6 Powerful Tips for Couples Navigating Money Differences Before Marriage

Are you and your partner struggling to align your financial philosophies as you prepare for marriage?

As a life coach, I’ve guided many couples through the complexities of merging finances and premarital financial planning. I understand the unique challenges that come with discussing money differences and achieving financial compatibility in relationships before tying the knot.

In this article, you’ll discover practical premarital financial planning tips and strategies for navigating these discussions, from creating a vision board to scheduling regular “money dates.” These techniques will help with communicating about finances before marriage and aligning financial goals as a couple.

Let’s dive into these money management tips for engaged couples.

Understanding Financial Disagreements Before Marriage

Money issues are a significant source of stress for many couples. I’ve seen numerous clients struggle with this when it comes to premarital financial planning.

Financial disagreements often arise from differing financial beliefs. These beliefs usually come from family backgrounds and personal experiences, affecting financial compatibility in relationships.

For example, one partner might see debt as a tool for investment, while the other views it as something to avoid. These differences can create tension and confusion when communicating about finances before marriage.

In my experience, couples frequently underestimate how crucial these conversations are. Ignoring them can lead to serious problems down the road, like resentment or even divorce. Premarital financial planning tips can help navigate different spending habits in relationships.

Addressing these issues before marriage is vital. It helps lay a solid foundation for your future together, including aligning financial goals as a couple and discussing money management for engaged couples.

Steps to Address Financial Differences Before Marriage

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with premarital financial planning:

- Create a shared financial goals vision board: Discuss and visualize your financial goals together, aligning financial goals as a couple.

- Schedule regular “money dates” to discuss finances: Maintain open communication with monthly financial check-ins, enhancing financial compatibility in relationships.

- Take a premarital financial education course: Enhance your financial knowledge as a couple, focusing on money management for engaged couples.

- Practice open communication about spending habits: Share and understand each other’s financial philosophies, navigating different spending habits in relationships.

- Develop a joint budget for shared expenses: Plan and manage your finances collaboratively, implementing budgeting strategies for newlyweds.

- Explore options for combining or separating accounts: Decide the best approach for managing your accounts, considering joint vs. separate bank accounts.

Let’s dive into these premarital financial planning tips!

1: Create a shared financial goals vision board

Creating a shared financial goals vision board is a powerful way to align your financial aspirations and is an essential part of premarital financial planning.

Actionable Steps:

- Gather materials and set a date: Collect magazines, markers, and a large board. Schedule a time to work on the vision board together, fostering financial compatibility in relationships.

- Discuss and list goals: Talk about individual and shared financial goals like buying a house or saving for retirement. Write them down, focusing on aligning financial goals as a couple.

- Display the vision board: Place the vision board in a visible spot to serve as a daily reminder of your shared goals and premarital financial planning tips.

Explanation:

These steps help solidify your financial aspirations and foster teamwork. A vision board makes abstract goals tangible and keeps both partners motivated, which is crucial for money management for engaged couples.

According to CNBC, visualizing goals can strengthen commitment and clarity in relationships.

This method sets the stage for effective financial planning and harmonious future discussions, enhancing communication about finances before marriage.

2: Schedule regular “money dates” to discuss finances

Having regular “money dates” is crucial for maintaining healthy financial communication before marriage and is a key premarital financial planning tip.

Actionable Steps:

- Set a consistent monthly date and time: Choose a specific day each month to meet and discuss finances, enhancing financial compatibility in relationships.

- Create an agenda: Outline topics like budgeting strategies for newlyweds, upcoming expenses, and aligning financial goals as a couple to cover during each meeting.

- Celebrate achievements: Use this time to acknowledge financial successes and address any concerns or adjustments needed in your money management for engaged couples.

Explanation:

These steps help keep both partners informed and engaged in premarital financial planning.

Regular “money dates” foster transparency and teamwork, which are essential for communicating about finances before marriage and building a strong financial partnership.

According to Investopedia, consistent financial discussions can significantly improve marital harmony.

This practice sets a solid foundation for future financial stability and mutual understanding, crucial aspects of premarital financial planning tips.

3: Take a premarital financial education course

Enrolling in a premarital financial education course can equip you and your partner with essential financial knowledge and is a crucial step in premarital financial planning.

Actionable Steps:

- Research and enroll in a reputable course: Look for a course that covers both basic and advanced financial topics tailored for couples, focusing on financial compatibility in relationships.

- Commit to completing the course together: Schedule regular study sessions and discuss what you’ve learned after each class, improving your communication about finances before marriage.

- Apply insights to your financial planning: Use the knowledge gained to make informed decisions about budgeting, saving, and investing, enhancing your money management skills as engaged couples.

Explanation:

These premarital financial planning tips will help you build a strong financial foundation before marriage. Taking a course together encourages teamwork and ensures both partners are equally informed about budgeting strategies for newlyweds.

According to MyVC, couples who engage in financial education report higher satisfaction in their relationships.

This proactive approach can prevent future conflicts and promote financial harmony, helping you align financial goals as a couple.

4: Practice open communication about spending habits

Open communication about spending habits is crucial for building trust and understanding in a relationship. This is a key aspect of premarital financial planning tips that can enhance financial compatibility in relationships.

Actionable Steps:

- Schedule a candid discussion: Set aside time to share your spending habits and financial philosophies without judgment. This is essential for communicating about finances before marriage.

- Identify potential conflict areas: Highlight where differences may arise and agree on strategies to manage them, which is crucial for money management for engaged couples.

- Establish purchase guidelines: Create clear rules for major purchases and everyday spending to prevent misunderstandings. This helps in navigating different spending habits in relationships.

Key benefits of open financial communication:

- Builds trust and transparency in the relationship

- Helps identify and resolve potential financial conflicts early

- Allows for better alignment of financial goals as a couple

Explanation:

These steps foster transparency and help avoid financial misunderstandings. Open communication is essential for aligning financial goals and is a crucial part of premarital financial planning.

According to Wilson Counseling, discussing finances openly can significantly improve relationship satisfaction and reduce conflicts.

Practicing these steps can lead to a more harmonious and financially stable partnership, which is the ultimate goal of premarital financial planning tips.

5: Develop a joint budget for shared expenses

Creating a joint budget is essential for managing your shared financial responsibilities effectively, and it’s a crucial premarital financial planning tip.

Actionable Steps:

- List all shared expenses: Identify and record all current and anticipated expenses like rent, utilities, and groceries, an important step in money management for engaged couples.

- Allocate funds for each category: Agree on how much to allocate for each expense to ensure both partners are comfortable with the budget, promoting financial compatibility in relationships.

- Review and adjust regularly: Revisit the budget monthly to accommodate any changes in income or expenses, a key aspect of premarital financial planning.

Explanation:

These steps help maintain financial transparency and prevent conflicts over money, which is crucial when communicating about finances before marriage.

Regularly reviewing your budget ensures it aligns with your evolving financial situation and aids in aligning financial goals as a couple.

According to Gate City Bank, a joint budget fosters mutual understanding and cooperation in financial planning.

Starting this habit now can pave the way for a financially stable marriage and is one of the essential premarital financial planning tips.

6: Explore options for combining or separating accounts

Exploring options for combining or separating accounts is crucial for maintaining financial harmony before marriage and is an essential part of premarital financial planning.

Actionable Steps:

- Discuss your financial goals and preferences: Have an open conversation about whether you prefer joint or separate bank accounts based on your financial goals and comfort levels, enhancing financial compatibility in relationships.

- Weigh the pros and cons: Evaluate the benefits and drawbacks of each option, considering factors like transparency, autonomy, and financial management for engaged couples.

- Choose a system that works for both: Decide on a combination or separation approach that suits both partners, such as joint accounts for shared expenses and separate accounts for personal spending, as part of your premarital financial planning tips.

Popular account management strategies for couples:

- Fully combined accounts for complete transparency

- Separate accounts with a joint account for shared expenses

- Proportional contributions based on individual incomes

Explanation:

These steps ensure that both partners are comfortable with the chosen financial arrangement, reducing potential conflicts and improving money management for engaged couples.

According to Investopedia, finding a balance between joint and separate accounts can enhance financial cooperation and clarity in relationships.

This approach helps build trust and a strong financial foundation for your marriage, aligning financial goals as a couple.

This method will set the stage for a financially harmonious and transparent partnership, which is crucial in premarital financial planning.

Partner with Alleo to Navigate Financial Differences

We’ve explored the challenges of discussing money differences before marriage and the steps to address them. Did you know you can work directly with Alleo to make this journey smoother and faster? Our premarital financial planning tips can help you achieve financial compatibility in relationships.

How Alleo Helps:

- Goal Setting: Use Alleo’s goal-setting feature to create and track financial goals, essential for aligning financial goals as a couple.

- Scheduling: Schedule and get reminders for regular “money dates” with Alleo, improving communication about finances before marriage.

- Education: Access Alleo’s resources and recommendations for financial education courses, enhancing money management for engaged couples.

- Communication: Utilize Alleo’s prompts and tools to facilitate open communication, helping navigate different spending habits in relationships.

- Budgeting: Use Alleo’s budgeting tools to develop and manage your joint budget, offering budgeting strategies for newlyweds.

- Account Management: Get advice from Alleo on combining or separating accounts, addressing joint vs. separate bank accounts.

Action Plan:

- Set Up an Account: Sign up on the Alleo platform and start your free 14-day trial. No credit card required.

- Create a Personalized Plan: Answer a few questions to help Alleo understand your financial situation and goals, including debt disclosure before tying the knot.

- Work with Alleo’s Coach: Follow the tailored coaching sessions to navigate your financial differences and explore premarital financial planning.

- Stay Accountable: Receive text and push notifications to keep you on track with your premarital financial planning tips.

Ready to get started for free? Let me show you how!

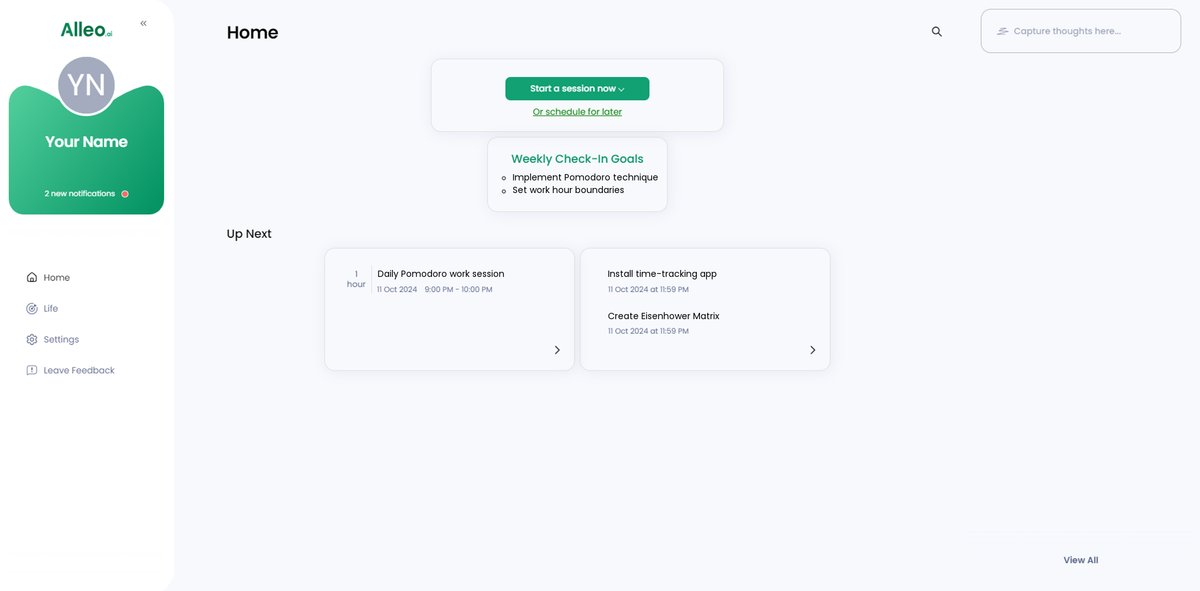

Step 1: Log In or Create Your Account

To begin addressing your financial differences as a couple, log in to your Alleo account or create a new one to access personalized financial guidance and tools.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish consistent financial practices that will help you and your partner align your money management styles and work towards shared financial goals.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to tackle your pre-marital money concerns head-on, allowing you to align your financial goals and create a solid foundation for your future together.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to discuss your financial goals as a couple and create a personalized plan for addressing money differences before marriage.

Step 5: Viewing and managing goals after the session

After your coaching session, review the financial goals you discussed with your partner on the Alleo app’s home page, where you can easily track and manage your shared objectives.

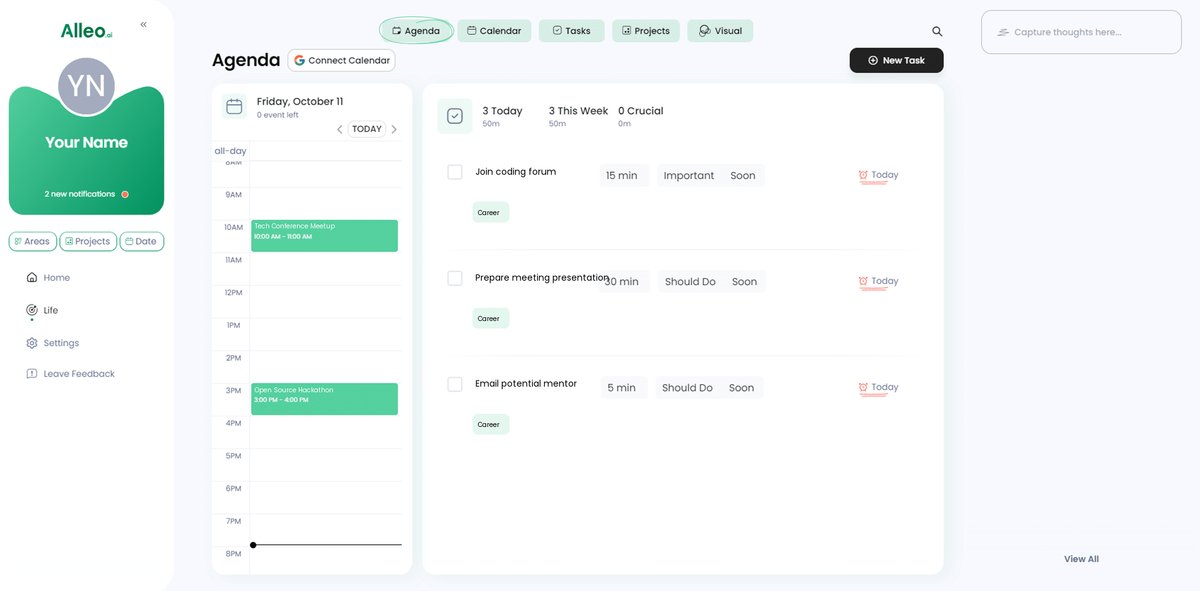

Step 6: Adding events to your calendar or app

Use Alleo’s calendar feature to schedule and track your “money dates” and financial goals, helping you stay accountable and monitor your progress in addressing financial differences before marriage.

Building a Solid Financial Foundation Before Marriage

We’ve covered practical premarital financial planning tips to address financial compatibility in relationships before marriage.

Remember, discussing money management for engaged couples can be tough, but it’s essential for a happy and stable relationship.

By creating a vision board, scheduling “money dates,” and taking a financial education course, you’re setting yourselves up for success in premarital financial planning.

Don’t forget to practice open communication about finances before marriage, develop a joint budget, and decide on account management that works for both of you, considering joint vs. separate bank accounts.

These steps can help you and your partner build trust and work as a team, aligning financial goals as a couple.

Alleo is here to guide you through this journey of navigating different spending habits in relationships.

Try Alleo for free today and start your path to financial harmony with our premarital financial planning tips.