how it can transform your financial life, aiding in building wealth in your 20s and 30s.

Ready to take charge of your financial journey and learn stock market basics for beginners? Let’s get started!