Millennial’s Ultimate Guide: Staying Motivated on Your Path to Financial Independence

Are you finding it hard to stay motivated on your journey to millennial financial independence? Achieving financial goals for millennials can be challenging, but it’s not impossible.

As a life coach, I’ve helped many navigate these challenges. In my experience, the emotional aspects of this journey are just as significant as the financial strategies. Overcoming financial challenges as a millennial requires both practical skills and mental resilience.

In this article, you’ll discover actionable steps to maintain motivation for millennial financial independence, from setting realistic goals to celebrating small wins. We’ll explore tools and techniques to keep you on track, including millennial-friendly personal finance apps and budgeting techniques for financial independence.

Let’s dive in and explore saving strategies for young adults and investment opportunities for young professionals that can help you in building wealth in your 20s and 30s.

Understanding the Emotional Hurdles on Your Financial Independence Journey

On the road to millennial financial independence motivation, emotional challenges often feel like the biggest obstacles. Many millennials face self-doubt and fear of missing out (FOMO), which can derail their progress towards financial goals for millennials.

In my experience, several clients struggle with comparing themselves to others, feeling they’re not advancing quickly enough in building wealth in their 20s and 30s. This can lead to discouragement and even giving up on long-term financial planning for millennials.

It’s painful to see financial goals slipping away due to emotional setbacks. Yet, these challenges are common and manageable with the right millennial money management tips and strategies.

Let’s explore how to address these emotional hurdles head-on and overcome financial challenges as a millennial.

Key Steps to Stay Motivated on Your Financial Independence Journey

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress towards millennial financial independence motivation.

- Define your personal financial independence goals: Set clear and realistic financial goals for millennials using the SMART criteria.

- Track progress with visual tools and milestones: Use spreadsheets or millennial-friendly personal finance apps to monitor income and expenses.

- Automate savings to remove decision fatigue: Set up automatic transfers to savings accounts or investment opportunities for young professionals.

- Join online communities for support and advice: Participate in forums or social media groups focused on millennial money management tips and financial independence.

- Practice gratitude for current financial position: Keep a gratitude journal specifically for your financial journey, focusing on overcoming financial challenges as a millennial.

- Celebrate small wins on the path to FI: Reward yourself for hitting small milestones in building wealth in your 20s and 30s.

Let’s dive in!

1: Define your personal financial independence goals

Setting clear personal financial independence goals is crucial for millennials to stay motivated on their journey towards financial success.

Actionable Steps:

- Use the SMART criteria to set clear and realistic financial goals for millennials.

- Example: “Save $10,000 in the next year by cutting down on non-essential expenses, a key saving strategy for young adults.”

- Break down larger goals into smaller, manageable milestones for effective millennial money management.

- Example: “Save $1,000 each month to build wealth in your 20s and 30s.”

- Visualize your goals by creating a vision board or using millennial-friendly personal finance apps.

- Example: “Create a vision board with images representing your financial goals for long-term financial planning.”

Explanation:

Taking these steps will give millennials a clear roadmap to follow, making the daunting task of financial independence more manageable. Breaking down larger goals into smaller milestones helps in maintaining motivation and keeping track of progress, crucial for overcoming financial challenges as a millennial.

Additionally, visualizing your goals can keep you inspired and focused on the end result. For instance, using a vision board or goal-setting apps can provide a constant reminder of what you are working towards, enhancing millennial financial independence motivation.

For more tips on setting financial goals, check out this article from Grey.

Key benefits of setting clear financial goals for millennials:

- Provides direction and focus for work-life balance and financial success

- Increases motivation and commitment to budgeting techniques for financial independence

- Allows for measurable progress in building wealth in your 20s and 30s

These actionable steps will help millennials envision and achieve their financial goals efficiently. Next, let’s discuss how to track your progress effectively using investment opportunities for young professionals.

2: Track progress with visual tools and milestones

Tracking your progress with visual tools and milestones is crucial to maintaining motivation on your journey to millennial financial independence.

Actionable Steps:

- Create a detailed budget using a spreadsheet or millennial-friendly personal finance apps. Track your weekly spending and identify areas for improvement in your millennial money management.

- Set up visual progress charts to monitor your achievements towards financial goals for millennials. Use a bar graph to track your savings growth and building wealth in your 20s and 30s.

- Schedule monthly financial review sessions to adjust your long-term financial planning for millennials based on progress. This ensures you stay on track with your saving strategies for young adults.

Explanation:

These steps matter because they provide a clear visual representation of your progress, making it easier to stay motivated on your path to millennial financial independence.

Regularly tracking your finances helps identify areas for improvement and celebrate milestones in your journey to overcome financial challenges as a millennial.

For more tips on managing your finances, check out this article by Katie Gatti Tassin.

Next, let’s examine how automating your savings can help you stay on track with your budgeting techniques for financial independence.

![]()

3: Automate savings to remove decision fatigue

Automating your savings is vital for reducing decision fatigue and staying on track with your financial goals, especially for millennials seeking financial independence motivation.

Actionable Steps:

- Set up automatic transfers to savings accounts or investment funds.

- Example: “Automate 10% of your income to go directly into a savings account, a key strategy for building wealth in your 20s and 30s.”

- Use financial tools that round up purchases and save the change.

- Example: “Enable round-up features on millennial-friendly personal finance apps.”

- Schedule regular increases in your automated savings amount.

- Example: “Increase automated savings by 1% every six months, supporting long-term financial planning for millennials.”

Explanation:

These steps matter because they simplify the savings process, making it easier to stay consistent with millennial money management tips. By automating savings, you ensure that you’re regularly setting aside money without having to think about it, which is crucial for overcoming financial challenges as a millennial.

This approach helps mitigate decision fatigue and keeps you steadily progressing towards your financial goals for millennials. For more tips on automating your savings, check out this article by Susan Njuguna.

Automating your savings can be a game-changer for millennial financial independence motivation. Next, let’s explore how joining online communities can support your journey.

4: Join online communities for support and advice

Joining online communities can provide essential support and advice on your millennial financial independence motivation journey.

Actionable Steps:

- Participate in forums or social media groups: Engage with the r/financialindependence subreddit to share experiences and seek advice on financial goals for millennials.

- Attend virtual meetups or webinars: Sign up for monthly Zoom webinars on personal finance topics to stay informed and motivated about millennial money management tips.

- Find a mentor or accountability partner: Pair up with a community member for monthly progress check-ins to stay on track with your saving strategies for young adults.

Explanation:

These steps matter because they provide a support system and valuable insights from others on the same path to millennial financial independence motivation. Engaging with online communities can help you stay motivated, overcome financial challenges as a millennial, and celebrate milestones.

For example, joining the r/financialindependence subreddit allows you to connect with like-minded individuals and gain practical advice on building wealth in your 20s and 30s. Additionally, attending webinars can keep you informed about the latest personal finance strategies and long-term financial planning for millennials.

For more tips on engaging with supportive communities, check out this article by Maria Jose Dassum Narino.

Benefits of joining financial independence communities:

- Access to diverse perspectives and experiences on millennial financial independence motivation

- Emotional support during challenges in work-life balance and financial success

- Exposure to new strategies and tools, including millennial-friendly personal finance apps

Connecting with others can significantly enhance your financial independence journey and help you master budgeting techniques for financial independence.

Next, let’s explore the importance of practicing gratitude for your current financial position.

5: Practice gratitude for current financial position

Practicing gratitude can significantly improve your motivation on the path to millennial financial independence.

Actionable Steps:

- Keep a gratitude journal: Write down three things you’re financially grateful for each week, focusing on your financial goals for millennials.

- Reflect on past achievements: Monthly, review your past financial milestones to appreciate your progress in building wealth in your 20s and 30s.

- Share gratitude practices: Post weekly gratitude entries in your financial independence group, discussing millennial money management tips.

Explanation:

These steps are essential because they shift your focus to positive financial progress, boosting motivation for long-term financial planning for millennials.

Reflecting on achievements and sharing gratitude helps maintain a positive outlook while overcoming financial challenges as a millennial. For more insights, check out this article by Katie Gatti Tassin.

Gratitude can transform your financial journey into a more fulfilling experience, enhancing your work-life balance and financial success.

6: Celebrate small wins on the path to FI

Celebrating small wins keeps you motivated and reinforces positive financial habits, which is crucial for millennial financial independence motivation.

Actionable Steps:

- Plan mini-celebrations: Reward yourself for every $1,000 saved with a special dinner, supporting your financial goals for millennials.

- Share achievements: Post celebratory updates in financial independence forums to get encouragement and improve millennial money management.

- Host budget-friendly gatherings: Celebrate progress with friends to stay motivated on your journey to financial independence.

Explanation:

These steps matter because they provide regular motivation and positive reinforcement. Celebrating milestones helps you appreciate your progress and stay committed to your goals, which is essential for building wealth in your 20s and 30s.

For more insights on staying motivated, check out this article by Emerson Rose.

Ways to celebrate financial milestones:

- Treat yourself to a small luxury within budget, aligning with saving strategies for young adults

- Take a day off to enjoy a free local attraction, maintaining work-life balance and financial success

- Create a visual representation of your progress, enhancing long-term financial planning for millennials

Celebrating small wins can make your journey to millennial financial independence more enjoyable and fulfilling.

Partner with Alleo on Your Financial Independence Journey

We’ve explored staying motivated on your millennial financial independence journey. But did you know you can partner with Alleo to make this easier and achieve your financial goals for millennials?

Alleo’s AI coach provides affordable, tailored support for millennial money management, just like a human coach. It’s an excellent tool for building wealth in your 20s and 30s.

Set up your account and create a personalized long-term financial planning strategy with Alleo. The coach will follow up on your progress, manage changes, and keep you accountable via text and push notifications, helping you overcome financial challenges as a millennial.

Ready to get started for free and boost your millennial financial independence motivation? Let me show you how!

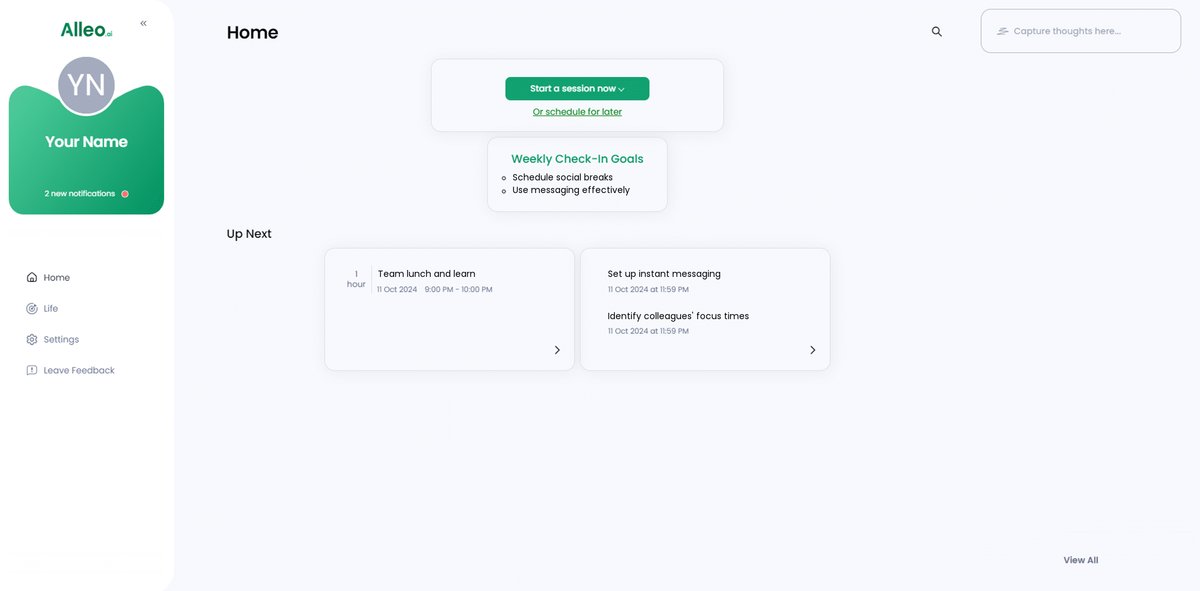

Step 1: Logging in or Creating an Account

To begin your financial independence journey with Alleo, simply Log in to your account or create a new one to access personalized coaching and support tailored to your goals.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” in the Alleo app to align with your financial independence journey. This option will help you break down your larger financial goals into manageable steps, keeping you motivated and on track towards financial freedom.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on budgeting, saving, and investing, helping you stay motivated and on track with your financial independence goals.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll collaborate with the AI coach to create a personalized financial independence plan tailored to your goals and current situation.

Step 5: Viewing and managing goals after the session

After your coaching session, you can easily view and manage the financial independence goals you discussed by checking the home page of the Alleo app, where they’ll be prominently displayed for your ongoing reference and tracking.

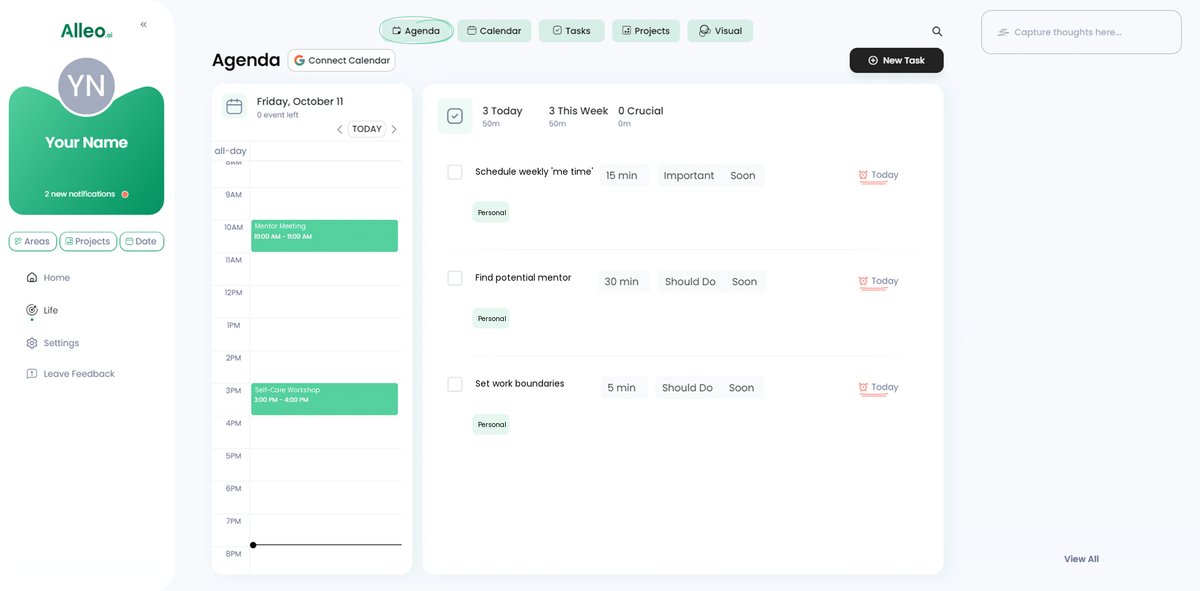

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress towards financial independence by adding key milestones, savings goals, and budget review sessions as events, helping you stay motivated and accountable on your journey.

Your Path to Financial Independence Starts Here

You’ve learned how to stay motivated on your journey to millennial financial independence. Remember, it’s a marathon, not a sprint when it comes to building wealth in your 20s and 30s.

Empathizing with your struggles, we’ve discussed practical steps to overcome emotional hurdles and tackle financial challenges as a millennial.

Set your financial goals for millennials, track progress, automate savings, join supportive communities, practice gratitude, and celebrate small wins as part of your long-term financial planning.

You’re not alone on this path to millennial financial independence. Many have successfully navigated these challenges using effective saving strategies for young adults.

Take the next step with Alleo. Our AI coach can guide you, offering personalized support to keep you on track with millennial money management tips.

Begin your journey to financial independence today. Sign up for free and let Alleo help you achieve your financial goals as a millennial professional.