5 Proven Techniques for Young Professionals to Build Wealth Consistently through Index Fund Investing

Are you struggling to maintain consistent investment discipline to achieve significant financial milestones? Index fund investing for beginners can be an excellent strategy for long-term wealth accumulation.

As a life coach, I’ve helped many young professionals navigate these challenges. In my experience, starting early and staying disciplined with passive income through index funds can transform your financial future.

In this article, you’ll learn how to build wealth consistently through index fund investing. We’ll cover actionable strategies to help you automate investments, diversify with index funds, and stay disciplined despite market fluctuations. These low-cost investing techniques are ideal for beginners looking to achieve financial independence through index funds.

Let’s dive in.

Understanding the Challenges of Consistent Investing

Young professionals often face challenges in maintaining consistent investment discipline, especially when it comes to index fund investing for beginners. Market volatility and life changes, such as job transitions or unexpected expenses, can derail even the best intentions for long-term investment strategies.

Many clients initially struggle with staying focused on their long-term goals because of these disruptions, which can impact retirement planning for millennials.

It’s common to feel overwhelmed by market fluctuations. The ups and downs can make it tempting to adjust your investments frequently, which often results in poor outcomes and undermines risk management in index fund investing.

Moreover, balancing immediate financial needs with future investment goals is tricky, particularly when considering passive income through index funds.

However, the benefits of long-term index fund investing far outweigh these challenges. With discipline and a structured approach, young professionals can achieve significant financial milestones through diversification with index funds and compound interest and wealth accumulation.

Roadmap to Building Wealth Consistently

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with index fund investing for beginners.

- Start investing early to maximize compound growth: Begin index fund investing as soon as possible to leverage the power of compound interest and wealth accumulation.

- Automate monthly investments in low-cost index funds: Set up automatic contributions to ensure consistent investing without constant decisions, using dollar-cost averaging techniques.

- Diversify across large, mid, and small-cap indexes: Spread your investments to reduce risk and increase potential returns, implementing diversification with index funds.

- Increase contributions as income grows over time: Gradually raise your investment amounts to build wealth faster, supporting long-term investment strategies.

- Stay disciplined through market volatility: Stick to your long-term plan despite market fluctuations, focusing on risk management in index fund investing.

Let’s dive into these index fund investing strategies for beginners!

1: Start investing early to maximize compound growth

Starting early in your investment journey, especially with index fund investing for beginners, allows you to leverage the power of compound interest and wealth accumulation.

Actionable Steps:

- Open a Roth IRA or 401(k) account.

- These accounts offer tax benefits and long-term investment strategies potential.

- Dedicate a fixed percentage of your income to investing each month.

- Aim for 10-15% of your income, focusing on low-cost investing for beginners.

- Educate yourself about compound interest and index fund investing for beginners.

- Resources like online courses or financial workshops on passive income through index funds are helpful.

Explanation: Starting early with index fund investing for beginners boosts your chances of significant wealth accumulation due to compound interest.

By opening a Roth IRA or 401(k), you gain tax-efficient investing strategies and maximize growth. Consistent monthly investments using dollar-cost averaging techniques ensure your contributions grow over time.

Learning about compound interest and diversification with index funds helps you understand their impact on retirement planning for millennials. For more information, check out this resource.

Next, let’s explore how automating investments can simplify your journey towards financial independence through index funds.

2: Automate monthly investments in low-cost index funds

Automating your investments ensures consistent contributions without the need for constant decision-making, making index fund investing for beginners more manageable.

Actionable Steps:

- Set up automatic contributions to your investment accounts.

- Automate a fixed amount to transfer to your index fund every month, employing dollar-cost averaging techniques.

- Choose low-cost index funds with low expense ratios.

- Opt for funds like the S&P 500 or Total Stock Market Index for broad market exposure and diversification with index funds.

Key benefits of automation include:

- Reduces emotional decision-making

- Ensures regular investing regardless of market conditions, supporting long-term investment strategies

- Saves time and mental energy

Explanation: Automating investments removes the emotional aspect of investing, ensuring you remain consistent in your index fund investing for beginners strategy.

Low-cost investing for beginners through index funds, such as those tracking the S&P 500, offers diversification and lower fees, which can enhance your returns over time and contribute to passive income through index funds.

For more details, check out this resource.

Next, let’s explore how diversification can further enhance your investment strategy and contribute to retirement planning for millennials.

3: Diversify across large, mid, and small-cap indexes

Diversifying your investments across large, mid, and small-cap indexes is crucial for reducing risk and enhancing returns in index fund investing for beginners.

Actionable Steps:

- Allocate your investments across different market capitalizations.

- Consider a sample allocation like 60% large-cap, 25% mid-cap, and 15% small-cap for diversification with index funds.

- Rebalance your portfolio annually to maintain your desired allocation.

- This helps you stay on track with your long-term investment strategies.

Explanation: Diversifying across various market capitalizations spreads risk and potentially increases returns, a key principle in index fund investing for beginners.

Large-cap stocks provide stability, while mid-cap and small-cap stocks offer growth opportunities, supporting risk management in index fund investing.

Regular rebalancing ensures your portfolio stays aligned with your goals. For further insights on diversification, check out this Investopedia article.

This diversified approach enhances your investment strategy and prepares you for the next step: increasing contributions as your income grows, supporting financial independence through index funds.

4: Increase contributions as income grows over time

Increasing your contributions as your income grows is crucial for accelerating wealth accumulation, especially when practicing index fund investing for beginners.

Actionable Steps:

- Set a goal to increase your investment contributions annually.

- Aim to raise your contributions by 1-2% each year, enhancing your long-term investment strategies.

- Redirect any raises, bonuses, or windfalls into your investment accounts.

- Use extra income to boost your investments, supporting passive income through index funds.

- Use a budgeting tool to identify areas where you can cut expenses and increase investments.

- Try apps that help with budgeting and tracking expenses, aiding in financial independence through index funds.

Smart ways to boost your contributions:

- Allocate a portion of each raise to investments, supporting compound interest and wealth accumulation

- Use tax refunds for extra contributions, enhancing tax-efficient investing strategies

- Set up a side hustle and invest the earnings, supporting diversification with index funds

Explanation: Consistently increasing your contributions ensures that your investments grow with your income, a key principle in index fund investing for beginners.

This approach leverages additional income sources and helps you stay on track with your financial goals, including retirement planning for millennials.

According to Triton Financial Group, increasing contributions over time significantly boosts long-term wealth.

This section prepares you for the next critical step: staying disciplined through market volatility, an essential aspect of risk management in index fund investing.

5: Stay disciplined through market volatility

Staying disciplined through market volatility is crucial to achieving long-term investment success, especially when practicing index fund investing for beginners.

Actionable Steps:

- Develop a long-term investment plan and stick to it.

- Create a detailed plan for index fund investing and follow it, regardless of market changes.

- Avoid reacting to market fluctuations by tuning out daily stock market noise.

- Focus on long-term investment strategies instead of short-term market movements.

Strategies for maintaining discipline in index fund investing:

- Review your investment plan regularly

- Educate yourself on market cycles and diversification with index funds

- Seek support from a financial advisor or community for guidance on passive income through index funds

Explanation: Staying disciplined ensures you don’t make hasty decisions during market fluctuations. A long-term plan for index fund investing helps keep you focused and prevents emotional reactions to market changes.

According to Triton Financial Group, tuning out daily market noise is key to maintaining discipline and achieving financial goals through low-cost investing for beginners.

Consider seeking support from a financial advisor or joining an investment community for additional guidance on index fund investing for beginners and retirement planning for millennials.

Partner with Alleo on Your Investment Journey

We’ve explored the challenges of consistent investing and how to overcome them, especially for beginners interested in index fund investing. Did you know you can work directly with Alleo to make this journey easier and faster, whether you’re focusing on long-term investment strategies or seeking passive income through index funds?

Set up an account, create a personalized plan, and get tailored coaching for index fund investing for beginners. Alleo’s AI coach will help you stay on track with retirement planning and diversification strategies, providing regular follow-ups and notifications to support your financial independence goals.

Ready to get started for free and learn about low-cost investing techniques? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards consistent investing with Alleo’s AI coach, simply log in to your account or create a new one to access personalized guidance and start building wealth through index fund investing.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a solid foundation for consistent investing, which will help you stay disciplined and automate your financial growth over time.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area to align with your goal of building wealth through consistent index fund investing, allowing Alleo’s AI coach to provide targeted guidance on investment strategies, budgeting, and maintaining financial discipline.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with our AI coach to create a personalized investment plan aligned with your financial goals and the strategies discussed in this article.

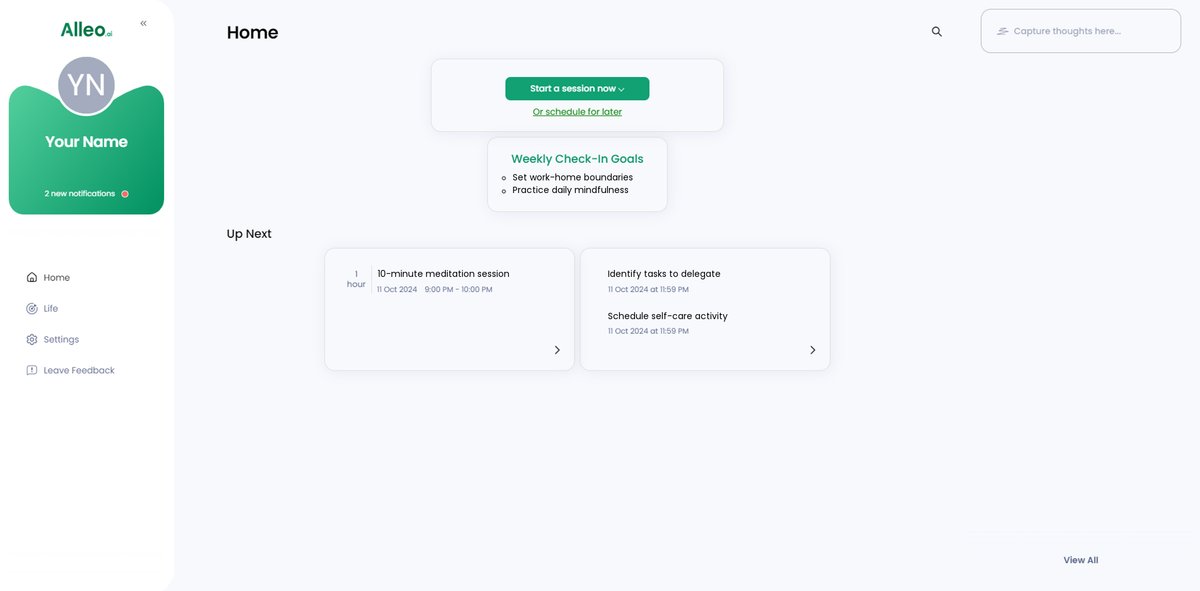

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the investment goals you discussed, allowing you to track your progress and stay committed to your long-term financial strategy.

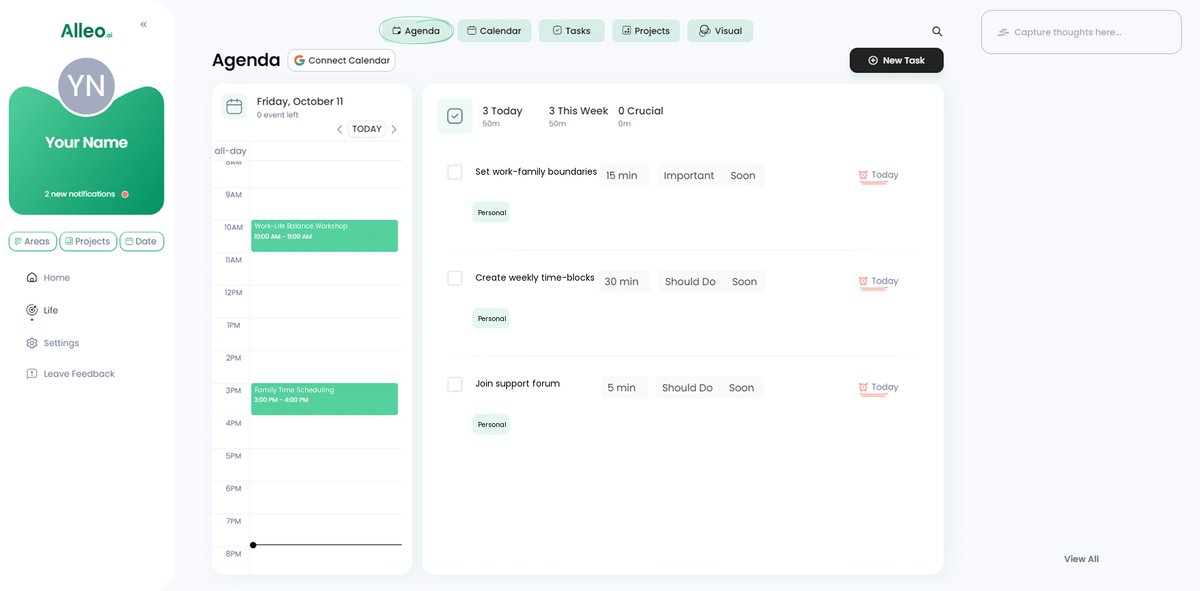

6: Add investment events to your calendar or app

Use Alleo’s calendar and task features to schedule regular investment check-ins, rebalancing dates, and contribution increases, helping you track your progress and stay accountable to your long-term financial goals.

You’ve learned how to overcome the challenges of consistent investing and stay disciplined with index fund investing for beginners.

Starting early, automating your investments, diversification with index funds, increasing contributions, and staying disciplined are key steps in long-term investment strategies.

These strategies will help you build wealth steadily over time through compound interest and wealth accumulation.

I understand that maintaining investment discipline can be tough, especially when considering passive income through index funds.

But with the right approach and tools, you can succeed in low-cost investing for beginners.

Remember, Alleo is here to help with retirement planning for millennials.

Our AI coach can guide you on your path to financial success, including tax-efficient investing strategies.

Take the first step today and try Alleo for free to explore dollar-cost averaging techniques.

You’re closer to your financial goals and financial independence through index funds than you think.