5 Essential Ways to Compare FIRE Strategies for Your Early Retirement Plan

Are you overwhelmed by the myriad of FIRE (Financial Independence, Retire Early) strategies and regional variations? Comparing FIRE strategies for retirement planning can be daunting, especially when considering factors like geographic arbitrage for FIRE or the Lean FIRE vs Fat FIRE comparison.

As a life coach, I’ve guided many through the complexities of early retirement planning. I’ve seen firsthand the confusion and stress that comes with navigating these decisions, from retirement savings calculations to investment portfolio diversification.

In this article, you’ll learn how to compare FIRE strategies for retirement planning effectively. We’ll explore Safe Withdrawal Rates (SWRs), tax optimization strategies, and consider healthcare costs in early retirement.

Let’s dive in and explore how to build passive income streams and implement frugal living tips to achieve your FIRE goals.

Understanding the Challenges of Early Retirement Planning

Navigating early retirement planning can be daunting. Many individuals struggle with the sheer number of FIRE strategies and the regional differences that complicate these decisions. When you compare FIRE strategies for retirement planning, the complexity becomes apparent.

I often see clients overwhelmed by the various approaches to Financial Independence Retire Early (FIRE). The stress of not knowing which strategy aligns best with their goals, such as investment portfolio diversification or frugal living tips, can be immense.

For example, understanding Safe Withdrawal Rates (SWRs) is crucial, yet many find it confusing. The complexity of tax optimization strategies further adds to the challenge when you compare FIRE strategies for retirement planning.

Ultimately, these uncertainties create significant anxiety. You deserve a clear, structured approach to make informed decisions about retirement savings calculations and passive income streams.

Key Steps to Effectively Compare FIRE Strategies for Early Retirement Planning

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to compare FIRE strategies for retirement planning and make progress:

- Calculate Your Personal FIRE Number: Determine your total retirement savings calculation needed by assessing your annual spending and applying the Rule of 25 for Financial Independence Retire Early (FIRE).

- Compare SWRs for Different Retirement Timelines: Study historical Safe Withdrawal Rates (SWRs) and use financial tools to model various scenarios for your investment portfolio diversification.

- Evaluate Regional FIRE Variations and Benchmarks: Research regional cost of living and consider geographic arbitrage for FIRE to optimize your retirement planning.

- Assess Tax Implications of Various FIRE Strategies: Understand tax-efficient accounts and develop tax optimization strategies for your withdrawal plan.

- Analyze Flexibility in Withdrawal Strategies: Compare different withdrawal methods, including the safe withdrawal rate, and plan for market volatility in early retirement.

Let’s dive in to compare FIRE strategies for retirement planning!

1: Calculate your personal FIRE number

Calculating your personal FIRE (Financial Independence Retire Early) number is essential for planning your early retirement and comparing FIRE strategies for retirement planning.

Actionable Steps:

- Track your current expenses: Monitor and categorize every expense over a few months to get a clear picture of your annual spending, which is crucial for retirement savings calculation.

- Set post-retirement lifestyle goals: Decide on the lifestyle you want in retirement, considering travel, hobbies, and essential costs, including healthcare costs in early retirement.

- Apply the Rule of 25: Multiply your annual spending by 25 to estimate the total savings required for early retirement, considering the safe withdrawal rate.

Explanation:

Understanding your FIRE number helps you set realistic savings goals and align your financial planning with your retirement dreams, whether you’re aiming for Lean FIRE or Fat FIRE.

Tracking expenses and setting lifestyle goals enable you to calculate accurate savings needs, providing clarity and direction for your investment portfolio diversification and passive income streams.

According to NerdWallet, this method ensures you have a solid foundation for your retirement plan and aids in making informed decisions when you compare FIRE strategies for retirement planning.

This calculation is the first step towards achieving financial independence and early retirement, guiding your frugal living tips and tax optimization strategies.

2: Compare SWRs for different retirement timelines

Understanding Safe Withdrawal Rates (SWRs) is crucial for ensuring your savings last throughout various retirement scenarios when you compare FIRE strategies for retirement planning.

Actionable Steps:

- Research historical SWRs: Study the 4% rule and other historical SWR studies to understand their performance across different market conditions for Financial Independence Retire Early (FIRE) planning.

- Use financial tools and simulations: Utilize financial planning software to model various withdrawal rates for different retirement timelines, including Monte Carlo simulations for retirement savings calculation.

- Analyze current trends: Keep updated with current market trends and SWR research to adjust your strategy accordingly, considering investment portfolio diversification.

Key factors to consider when comparing SWRs:

- Length of retirement

- Portfolio allocation

- Inflation rates

Explanation:

Understanding and comparing Safe Withdrawal Rates (SWRs) helps ensure your retirement plan is sustainable across different market conditions when you compare FIRE strategies for retirement planning.

Historical SWR studies and financial tools, like Monte Carlo simulations, offer insights into the probability of success for various withdrawal rates, essential for calculating retirement savings.

According to Early Retirement Now, using these tools can provide a clearer picture of how your savings will perform. This approach helps you adapt your strategy based on current trends, securing your financial future.

This knowledge can empower you to make informed decisions and adjust as needed when you compare FIRE strategies for retirement planning.

3: Evaluate regional FIRE variations and benchmarks

Evaluating regional FIRE variations and benchmarks is crucial for optimizing your early retirement plan and helping you compare FIRE strategies for retirement planning.

Actionable Steps:

- Research regional cost of living: Compare cost of living indices for different regions to adjust your FIRE number based on local benchmarks and expenses, which is essential for financial independence retire early (FIRE) planning.

- Consider geographic arbitrage: Explore the benefits of relocating to lower-cost areas either domestically or internationally to maximize your savings and quality of life, a key aspect of geographic arbitrage for FIRE.

Explanation:

Understanding regional variations in cost of living helps you fine-tune your FIRE plan to fit different locations and optimize your retirement savings calculation.

Geographic arbitrage can significantly lower your expenses and stretch your retirement savings further, which is particularly relevant when comparing Lean FIRE vs Fat FIRE approaches.

For more insights, you can read about the benefits of geographic arbitrage on T. Rowe Price.

This approach empowers you to make informed decisions that align with your financial goals and lifestyle preferences, including considerations for healthcare costs in early retirement.

By evaluating these regional benchmarks, you’ll be better equipped to achieve financial independence effectively and compare FIRE strategies for retirement planning.

4: Assess tax implications of various FIRE strategies

Understanding the tax implications of various FIRE strategies is vital for maximizing your retirement savings and minimizing liabilities when you compare FIRE strategies for retirement planning.

Actionable Steps:

- Learn about tax-advantaged accounts: Familiarize yourself with the benefits and rules of 401(k)s, IRAs, and Roth IRAs to optimize your retirement contributions and withdrawals, essential for Financial Independence Retire Early (FIRE).

- Develop a tax-efficient withdrawal plan: Create a strategy to withdraw funds from different accounts in a tax-efficient manner, considering Roth conversions and other methods for tax optimization strategies.

Explanation:

Understanding how to leverage tax-advantaged accounts and creating a tax-efficient withdrawal plan helps you minimize tax liabilities during retirement. Tax-efficient strategies can significantly impact how long your savings last and affect your safe withdrawal rate.

For more detailed insights, consider reading this article on NerdWallet. These steps ensure that you make the most of your hard-earned savings, securing a more stable financial future as you compare FIRE strategies for retirement planning.

Key tax considerations for FIRE strategies:

- Capital gains taxes

- Early withdrawal penalties

- Required Minimum Distributions (RMDs)

Taking these steps can significantly enhance your financial independence plan and retirement savings calculation.

5: Analyze flexibility in withdrawal strategies

Analyzing flexibility in withdrawal strategies is essential to adapt your retirement plan to changing conditions and compare FIRE strategies for retirement planning.

Actionable Steps:

- Evaluate different withdrawal methods: Compare fixed withdrawal rates, dynamic withdrawal methods, and bucket strategies to find what suits your needs and aligns with your safe withdrawal rate.

- Plan for market volatility: Develop a contingency plan for market downturns by implementing strategies like glidepaths and prime harvesting, considering investment portfolio diversification.

- Adjust based on market performance: Regularly review and adjust your withdrawal strategy to reflect current market conditions and personal financial goals, which is crucial for Financial Independence Retire Early (FIRE) planning.

Benefits of flexible withdrawal strategies:

- Adaptation to market fluctuations

- Preservation of capital during downturns

- Potential for increased spending in good years

Explanation:

Flexibility in withdrawal strategies helps mitigate risks and adapt to market changes, ensuring a sustainable retirement plan. Comparing methods and planning for volatility are crucial steps when you compare FIRE strategies for retirement planning.

According to Early Retirement Now, understanding these strategies can help secure your financial future. This approach allows you to respond effectively to market fluctuations and achieve financial independence.

Flexibility ensures your plan remains effective in any economic climate, whether you’re pursuing Lean FIRE or Fat FIRE.

Partner with Alleo to Master Your FIRE Strategy

We’ve explored the challenges of navigating various FIRE strategies and how to solve them. But did you know you can work directly with Alleo to make this journey easier and compare FIRE strategies for retirement planning?

Sign up for an account and create a personalized plan with Alleo’s AI coach. This coach provides affordable, tailored support, just like a human coach, helping you with retirement savings calculations and investment portfolio diversification.

You’ll have full coaching sessions and a free 14-day trial, no credit card required. The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, assisting with frugal living tips and passive income streams.

Ready to get started for free? Let me show you how to compare FIRE strategies for retirement planning and achieve financial independence!

Step 1: Log In or Create Your Account

To begin your FIRE journey with Alleo’s AI coach, simply log in to your existing account or create a new one to access personalized guidance for your early retirement planning.

Step 2: Choose Your FIRE Goals

Select “Setting and achieving personal or professional goals” to focus your efforts on reaching financial independence and early retirement, aligning with the FIRE strategies discussed in the article and tailoring your journey towards a successful early retirement plan.

Step 3: Select ‘Finances’ as Your Focus Area

Choose ‘Finances’ as your focus area to dive deep into FIRE strategies, compare Safe Withdrawal Rates, and optimize your early retirement plan with personalized guidance from Alleo’s AI coach.

Step 4: Starting a Coaching Session

Begin your FIRE journey with an intake session, where you’ll work with Alleo’s AI coach to set up a personalized early retirement plan tailored to your financial goals and regional considerations.

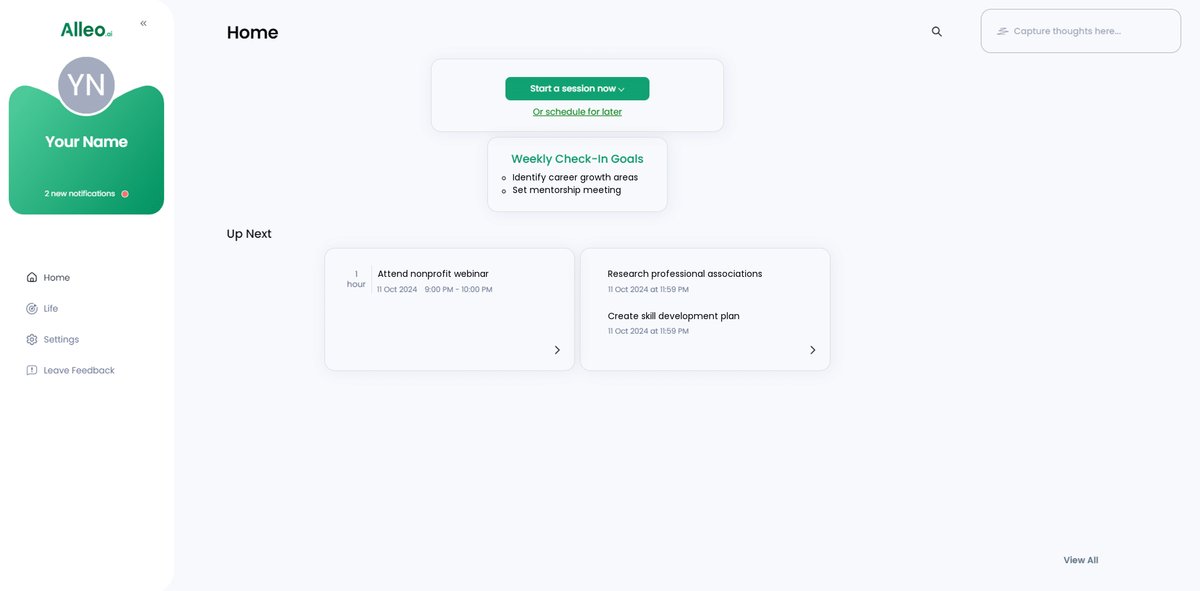

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the FIRE goals you discussed, allowing you to track your progress towards early retirement and financial independence.

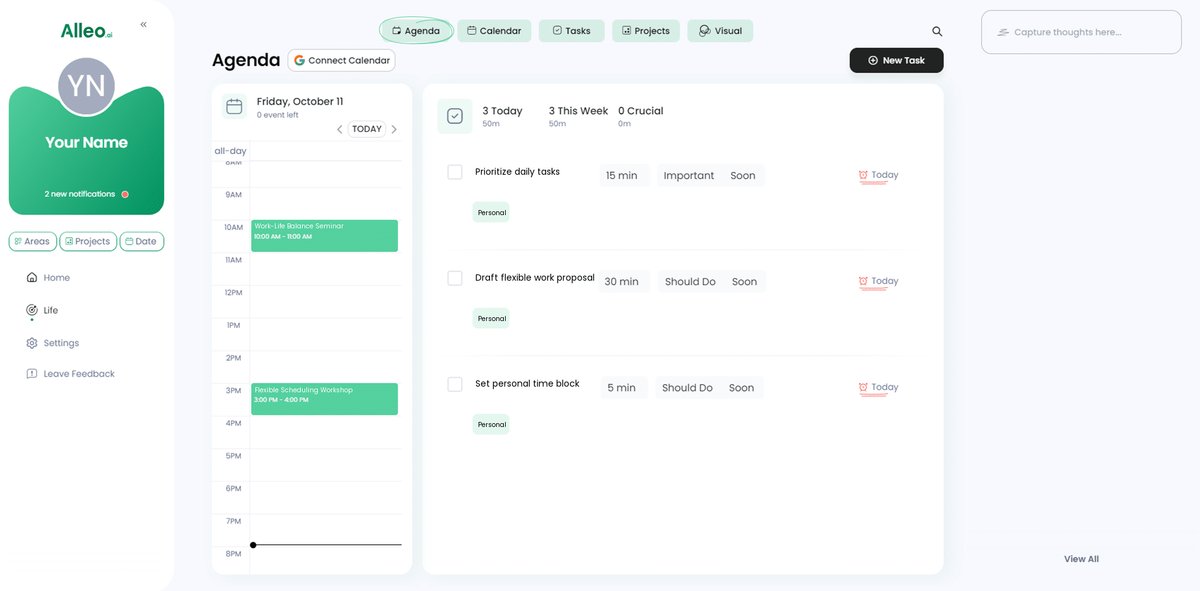

Step 6: Adding events to your calendar or app

Track your progress towards financial independence by adding key milestones and tasks to the Alleo app’s calendar and task features, allowing you to stay organized and motivated on your FIRE journey.

Empowering Your Path to Early Retirement

With the strategies and plans we’ve discussed to compare FIRE strategies for retirement planning, you’re now equipped to navigate the complexities of early retirement. It’s all about understanding your personal needs and making informed decisions about financial independence and retiring early (FIRE).

Remember, planning for early retirement doesn’t have to be overwhelming. You have the tools to calculate your FIRE number, compare safe withdrawal rates (SWRs), evaluate regional variations for geographic arbitrage, and understand tax optimization strategies.

By staying flexible and adapting your withdrawal strategies, you can secure your financial future through investment portfolio diversification and passive income streams.

Alleo is here to support you every step of the way. Start your journey towards financial independence and early retirement with Alleo today, whether you’re aiming for Lean FIRE or Fat FIRE.